Rivian Stock Plunges: Understanding Today's Decline

Table of Contents

Rivian Stock Plunges Amidst Production Slowdown and Wider Market Concerns

Rivian Automotive, Inc.'s (RIVN) stock experienced a significant drop on [Date of Stock Plunge], plummeting [Percentage]% to [Closing Price] per share. This sharp decline follows a broader sell-off in the electric vehicle (EV) sector and is compounded by concerns surrounding the company's production targets and financial performance. The drop underscores the ongoing challenges faced by Rivian as it navigates a competitive EV market and strives to scale its operations.

The immediate catalyst for the stock's fall appears to be [Specific News or Event that triggered the drop, e.g., a disappointing production update, a negative analyst report, broader market downturn]. [Elaborate on the specific news or event, providing details and context. For instance, if it was a production update, specify the number of vehicles produced, the shortfall compared to expectations, and the company's explanation for the underperformance. If it was an analyst report, mention the analyst firm, their rating change, and the reasoning behind their downgrade. If it was a market downturn, explain the broader economic factors at play].

Rivian's stock has been on a volatile trajectory since its initial public offering (IPO) in [Year of IPO]. While the company initially garnered significant investor enthusiasm due to its innovative vehicle designs and substantial backing from Amazon and Ford, it has struggled to meet ambitious production goals. [Insert data on Rivian's production numbers throughout the relevant period, comparing them with initial projections and highlighting any discrepancies]. This underperformance has fueled concerns about the company's ability to compete effectively against established automakers and other emerging EV players.

Beyond immediate production challenges, Rivian faces several broader headwinds. Rising inflation, increasing interest rates, and supply chain disruptions continue to impact the entire automotive industry, but particularly affect companies like Rivian that are heavily reliant on complex and specialized components. [Include data on relevant economic indicators, like inflation rates or interest rates, and their potential impact on Rivian's performance]. Furthermore, the intensifying competition in the EV market, with established players investing heavily in electrification and new entrants emerging constantly, adds another layer of pressure. [Discuss the competitive landscape, mentioning key competitors and their market share or recent announcements].

Rivian's financial performance also plays a significant role in investor sentiment. The company has reported [Mention recent financial results, including revenue, losses, and cash burn rate]. [Include details about Rivian’s financial situation, comparing it to its projections and those of competitors. Note any changes in profitability, debt levels, and cash reserves]. These figures raise questions about the company's long-term financial sustainability, particularly in light of its substantial capital expenditures required for factory expansion and research and development.

While Rivian has announced plans to [Mention any significant future plans, such as new models, factory expansions, or technological advancements], investors remain cautious about the company's ability to execute these plans effectively and profitably. [Provide details about these plans, including timelines and potential challenges]. The market's reaction to today's decline suggests a growing skepticism regarding the company's short-term prospects.

Looking ahead, Rivian's success will hinge on its ability to address its production challenges, manage its costs effectively, and navigate the increasingly competitive EV landscape. Analysts are divided on the company's future trajectory, with some maintaining a positive outlook based on its long-term potential, while others express concerns about its ability to achieve profitability and sustainable growth. [Include a summary of various analysts’ opinions and ratings on Rivian's stock]. The coming months will be crucial in determining whether Rivian can regain investor confidence and fulfill its ambitious vision.

Featured Posts

-

Toronto Plane Crash Passengers Offered 30 000 Each In Compensation

Feb 22, 2025

Toronto Plane Crash Passengers Offered 30 000 Each In Compensation

Feb 22, 2025 -

Maine Governor Mills Addresses U S Investigation

Feb 22, 2025

Maine Governor Mills Addresses U S Investigation

Feb 22, 2025 -

Hunter Schafer Euphoria Stars Passport Reflects Updated Gender Identity

Feb 22, 2025

Hunter Schafer Euphoria Stars Passport Reflects Updated Gender Identity

Feb 22, 2025 -

Inside Tate Mc Raes Mind Perpetual Motion And Creativity

Feb 22, 2025

Inside Tate Mc Raes Mind Perpetual Motion And Creativity

Feb 22, 2025 -

Tate Mc Raes Secret 790 000 Media Exposure

Feb 22, 2025

Tate Mc Raes Secret 790 000 Media Exposure

Feb 22, 2025

Latest Posts

-

Accountability For Doge And Musk Gop Lawmakers Answer To Voters

Feb 23, 2025

Accountability For Doge And Musk Gop Lawmakers Answer To Voters

Feb 23, 2025 -

Bivol Outpoints Beterbiev In Light Heavyweight Rematch

Feb 23, 2025

Bivol Outpoints Beterbiev In Light Heavyweight Rematch

Feb 23, 2025 -

Cejudo Vs Song Yadong Live Ufc Seattle Fight Blog

Feb 23, 2025

Cejudo Vs Song Yadong Live Ufc Seattle Fight Blog

Feb 23, 2025 -

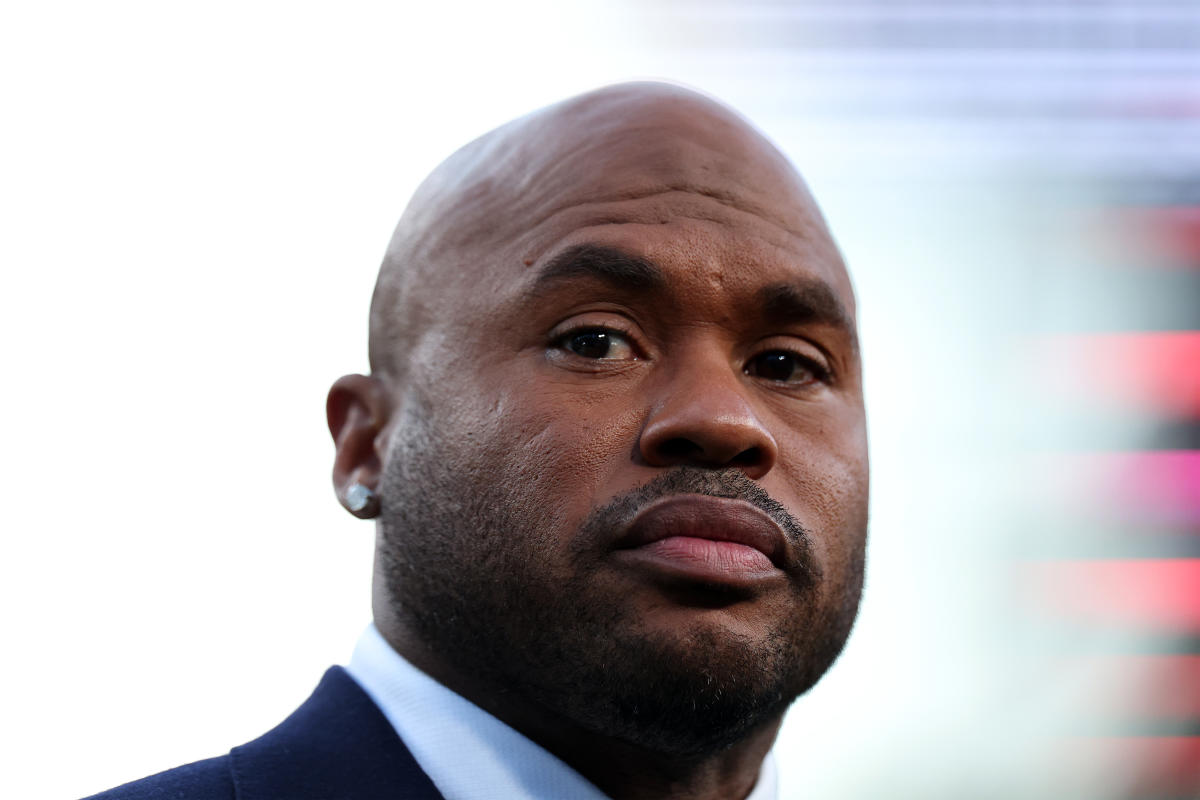

Infidelity Accusations Against Steve Smith Spread On X Ex Nfl Player Responds

Feb 23, 2025

Infidelity Accusations Against Steve Smith Spread On X Ex Nfl Player Responds

Feb 23, 2025 -

Late Goals Secure Comfortable Tottenham Victory Over Ipswich

Feb 23, 2025

Late Goals Secure Comfortable Tottenham Victory Over Ipswich

Feb 23, 2025