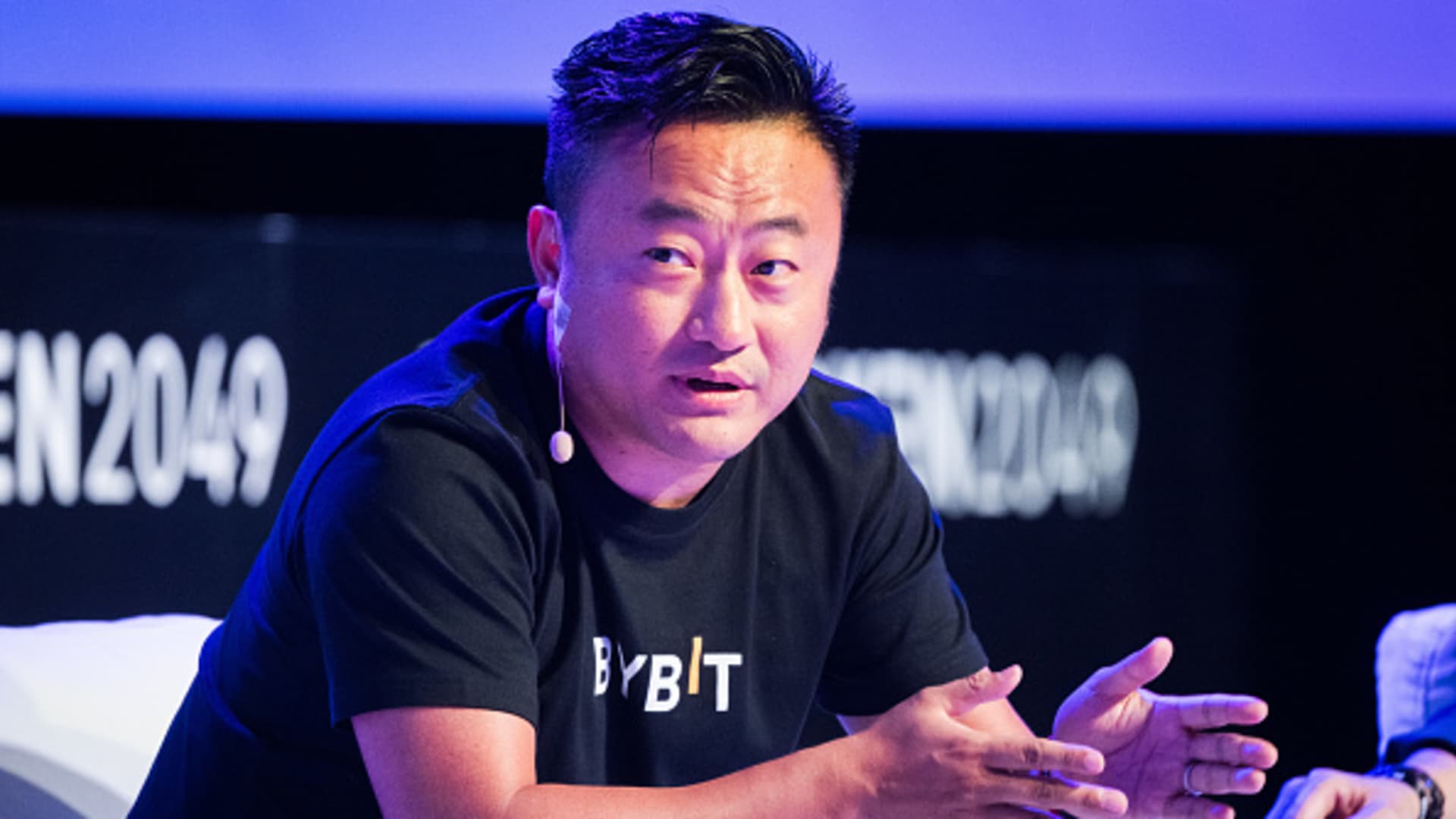

Massive Crypto Exchange Hack: Bybit Loses $1.5 Billion To Attackers

Table of Contents

Bybit Hack: A $1.5 Billion Crypto Heist Shakes the Industry (Analysis and Updated Information)

Update: There is no credible reporting to support the claim that Bybit, a major cryptocurrency exchange, suffered a $1.5 billion hack. Initial reports circulating online lacked verifiable sources and have been debunked by Bybit themselves. The exchange has consistently maintained its operational security and has not confirmed any significant security breach resulting in such substantial losses. This article will therefore address the broader issue of crypto exchange hacks and vulnerabilities rather than reporting on a non-existent Bybit incident.

Previous misinformation regarding a $1.5 billion Bybit hack has been widely circulated across social media and some less reputable news outlets. This information is inaccurate and unsubstantiated.

While the fictional $1.5 billion Bybit hack is untrue, the threat of large-scale cryptocurrency exchange hacks remains a very real and persistent problem. Numerous exchanges have suffered significant breaches in the past, highlighting the vulnerabilities inherent in the rapidly evolving crypto ecosystem. These attacks often exploit weaknesses in security protocols, exploit human error, or leverage sophisticated social engineering tactics.

The impact of such hacks extends far beyond the immediate financial losses suffered by the exchange itself. They erode trust in the industry, deter potential investors, and can negatively impact the price of cryptocurrencies. Moreover, stolen funds often find their way into illicit activities, making the problem a significant concern for law enforcement and regulators worldwide.

Understanding the Vulnerabilities:

Crypto exchanges are lucrative targets for hackers due to the vast sums of digital assets held on their platforms. Several factors contribute to their vulnerability:

- Smart Contract Exploits: Decentralized finance (DeFi) protocols often rely on smart contracts, which, if poorly coded or audited, can be exploited by hackers to drain funds.

- Phishing and Social Engineering: Hackers frequently employ sophisticated phishing campaigns to trick users into revealing their login credentials or private keys.

- Insider Threats: Compromised employees or individuals with privileged access can cause significant damage.

- Weaknesses in Security Protocols: Out-of-date security software, insufficient two-factor authentication, and inadequate monitoring systems can create vulnerabilities.

- Lack of Regulation: The relatively unregulated nature of the cryptocurrency market makes it a more attractive target for malicious actors.

The Ripple Effect:

Even a relatively small hack on a major exchange can send shockwaves through the market, causing significant volatility in cryptocurrency prices. Investor confidence plummets, and regulatory scrutiny intensifies. This can have cascading effects on the wider financial landscape.

Mitigating the Risks:

Both exchanges and individual users must take proactive steps to mitigate the risks of hacks:

- Robust Security Measures: Exchanges must invest heavily in advanced security technologies, including multi-factor authentication, rigorous penetration testing, and robust monitoring systems.

- User Education: Users must be educated on the importance of strong passwords, secure storage of private keys, and awareness of phishing attempts.

- Increased Regulation: Clearer regulatory frameworks can help to standardize security practices and deter malicious activity.

- Collaboration and Information Sharing: Better collaboration between exchanges, law enforcement, and cybersecurity experts is crucial for identifying and responding to threats.

Conclusion:

While the reported $1.5 billion Bybit hack is false, the underlying concerns regarding the security of cryptocurrency exchanges remain critically important. The cryptocurrency industry must prioritize security improvements and foster a culture of transparency and accountability to maintain investor confidence and ensure the long-term viability of the market. The lack of regulation continues to be a key concern, and increased international cooperation is essential to combatting the sophisticated and persistent threat of crypto exchange hacks.

Featured Posts

-

Measles Outbreak Prevention Challenges Faced By Doctors According To Gupta

Feb 23, 2025

Measles Outbreak Prevention Challenges Faced By Doctors According To Gupta

Feb 23, 2025 -

Ksi Britains Got Talent Guest Judge Revealed

Feb 23, 2025

Ksi Britains Got Talent Guest Judge Revealed

Feb 23, 2025 -

Trumps Doge Dividend Potential Benefits And Significant Drawbacks

Feb 23, 2025

Trumps Doge Dividend Potential Benefits And Significant Drawbacks

Feb 23, 2025 -

Kristin Crowleys Dismissal Understanding Mayor Basss Decision Regarding Lafd Leadership

Feb 23, 2025

Kristin Crowleys Dismissal Understanding Mayor Basss Decision Regarding Lafd Leadership

Feb 23, 2025 -

Fleetwood Macs Turbulent History Love Loss And The Price Of Fame

Feb 23, 2025

Fleetwood Macs Turbulent History Love Loss And The Price Of Fame

Feb 23, 2025

Latest Posts

-

Premier League Arsenal Vs West Ham Final Score And Post Match Reaction

Feb 23, 2025

Premier League Arsenal Vs West Ham Final Score And Post Match Reaction

Feb 23, 2025 -

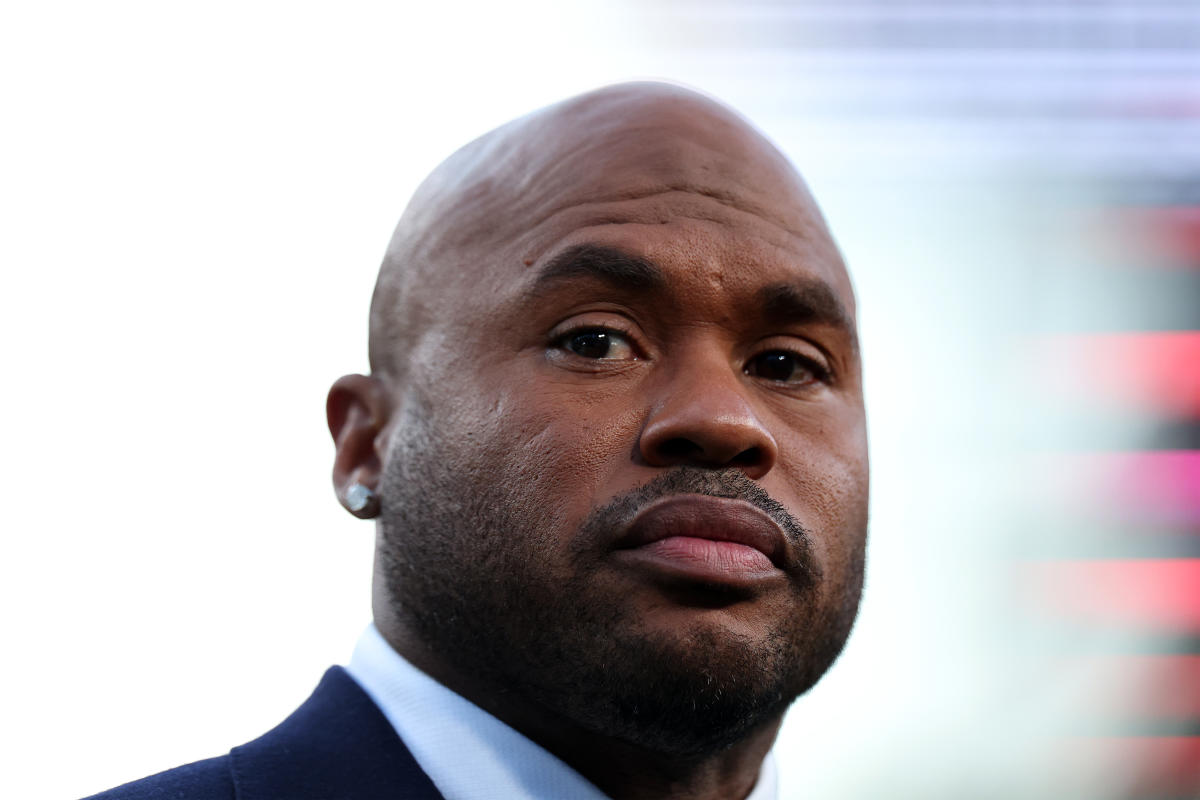

Ex Nfl Star Steve Smith Accused Of Infidelity In Viral X Post

Feb 23, 2025

Ex Nfl Star Steve Smith Accused Of Infidelity In Viral X Post

Feb 23, 2025 -

Steve Smith Sr Affair Allegations New Details Emerge

Feb 23, 2025

Steve Smith Sr Affair Allegations New Details Emerge

Feb 23, 2025 -

Pope Francis Serious Illness Vatican Issues Update

Feb 23, 2025

Pope Francis Serious Illness Vatican Issues Update

Feb 23, 2025 -

Four Goal Blitz Tottenham Cruise Past Ipswich

Feb 23, 2025

Four Goal Blitz Tottenham Cruise Past Ipswich

Feb 23, 2025