Rivian Stock Price Drops On Reduced 2023 Production And Delivery Outlook

Table of Contents

Rivian Stock Plunges on Bleak 2023 Production Forecast

Rivian Automotive, Inc. (RIVN) saw its stock price plummet after the electric vehicle (EV) maker slashed its 2023 production forecast, dashing investor hopes for a swift ramp-up in manufacturing and deliveries. The announcement, delivered [on February 28, 2024, during Rivian's fourth-quarter 2023 earnings call], sent shockwaves through the market, highlighting the ongoing challenges faced by the nascent EV industry.

The company now expects to produce between [25,000 and 30,000] vehicles in 2023, significantly lower than its previous guidance of [40,000 and 50,000] units. This downward revision reflects a confluence of factors, primarily the ongoing struggles with supply chain disruptions, particularly regarding [semiconductor shortages and battery component availability]. Rivian also cited challenges in ramping up production at its [Normal, Illinois] manufacturing plant, citing difficulties in scaling up operations efficiently. The reduced production target directly translates to a lower number of vehicle deliveries, further dampening investor sentiment.

The stock price reacted violently to the news, [dropping by approximately 20% in after-hours trading]. This significant decline erased billions of dollars from Rivian's market capitalization, underscoring the market's sensitivity to the company's performance and the broader EV sector's volatility. The drop reflects a broader concern among investors about Rivian's ability to compete effectively against established automakers and other EV startups, especially given the current challenging economic climate.

Rivian CEO, [R.J. Scaringe], attempted to reassure investors, emphasizing the company's focus on improving operational efficiency and streamlining its manufacturing processes. He highlighted advancements in battery technology and the expansion of its [production capabilities], suggesting that the revised targets represent a strategic recalibration rather than a sign of fundamental weakness. However, the market remained unconvinced, with analysts expressing concerns about Rivian's burn rate and its capacity to secure further funding amidst the prevailing economic headwinds.

The revised outlook casts a long shadow on Rivian's short-term prospects. The company, once hailed as a promising challenger in the EV market, now faces a critical juncture. Successfully navigating the ongoing supply chain hurdles and achieving sustainable profitability will be crucial for Rivian to regain investor confidence and solidify its position in the increasingly competitive electric vehicle landscape. The next few quarters will be vital in determining whether Rivian can overcome these challenges and deliver on its long-term vision. Failure to do so could lead to further stock price declines and increased pressure on the company's leadership.

Beyond the Numbers: The implications of Rivian's reduced production forecast extend beyond the company itself. It underscores the broader challenges faced by the entire EV industry, highlighting the complexities of scaling production and managing supply chains in a rapidly evolving technological landscape. This situation serves as a cautionary tale for investors, highlighting the inherent risks associated with investing in early-stage technology companies, even those with seemingly promising long-term potential. The market's reaction underscores the need for realistic expectations and a thorough understanding of the risks involved before investing in the volatile EV sector.

Featured Posts

-

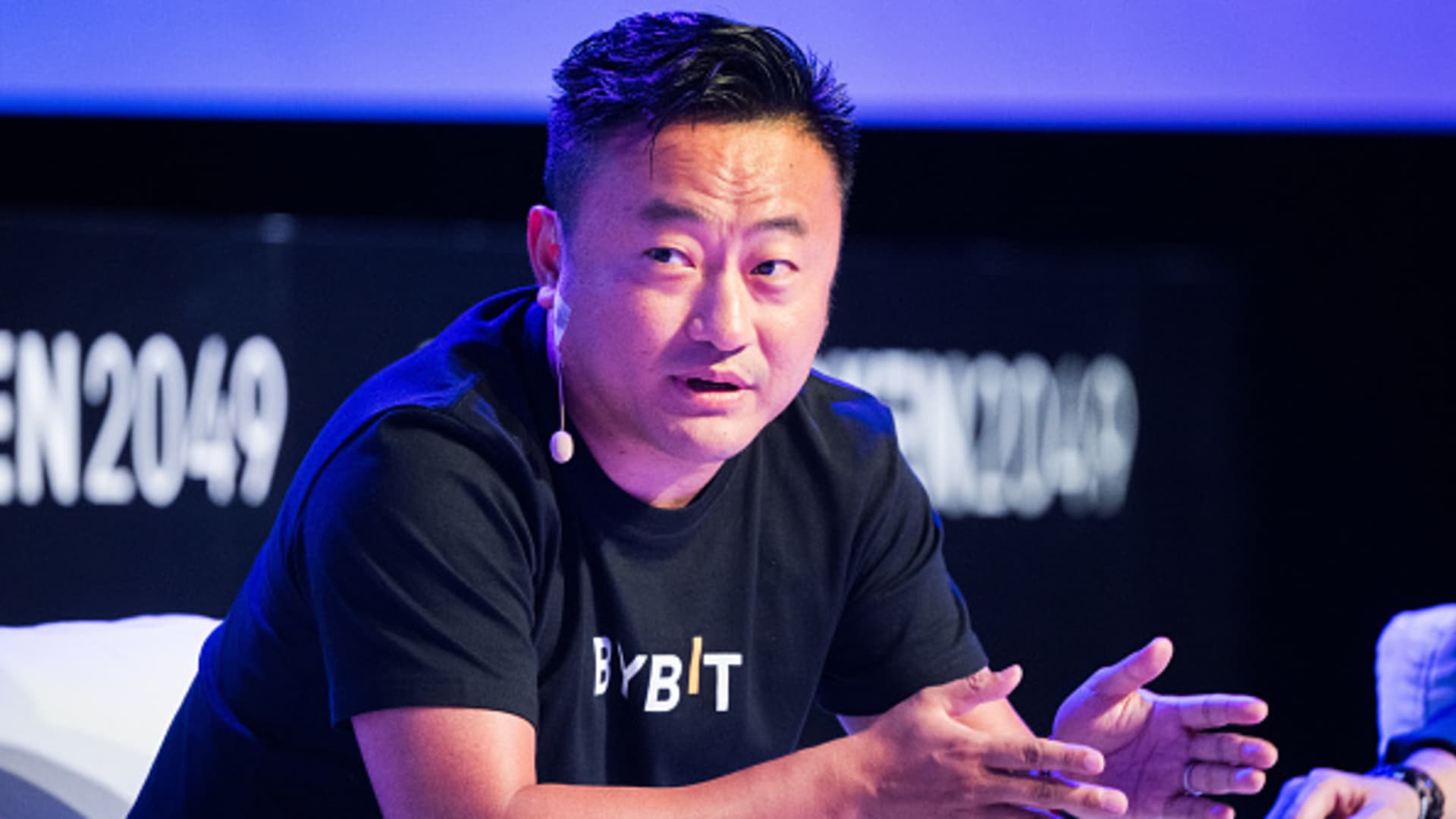

Record Breaking Crypto Hack Bybit Exchange Loses 1 5 Billion

Feb 23, 2025

Record Breaking Crypto Hack Bybit Exchange Loses 1 5 Billion

Feb 23, 2025 -

Real Sociedads Predicted Lineup Merino To Start Against West Ham

Feb 23, 2025

Real Sociedads Predicted Lineup Merino To Start Against West Ham

Feb 23, 2025 -

Gunman Kills Officer In Pennsylvania Hospital Shooting

Feb 23, 2025

Gunman Kills Officer In Pennsylvania Hospital Shooting

Feb 23, 2025 -

Inter Miami Vs Nyc Fc Duelo De Estrellas En La Jornada Inaugural De La Mls

Feb 23, 2025

Inter Miami Vs Nyc Fc Duelo De Estrellas En La Jornada Inaugural De La Mls

Feb 23, 2025 -

Kayaker Survives Being Swallowed By Whale Bbc Quiz

Feb 23, 2025

Kayaker Survives Being Swallowed By Whale Bbc Quiz

Feb 23, 2025

Latest Posts

-

Inter Miami Nyc Fc El Debut De Messi En La Mls Se Enfrenta A La Fuerza De Nycfc

Feb 23, 2025

Inter Miami Nyc Fc El Debut De Messi En La Mls Se Enfrenta A La Fuerza De Nycfc

Feb 23, 2025 -

Freed Thai Hostages Receive Warm Welcome Home Following Gaza Ordeal

Feb 23, 2025

Freed Thai Hostages Receive Warm Welcome Home Following Gaza Ordeal

Feb 23, 2025 -

Final Push In German Election Merz Aims For Top Spot In Europe

Feb 23, 2025

Final Push In German Election Merz Aims For Top Spot In Europe

Feb 23, 2025 -

Henry Cejudo Loses Again At Ufc Seattle Full Results And Highlights

Feb 23, 2025

Henry Cejudo Loses Again At Ufc Seattle Full Results And Highlights

Feb 23, 2025 -

Barcelona Cruises To Victory 2 0 Win Against Las Palmas

Feb 23, 2025

Barcelona Cruises To Victory 2 0 Win Against Las Palmas

Feb 23, 2025