LA's Burned Lots: Smart Investment Or Risky Gamble?

Table of Contents

LA's Burned Lots: Smart Investment or Risky Gamble?

Los Angeles, CA – The devastating wildfires that have swept through parts of Los Angeles in recent years have left behind a grim landscape of charred remains, including numerous burned lots. While the immediate aftermath evokes images of devastation, a new question is emerging amongst investors: are these scorched parcels of land a smart investment or a risky gamble? The answer, it turns out, is complex and depends on a multitude of factors.

The immediate aftermath of a wildfire leaves behind a scene of destruction that is difficult to assess for investment potential. The land itself may be unstable, riddled with debris, and potentially contaminated with hazardous materials like asbestos or lead paint from destroyed structures. Furthermore, obtaining necessary permits and navigating environmental regulations can be a costly and time-consuming process. [Specific examples of permitting delays and costs in LA County following recent wildfires could be inserted here. For instance, data from the LA County Department of Public Works or similar sources should be researched and included to provide concrete figures]. This adds significant layers of complexity and expense beyond the initial purchase price.

However, despite these significant challenges, some investors see opportunity in these burned lots. Prices are often significantly lower than comparable unburned lots in the same area, creating a potential for substantial profit if the land is successfully rehabilitated. The longer-term appreciation potential of land in desirable Los Angeles neighborhoods, particularly if reconstruction occurs and property values rebound, can outweigh the initial risks for shrewd investors. [Specific examples of property value changes in areas affected by past wildfires – before and after reconstruction – should be included here. Data from Zillow, Redfin, or the Los Angeles County Assessor’s office could be used to illustrate this point with concrete numbers and trends].

The risk profile, however, is substantial. The environmental remediation alone can be incredibly expensive. [Include specific cost estimates for soil remediation and hazardous material removal in LA County following wildfires, citing relevant government agencies or environmental consulting firms]. Utility services may be disrupted or require extensive repairs, adding further costs. Moreover, there's always the uncertainty surrounding future wildfire risks. The possibility of another fire, even years later, remains a significant concern, potentially wiping out any investment gains. [Include statistics on the frequency and intensity of wildfires in the specific LA areas affected, along with data on insurance premiums for properties in high-risk zones. Sources like Cal Fire or the Insurance Information Institute would be helpful].

Beyond the financial aspects, there's a strong ethical dimension to consider. Purchasing burned lots raises questions about gentrification and displacement, particularly if the previous owners were unable to rebuild. [Discuss the impact of wildfires on vulnerable communities in LA and the potential for investment to exacerbate existing inequalities. Include quotes from community activists or researchers working on this issue]. A responsible investment strategy should carefully consider these social implications.

In conclusion, investing in LA's burned lots is a complex proposition involving significant financial risks and ethical considerations. While potential for high returns exists, the substantial upfront costs, environmental challenges, and ongoing risks associated with wildfire recurrence make it a gamble suitable only for well-informed and financially resilient investors who thoroughly assess all potential pitfalls. Due diligence is paramount, including comprehensive environmental assessments, detailed cost projections, and a clear understanding of local regulations and the potential social impact of such investment. [Concluding thoughts and possibly a quote from a real estate expert specializing in post-wildfire property development could add weight and authority].

Featured Posts

-

Sons Murder Fuels Mothers Revenge The Unforeseen Results

Feb 25, 2025

Sons Murder Fuels Mothers Revenge The Unforeseen Results

Feb 25, 2025 -

Elon Musk Questions Federal Employee Productivity A Nationwide Inquiry

Feb 25, 2025

Elon Musk Questions Federal Employee Productivity A Nationwide Inquiry

Feb 25, 2025 -

Emergency Landing Delta Flight From Los Angeles Reports Smoke On Board

Feb 25, 2025

Emergency Landing Delta Flight From Los Angeles Reports Smoke On Board

Feb 25, 2025 -

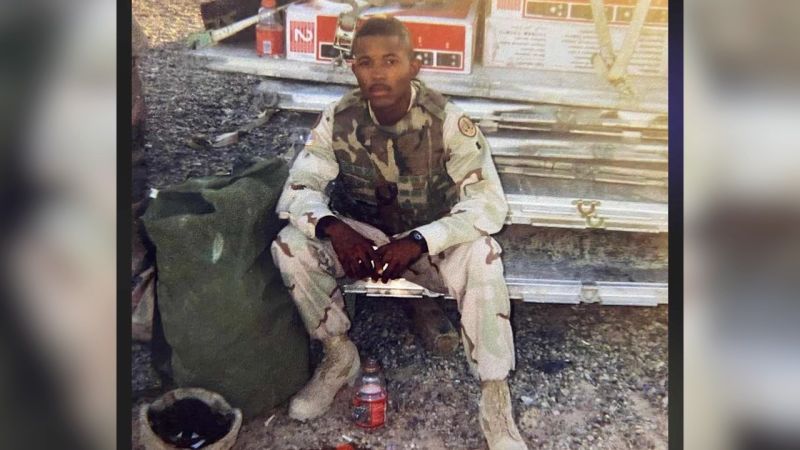

Wife Recounts Husbands Ice Arrest Us Veteran Detained

Feb 25, 2025

Wife Recounts Husbands Ice Arrest Us Veteran Detained

Feb 25, 2025 -

American Airlines Flight From Nyc To Delhi Safely Lands In Rome Following Security Alert

Feb 25, 2025

American Airlines Flight From Nyc To Delhi Safely Lands In Rome Following Security Alert

Feb 25, 2025

Latest Posts

-

Trumps New Tariffs How They Could Impact Your Wallet

Feb 25, 2025

Trumps New Tariffs How They Could Impact Your Wallet

Feb 25, 2025 -

Red Carpet Highlights The Best Looks From The 2025 Sag Awards

Feb 25, 2025

Red Carpet Highlights The Best Looks From The 2025 Sag Awards

Feb 25, 2025 -

Met Office Amber Warning Heavy Rain And Flooding Across Wales

Feb 25, 2025

Met Office Amber Warning Heavy Rain And Flooding Across Wales

Feb 25, 2025 -

Nz Government Minister Andrew Bayly Steps Down Over Workplace Conduct Complaint

Feb 25, 2025

Nz Government Minister Andrew Bayly Steps Down Over Workplace Conduct Complaint

Feb 25, 2025 -

Concern For Pope Francis Vatican Releases Statement On His Health After Critical Assessment

Feb 25, 2025

Concern For Pope Francis Vatican Releases Statement On His Health After Critical Assessment

Feb 25, 2025