Is A Trump Dogecoin Dividend A Good Idea? Weighing The Pros And Cons

Table of Contents

Is a Trump Dogecoin Dividend a Good Idea? Weighing the Pros and Cons

A proposal to distribute Dogecoin as a dividend to shareholders of a Trump-related company has sparked debate. While the idea holds potential benefits, significant drawbacks and uncertainties need careful consideration.

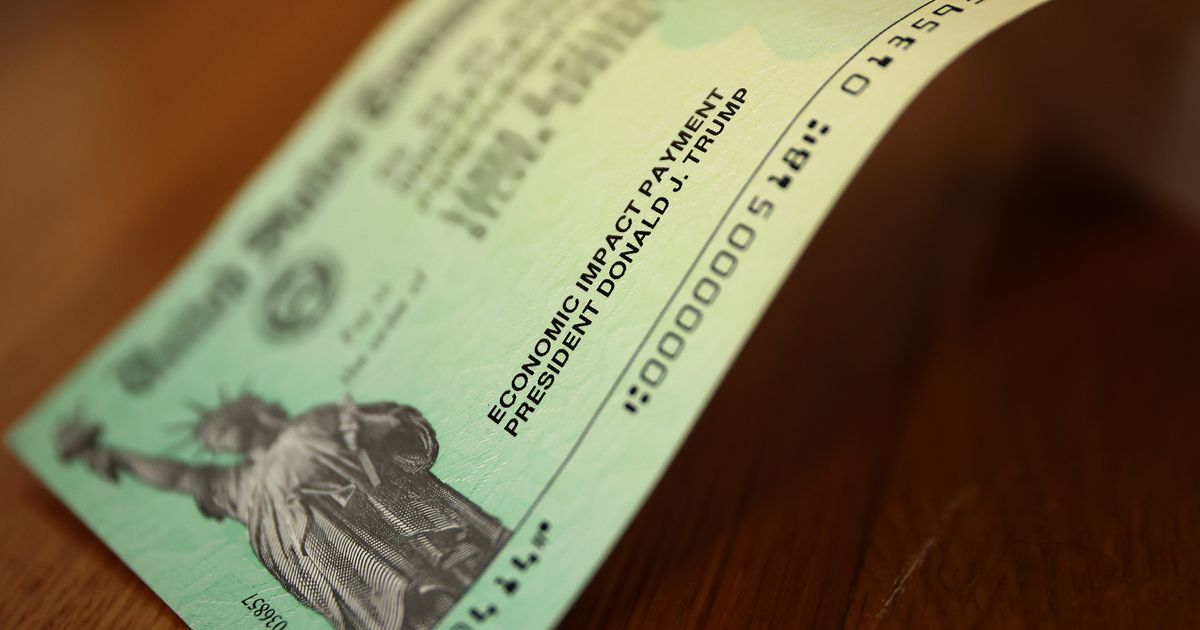

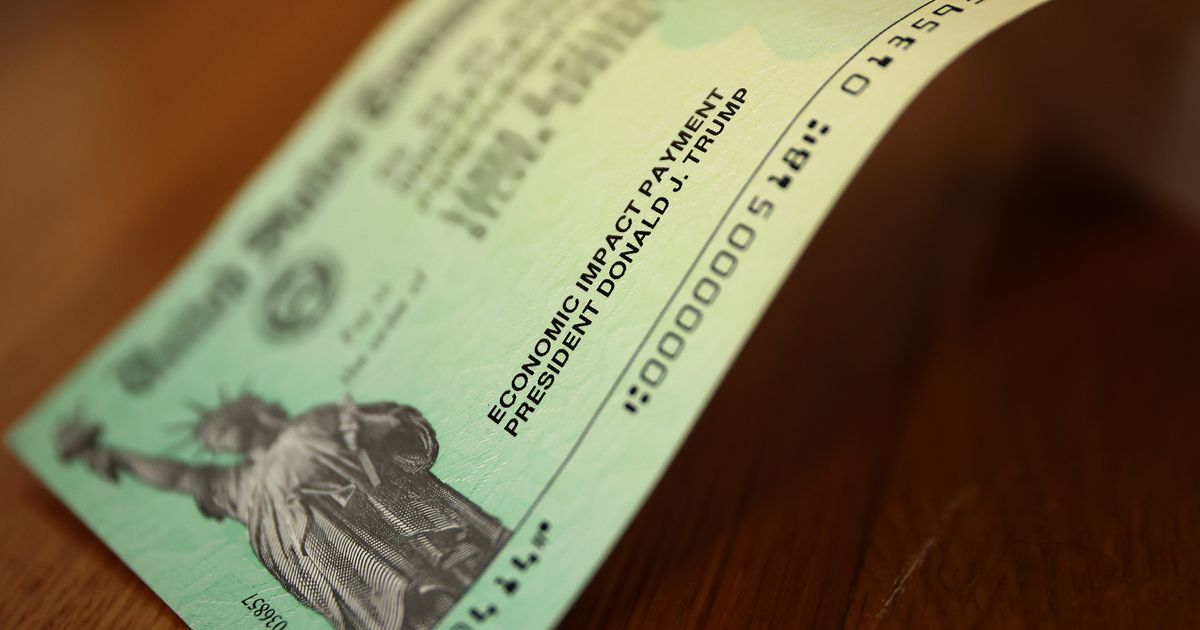

WASHINGTON, D.C. – A novel proposal to distribute Dogecoin (DOGE), the meme-based cryptocurrency, as a dividend to shareholders of a Trump-related company has ignited a firestorm of discussion among financial experts and cryptocurrency enthusiasts. The idea, while seemingly outlandish, presents a fascinating case study in the intersection of traditional finance, meme culture, and the volatile world of cryptocurrencies. While proponents highlight the potential for increased shareholder engagement and brand visibility, detractors point to the inherent risks associated with cryptocurrency volatility and the regulatory uncertainties surrounding such a distribution.

The core of the proposal revolves around [Company Name, a company with significant ties to former President Donald Trump, such as a SPAC or a company he owns a stake in – this needs to be replaced with the actual company name if it exists. If no such company exists that has publicly proposed this, this section needs significant reworking to reflect that]. The specifics of the proposed dividend are currently unclear, including the exact amount of DOGE to be distributed and the timeline for distribution. However, the mere suggestion has already sent ripples through the financial markets and social media, sparking heated debate about its feasibility and potential impact.

Arguments for the Dogecoin Dividend:

- Increased Shareholder Engagement: Proponents argue that a DOGE dividend could significantly boost shareholder engagement, particularly among younger investors who are more familiar with cryptocurrencies. The novelty of the approach could generate substantial media attention and potentially attract new investors to the company.

- Brand Building and Marketing: The unorthodox approach could serve as a powerful marketing tactic, associating the company with a trending asset and generating significant buzz, particularly within the online communities that embrace meme culture and cryptocurrencies. This unconventional strategy could appeal to a demographic typically less engaged with traditional investments.

- Potential for Appreciation: While highly speculative, the value of DOGE could appreciate over time, potentially resulting in a significant return for shareholders. However, this is contingent on market conditions and the overall future trajectory of the cryptocurrency.

Arguments Against the Dogecoin Dividend:

- Extreme Volatility: Dogecoin is known for its extremely volatile price swings, making it a highly risky asset. A DOGE dividend could expose shareholders to significant losses if the value of the cryptocurrency declines after distribution. The lack of intrinsic value and reliance on speculation presents a clear danger.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving, and there's significant uncertainty regarding the tax implications and legal ramifications of distributing a cryptocurrency as a dividend. Shareholders could face unforeseen tax liabilities or legal challenges as a result.

- Lack of Transparency and Predictability: The value of DOGE is subject to unpredictable market forces and manipulation, making it difficult to assess the true value of the dividend at the time of distribution. This lack of transparency and predictability poses a significant risk to shareholders.

- Reputational Risk: The unconventional nature of the proposal could damage the company's reputation, alienating traditional investors and potentially harming its long-term prospects. The association with a volatile meme coin could undermine the company’s perceived stability and credibility.

Conclusion:

The proposed Dogecoin dividend presents a complex scenario with potential upsides and significant downsides. While the novelty of the approach could generate short-term gains in terms of publicity and investor engagement, the inherent risks associated with cryptocurrency volatility and regulatory uncertainty cannot be ignored. A thorough cost-benefit analysis, factoring in potential legal and tax implications, is crucial before implementing such a strategy. Investors considering participating in such a venture should carefully weigh the potential rewards against the significant risks involved, seeking expert financial and legal advice before making any investment decisions. The long-term implications of this unconventional approach remain uncertain and will likely be a topic of ongoing debate.

Featured Posts

-

Can Zelenskys Diplomacy Mend The Us Ukraine Rift Under Trumps Shadow

Feb 25, 2025

Can Zelenskys Diplomacy Mend The Us Ukraine Rift Under Trumps Shadow

Feb 25, 2025 -

Federal Agencies Face Musks Wrath Explain Last Week Or Be Fired

Feb 25, 2025

Federal Agencies Face Musks Wrath Explain Last Week Or Be Fired

Feb 25, 2025 -

Military In Uncharted Territory Analyzing Trumps Pentagon Restructuring

Feb 25, 2025

Military In Uncharted Territory Analyzing Trumps Pentagon Restructuring

Feb 25, 2025 -

Federal Employee Action Demanded Document Work Or Resign Says Doge

Feb 25, 2025

Federal Employee Action Demanded Document Work Or Resign Says Doge

Feb 25, 2025 -

From Tragedy To Art A Mothers Journey After The Lockerbie Plane Bombing

Feb 25, 2025

From Tragedy To Art A Mothers Journey After The Lockerbie Plane Bombing

Feb 25, 2025

Latest Posts

-

Key Women Supporting Luigi Mangiones Legal Battle

Feb 25, 2025

Key Women Supporting Luigi Mangiones Legal Battle

Feb 25, 2025 -

Elon Musk Seeks Accountability Inquiry Into Federal Employee Jobs

Feb 25, 2025

Elon Musk Seeks Accountability Inquiry Into Federal Employee Jobs

Feb 25, 2025 -

Elon Musk Questions Federal Employee Roles And Responsibilities

Feb 25, 2025

Elon Musk Questions Federal Employee Roles And Responsibilities

Feb 25, 2025 -

Smoke Prompts Emergency Landing For Delta Flight Originating In Los Angeles

Feb 25, 2025

Smoke Prompts Emergency Landing For Delta Flight Originating In Los Angeles

Feb 25, 2025 -

Discovery Of Potential Second Tomb For Pharaoh Thutmose Ii

Feb 25, 2025

Discovery Of Potential Second Tomb For Pharaoh Thutmose Ii

Feb 25, 2025