Rivian Automotive Stock Falls: Investors React To News

Table of Contents

Rivian Stock Plunges as Investors Digest Q2 Results and Production Shortfall

Rivian Automotive's stock price experienced a sharp decline [on the date of the drop], following the release of the company's second-quarter earnings report and a downward revision of its production forecast for 2023. The electric vehicle (EV) maker, once a darling of the market, is now grappling with increased competition, rising production costs, and persistent supply chain challenges. The market reacted negatively to the company's underperformance, highlighting the growing pressure on EV startups to deliver consistent results.

The stock, which traded at [opening price] before the announcement, plummeted [percentage drop] to close at [closing price]. This represents a significant setback for Rivian, which has been struggling to meet ambitious production targets since its initial public offering (IPO) in [year of IPO]. The drop wiped out [dollar amount] in market capitalization. The decline further amplified concerns about the company's long-term financial viability and its ability to compete effectively against established automakers like Tesla and Ford, as well as other emerging EV players.

Rivian reported a second-quarter loss of [amount] on revenue of [amount]. While revenue was slightly higher than some analysts' projections, the overall performance fell short of expectations, particularly concerning production. The company produced [number] vehicles in Q2, significantly below the projected [original projection]. This production shortfall, attributed to [specific reasons provided by the company such as supply chain issues, factory ramp-up challenges, etc.], directly impacted the company's ability to meet its delivery targets and ultimately its revenue. The revised 2023 production guidance of [revised production figure] further fueled investor anxieties.

“The challenges we faced in Q2 underscore the complexity of scaling a new EV manufacturing business,” said [CEO name], in a prepared statement. “[Quote from CEO statement acknowledging challenges and addressing future plans. If a specific quote isn't available, paraphrase the company’s overall message about addressing the issues].”

The company's struggles are not unique within the EV sector. Many startups are facing similar hurdles as they try to ramp up production and navigate the complexities of the automotive industry. However, Rivian's significant drop highlights the market's increasingly unforgiving stance towards companies that fail to meet expectations. The pressure is mounting for Rivian to demonstrate clear progress in resolving its production bottlenecks and improving its operational efficiency.

Analysts are divided on Rivian's long-term prospects. Some remain optimistic, pointing to the company's strong order book and its innovative vehicle designs. They argue that the current challenges are temporary and that Rivian has the potential to overcome them and become a major player in the EV market. However, others are more cautious, highlighting the company's high burn rate and the increasing intensity of competition. They suggest that Rivian needs to significantly improve its cost structure and production efficiency to ensure its survival.

The stock's sharp decline underscores the inherent risks associated with investing in early-stage EV companies. While the long-term potential of the EV market is undeniable, the path to profitability is fraught with challenges. Rivian's experience serves as a cautionary tale for investors, highlighting the importance of careful due diligence and a realistic assessment of the risks involved. The coming months will be crucial for Rivian, as it works to address its production challenges and regain investor confidence. The success or failure of these efforts will have a significant impact on the company's future and the broader EV landscape.

Featured Posts

-

After 2025 Espn And Mlb To Sever Decades Long Partnership

Feb 22, 2025

After 2025 Espn And Mlb To Sever Decades Long Partnership

Feb 22, 2025 -

Watch Leicester City Vs Brentford Live Stream Free Online

Feb 22, 2025

Watch Leicester City Vs Brentford Live Stream Free Online

Feb 22, 2025 -

Could Hooters Be The Next Restaurant Chain To File For Bankruptcy

Feb 22, 2025

Could Hooters Be The Next Restaurant Chain To File For Bankruptcy

Feb 22, 2025 -

Where To Watch The Michigan State Vs Michigan Ncaa Mens Basketball Game Online

Feb 22, 2025

Where To Watch The Michigan State Vs Michigan Ncaa Mens Basketball Game Online

Feb 22, 2025 -

Thutmose Ii Tomb Discovery Significant Archaeological Find In Egypt

Feb 22, 2025

Thutmose Ii Tomb Discovery Significant Archaeological Find In Egypt

Feb 22, 2025

Latest Posts

-

Joshua Buatsi And Callum Smiths Absolute War What It Means For Anthony Joshua

Feb 24, 2025

Joshua Buatsi And Callum Smiths Absolute War What It Means For Anthony Joshua

Feb 24, 2025 -

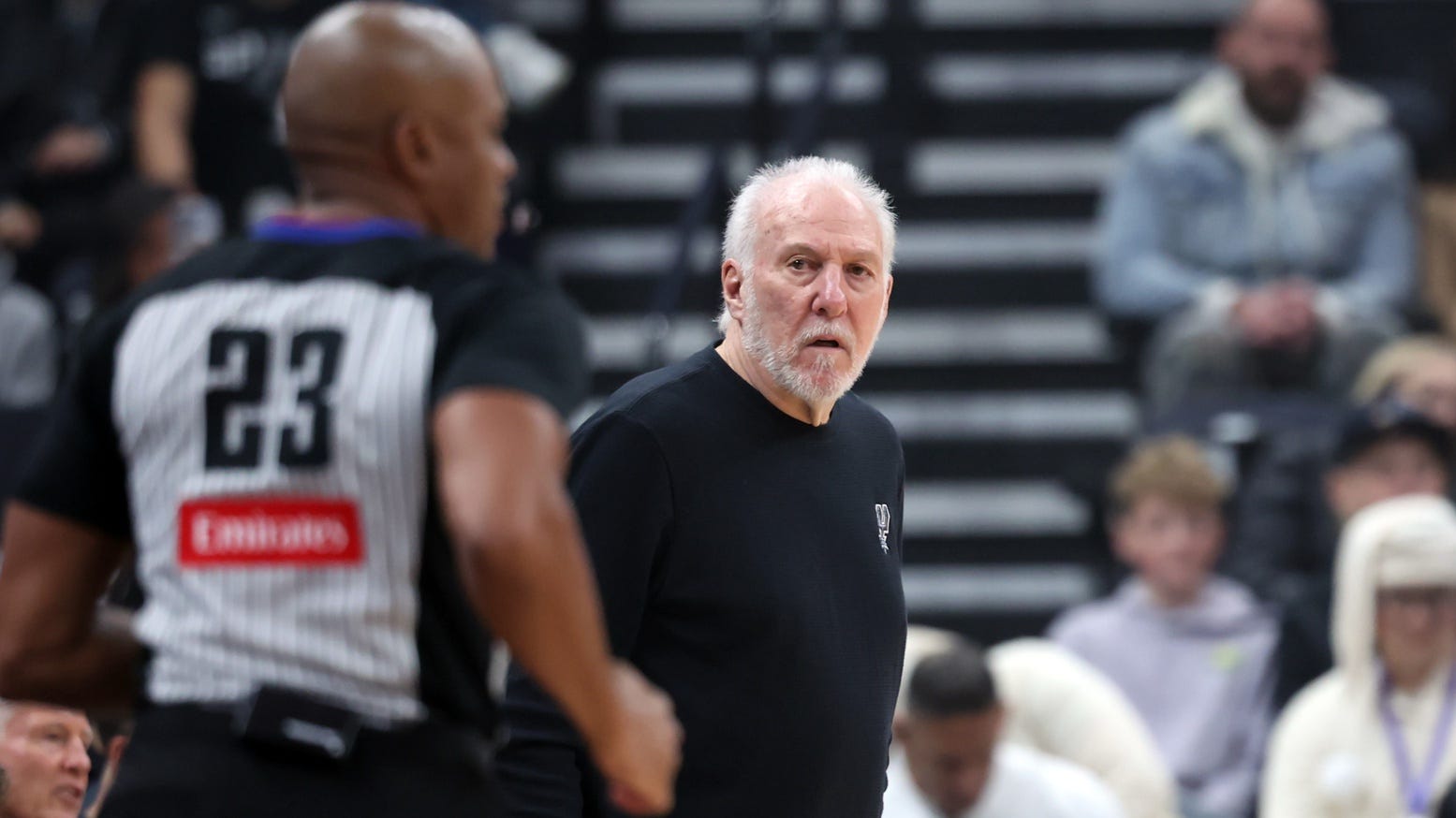

Spurs Coach Gregg Popovich No Expected Return Date For Health Issues

Feb 24, 2025

Spurs Coach Gregg Popovich No Expected Return Date For Health Issues

Feb 24, 2025 -

Como Ver El Partido La Palmas Vs Barcelona En Vivo Por Streaming

Feb 24, 2025

Como Ver El Partido La Palmas Vs Barcelona En Vivo Por Streaming

Feb 24, 2025 -

Manchester United Held To 2 2 Draw In Tense Encounter At Everton

Feb 24, 2025

Manchester United Held To 2 2 Draw In Tense Encounter At Everton

Feb 24, 2025 -

Las Palmas Vs Fc Barcelona Catalan Giants Claim 2 0 Away Victory

Feb 24, 2025

Las Palmas Vs Fc Barcelona Catalan Giants Claim 2 0 Away Victory

Feb 24, 2025