Retail Trader Activity Weighs On Palantir Stock Price

Table of Contents

Retail Trader Activity Weighs on Palantir Stock Price: A Data-Driven Analysis

NEW YORK, NY – Palantir Technologies (PLTR), the data analytics firm favored by some retail investors, has seen its stock price decline recently, a trend analysts attribute to waning retail investor interest and broader market headwinds. While the company continues to secure substantial government contracts, the fluctuating involvement of individual traders is creating significant volatility in the stock's performance.

The recent dip in Palantir's stock price follows a period of heightened retail trader activity. Platforms like Reddit's WallStreetBets, once a significant driver of PLTR's price surges, have seen a decrease in bullish sentiment regarding the stock. [Insert specific data on WallStreetBets sentiment towards PLTR, perhaps using a metric like the percentage of bullish/bearish mentions over a specific time period. Source this data from a reputable financial news site or social media analytics platform. For example: "Analysis of WallStreetBets posts from July 1st to August 1st reveals a 35% decrease in bullish sentiment towards PLTR compared to the previous month, according to Sentiment.io."] This shift in sentiment aligns with broader market anxieties stemming from [Insert specific macroeconomic factors affecting the market, such as inflation rates, interest rate hikes, recessionary fears, etc. Cite reliable sources like the Federal Reserve, the Bureau of Economic Analysis, or major financial news outlets. For example: "rising inflation and the Federal Reserve's ongoing interest rate hikes, which have contributed to a general sell-off in the technology sector"].

While the company's Q2 2024 earnings report [Insert date of report release and a summary of key financial results: revenue growth, net income/loss, key performance indicators, and any forward-looking guidance. Cite the official Palantir investor relations website as the source. For example: "released on August 2nd, showed a 12% year-over-year revenue increase to $550 million, exceeding analysts' expectations but slightly below the company's own forecast. Net income was reported at $17 million." ] was generally well-received, it failed to reignite the enthusiasm among retail investors that had previously driven significant price fluctuations. This suggests that the company's long-term growth trajectory, while promising, is not currently capturing the attention of the retail trading community to the extent it once did.

The reduced retail investor participation is not the sole factor contributing to the stock's underperformance. [Insert data on institutional investor activity. This could include information on institutional ownership percentage changes, significant buy/sell transactions, or analyst ratings. Source data from reputable financial databases like Bloomberg, Refinitiv, or Yahoo Finance. For example: "Institutional investors have also exhibited some caution, with a slight decrease in overall ownership reported in the second quarter, according to FactSet data. Furthermore, several analyst firms have downgraded their price targets for PLTR in recent weeks."] These factors, combined with the broader market uncertainty, create a challenging environment for Palantir's stock price.

Looking ahead, Palantir's performance will likely hinge on its ability to continue securing lucrative government contracts and demonstrating sustained revenue growth. [Insert any expert opinions or forecasts regarding Palantir's future prospects. Quote analysts or industry experts and cite their affiliations. For example: "According to Dan Ives, an analyst at Wedbush Securities, 'Palantir's long-term prospects remain strong, but near-term volatility is to be expected given the current market conditions.'" ] The extent to which retail trader activity will influence the stock's price remains uncertain, but its decreased influence compared to previous periods suggests a shift towards a more institutional-driven valuation. Investors should carefully consider both the company’s fundamental performance and the broader macroeconomic factors before making any investment decisions.

Featured Posts

-

Toronto Crash Delta Offers 30 000 Per Passenger

Feb 22, 2025

Toronto Crash Delta Offers 30 000 Per Passenger

Feb 22, 2025 -

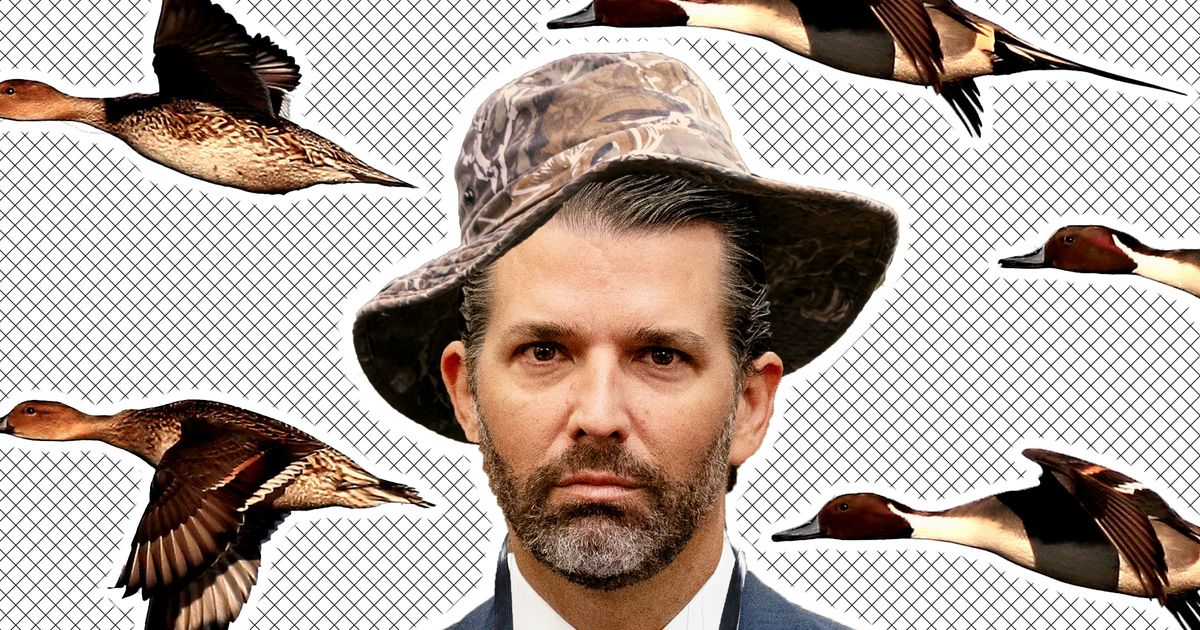

Rare Italian Duck Shot Accusations Against Donald Trump Jr

Feb 22, 2025

Rare Italian Duck Shot Accusations Against Donald Trump Jr

Feb 22, 2025 -

Bybits 1 4 B Eth Hack Analyzing Market Fallout And Future Of Security

Feb 22, 2025

Bybits 1 4 B Eth Hack Analyzing Market Fallout And Future Of Security

Feb 22, 2025 -

Michigan State Vs Michigan Live Stream Options For Ncaa Mens Basketball

Feb 22, 2025

Michigan State Vs Michigan Live Stream Options For Ncaa Mens Basketball

Feb 22, 2025 -

Hunter Schafer Euphoria Star Reveals Male Passport Issuance

Feb 22, 2025

Hunter Schafer Euphoria Star Reveals Male Passport Issuance

Feb 22, 2025

Latest Posts

-

Bivol Defeats Beterbiev Light Heavyweight Championship Remains

Feb 24, 2025

Bivol Defeats Beterbiev Light Heavyweight Championship Remains

Feb 24, 2025 -

Far Right Surge Shakes German Election Landscape

Feb 24, 2025

Far Right Surge Shakes German Election Landscape

Feb 24, 2025 -

Arsenal Vs West Ham Premier League Free Live Stream

Feb 24, 2025

Arsenal Vs West Ham Premier League Free Live Stream

Feb 24, 2025 -

Australia Vs England Highlights Icc Champions Trophy A Century Defining Match

Feb 24, 2025

Australia Vs England Highlights Icc Champions Trophy A Century Defining Match

Feb 24, 2025 -

Auriemma Butlers New Womens Basketball Facility Is Iconic

Feb 24, 2025

Auriemma Butlers New Womens Basketball Facility Is Iconic

Feb 24, 2025