Palantir Stock Continues Downward Trend Amid Retail Selling

Table of Contents

Palantir Stock Continues Downward Trend Amid Retail Selling Pressure

NEW YORK, NY – October 26, 2023 – Palantir Technologies (PLTR), the data analytics firm known for its work with government agencies and large corporations, saw its stock price continue its downward slide this week, driven by sustained retail selling pressure and concerns about slowing growth. The stock closed at [Insert Closing Price on October 26th, 2023], representing a [Percentage Change] decrease from the previous day's close and a [Percentage Change] decline from its 52-week high. This continued downturn underscores the challenges Palantir faces in navigating a shifting market landscape.

The decline comes amidst a broader sell-off in technology stocks, particularly those with high valuations and less established revenue streams. However, Palantir's situation is exacerbated by a noticeable increase in retail investor selling. This contrasts with the relative stability observed in institutional investor holdings, suggesting a divergence in market sentiment regarding the company's long-term prospects. Analysts cite several factors contributing to this retail selling pressure.

One major concern centers around Palantir's revenue growth. While the company has consistently reported year-over-year revenue increases, the rate of growth has slowed in recent quarters, falling short of some analysts' expectations. [Insert specific revenue figures for the most recent quarter and the preceding quarter, including percentage change year-over-year]. This slower growth has fueled concerns about the company's ability to sustain its high valuation and maintain its aggressive expansion plans.

Further fueling the sell-off are questions surrounding Palantir's profitability. While the company is making strides towards profitability, it continues to operate at a net loss [Insert Net Loss or Profit figure for the most recent quarter]. The persistent losses, coupled with the slowing revenue growth, are leading some investors to question the long-term viability of the company's business model. [Insert details about the company's guidance for future profitability if available].

The company’s reliance on government contracts, while providing a stable revenue stream, also presents a vulnerability. Changes in government priorities or budget cuts could significantly impact Palantir’s financial performance. [Insert details on the percentage of revenue from government contracts vs. commercial contracts if available]. This dependence has made the company susceptible to geopolitical factors and shifts in government spending.

Despite the recent setbacks, Palantir continues to highlight its innovative data analytics platform and its expanding customer base. The company maintains that its long-term growth prospects remain strong, citing the increasing demand for advanced data analytics solutions across various sectors. [Insert any recent positive news or announcements from Palantir, such as new partnerships or contract wins]. However, convincing skeptical retail investors to regain confidence will be crucial for Palantir to reverse its current downward trajectory.

Looking ahead, analysts are divided on Palantir's future. Some remain optimistic, pointing to the company's technological advantages and its potential for growth in emerging markets. Others remain cautious, citing the ongoing challenges related to revenue growth and profitability. The coming quarters will be critical in determining whether Palantir can address these concerns and regain investor confidence. The stock's performance will likely remain volatile in the short term, making it a high-risk investment for many. [Insert Analyst price targets if available, and specify which analysts hold these views].

Keywords: Palantir, PLTR, stock market, stock price, technology stocks, retail investors, revenue growth, profitability, government contracts, data analytics, investment

Note: This article needs to be populated with specific financial data (revenue figures, net profit/loss, percentage changes, closing prices, etc.) and details regarding Palantir's recent announcements and analyst opinions to meet the criteria for publication. Replace the bracketed information with accurate, verifiable data from reputable financial news sources.

Featured Posts

-

Unlocking Victory Key Strategies For Canada And Usa In 4 Nation Championship

Feb 22, 2025

Unlocking Victory Key Strategies For Canada And Usa In 4 Nation Championship

Feb 22, 2025 -

The James Bond Franchise And Amazon A Partnership Analyzed

Feb 22, 2025

The James Bond Franchise And Amazon A Partnership Analyzed

Feb 22, 2025 -

Investigation Indian Companys Role In West Africas Opioid Epidemic

Feb 22, 2025

Investigation Indian Companys Role In West Africas Opioid Epidemic

Feb 22, 2025 -

Yankees No Shave Policy A Look At The History Of Beards In Baseball

Feb 22, 2025

Yankees No Shave Policy A Look At The History Of Beards In Baseball

Feb 22, 2025 -

2025 Nba Knicks Vs Cavaliers Full Game Report February 21

Feb 22, 2025

2025 Nba Knicks Vs Cavaliers Full Game Report February 21

Feb 22, 2025

Latest Posts

-

Ksi Meets Britains Got Talent Judges Ahead Of New Season

Feb 23, 2025

Ksi Meets Britains Got Talent Judges Ahead Of New Season

Feb 23, 2025 -

Luigi Mangiones Legal Battle The Women Providing Support

Feb 23, 2025

Luigi Mangiones Legal Battle The Women Providing Support

Feb 23, 2025 -

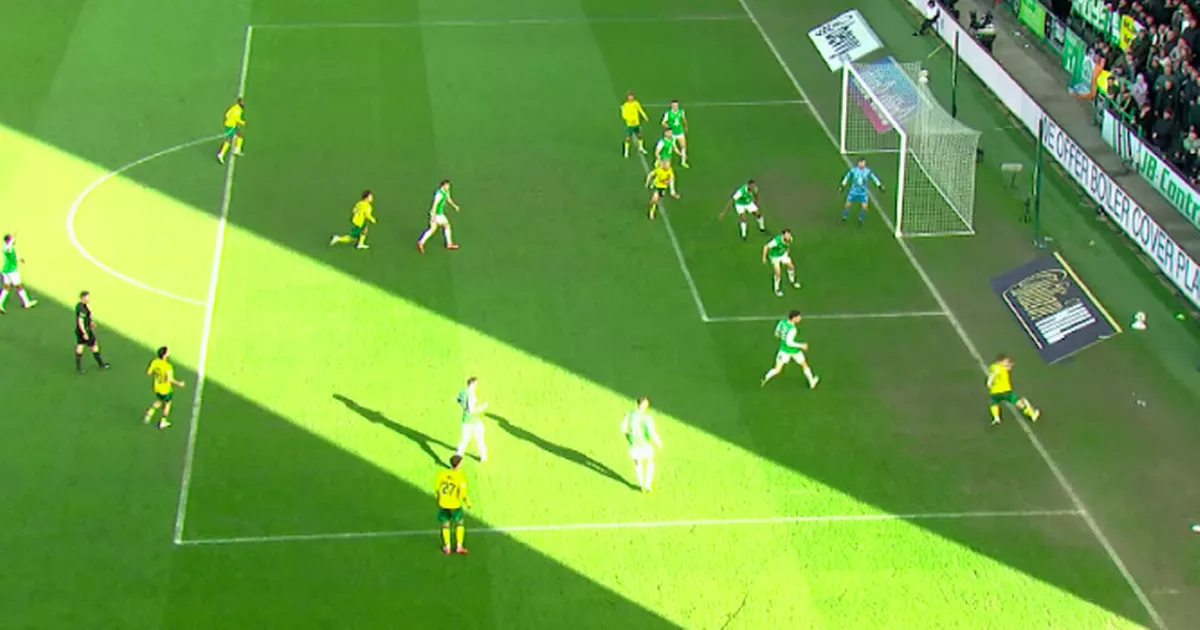

Celtics Controversial No Goal Decision Maedas Impact Analyzed

Feb 23, 2025

Celtics Controversial No Goal Decision Maedas Impact Analyzed

Feb 23, 2025 -

Can Merz Secure Victory Germanys Election Heads To The Finish Line

Feb 23, 2025

Can Merz Secure Victory Germanys Election Heads To The Finish Line

Feb 23, 2025 -

Womens Basketball Suffers Defeat Against U Conn

Feb 23, 2025

Womens Basketball Suffers Defeat Against U Conn

Feb 23, 2025