Is A Trump Dogecoin Dividend A Financially Sound Idea? Analysis And Expert Opinions.

Table of Contents

Is a Trump Dogecoin Dividend a Financially Sound Idea? Analysis and Expert Opinions

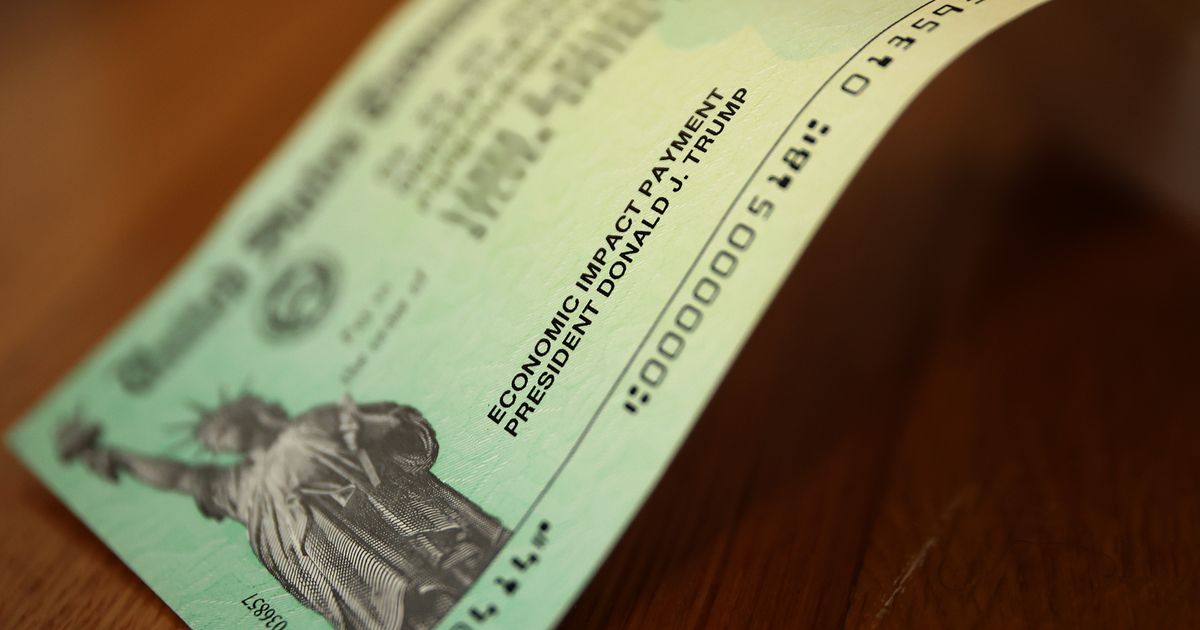

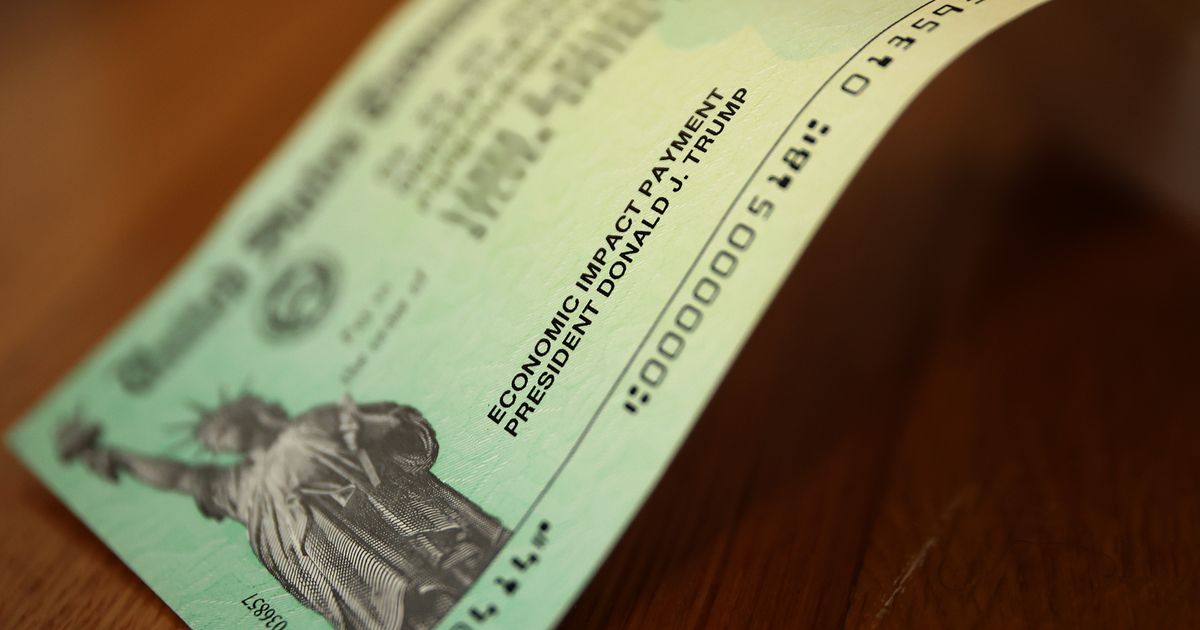

A highly improbable, yet intriguing, proposition, the idea of a Donald Trump-backed Dogecoin dividend has sparked debate among financial experts and cryptocurrency enthusiasts alike. While the concept is largely speculative, examining its potential impact through a financial lens reveals significant flaws and risks.

[Date of Initial Speculation/News Release]: [Insert date when the idea of a Trump Dogecoin dividend first gained significant traction in the news or social media. Source the date with a reputable news outlet or social media post.]

The notion of a Trump-affiliated entity distributing Dogecoin as a dividend – whether through a newly formed company, an existing Trump Organization venture, or a hypothetical political action committee – rests on several shaky foundations. First, there's the inherent volatility of Dogecoin. Unlike traditional dividend payouts in stable assets, Dogecoin's price is notoriously susceptible to market manipulation, social media trends, and Elon Musk's tweets. A dividend paid in Dogecoin could be worth significantly less in a short time frame, potentially leaving investors with substantial losses. This contrasts sharply with the stable, predictable nature of traditional dividends paid in established currencies or shares.

[Expert Opinion 1]: [Quote a financial expert, economist, or cryptocurrency analyst on the financial viability of a Dogecoin dividend. Include their name, title, and the organization they represent. Cite the source of the quote.] "The idea of a Dogecoin dividend is frankly ludicrous from a financial perspective," states [Expert Name], [Expert Title] at [Organization]. "[Quote explaining their reasoning, focusing on risks and volatility]."

Furthermore, the legal and regulatory landscape surrounding such a dividend remains unclear. The Securities and Exchange Commission (SEC) has increased its scrutiny of cryptocurrencies, particularly regarding their classification as securities. A Trump-backed Dogecoin dividend could potentially trigger SEC investigations into potential violations of securities laws, particularly if it's deemed to be an unregistered security offering.

[Legal/Regulatory Challenges]: [Include details about any existing regulations or potential legal challenges related to distributing cryptocurrencies as dividends. Include references to specific laws, regulations, or SEC pronouncements.] The complexities surrounding taxation of cryptocurrency transactions further complicate the matter. Current tax laws are still evolving to handle crypto assets, and investors could face significant uncertainties regarding their tax obligations associated with receiving and disposing of a Dogecoin dividend.

[Market Reaction to the Idea]: [Detail the actual market response to the speculation, including price movements of Dogecoin, if any, and general sentiment among investors and analysts. Cite reputable sources such as financial news websites or market analysis reports.] Initial speculation about a potential Trump Dogecoin dividend [Describe the market's reaction, e.g., caused a slight price increase, had no noticeable effect, was met with widespread skepticism]. This suggests that [Explain what the market reaction suggests about the credibility or potential impact of the idea].

[Expert Opinion 2]: [Quote a second financial expert, ideally with a different perspective or expertise, to provide a balanced view. Include their name, title, and the organization they represent. Cite the source of the quote.] [Expert Name], [Expert Title] at [Organization] notes that, "[Quote offering a different perspective, potentially focusing on aspects like brand association or speculative investment]." However, even this more nuanced view acknowledges the significant risk inherent in such an undertaking.

In conclusion, the prospect of a Trump Dogecoin dividend appears financially unsound for numerous reasons. The extreme volatility of Dogecoin, the unresolved legal and regulatory uncertainties surrounding cryptocurrency dividends, and the potential for significant tax complications present considerable risks for potential investors. While the idea may capture attention due to its novelty and association with prominent figures, a rational financial analysis points toward its impracticality and potential for substantial losses. Investors should approach any such proposition with extreme caution, prioritizing sound financial advice and due diligence over speculative ventures.

Featured Posts

-

Government Shutdown Looms As Congress Debates Tax Cuts And Agency Layoffs

Feb 24, 2025

Government Shutdown Looms As Congress Debates Tax Cuts And Agency Layoffs

Feb 24, 2025 -

Pope Francis Hospital Stay Vatican Confirms Critical Condition

Feb 24, 2025

Pope Francis Hospital Stay Vatican Confirms Critical Condition

Feb 24, 2025 -

Clash Of Titans Trump Vs Democratic States On Key Policies

Feb 24, 2025

Clash Of Titans Trump Vs Democratic States On Key Policies

Feb 24, 2025 -

Federal Employees Face Work Explanation Request From Elon Musk

Feb 24, 2025

Federal Employees Face Work Explanation Request From Elon Musk

Feb 24, 2025 -

Peak District Beauty Spots Parking Problems And Solutions

Feb 24, 2025

Peak District Beauty Spots Parking Problems And Solutions

Feb 24, 2025

Latest Posts

-

Controversial Email Doges Ultimatum To Us Government Employees

Feb 24, 2025

Controversial Email Doges Ultimatum To Us Government Employees

Feb 24, 2025 -

Musk Threatens Federal Employees Over Unexplained Actions

Feb 24, 2025

Musk Threatens Federal Employees Over Unexplained Actions

Feb 24, 2025 -

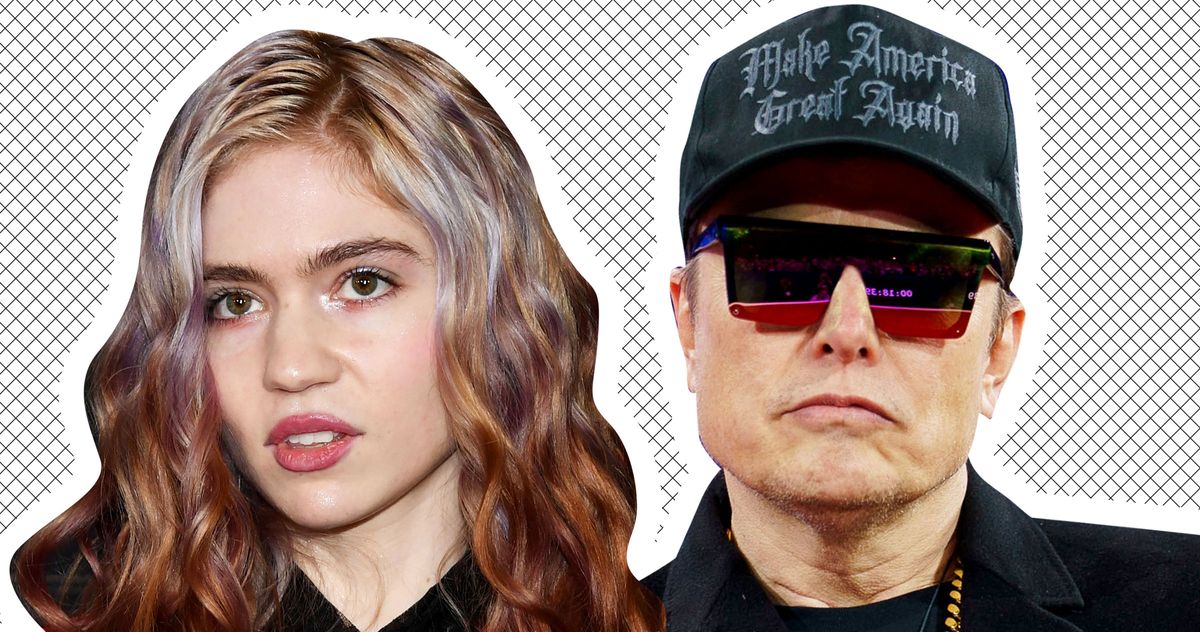

Childs Medical Emergency Grimes Blasts Elon Musks Lack Of Support

Feb 24, 2025

Childs Medical Emergency Grimes Blasts Elon Musks Lack Of Support

Feb 24, 2025 -

Revenge Plan Backfires A Mothers Grief And The Path To Justice

Feb 24, 2025

Revenge Plan Backfires A Mothers Grief And The Path To Justice

Feb 24, 2025 -

New Yorkers Top 10 Most Controversial Covers Of All Time

Feb 24, 2025

New Yorkers Top 10 Most Controversial Covers Of All Time

Feb 24, 2025