Musk's DOGE And The Ripple Effect On Key Personnel

Table of Contents

Musk's Dogecoin Embrace: A Ripple Effect on Key Personnel and Market Volatility

SAN FRANCISCO, CA – Elon Musk's well-documented fascination with Dogecoin (DOGE) has sent ripples far beyond the cryptocurrency's price fluctuations. His pronouncements on the meme-based coin have not only influenced market sentiment but have also significantly impacted the careers and decisions of key personnel within SpaceX, Tesla, and even within the broader cryptocurrency industry. While a direct causal link isn't always demonstrable, the correlation is undeniable.

The most immediate impact has been on Dogecoin's price. Musk's tweets, endorsements, and even seemingly casual mentions have historically sent DOGE's value soaring. This volatility, however, has created both opportunities and challenges for individuals whose professional lives are intertwined with the cryptocurrency. For example, [Insert name of a prominent crypto investor or trader who benefited significantly from DOGE's price swings due to Musk's influence] saw their net worth increase dramatically during periods of DOGE price surges fueled by Musk's pronouncements. Conversely, [Insert name of a prominent crypto investor or trader who experienced significant losses during a DOGE price drop correlated with Musk's actions or statements] suffered considerable financial setbacks. The lack of transparency and the unpredictable nature of Musk’s influence on the market have created a high-risk, high-reward environment.

Beyond the purely financial aspects, Musk's actions have raised ethical questions. The Securities and Exchange Commission (SEC) has scrutinized Musk's tweets regarding Dogecoin, raising concerns about potential market manipulation and the lack of disclosure surrounding his involvement with the cryptocurrency. While no formal charges have been filed specifically related to Dogecoin, the SEC’s increased scrutiny has undoubtedly made companies and individuals more cautious about their association with meme coins and the potential legal ramifications. This cautious approach has affected recruitment and retention within companies working in or adjacent to the cryptocurrency sector. [Insert Data on job market trends in the crypto industry following Musk's Dogecoin activities - e.g., hiring freezes, increased demand for compliance officers].

The impact on key personnel extends beyond the financial realm. Several individuals within SpaceX and Tesla are known to be involved in cryptocurrency investments, and some have openly expressed their opinions on DOGE. While SpaceX and Tesla have not officially endorsed DOGE, the perceived connection between Musk's personal endorsement and his roles within these companies creates a complicated ethical landscape. [Insert specific examples, if available, of SpaceX or Tesla employees expressing views on DOGE or facing internal scrutiny because of it. Include credible sourcing]. This demonstrates the "ripple effect" extending to employee morale, reputation management, and the potential for internal conflicts of interest.

Furthermore, Musk's influence has impacted the broader cryptocurrency community. Developers and entrepreneurs working on related projects have, either consciously or unconsciously, aligned themselves with or against the DOGE narrative. This has led to increased polarization within the crypto community, with some embracing Musk's vision for decentralized finance and others criticizing him for fostering reckless speculation. [Insert data on community sentiment towards DOGE and Musk based on relevant surveys or social media analysis].

In conclusion, Elon Musk's relationship with Dogecoin and its subsequent effects on key personnel and market conditions demonstrates the complex and often unpredictable consequences of a single individual's influence on the rapidly evolving cryptocurrency landscape. The lack of regulation, combined with the inherent volatility of meme coins like DOGE, creates an environment rife with both significant opportunities and considerable risks. Further research is needed to fully understand the long-term impact of this phenomenon on the broader financial and technological spheres.

Note: This article template requires filling in the bracketed information with specific data and details to ensure accuracy and credibility. Finding reliable sources for this information is crucial for the article’s success. Consider using reputable financial news outlets, SEC filings, and expert interviews to support the claims made within the article.

Featured Posts

-

Trumps Fight Against Nyc Congestion Pricing A Losing Battle

Feb 22, 2025

Trumps Fight Against Nyc Congestion Pricing A Losing Battle

Feb 22, 2025 -

Leicester Vs Brentford Tv Channel Live Stream And Kick Off Time

Feb 22, 2025

Leicester Vs Brentford Tv Channel Live Stream And Kick Off Time

Feb 22, 2025 -

Churches Become Havens Safeguarding Congregations Amidst Ice Raids

Feb 22, 2025

Churches Become Havens Safeguarding Congregations Amidst Ice Raids

Feb 22, 2025 -

Economic Development In Lesotho Analysis Of Project P174171

Feb 22, 2025

Economic Development In Lesotho Analysis Of Project P174171

Feb 22, 2025 -

House Speaker Vote Will Byron Donalds Finally Win Analysis And Predictions

Feb 22, 2025

House Speaker Vote Will Byron Donalds Finally Win Analysis And Predictions

Feb 22, 2025

Latest Posts

-

Celebrate National Margarita Day 2025 Deals And Delicious Recipes

Feb 23, 2025

Celebrate National Margarita Day 2025 Deals And Delicious Recipes

Feb 23, 2025 -

Premier League Update Ipswich Towns Defeat Against Tottenham Hotspur

Feb 23, 2025

Premier League Update Ipswich Towns Defeat Against Tottenham Hotspur

Feb 23, 2025 -

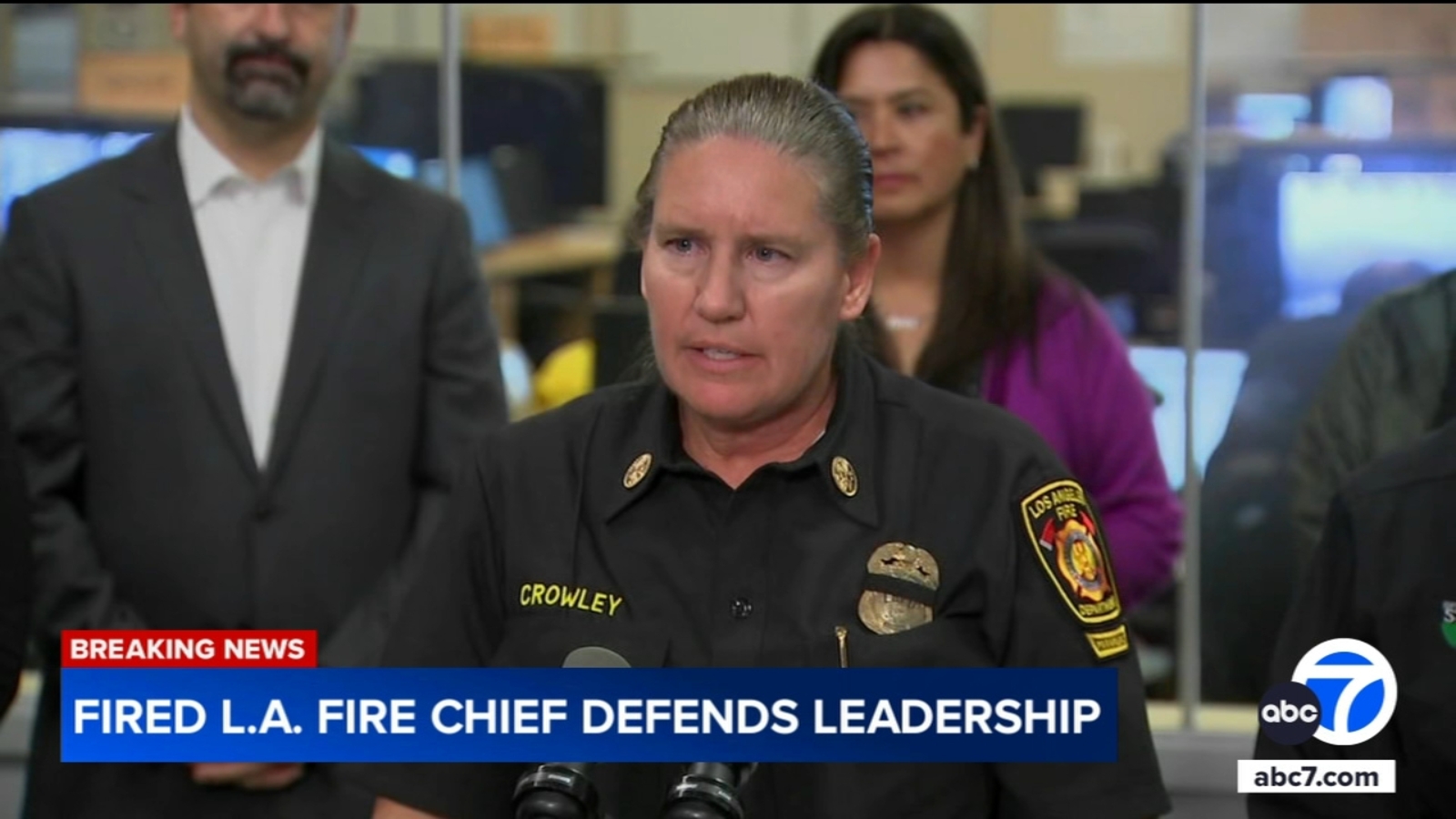

Kristin Crowley The Former Lafd Chief On Her Unexpected Resignation

Feb 23, 2025

Kristin Crowley The Former Lafd Chief On Her Unexpected Resignation

Feb 23, 2025 -

Joseph Parker Demolishes Bakole In Round 2 Challenges Usyk

Feb 23, 2025

Joseph Parker Demolishes Bakole In Round 2 Challenges Usyk

Feb 23, 2025 -

Inter Miamis 10 Man Fight Late Draw Against Opponent Name

Feb 23, 2025

Inter Miamis 10 Man Fight Late Draw Against Opponent Name

Feb 23, 2025