Major Crypto Security Breach: Bybit Reports $1.4 Billion Loss

Table of Contents

Bybit Denies $1.4 Billion Crypto Security Breach; Rumors Spur Market Volatility

HONG KONG, [Date of Publication] – A wave of panic swept through the cryptocurrency market earlier this week following unsubstantiated online reports claiming a massive $1.4 billion security breach at Bybit, one of the world's largest cryptocurrency exchanges. Bybit swiftly and vehemently denied these allegations, attributing the rumors to a coordinated disinformation campaign. However, the episode highlighted the persistent vulnerability of the crypto sector to misinformation and the potential for significant market disruption.

The initial reports, which circulated widely on social media and various cryptocurrency forums, claimed that hackers had compromised Bybit's systems, leading to the theft of a staggering $1.4 billion in user assets. The purported breach quickly gained traction, driving a sharp decline in the price of Bitcoin and other major cryptocurrencies. Several prominent crypto influencers amplified the rumors, further fueling the panic and contributing to significant trading volume spikes, as investors reacted to the unverified news.

Bybit responded within hours, issuing a strongly worded statement categorically denying any security breach or loss of user funds. The exchange's official statement highlighted the robustness of its security protocols, including multi-signature authorization, cold storage for the majority of its assets, and a multi-layered security system designed to protect against various types of attacks. The company also underscored its commitment to transparency and pledged to cooperate fully with any legitimate investigation into the matter.

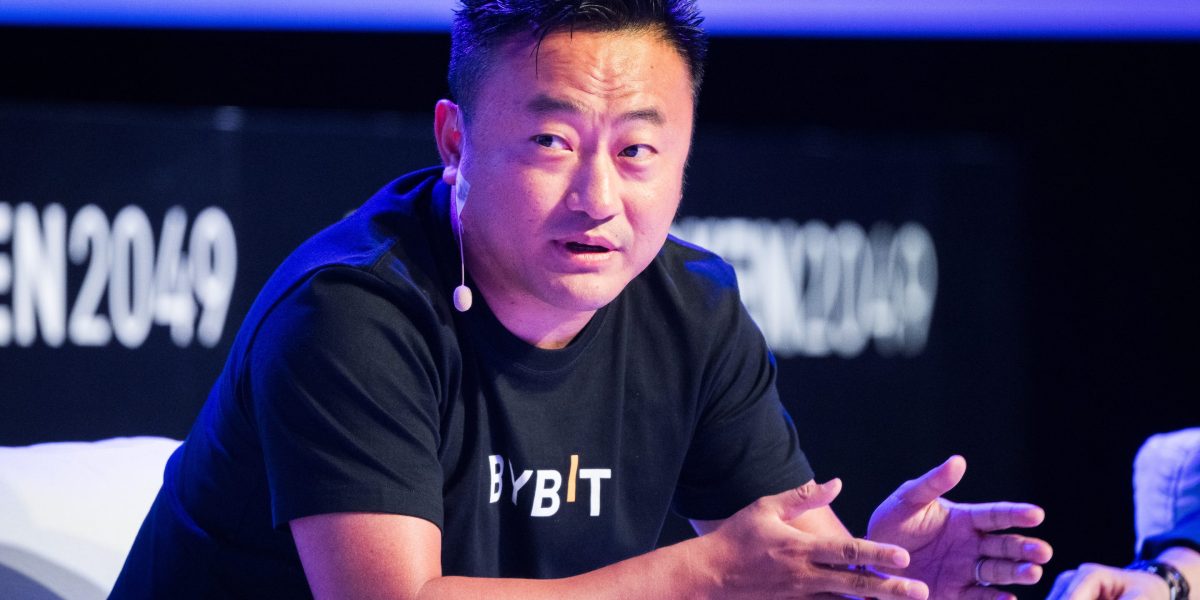

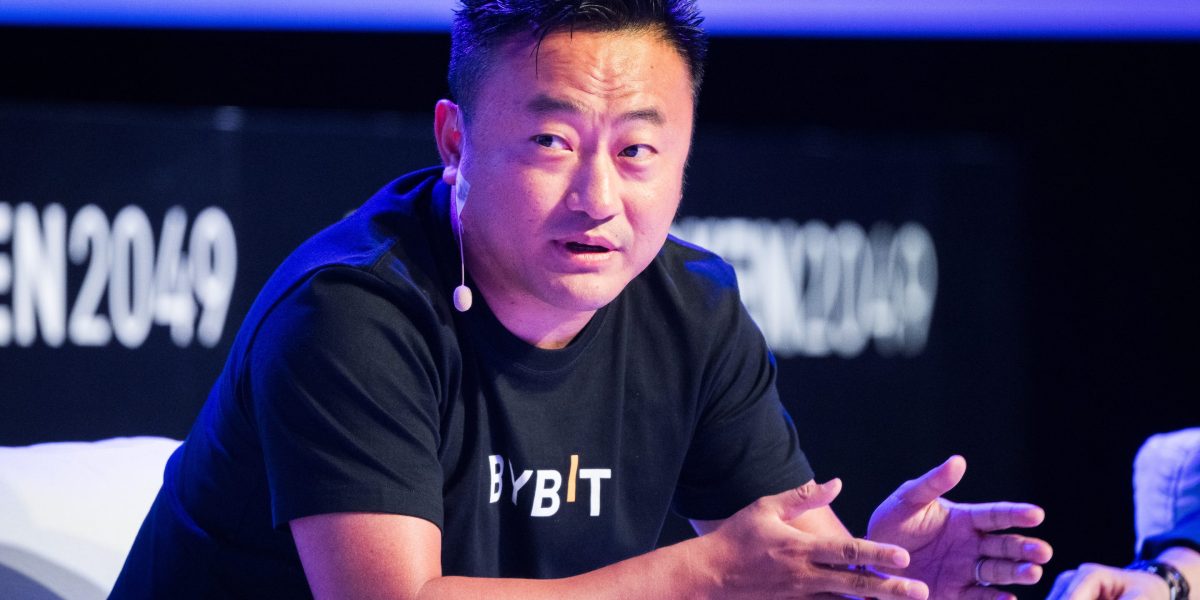

"[Quote from Bybit CEO or relevant spokesperson regarding the denial and security measures]", said [Name and Title of spokesperson]. "[Further quote addressing the impact on market sentiment and the company's commitment to user security.]"

Despite Bybit's swift and forceful denial, the impact of the false report was significant. The episode exposed the fragility of the crypto market's confidence and underscored its susceptibility to misinformation. The rapid spread of the unsubstantiated allegations caused considerable market volatility, with Bitcoin experiencing a noticeable dip before recovering some ground. Other cryptocurrencies also saw price fluctuations reflecting the uncertainty caused by the rumors.

Security experts have weighed in on the incident, emphasizing the importance of verifying information from reputable sources before reacting to news circulating online. They also highlighted the need for exchanges to maintain robust security measures and transparent communication with users to maintain confidence. The incident serves as a stark reminder of the challenges involved in regulating and ensuring the security of the still-evolving cryptocurrency market.

The origins of the false report remain unclear. Bybit has suggested a potential malicious campaign aimed at damaging the exchange's reputation or manipulating the crypto market. However, without definitive evidence, speculation continues. Authorities have not yet launched a formal investigation into the matter, but the incident underscores the potential for significant financial losses and reputational damage from false narratives within the volatile cryptocurrency space.

The incident also raises questions about the regulatory oversight of the cryptocurrency sector. While cryptocurrencies are increasingly gaining mainstream adoption, the lack of uniform regulations across different jurisdictions leaves the market vulnerable to manipulation and misinformation. This incident will likely further fuel discussions on the need for clearer regulatory frameworks to protect investors and maintain the integrity of the crypto market. The fallout from the false alarm will continue to be closely watched by investors and industry experts alike, highlighting the ongoing challenges of balancing innovation with security and transparency in the crypto world.

Featured Posts

-

Shift In Us Ukraine Policy Trumps Stance Mirrors Russias

Feb 22, 2025

Shift In Us Ukraine Policy Trumps Stance Mirrors Russias

Feb 22, 2025 -

Chelsea Handler On Being Ghosted By Andrew Cuomo

Feb 22, 2025

Chelsea Handler On Being Ghosted By Andrew Cuomo

Feb 22, 2025 -

Is Reacher Season 3 Free On Prime Video A Streaming Guide

Feb 22, 2025

Is Reacher Season 3 Free On Prime Video A Streaming Guide

Feb 22, 2025 -

The Drill Tiger Woods Detested A Look At His Intense Training

Feb 22, 2025

The Drill Tiger Woods Detested A Look At His Intense Training

Feb 22, 2025 -

Hunter Schafer Addresses Passport Gender Change To Male

Feb 22, 2025

Hunter Schafer Addresses Passport Gender Change To Male

Feb 22, 2025

Latest Posts

-

Beterbiev Vs Bivol 2 Fight Card Date Time And How To Watch

Feb 23, 2025

Beterbiev Vs Bivol 2 Fight Card Date Time And How To Watch

Feb 23, 2025 -

Double Homicide Virginia Beach Police Officers Shot And Killed During Traffic Stop

Feb 23, 2025

Double Homicide Virginia Beach Police Officers Shot And Killed During Traffic Stop

Feb 23, 2025 -

Snl 50th Anniversary Covid 19 Impacts Maya Rudolph And Martin Shorts Appearances

Feb 23, 2025

Snl 50th Anniversary Covid 19 Impacts Maya Rudolph And Martin Shorts Appearances

Feb 23, 2025 -

Watch Southampton Vs Brighton Live Stream And Match Preview

Feb 23, 2025

Watch Southampton Vs Brighton Live Stream And Match Preview

Feb 23, 2025 -

Perrie Edwards Life With Fiance Alex Oxlade Chamberlain Family Career And More

Feb 23, 2025

Perrie Edwards Life With Fiance Alex Oxlade Chamberlain Family Career And More

Feb 23, 2025