Lower Delivery Estimates Weigh Heavily On Rivian Automotive Stock Price

Table of Contents

Lower Delivery Estimates Weigh Heavily on Rivian Automotive Stock Price

Rivian Automotive's stock price plummeted after the electric vehicle (EV) maker slashed its 2023 production forecast, raising concerns about its ability to compete in the increasingly crowded EV market. The downward revision, announced [on August 9, 2023, during the company's second-quarter earnings call], sent shockwaves through the financial markets, wiping out billions in market capitalization. Investors reacted negatively to the reduced outlook, highlighting the challenges facing even well-funded EV startups in navigating the complexities of scaling production and meeting ambitious targets.

The company originally projected to produce [25,000] vehicles in 2023. However, this figure was drastically lowered to a range of [12,500 to 13,000] vehicles. This represents a significant shortfall, underscoring the operational hurdles Rivian is encountering. The company cited supply chain constraints, particularly related to [semiconductors and battery components], as the primary reason for the reduced output. These challenges, coupled with the broader macroeconomic headwinds impacting the automotive industry, have contributed to the pessimistic outlook.

The revised production forecast immediately impacted Rivian's stock price, causing a [double-digit percentage] drop in after-hours trading [on August 9, 2023]. The decline continued into the following trading day, further eroding investor confidence. This sharp downturn underscores the market's sensitivity to delivery projections in the volatile EV sector, where investor sentiment is heavily influenced by production capacity and market share gains.

Beyond the immediate market reaction, the lowered production targets raise questions about Rivian's long-term viability and its ability to compete against established automakers and other EV startups. The company is burning through significant cash reserves, and the reduced production will likely impact its path to profitability. Analysts are now reassessing their price targets, with some predicting further declines in the stock price if Rivian fails to demonstrate significant improvements in its operational efficiency and supply chain management.

Rivian's CEO, R.J. Scaringe, acknowledged the challenges in a statement accompanying the earnings report, emphasizing the company's focus on improving its manufacturing processes and strengthening its supply chain relationships. He highlighted efforts to streamline production and optimize its manufacturing facilities to address the bottlenecks. However, the market remains skeptical, demanding concrete evidence of tangible improvements before restoring confidence.

The situation at Rivian serves as a cautionary tale for other EV startups. While the sector enjoys significant investor interest, translating ambitious plans into consistent production and profitability remains a considerable hurdle. The company's experience highlights the importance of realistic production targets and robust supply chain management in navigating the complexities of scaling an EV manufacturing business. The coming months will be critical for Rivian, as it seeks to demonstrate that it can overcome its current challenges and deliver on its long-term promises. The company's success will not only impact its own stock price but also serve as a barometer for the broader EV sector. Failure to meet revised targets could further dampen investor enthusiasm for the sector as a whole.

Featured Posts

-

Hooters Faces Bankruptcy After Closing Multiple Locations

Feb 22, 2025

Hooters Faces Bankruptcy After Closing Multiple Locations

Feb 22, 2025 -

Msu Um Basketball Game Where To Watch Fridays Big Rivalry Matchup

Feb 22, 2025

Msu Um Basketball Game Where To Watch Fridays Big Rivalry Matchup

Feb 22, 2025 -

Knicks Vs Cavaliers Odds Expert Predictions And Best Bets

Feb 22, 2025

Knicks Vs Cavaliers Odds Expert Predictions And Best Bets

Feb 22, 2025 -

Official Dusty May Agrees To Contract As Michigan Basketball Coach

Feb 22, 2025

Official Dusty May Agrees To Contract As Michigan Basketball Coach

Feb 22, 2025 -

Complete Ranking Every Song On Tate Mc Raes So Close Album

Feb 22, 2025

Complete Ranking Every Song On Tate Mc Raes So Close Album

Feb 22, 2025

Latest Posts

-

Callum Smith Triumphant After Tough Fight With Buatsi

Feb 23, 2025

Callum Smith Triumphant After Tough Fight With Buatsi

Feb 23, 2025 -

Supreme Court Awaits On Case Regarding Trumps Removal Of Watchdog

Feb 23, 2025

Supreme Court Awaits On Case Regarding Trumps Removal Of Watchdog

Feb 23, 2025 -

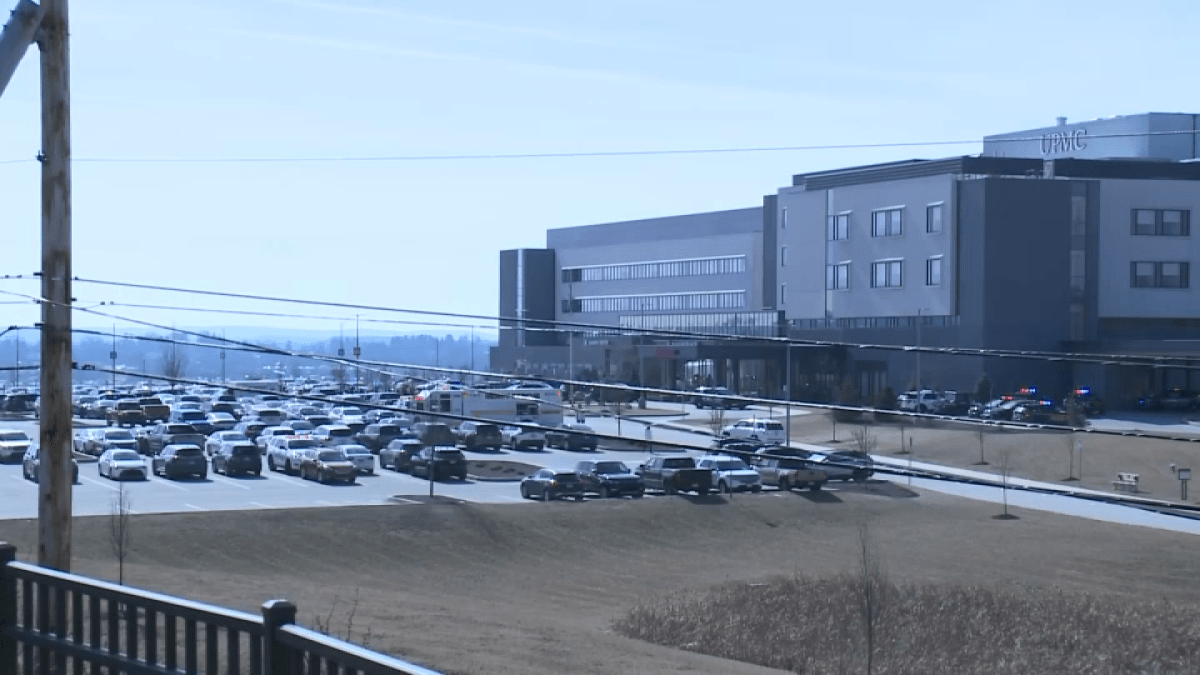

Officer Fatally Shot At Pennsylvania Hospital Gunman Found Dead

Feb 23, 2025

Officer Fatally Shot At Pennsylvania Hospital Gunman Found Dead

Feb 23, 2025 -

Celtics 13 Point Lead Prompts Angry Reaction From Sutton

Feb 23, 2025

Celtics 13 Point Lead Prompts Angry Reaction From Sutton

Feb 23, 2025 -

Key German Election Scholzs Vision For Europes Direction

Feb 23, 2025

Key German Election Scholzs Vision For Europes Direction

Feb 23, 2025