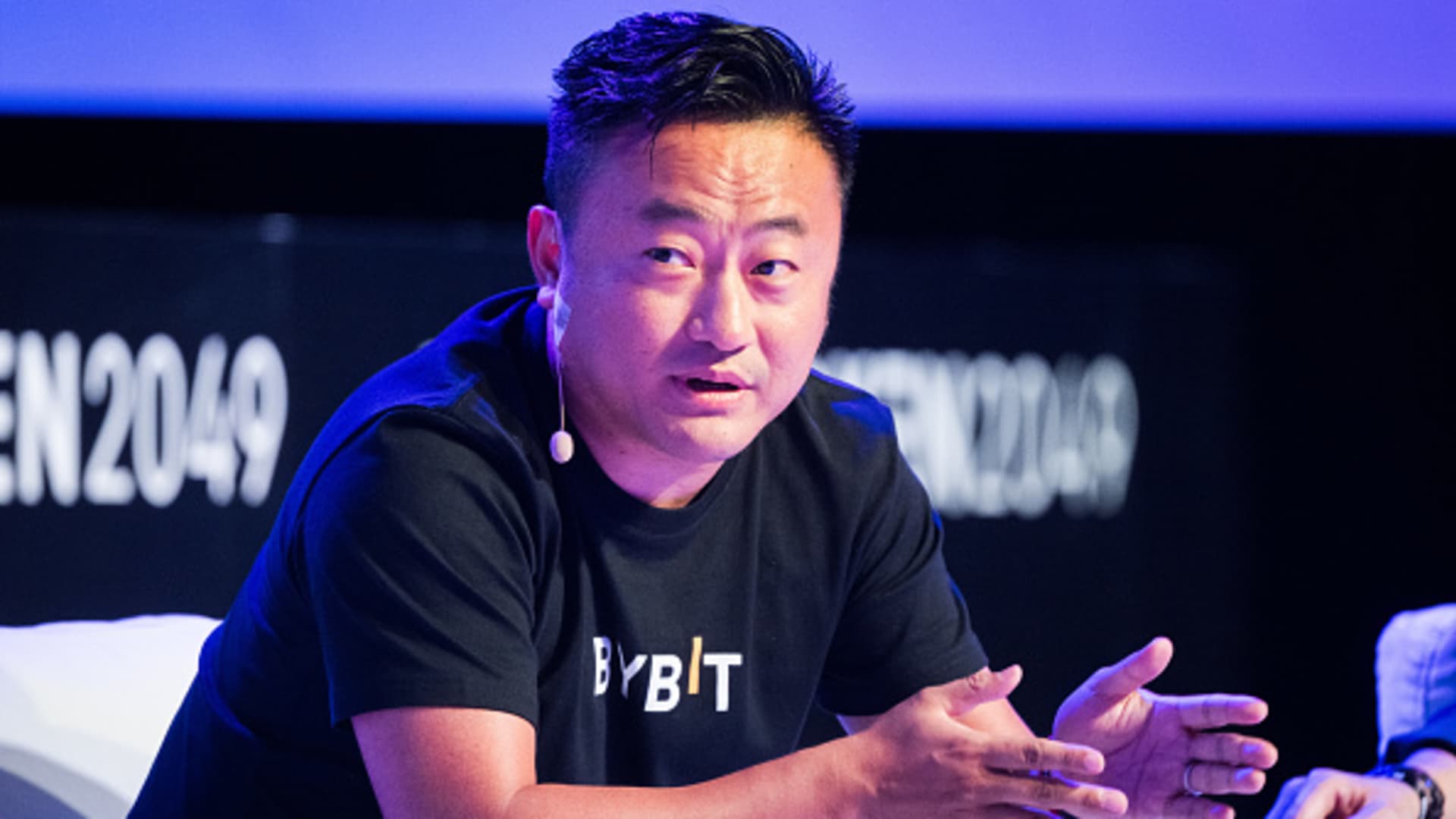

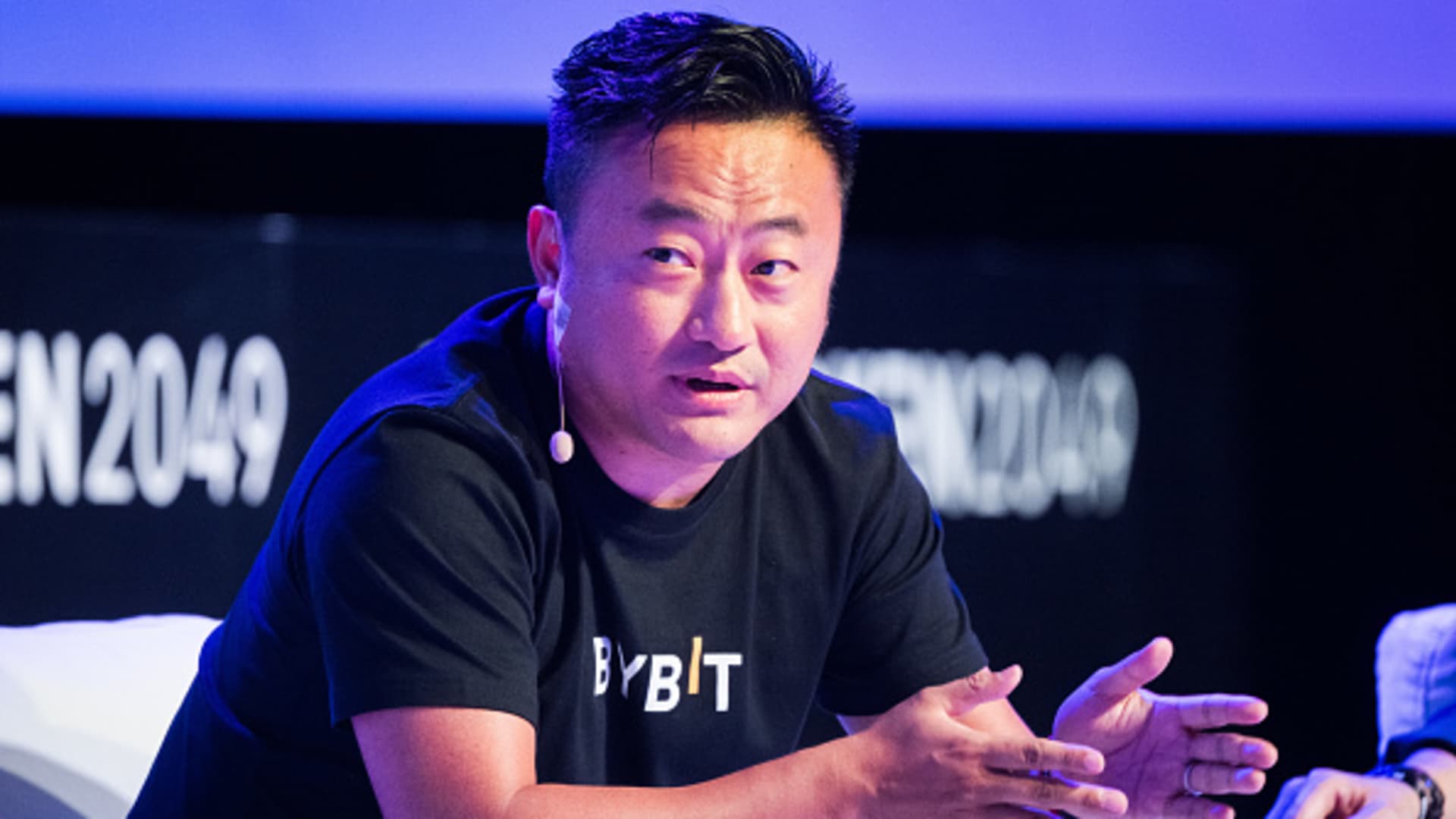

Massive Crypto Exchange Hack: Bybit Loses $1.5 Billion To Hackers

Table of Contents

Bybit Hack: $1.5 Billion Crypto Heist Shakes Confidence in Exchanges

HONG KONG, October 26, 2024 – The cryptocurrency world is reeling from a massive security breach at Bybit, one of the world's largest cryptocurrency exchanges. Early reports suggest that hackers stole approximately $1.5 billion in digital assets in a sophisticated attack that exploited a vulnerability in the exchange's security infrastructure. The incident has sent shockwaves through the market, raising serious questions about the security protocols of even the largest exchanges and potentially impacting investor confidence.

The attack, which reportedly occurred on October 25th, 2024 (the exact timing remains under investigation), went undetected for several hours before Bybit detected unusual activity within its system. The exchange immediately suspended trading and withdrawals to contain the damage, initiating a comprehensive internal investigation and collaborating with cybersecurity experts and law enforcement agencies. While Bybit has yet to officially confirm the exact amount stolen and the specific cryptocurrencies compromised, initial reports, citing unnamed sources within the company and blockchain analysis firms, point to a loss exceeding $1.5 billion. This makes it one of the largest cryptocurrency heists in history, surpassing previous attacks on exchanges like [Insert Name of Exchange and amount stolen from previous hack if applicable, otherwise delete this bracketed information].

The details of the hack remain scarce, with Bybit maintaining a tight lid on specific details while investigations unfold. However, preliminary findings suggest the attackers employed a highly sophisticated technique, possibly involving [Specific type of exploit if known, e.g., zero-day vulnerability, insider threat, social engineering]. The sophistication of the attack highlights the ever-evolving nature of cyber threats targeting cryptocurrency exchanges and underscores the need for robust and constantly updated security measures.

The impact of the hack extends far beyond Bybit's user base. The incident has triggered a sharp decline in cryptocurrency prices across major exchanges, with Bitcoin and Ethereum experiencing significant dips following the news. Investor confidence in the cryptocurrency market is understandably shaken, as the event highlights the inherent risks associated with digital asset trading. Regulatory scrutiny of cryptocurrency exchanges is also expected to intensify in the wake of this major security failure.

Bybit has pledged to fully cooperate with authorities and is committed to recovering the stolen funds. The company issued a statement assuring its users that it is working to assess the full extent of the damage and will provide updates as they become available. However, the extent of the impact on users and the timeline for potential recovery remain unclear. The exchange's reputation has taken a significant blow, and the long-term consequences of the hack remain to be seen. This incident serves as a stark reminder of the vulnerabilities within the cryptocurrency ecosystem and the urgent need for stronger security measures across the board.

Further investigations are underway to determine the full scope of the breach, identify the perpetrators, and recover the stolen funds. [Insert details about any arrests or leads if available]. The incident underscores the critical need for improved security standards within the cryptocurrency industry to safeguard user assets and maintain the integrity of the market. The cryptocurrency community is closely monitoring developments and awaiting further information from Bybit and law enforcement agencies.

Featured Posts

-

Indian Pharma Firm Fueling West Africas Opioid Crisis Exposed

Feb 22, 2025

Indian Pharma Firm Fueling West Africas Opioid Crisis Exposed

Feb 22, 2025 -

Investigation Launched After 477 Lucky Cats Vanish From Gordon Ramsays

Feb 22, 2025

Investigation Launched After 477 Lucky Cats Vanish From Gordon Ramsays

Feb 22, 2025 -

Michigan Basketball Dusty May Finalizes Contract Agreement

Feb 22, 2025

Michigan Basketball Dusty May Finalizes Contract Agreement

Feb 22, 2025 -

Sahel Instability Russias Influence And The Rise Of Extremist Groups

Feb 22, 2025

Sahel Instability Russias Influence And The Rise Of Extremist Groups

Feb 22, 2025 -

Rep Byron Donalds Receives Trumps Total Endorsement But Theres A Catch

Feb 22, 2025

Rep Byron Donalds Receives Trumps Total Endorsement But Theres A Catch

Feb 22, 2025

Latest Posts

-

Judges Ruling To Resume Foreign Aid A Reality Check From The Field

Feb 23, 2025

Judges Ruling To Resume Foreign Aid A Reality Check From The Field

Feb 23, 2025 -

Investigation Underway After Two Virginia Beach Police Officers Killed

Feb 23, 2025

Investigation Underway After Two Virginia Beach Police Officers Killed

Feb 23, 2025 -

West Ham Defeat Arsenal Premier League Result And Key Moments

Feb 23, 2025

West Ham Defeat Arsenal Premier League Result And Key Moments

Feb 23, 2025 -

Everton Vs Manchester United Man Of The Match Announced

Feb 23, 2025

Everton Vs Manchester United Man Of The Match Announced

Feb 23, 2025 -

Watch Everton Vs Manchester United Premier League Live Stream Details

Feb 23, 2025

Watch Everton Vs Manchester United Premier League Live Stream Details

Feb 23, 2025