Rivian Stock Down 3% On Strong Delivery Numbers

Table of Contents

Rivian Stock Dips Despite Strong Delivery Numbers: A Sign of Market Volatility or Underlying Concerns?

Rivian Automotive, Inc. (RIVN) saw its stock price fall by approximately 3% on [Date of Stock Drop], despite reporting strong vehicle delivery figures for [Quarter/Month, e.g., the second quarter of 2024 or August 2024]. The unexpected decline highlights the complexities of the electric vehicle (EV) market and investor sentiment, raising questions about the company's long-term prospects.

The Irvine, California-based EV maker announced [Number] vehicle deliveries for the period, a [Percentage]% increase compared to [Previous Period's Deliveries and Percentage Change]. This substantial growth, surpassing analyst expectations of [Analyst Expected Delivery Numbers], seemed to be a clear indicator of positive momentum for the company. However, the market reacted differently, suggesting that factors beyond pure delivery numbers are influencing investor confidence.

Several market analysts have attributed the stock dip to a combination of factors. Firstly, the broader market volatility plays a significant role. The overall economic uncertainty, alongside fluctuating interest rates and concerns about inflation, has created a challenging environment for growth stocks, especially in the nascent EV sector. Rivian, being a relatively young company, is particularly susceptible to these macroeconomic headwinds.

Secondly, the stock's performance might reflect investor concerns regarding Rivian's [Mention Specific Challenges, e.g., production ramp-up challenges, competition from established automakers, or profitability]. While delivery numbers are encouraging, consistent and profitable production remains a crucial hurdle for the company. Analysts point to [Specific Data Supporting this Point, e.g., production costs, manufacturing bottlenecks, or delays in new model rollouts] as potential areas of concern.

Thirdly, the stock price could be reacting to the ongoing competitive landscape. Established automakers are aggressively investing in their own EV initiatives, creating intense competition for market share. Rivian's ability to differentiate itself in this crowded market, through innovative technology, attractive pricing, and strong brand recognition, will be critical for its future success. [Mention Specific Competitors and their recent moves].

Despite the temporary setback, Rivian maintains a strong long-term vision. The company's focus on sustainable manufacturing practices, its partnership with [mention key partnerships, e.g., Amazon], and its ambitious product pipeline continue to attract attention. However, the recent stock dip underscores the inherent risks associated with investing in a young, growth-oriented EV company.

Looking ahead, investors will be keenly watching Rivian’s progress on [Mention Key Upcoming Events/Milestones, e.g., production targets for the next quarter, new product launches, or cost-cutting measures]. The company's ability to address the challenges highlighted above and translate strong delivery numbers into sustainable profitability will ultimately determine its long-term success and influence investor sentiment. The market's reaction highlights the fact that in the dynamic EV industry, solid performance is necessary, but not always sufficient to guarantee a positive market response. The interplay between company performance, market conditions, and investor sentiment continues to shape the narrative around Rivian's future.

Note: This article requires filling in the bracketed information with specific data obtained from reliable financial news sources and Rivian's official announcements. Ensure that all data points are accurately cited to maintain journalistic integrity and credibility. The date of publication should also be added at the end.

Featured Posts

-

Bybit Suffers Record Breaking 1 4 Billion Crypto Attack

Feb 22, 2025

Bybit Suffers Record Breaking 1 4 Billion Crypto Attack

Feb 22, 2025 -

Baseballs Beard Culture A History Tied To The Yankees

Feb 22, 2025

Baseballs Beard Culture A History Tied To The Yankees

Feb 22, 2025 -

Knicks Fall To Cavaliers In Convincing Loss

Feb 22, 2025

Knicks Fall To Cavaliers In Convincing Loss

Feb 22, 2025 -

Cal Fire Captain Murder Deputies Name Suspect In Case

Feb 22, 2025

Cal Fire Captain Murder Deputies Name Suspect In Case

Feb 22, 2025 -

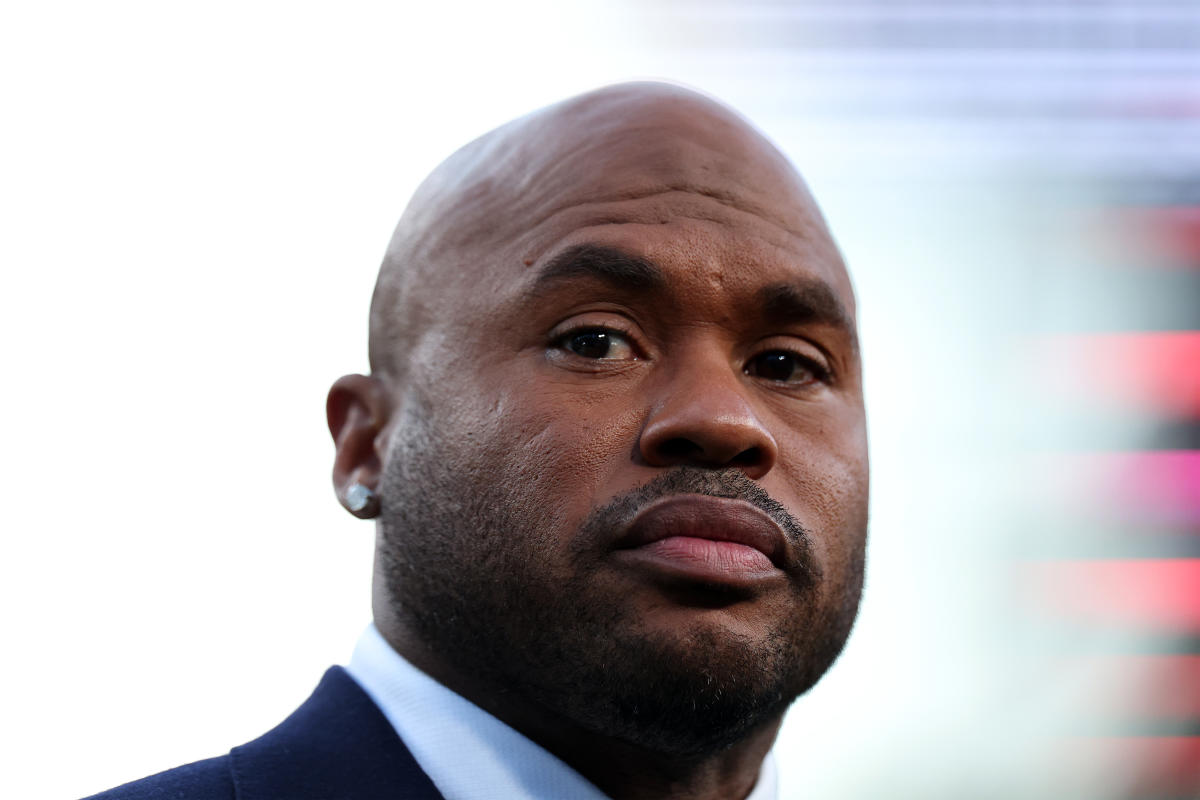

Byron Donalds Will He Become Speaker Of The House

Feb 22, 2025

Byron Donalds Will He Become Speaker Of The House

Feb 22, 2025

Latest Posts

-

Cejudo Vs Song Yadong Live Ufc Seattle Fight Blog

Feb 23, 2025

Cejudo Vs Song Yadong Live Ufc Seattle Fight Blog

Feb 23, 2025 -

Infidelity Accusations Against Steve Smith Spread On X Ex Nfl Player Responds

Feb 23, 2025

Infidelity Accusations Against Steve Smith Spread On X Ex Nfl Player Responds

Feb 23, 2025 -

Late Goals Secure Comfortable Tottenham Victory Over Ipswich

Feb 23, 2025

Late Goals Secure Comfortable Tottenham Victory Over Ipswich

Feb 23, 2025 -

Meyers Snl Writers Reunite For Hilarious Late Night Success

Feb 23, 2025

Meyers Snl Writers Reunite For Hilarious Late Night Success

Feb 23, 2025 -

St Louis City Sc Completes Signing Of Joey Zalinsky

Feb 23, 2025

St Louis City Sc Completes Signing Of Joey Zalinsky

Feb 23, 2025