Rivian Stock Down Despite Positive Q4 Earnings Report

Table of Contents

Rivian Stock Dips Despite Strong Q4 Earnings: Investors Remain Wary

Irvine, CA – February 28, 2024 – Rivian Automotive, the electric vehicle (EV) maker backed by Amazon and Ford, saw its stock price decline despite reporting better-than-expected fourth-quarter earnings. While the company exceeded analysts' predictions on several key metrics, lingering concerns about production ramp-up, competition in the burgeoning EV market, and broader macroeconomic headwinds overshadowed the positive financial results.

Rivian announced Q4 2023 revenue of [$661 million], surpassing the consensus estimate of [$600 million]. The company produced [25,000] vehicles during the quarter, significantly more than the [14,000] produced in Q3 2023. This substantial increase demonstrates progress in addressing production bottlenecks that plagued the company earlier in the year. The production increase, coupled with cost-cutting measures, contributed to a narrower-than-expected net loss of [$1.2 billion], although this still represents a significant financial burden for the young company.

Despite these seemingly positive figures, Rivian's stock price fell [by approximately X%] in after-hours trading following the earnings release. This negative market reaction highlights the complex factors influencing investor sentiment toward the EV sector.

Analysts attribute the stock decline to several key issues. Firstly, while production increased, it remains below the company's ambitious targets. Rivian continues to grapple with supply chain challenges, particularly regarding procuring battery cells, a constraint impacting the entire EV industry. Secondly, the intense competition in the EV space continues to intensify, with established automakers like Tesla, Ford, and General Motors aggressively expanding their EV offerings. Rivian faces the challenge of establishing itself as a viable competitor in this crowded market.

Furthermore, the broader macroeconomic climate adds another layer of uncertainty. Rising interest rates and persistent inflation have made investors more risk-averse, leading them to reassess valuations across the technology and automotive sectors. This macroeconomic backdrop is likely impacting investor confidence in even promising EV companies like Rivian.

Looking ahead, Rivian’s success will hinge on its ability to accelerate production, successfully launch new vehicle models (including an anticipated pickup truck), and effectively manage its operational costs. The company reaffirmed its full-year 2024 production guidance of [50,000] vehicles. Meeting this target will be crucial in demonstrating its ability to scale its operations and compete effectively in the long term. However, achieving this ambitious goal amidst ongoing supply chain hurdles and fierce competition remains a significant challenge.

Rivian’s CEO [RJ Scaringe] acknowledged the challenges in a post-earnings call, stating that the company remains focused on enhancing its manufacturing processes and streamlining its supply chain. He emphasized the company’s long-term vision and commitment to sustainable transportation, but investors clearly remain cautious, preferring to see concrete evidence of sustained growth and profitability before significantly increasing their investment.

The dip in Rivian's stock price underscores the volatile nature of the EV market and the complex interplay of factors influencing investor sentiment. While the Q4 earnings report showcased progress, the road to profitability and sustained growth for Rivian remains long and arduous, requiring significant execution and a degree of market luck. The coming quarters will be crucial in determining whether Rivian can overcome its current challenges and realize its ambitious goals. Only time will tell if the company can translate promising financial results into sustained stock market success.

Featured Posts

-

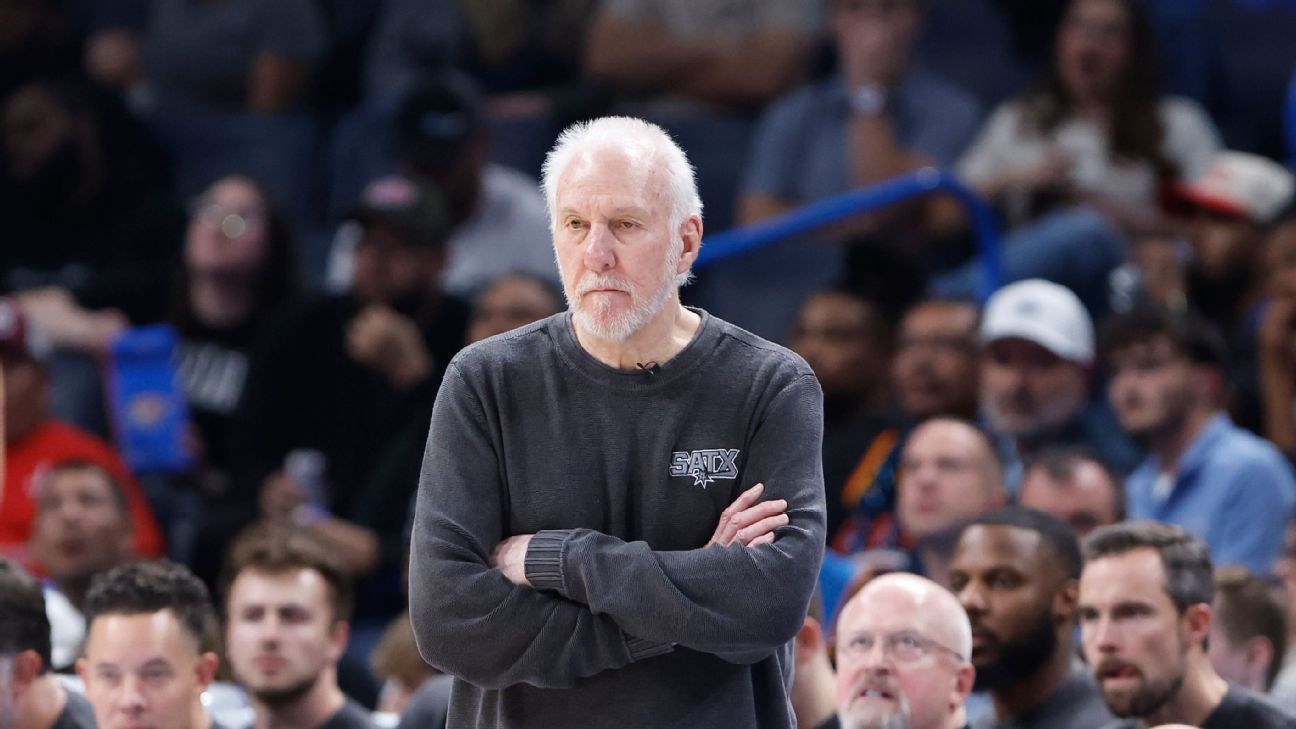

Popovichs Spurs Return Uncertain Coach Expected To Miss Rest Of Season

Feb 23, 2025

Popovichs Spurs Return Uncertain Coach Expected To Miss Rest Of Season

Feb 23, 2025 -

Conservative Backlash Trumps Rhetoric Risks Losing Key Voters

Feb 23, 2025

Conservative Backlash Trumps Rhetoric Risks Losing Key Voters

Feb 23, 2025 -

Conservative Backlash Looms As Trump Intensifies Attacks

Feb 23, 2025

Conservative Backlash Looms As Trump Intensifies Attacks

Feb 23, 2025 -

Dropped Charges Case Adams Doj Offer Explanation In Court

Feb 23, 2025

Dropped Charges Case Adams Doj Offer Explanation In Court

Feb 23, 2025 -

Watch Beterbiev Vs Bivol And Parker Boxing Match Live Stream Guide

Feb 23, 2025

Watch Beterbiev Vs Bivol And Parker Boxing Match Live Stream Guide

Feb 23, 2025

Latest Posts

-

Governor Praises Virginia Beach Police Officers Courage

Feb 23, 2025

Governor Praises Virginia Beach Police Officers Courage

Feb 23, 2025 -

Arsenal Vs West Ham Live Stream And Match Details Feb 22 2025

Feb 23, 2025

Arsenal Vs West Ham Live Stream And Match Details Feb 22 2025

Feb 23, 2025 -

Live Stream Arsenal Vs West Ham Premier League Football

Feb 23, 2025

Live Stream Arsenal Vs West Ham Premier League Football

Feb 23, 2025 -

Judges Ruling To Resume Foreign Aid A Reality Check From The Field

Feb 23, 2025

Judges Ruling To Resume Foreign Aid A Reality Check From The Field

Feb 23, 2025 -

Investigation Underway After Two Virginia Beach Police Officers Killed

Feb 23, 2025

Investigation Underway After Two Virginia Beach Police Officers Killed

Feb 23, 2025