Looming Shutdown: Congress Weighs Tax Cuts Against Agency Layoffs

Table of Contents

Looming Shutdown: Congress Grapples with Tax Cuts Amidst Potential Agency Layoffs

Washington, D.C. – The U.S. government faces a potential shutdown as Congress struggles to reconcile competing priorities: delivering on promised tax cuts and avoiding drastic agency budget cuts. With a deadline looming, lawmakers are locked in intense negotiations, leaving the nation's workforce and vital government services hanging in the balance.

The current fiscal year is set to expire on [Insert Date – e.g., September 30th, 2024], and without a passing budget resolution, numerous federal agencies will be forced to cease operations. This would impact millions of federal employees, potentially leading to [Insert Number] furloughed workers and significant disruptions to a wide array of services, from passport processing and national park operations to crucial research initiatives and social security benefit payments.

The primary source of the impasse lies in the sharply divided perspectives on fiscal policy. Proponents of the proposed tax cuts, largely within the [Insert Relevant Political Party – e.g., Republican] party, argue that the reductions are essential for stimulating economic growth and providing relief to taxpayers. They contend that the cuts will ultimately benefit the economy and offset any potential short-term disruption caused by a temporary shutdown. Specifics of the proposed tax cuts include [Insert Details of Proposed Tax Cuts, e.g., reductions in corporate tax rates, expanded child tax credits, etc.]. [Insert Names and Quotes from key proponents].

However, opponents, primarily within the [Insert Relevant Political Party – e.g., Democratic] party, express serious concerns about the fiscal implications of these tax cuts, particularly given the projected budget deficit. They argue that implementing such significant tax reductions without identifying corresponding spending cuts would exacerbate the national debt and ultimately undermine the country's long-term financial stability. They emphasize the potential negative consequences of a government shutdown, highlighting the disruption to essential services and the economic uncertainty it would create. [Insert Names and Quotes from key opponents].

Negotiations have been fraught with tension. [Insert Details of Negotiation Processes, e.g., bipartisan talks, caucus meetings, etc.]. [Insert Specific sticking points in the negotiations, e.g., disagreements over funding levels for specific agencies, compromises on the tax cut proposals, etc.]. Both sides have presented seemingly intractable positions, leaving little room for compromise.

The potential consequences of a shutdown extend far beyond the immediate disruption to government operations. A prolonged shutdown could negatively impact consumer confidence, hinder economic growth, and damage the nation's international standing. Experts predict [Insert Expert Opinions and Predictions on the economic consequences of a government shutdown].

As the deadline approaches, the pressure on Congress to reach an agreement intensifies. The public is closely watching the unfolding events, with growing anxiety about the potential impact on their lives and livelihoods. Whether lawmakers can find a path forward and avert a shutdown remains uncertain, leaving the nation on edge. [Insert Concluding statement summarizing the current situation and outlook for the future].

Note: This template requires filling in the bracketed information with specific data and details obtained from reliable news sources, government websites, and expert analysis to provide a complete and accurate news report. Remember to cite all sources appropriately.

Featured Posts

-

2025 Insurance Nightmare Doctors Video Sparks Debate

Feb 24, 2025

2025 Insurance Nightmare Doctors Video Sparks Debate

Feb 24, 2025 -

Veteran Actress Lynne Marie Stewart Dead At 78 Its Always Sunny And Beyond

Feb 24, 2025

Veteran Actress Lynne Marie Stewart Dead At 78 Its Always Sunny And Beyond

Feb 24, 2025 -

Analyzing The 2025 German Federal Election What To Expect

Feb 24, 2025

Analyzing The 2025 German Federal Election What To Expect

Feb 24, 2025 -

Will Trumps Changes Impact Your Postal Service

Feb 24, 2025

Will Trumps Changes Impact Your Postal Service

Feb 24, 2025 -

Elon Musk Seeks Explanation Of Federal Employee Duties

Feb 24, 2025

Elon Musk Seeks Explanation Of Federal Employee Duties

Feb 24, 2025

Latest Posts

-

Government Responds To Concerns Over New Dog Breeds

Feb 25, 2025

Government Responds To Concerns Over New Dog Breeds

Feb 25, 2025 -

Remembering Lockerbie A Mothers Art Honors Lost Sons And Daughters

Feb 25, 2025

Remembering Lockerbie A Mothers Art Honors Lost Sons And Daughters

Feb 25, 2025 -

Avenging Her Son A Mothers Plan Backfires

Feb 25, 2025

Avenging Her Son A Mothers Plan Backfires

Feb 25, 2025 -

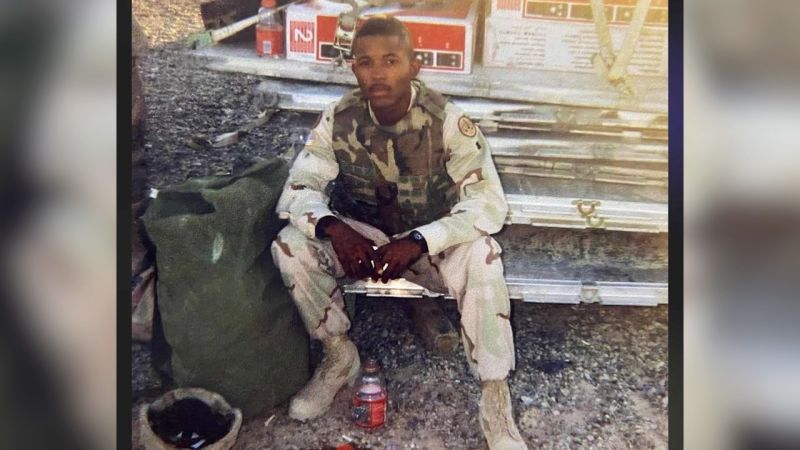

Ice Is About To Detain Me Veterans Wife Shares Arrest Story

Feb 25, 2025

Ice Is About To Detain Me Veterans Wife Shares Arrest Story

Feb 25, 2025 -

Justice Denied A Mothers Quest For Revenge And Its Fallout

Feb 25, 2025

Justice Denied A Mothers Quest For Revenge And Its Fallout

Feb 25, 2025