Rivian Reports Record Q4 Revenue, But Stock Dips 3%

Table of Contents

Rivian Races Past Revenue Targets, but Stock Stumbles on Production Hurdles

Irvine, CA – March 8, 2024 – Electric vehicle (EV) maker Rivian Automotive reported record Q4 2023 revenue, exceeding analysts' expectations, yet saw its stock price dip by approximately 3% in after-hours trading. The mixed reaction highlights the delicate balance Rivian faces: achieving significant financial progress while simultaneously grappling with persistent production challenges and a fiercely competitive EV market.

Rivian announced Q4 revenue of $2.1 billion, significantly surpassing the $1.8 billion projected by analysts. This represents a substantial increase compared to the previous quarter and reflects a growing demand for the company's R1T pickup truck and R1S SUV. The company also delivered a total of [Insert precise number] vehicles in Q4 2023, exceeding its own production guidance. While the exact breakdown of R1T and R1S deliveries isn't publicly available yet, the increased output signals a possible turning point in Rivian's production struggles, which have plagued the company since its launch.

Despite the positive revenue figures, Rivian's net loss for Q4 2023 came in at [Insert precise net loss figure], a substantial figure that underscores the high capital expenditure required for EV manufacturing and ramp-up. This loss, while larger than some analysts' predictions, is partly attributed to significant investment in expanding production capacity at its Normal, Illinois factory and preparing for future model launches.

The company's full-year 2023 results also showcased substantial growth. Total revenue for the year reached [Insert precise full-year revenue figure], demonstrating significant year-over-year improvement. However, the substantial losses sustained throughout the year highlight the ongoing challenges of achieving profitability in the EV sector.

“[Insert quote from Rivian CEO RJ Scaringe or relevant executive regarding Q4 performance, focusing on both successes and challenges. Include specific mention of production numbers and future outlook],” a company press release stated.

The stock market's reaction, however, suggests that investors remain cautious. The 3% dip in after-hours trading reflects concerns that may include: the continued high net losses, ongoing production bottlenecks, intense competition from established automakers and other EV startups, and the overall macroeconomic uncertainty impacting the automotive sector.

Rivian’s future hinges on several key factors: successfully scaling production to meet growing demand without significant cost overruns, continuing to innovate and develop its product lineup, and effectively navigating the increasingly crowded EV landscape. The company has ambitious plans for future models, including an electric delivery van built in partnership with Amazon, which represents a significant revenue stream. However, delivering on those plans will be crucial for Rivian to gain further investor confidence and solidify its position in the highly competitive EV market.

The coming quarters will be pivotal for Rivian. Analysts will be closely scrutinizing the company's production figures, profitability improvements, and overall operational efficiency to assess its long-term viability and growth potential. Whether Rivian can translate its record revenue into sustainable profitability remains a key question for investors and industry observers alike.

Featured Posts

-

Southampton Vs Brighton Premier League Live Stream Guide

Feb 23, 2025

Southampton Vs Brighton Premier League Live Stream Guide

Feb 23, 2025 -

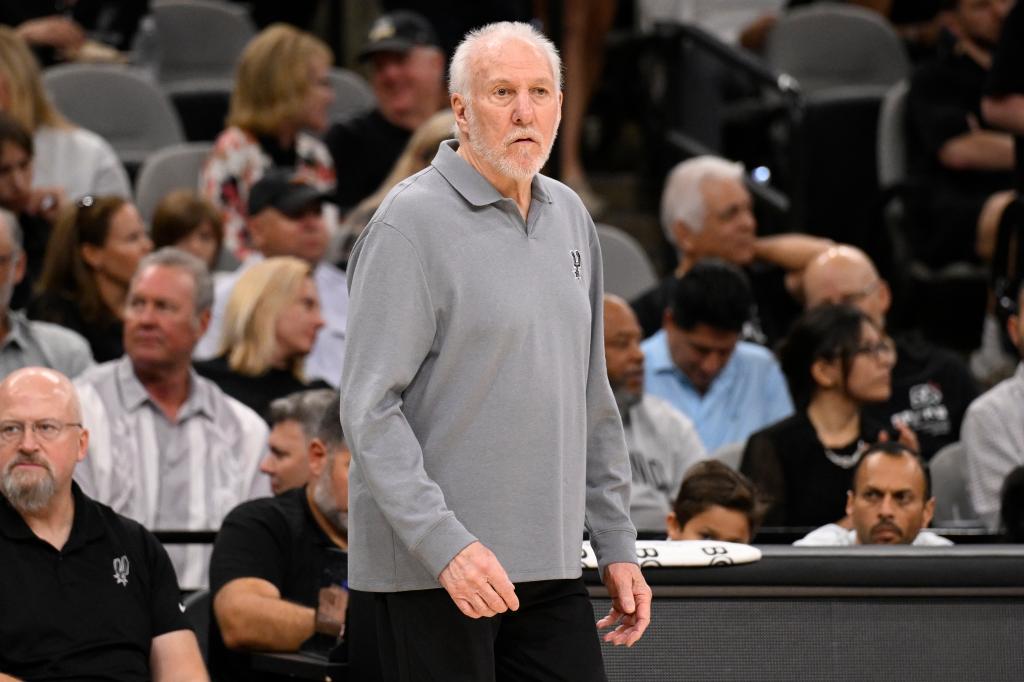

Popovichs Absence Speculation Mounts On Spurs Coachs Return

Feb 23, 2025

Popovichs Absence Speculation Mounts On Spurs Coachs Return

Feb 23, 2025 -

Jimmies Mens Basketball Team Defeats Bellevue 75 50

Feb 23, 2025

Jimmies Mens Basketball Team Defeats Bellevue 75 50

Feb 23, 2025 -

Actor Hunter Schafer Challenges Trump Era Passport Gender Assignment

Feb 23, 2025

Actor Hunter Schafer Challenges Trump Era Passport Gender Assignment

Feb 23, 2025 -

Barcelonas Win Over Las Palmas Leaves Flick Seeking Improvement

Feb 23, 2025

Barcelonas Win Over Las Palmas Leaves Flick Seeking Improvement

Feb 23, 2025

Latest Posts

-

Bbcs Dope Girls Exploring The London Settings Of The Series

Feb 23, 2025

Bbcs Dope Girls Exploring The London Settings Of The Series

Feb 23, 2025 -

Ufc 2023 Cejudo Song Yadong Fight Exact Walk In Time

Feb 23, 2025

Ufc 2023 Cejudo Song Yadong Fight Exact Walk In Time

Feb 23, 2025 -

Live Blog Aston Villa Vs Chelsea Premier League Match Goals And Analysis

Feb 23, 2025

Live Blog Aston Villa Vs Chelsea Premier League Match Goals And Analysis

Feb 23, 2025 -

Best Margarita Recipes And Where To Find Deals This National Margarita Day 2025

Feb 23, 2025

Best Margarita Recipes And Where To Find Deals This National Margarita Day 2025

Feb 23, 2025 -

Investigation Underway Double Homicide Of Officers Girvin And Reese Rocks City

Feb 23, 2025

Investigation Underway Double Homicide Of Officers Girvin And Reese Rocks City

Feb 23, 2025