Is A Dogecoin Dividend Feasible? Assessing Trump's Economic Proposal

Table of Contents

Is a Dogecoin Dividend Feasible? Assessing Trump's Economic Proposal – A Deep Dive

[Headline Updated] Trump's Dogecoin Dividend Idea: A Pipe Dream or Viable Economic Policy?

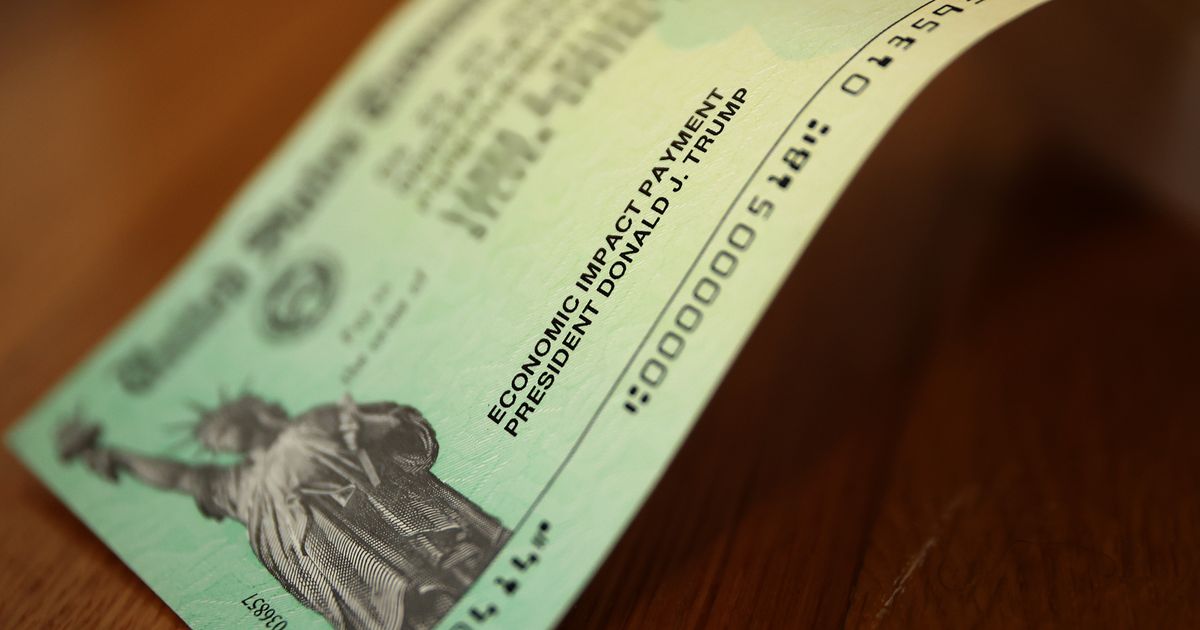

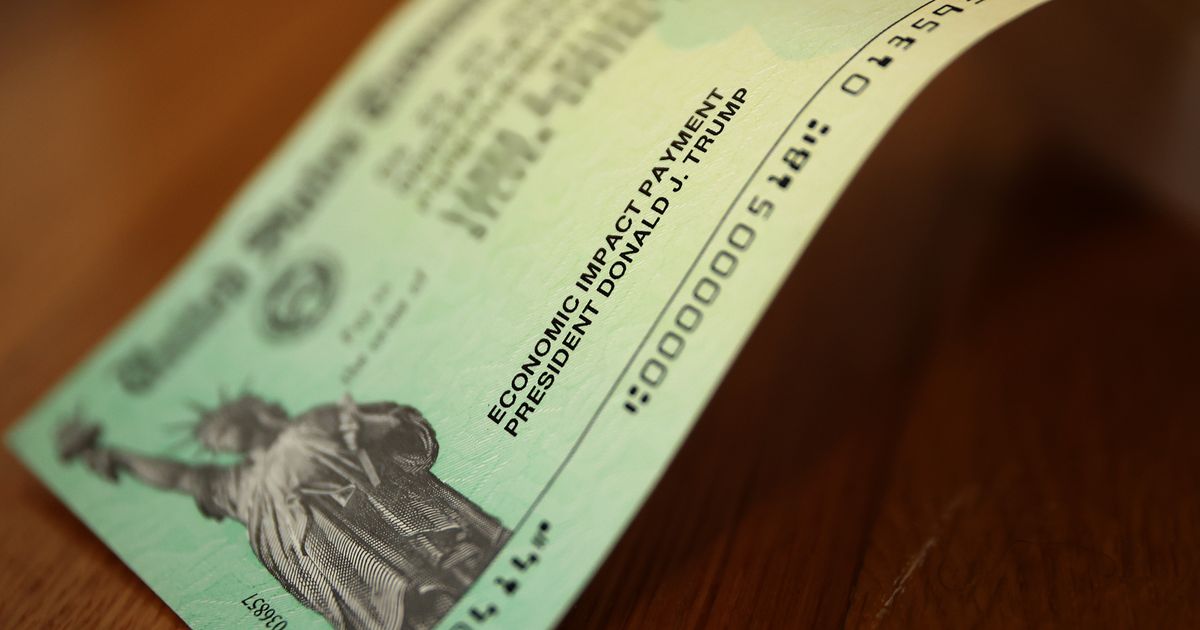

[Lead Paragraph Updated] Former President Donald Trump's recent suggestion of a Dogecoin dividend as part of his economic platform has sparked widespread debate. While the novelty of the proposal grabs headlines, a closer examination reveals significant hurdles to feasibility, raising serious questions about its economic viability and potential consequences.

[Section 1: Trump's Proposal and Initial Reactions]

Trump's proposal, floated during recent media appearances and campaign rallies, involves distributing Dogecoin, the meme-based cryptocurrency, as a dividend to American citizens. The specific mechanics – the amount of Dogecoin per citizen, the source of the Dogecoin, and the timing of the distribution – remain largely undefined. This vagueness has fueled criticism from economists and financial analysts who point to the inherent volatility of cryptocurrencies and the potential for market manipulation. Immediate reactions ranged from amused skepticism to outright condemnation, with experts questioning the proposal's practicality and potential negative impacts on the US economy and the cryptocurrency market itself.

[Section 2: The Challenges of a Dogecoin Dividend]

Several key challenges undermine the feasibility of a Dogecoin dividend. First, the sheer scale of such an undertaking is daunting. Distributing Dogecoin to over 330 million Americans would require a massive and coordinated effort, potentially overwhelming existing cryptocurrency infrastructure. Secondly, the volatility of Dogecoin poses a significant risk. Its value fluctuates wildly, meaning the actual financial benefit to recipients would be unpredictable and could be significantly less than anticipated, even potentially worthless depending on market conditions at the time of distribution. Thirdly, the source of the Dogecoin is unclear. Would the government purchase it on the open market, potentially driving up its price artificially? Would it rely on donations or partnerships with private entities? Each option presents unique logistical, ethical, and economic concerns.

[Section 3: Economic Implications and Potential Risks]

Economists warn of several potential negative consequences. A massive government purchase of Dogecoin could create an artificial bubble, inflating its price and making it vulnerable to a subsequent crash, harming both recipients and the broader cryptocurrency market. Further, the distribution of a volatile asset to the general public could lead to widespread financial losses for those unfamiliar with cryptocurrency investing. This could disproportionately affect low-income individuals who might be more likely to hold onto their Dogecoin in the hopes of substantial gains, potentially suffering significant financial losses if its value declines. Finally, the proposal’s lack of detail and economic grounding raises concerns about its overall credibility.

[Section 4: Alternative Perspectives and Counterarguments]

While the widespread consensus among economists casts serious doubt on the practicality of the proposal, some counterarguments exist. Supporters might argue that such a move could stimulate the cryptocurrency market and drive innovation. Furthermore, they could posit that the educational impact of such a wide-scale distribution could enhance financial literacy and promote wider adoption of digital assets. However, these arguments are largely overshadowed by the significant economic risks and logistical challenges outlined above.

[Section 5: Conclusion]

Trump’s proposed Dogecoin dividend, while intriguing in its novelty, faces insurmountable challenges in terms of feasibility, economic soundness, and potential negative consequences. The lack of detail, the inherent volatility of Dogecoin, and the potential for market manipulation render it an impractical and potentially harmful economic policy. While the proposal might have gained attention through its unconventional nature, a thorough economic analysis reveals its serious flaws and its unlikelihood of becoming a reality. The focus should remain on evidence-based economic policies with a clear understanding of their potential implications, rather than speculative, attention-grabbing proposals.

Featured Posts

-

Kennedy Center Faces Potential Show Cancellations Due To Poor Ticket Sales

Feb 25, 2025

Kennedy Center Faces Potential Show Cancellations Due To Poor Ticket Sales

Feb 25, 2025 -

Online Assault Tracker Documenting The Attacks Against Me

Feb 25, 2025

Online Assault Tracker Documenting The Attacks Against Me

Feb 25, 2025 -

Palestinian Prisoner Release Delayed Israeli Hostages Freed

Feb 25, 2025

Palestinian Prisoner Release Delayed Israeli Hostages Freed

Feb 25, 2025 -

The Lockerbie Tragedy One Mothers Powerful Sculpting Tribute

Feb 25, 2025

The Lockerbie Tragedy One Mothers Powerful Sculpting Tribute

Feb 25, 2025 -

The Invisible Toll Massive Russian Deaths In Ukraine Unreported

Feb 25, 2025

The Invisible Toll Massive Russian Deaths In Ukraine Unreported

Feb 25, 2025

Latest Posts

-

Msnbc Cancels Joy Reids Show In Major Programming Overhaul

Feb 25, 2025

Msnbc Cancels Joy Reids Show In Major Programming Overhaul

Feb 25, 2025 -

Sag Awards 2025 A Look At The Most Stylish Celebrities

Feb 25, 2025

Sag Awards 2025 A Look At The Most Stylish Celebrities

Feb 25, 2025 -

Facing China Tariffs Apple Announces Massive 500 Billion Us Investment

Feb 25, 2025

Facing China Tariffs Apple Announces Massive 500 Billion Us Investment

Feb 25, 2025 -

Significant Restructuring Planned For Usaid Under Trump

Feb 25, 2025

Significant Restructuring Planned For Usaid Under Trump

Feb 25, 2025 -

Pope Francis Condition From Critical To Stable Overnight

Feb 25, 2025

Pope Francis Condition From Critical To Stable Overnight

Feb 25, 2025