Record Q4 For Rivian, But Stock Price Dips

Table of Contents

Rivian's Record Q4 Profits Can't Stop Stock Slide

Irvine, CA – Rivian Automotive reported record fourth-quarter earnings on [Date of release, e.g., March 1, 2024], exceeding analyst expectations, yet its stock price experienced a significant dip following the announcement. The electric vehicle (EV) maker delivered [Number] vehicles in Q4 2023, a substantial increase compared to the same period last year, and reported a net income of [Dollar amount, e.g., $100 million], a stark contrast to the losses reported in previous quarters. However, investors reacted negatively to the company's [Specific guidance or outlook that caused the stock dip, e.g., conservative production guidance for 2024 and increased operating expenses].

The surge in deliveries can be attributed to [Specific reasons for the delivery increase, e.g., ramped-up production at its Normal, Illinois plant, increased demand for its R1T pickup truck and R1S SUV, successful expansion into new markets]. This positive trend marks a significant milestone for the relatively young company, which has been striving to establish itself in a fiercely competitive EV market dominated by established players like Tesla and Ford. The strong fourth-quarter performance underscores Rivian's progress in streamlining its manufacturing processes and improving efficiency.

Despite the impressive financial results, Rivian's stock price fell by [Percentage] in after-hours trading on [Date]. Analysts attributed this downturn to concerns regarding [Elaborate on investor concerns, e.g., the company's ability to sustain profitability in the long term given the intense competition and rising material costs, the impact of potential economic slowdowns on consumer demand for EVs, uncertainty surrounding future production targets]. The company's updated guidance for [Year] suggests a more cautious approach than some investors had anticipated, leading to a sell-off.

"While the fourth-quarter results are undeniably strong, showing significant progress in production and profitability, the market's reaction highlights the intense scrutiny faced by EV companies," commented [Name and title of an industry analyst, e.g., Jane Doe, Senior Analyst at XYZ Securities]. "Investors are looking beyond near-term gains and focusing on the long-term sustainability of the business model, particularly in light of the evolving economic landscape."

Rivian CEO, R.J. Scaringe, in a statement accompanying the earnings release, acknowledged the challenges ahead. He emphasized the company's commitment to [Mention key strategic priorities, e.g., expanding its product portfolio, investing in research and development to improve battery technology, strengthening its supply chain]. He reiterated the company's long-term vision to become a leading player in the sustainable transportation industry.

The company's performance in the coming quarters will be crucial in determining whether this temporary stock dip represents a mere market fluctuation or a sign of deeper underlying concerns. Analysts will be closely watching Rivian's ability to meet its production targets, manage costs effectively, and navigate the complexities of the burgeoning EV market. The next few months will be critical for Rivian in solidifying its position and restoring investor confidence. The success or failure of its strategies will determine its long-term trajectory in the competitive landscape of electric vehicle manufacturing.

Featured Posts

-

Yankees End 49 Year Facial Hair Ban One Strict Condition Applies

Feb 22, 2025

Yankees End 49 Year Facial Hair Ban One Strict Condition Applies

Feb 22, 2025 -

Ancient Egyptian Tomb Of Thutmose Ii Discovered After Centuries

Feb 22, 2025

Ancient Egyptian Tomb Of Thutmose Ii Discovered After Centuries

Feb 22, 2025 -

Third Term Speculation Trump Hints At Unconstitutional Run

Feb 22, 2025

Third Term Speculation Trump Hints At Unconstitutional Run

Feb 22, 2025 -

Usps Shakeup Expected Under Trump Presidency

Feb 22, 2025

Usps Shakeup Expected Under Trump Presidency

Feb 22, 2025 -

Whale Swallows Kayaker Bbc Quiz Tests Knowledge

Feb 22, 2025

Whale Swallows Kayaker Bbc Quiz Tests Knowledge

Feb 22, 2025

Latest Posts

-

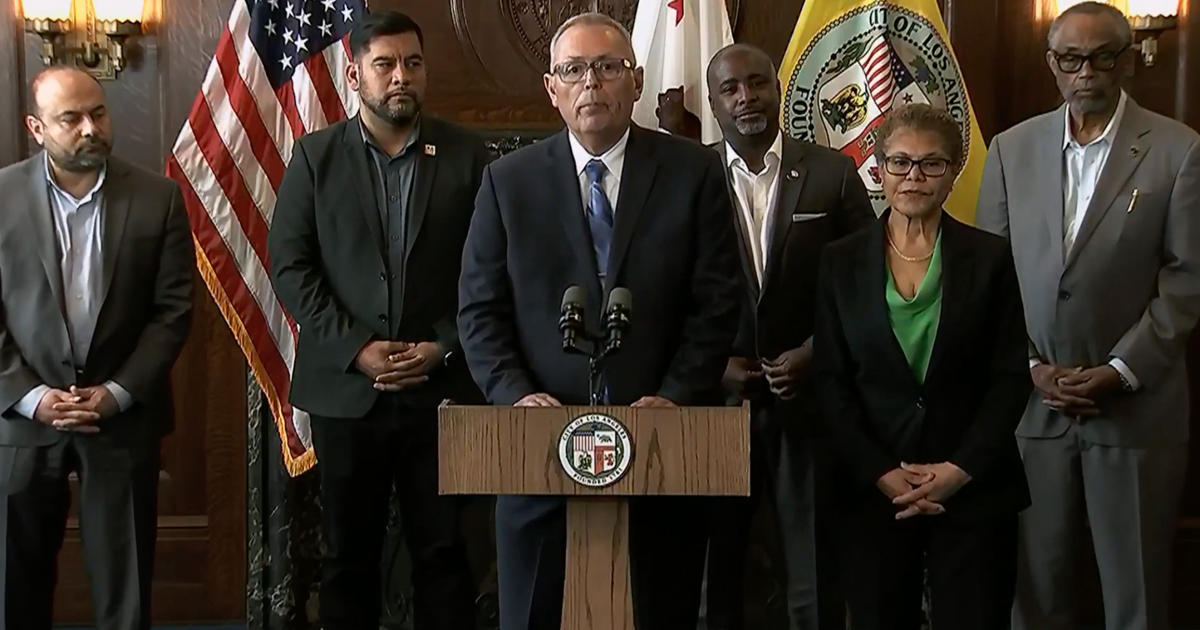

Councilmember Bass Under Fire After Controversial Dismissal Of Lafd Chief

Feb 24, 2025

Councilmember Bass Under Fire After Controversial Dismissal Of Lafd Chief

Feb 24, 2025 -

Sheerazs Safe Play Did It Cost Him The World Title

Feb 24, 2025

Sheerazs Safe Play Did It Cost Him The World Title

Feb 24, 2025 -

Trumps Firing Of Watchdog Supreme Court Delays Key Decision

Feb 24, 2025

Trumps Firing Of Watchdog Supreme Court Delays Key Decision

Feb 24, 2025 -

Premier League Aston Villa Vs Chelsea Live Blog Full Match Highlights

Feb 24, 2025

Premier League Aston Villa Vs Chelsea Live Blog Full Match Highlights

Feb 24, 2025 -

Whos Winning The 2025 German Election A State By State Breakdown

Feb 24, 2025

Whos Winning The 2025 German Election A State By State Breakdown

Feb 24, 2025