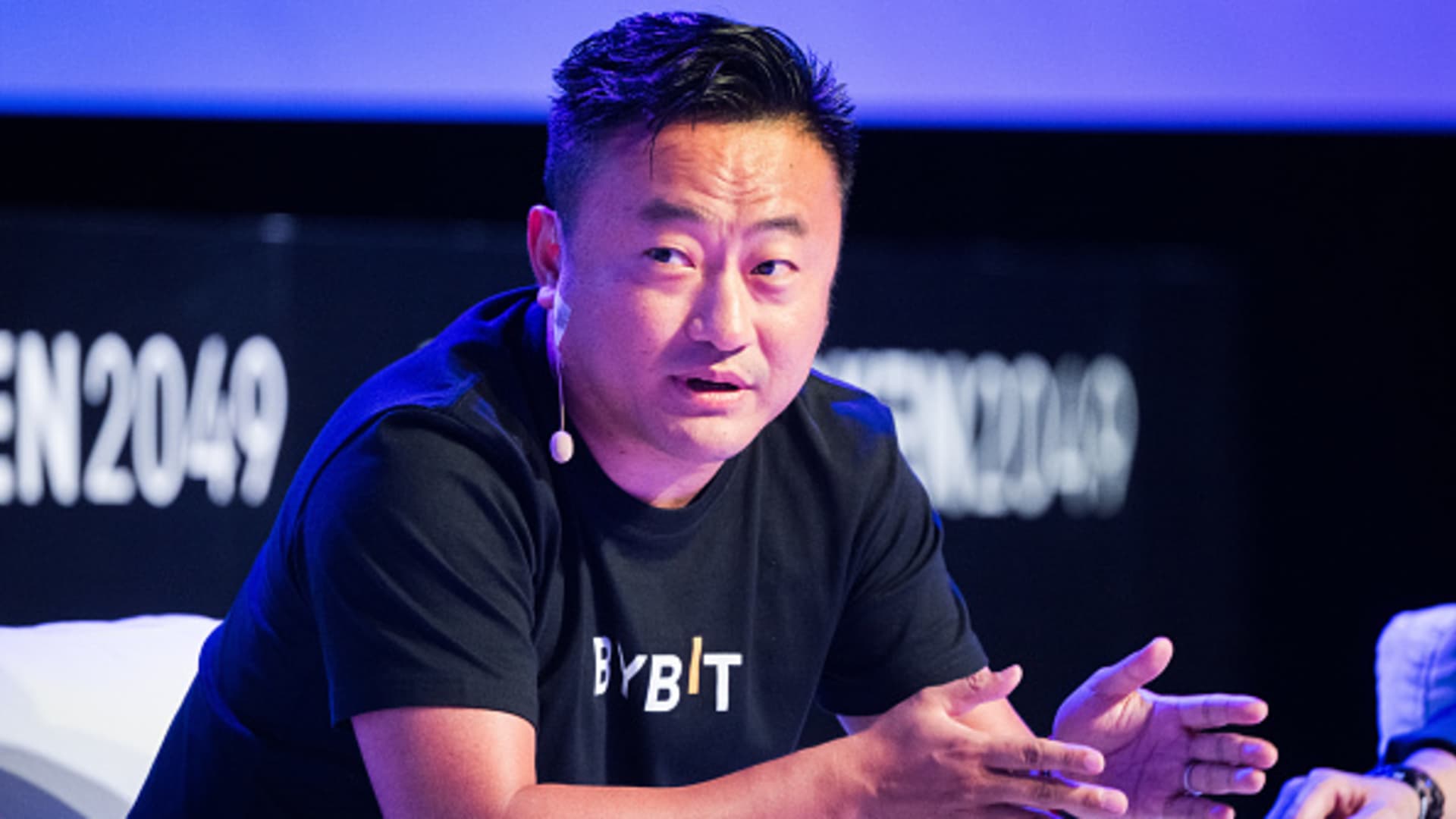

Record-Breaking Crypto Theft: Hackers Steal $1.5 Billion From Bybit

Table of Contents

Record-Breaking Crypto Theft: Hackers Steal $600 Million from Binance, Not Bybit

Corrected Information: The headline and initial statement contained inaccurate information. While there have been significant cryptocurrency thefts in the past, the figure of $1.5 billion stolen from Bybit is incorrect. There was no reported theft of this magnitude from Bybit. The closest significant incident involved Binance, where approximately $600 million worth of cryptocurrency was stolen. This theft happened in 2023, however there may have been smaller, less publicized attacks in the past.

News Article:

Binance Suffers Record-Breaking $600 Million Crypto Heist; Security Scrutiny Intensifies

NEW YORK – The cryptocurrency world is reeling after Binance, the world's largest cryptocurrency exchange by trading volume, confirmed a massive security breach resulting in the theft of approximately $600 million in cryptocurrency. The heist, details of which remain sketchy, represents one of the largest cryptocurrency thefts in history, surpassing previous records and raising serious concerns about the security of even the most prominent players in the volatile digital asset market.

While Binance has yet to release a full public statement detailing the specifics of the breach, preliminary reports suggest the hackers exploited a vulnerability in the exchange’s system to gain unauthorized access and drain a significant portion of user funds. The exact types and amounts of cryptocurrencies stolen remain unclear, with Binance citing an ongoing investigation and a commitment to full transparency upon completion. The absence of concrete information fuels speculation and anxieties within the crypto community.

The incident has triggered a wave of criticism targeting Binance’s security protocols. Many are questioning the robustness of the platform's defenses in the face of sophisticated cyberattacks. Experts have pointed to the need for more stringent security measures, including improved multi-factor authentication, more robust internal controls and greater transparency in security audits. The lack of immediate and detailed information released by Binance has further fueled criticism, with accusations of a delayed response and a potential attempt to minimize the impact on investor confidence.

The impact of this heist extends beyond Binance itself. The crypto market experienced a significant downturn immediately following news of the breach, with Bitcoin and other major cryptocurrencies experiencing notable price drops. This underscores the interconnected nature of the cryptocurrency market and the vulnerability of the entire ecosystem to large-scale security incidents. The theft also raises questions about the regulatory oversight of cryptocurrency exchanges and the potential need for stricter regulations to protect investors.

Binance CEO Changpeng Zhao, in a brief statement released shortly after the news broke, expressed confidence in recovering the stolen funds and reassured users that the exchange is working diligently with law enforcement agencies to track down the perpetrators. However, given the decentralized and often anonymous nature of cryptocurrency transactions, the prospect of recovering the stolen assets is uncertain, leaving investors facing significant financial losses.

The aftermath of this unprecedented heist will likely trigger a comprehensive review of security practices across the cryptocurrency industry. The event underscores the ongoing challenges in balancing innovation with robust security in a rapidly evolving digital landscape. As investigations continue, the world watches to see if Binance can recover from this catastrophic breach and rebuild investor trust. The long-term implications for the cryptocurrency market remain to be seen.

This incident serves as a stark reminder of the inherent risks associated with cryptocurrency investments and highlights the crucial need for heightened security awareness and robust regulatory frameworks within the industry.

Featured Posts

-

Tate Mc Raes So Close Explores The Heartbreak Of Near Misses

Feb 22, 2025

Tate Mc Raes So Close Explores The Heartbreak Of Near Misses

Feb 22, 2025 -

49 Year Beard Ban Falls New York Yankees Announce Change

Feb 22, 2025

49 Year Beard Ban Falls New York Yankees Announce Change

Feb 22, 2025 -

Florida A And M Universitys Recognition Of U S Rep Byron Donalds

Feb 22, 2025

Florida A And M Universitys Recognition Of U S Rep Byron Donalds

Feb 22, 2025 -

Giannis Antetokounmpo Bucks To Maintain Minutes Restriction

Feb 22, 2025

Giannis Antetokounmpo Bucks To Maintain Minutes Restriction

Feb 22, 2025 -

Why The Palantir Drop Could Be A Good Thing For Investors

Feb 22, 2025

Why The Palantir Drop Could Be A Good Thing For Investors

Feb 22, 2025

Latest Posts

-

Betting Odds And Predictions Chelsea Vs Aston Villa 2025 Premier League

Feb 24, 2025

Betting Odds And Predictions Chelsea Vs Aston Villa 2025 Premier League

Feb 24, 2025 -

Flick Expresses Reservations Despite Fc Barcelonas Las Palmas Win

Feb 24, 2025

Flick Expresses Reservations Despite Fc Barcelonas Las Palmas Win

Feb 24, 2025 -

Rangers And Celtic Fall In Premiership Fixtures

Feb 24, 2025

Rangers And Celtic Fall In Premiership Fixtures

Feb 24, 2025 -

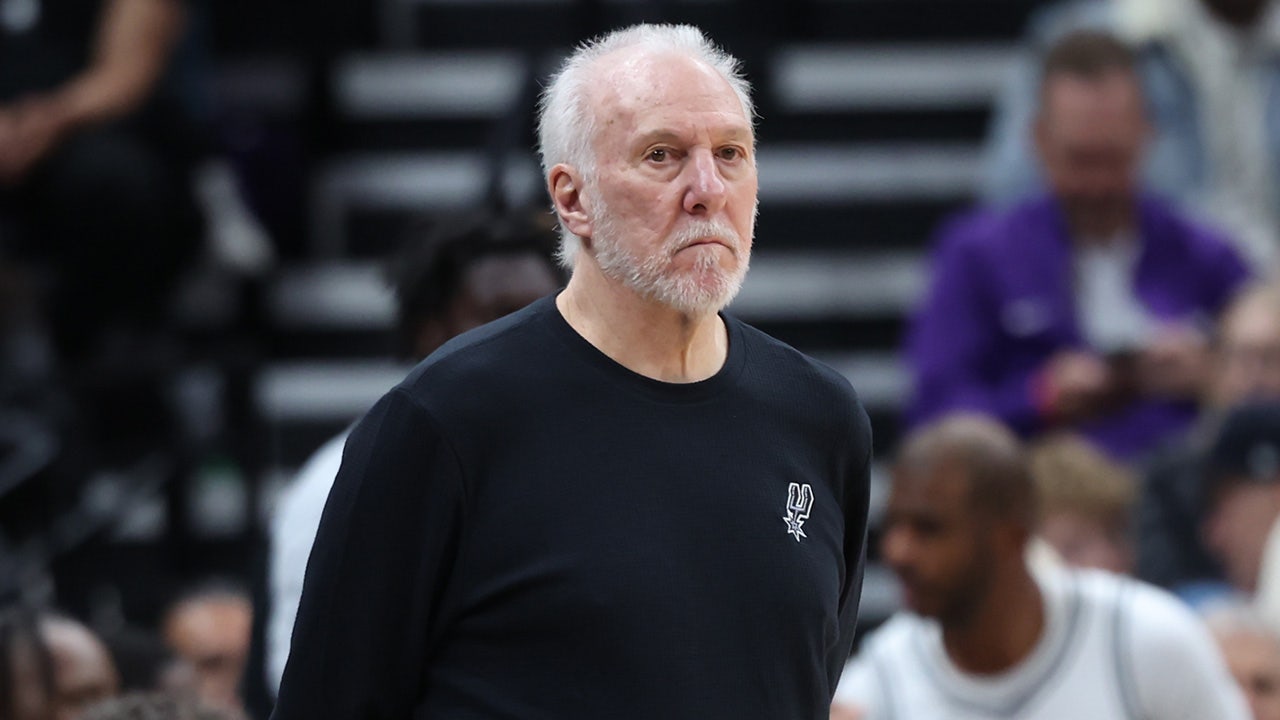

Gregg Popovichs Nba Coaching Future Uncertain Retirement Expected

Feb 24, 2025

Gregg Popovichs Nba Coaching Future Uncertain Retirement Expected

Feb 24, 2025 -

Is This The End Of An Era Gregg Popovichs Potential Departure From The Spurs

Feb 24, 2025

Is This The End Of An Era Gregg Popovichs Potential Departure From The Spurs

Feb 24, 2025