Rivian Automotive's Stock Takes A Hit After Revised Delivery Projections

Table of Contents

Rivian Stock Plummets on Revised Delivery Projections: Electric Vehicle Maker Faces Headwinds

Irvine, California – October 26, 2023 – Rivian Automotive, Inc. (RIVN), the electric vehicle (EV) startup that once soared to dizzying heights, saw its stock price take a significant hit today following a downward revision of its 2023 production targets. The company now expects to deliver between 25,000 and 26,000 vehicles this year, a substantial reduction from its previous guidance of 50,000. The announcement sent shockwaves through the market, wiping out billions in market capitalization and raising concerns about the company's long-term viability in an increasingly competitive EV landscape.

The revised projection, disclosed in Rivian's third-quarter earnings report, cited several factors contributing to the shortfall. Supply chain constraints, particularly the ongoing global chip shortage, continue to hamper production. The company also acknowledged challenges related to ramping up production at its Normal, Illinois factory, citing issues with automation and workforce optimization. Furthermore, the report highlighted increased costs associated with raw materials and logistics, squeezing profit margins.

Rivian's CEO, RJ Scaringe, addressed the disappointing news in a prepared statement, emphasizing the company's commitment to long-term growth and innovation. He acknowledged the challenges faced but expressed confidence in Rivian's product line and technology, pointing to positive customer feedback and growing demand for its R1T pickup truck and R1S SUV. Scaringe attributed the production shortfall to prioritizing quality over speed, suggesting a strategic shift towards a more sustainable and less aggressive production ramp-up. However, investors appeared unconvinced, with the stock price dropping [Insert Percentage Drop]% in early trading following the announcement.

The revised delivery projections cast a shadow over Rivian's ambitious growth plans. The company has significant investments in its manufacturing infrastructure and research and development, and the lower-than-expected production numbers raise questions about the company's ability to generate sufficient revenue to support these expenses. Analysts are now reassessing their forecasts for Rivian's financial performance, with many lowering their price targets in response to the news.

The setback also underscores the challenges faced by many EV startups attempting to scale up production and compete with established automotive giants. While the market for electric vehicles is booming, the transition is fraught with complexities, including navigating volatile supply chains, managing high capital expenditures, and facing intense competition from both legacy automakers and other new entrants.

The situation is further complicated by the broader economic uncertainty, with rising interest rates and inflation putting pressure on consumer spending and impacting investor sentiment toward growth stocks like Rivian. The company's ability to navigate these headwinds and regain investor confidence will be crucial in determining its long-term success.

While Rivian's revised projections are undoubtedly a blow, it's important to note that the company still retains a strong brand reputation and enjoys positive consumer reviews for its innovative products. However, the road ahead will require adept management, strategic adjustments, and a demonstrable ability to improve production efficiency to regain market trust and meet investor expectations. The coming quarters will be critical in determining whether Rivian can overcome these challenges and deliver on its long-term promise. The market will be watching closely.

[Insert Specific Details Here]:

- Exact Percentage Drop in Stock Price: Replace "[Insert Percentage Drop]%" with the precise percentage decrease in Rivian's stock price immediately following the announcement. Include the time of the announcement and the stock exchange (e.g., NASDAQ).

- Third-Quarter Earnings Report Details: Include key financial figures from the report, such as revenue, net loss, and any other relevant financial metrics.

- Specific Supply Chain Issues: Elaborate on the specific supply chain bottlenecks faced by Rivian, perhaps naming specific components or suppliers.

- Analyst Comments: Quote specific analysts and their revised price targets for Rivian stock. Include their reasoning for the change.

- Rivian's Response to Criticism: Include more direct quotes from RJ Scaringe's statement addressing the criticisms and the company's plans for improvement.

- Competitive Landscape: Mention specific competitors and how Rivian's struggles affect their positions in the market.

Remember to replace the bracketed information with precise, verifiable data from reputable sources like Rivian's official press releases, financial news websites (e.g., Bloomberg, Reuters, Yahoo Finance), and SEC filings. This will ensure accuracy and credibility.

Featured Posts

-

Fbi Announces Relocation Of 1 500 Personnel From Headquarters

Feb 23, 2025

Fbi Announces Relocation Of 1 500 Personnel From Headquarters

Feb 23, 2025 -

Millwall Edges Derby County 1 0 Josh Coburns Decisive Strike

Feb 23, 2025

Millwall Edges Derby County 1 0 Josh Coburns Decisive Strike

Feb 23, 2025 -

Champions Trophy Inglis Stars As Australia Defeats England

Feb 23, 2025

Champions Trophy Inglis Stars As Australia Defeats England

Feb 23, 2025 -

Bivol Vs Beterbiev 2 Light Heavyweight Rematch Results And Highlights

Feb 23, 2025

Bivol Vs Beterbiev 2 Light Heavyweight Rematch Results And Highlights

Feb 23, 2025 -

Hooters Facing Bankruptcy After Mass Closures

Feb 23, 2025

Hooters Facing Bankruptcy After Mass Closures

Feb 23, 2025

Latest Posts

-

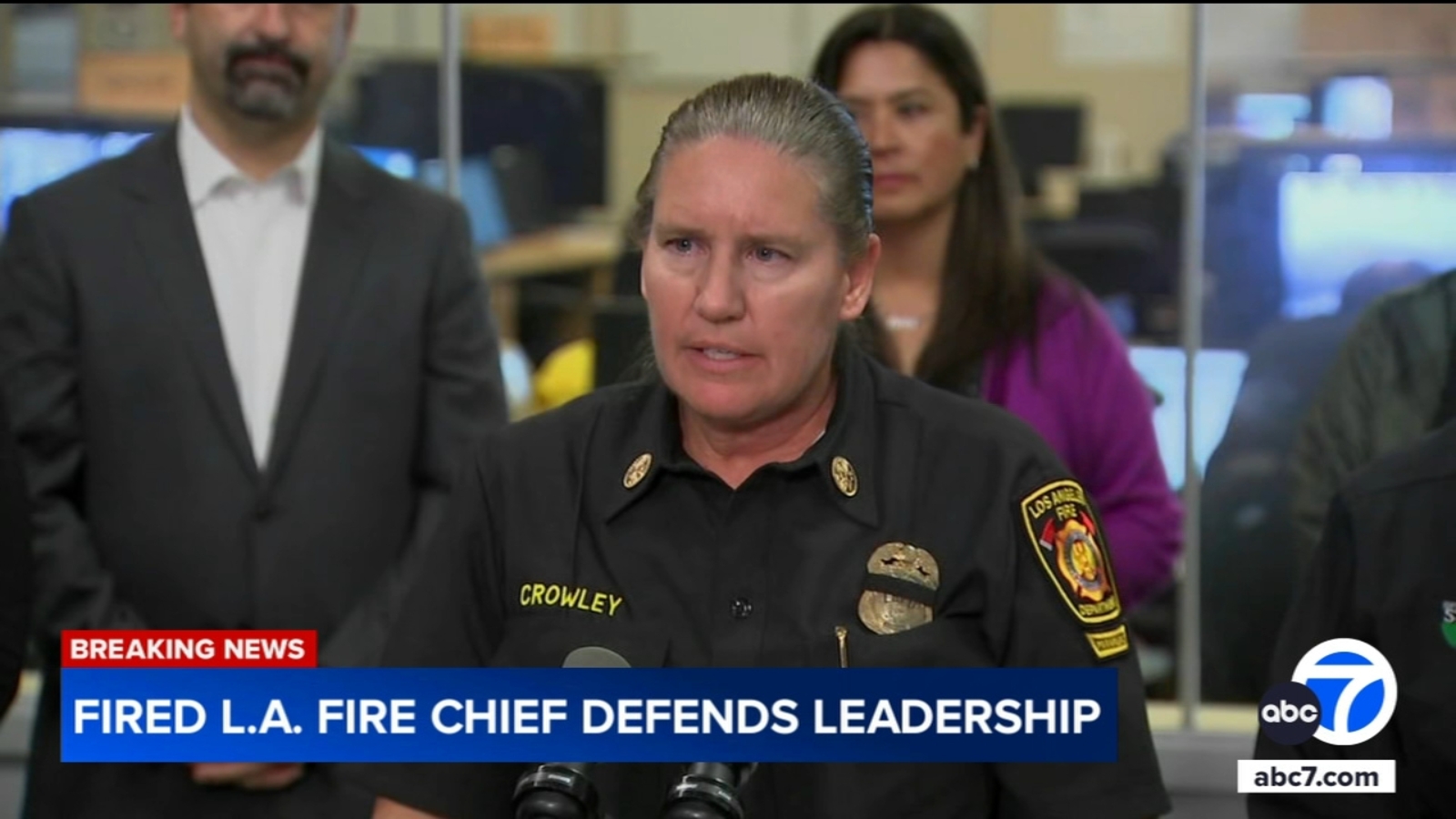

Kristin Crowley The Former Lafd Chief On Her Unexpected Resignation

Feb 23, 2025

Kristin Crowley The Former Lafd Chief On Her Unexpected Resignation

Feb 23, 2025 -

Joseph Parker Demolishes Bakole In Round 2 Challenges Usyk

Feb 23, 2025

Joseph Parker Demolishes Bakole In Round 2 Challenges Usyk

Feb 23, 2025 -

Inter Miamis 10 Man Fight Late Draw Against Opponent Name

Feb 23, 2025

Inter Miamis 10 Man Fight Late Draw Against Opponent Name

Feb 23, 2025 -

Fleetwood Macs Classic Album Poised For Another No 1

Feb 23, 2025

Fleetwood Macs Classic Album Poised For Another No 1

Feb 23, 2025 -

Chelseas Premier League Hopes Dashed By Aston Villa

Feb 23, 2025

Chelseas Premier League Hopes Dashed By Aston Villa

Feb 23, 2025