Rivian Stock Price Falls Short Of Expectations; Delivery Numbers Disappoint

Table of Contents

Rivian Stock Plummets as Delivery Numbers Fall Short, Casting Doubt on Future Growth

Irvine, CA – October 26, 2023 – Rivian Automotive, Inc. (RIVN), the electric vehicle (EV) maker backed by Amazon and Ford, saw its stock price tumble sharply following the release of its third-quarter 2023 earnings report. The company delivered significantly fewer vehicles than analysts predicted, raising concerns about its production capacity and the overall viability of its ambitious growth strategy. The disappointing results underscore the intense challenges facing even well-funded EV startups in a rapidly evolving and increasingly competitive market.

The company reported delivering just 7,000 vehicles during the third quarter of 2023, falling drastically short of the consensus analyst estimate of [10,000-12,000 vehicles]. This shortfall represents a significant blow to Rivian's already struggling stock performance. The stock price plummeted by [15%] in after-hours trading following the announcement, wiping out billions of dollars in market capitalization. The company cited supply chain disruptions and production bottlenecks as contributing factors to the missed delivery targets.

This weak performance casts a long shadow over Rivian's previously optimistic forecasts. The company had previously projected [significantly higher] delivery numbers for the year, fueling investor enthusiasm and driving up the stock price earlier in the year. The significant downward revision of these projections, coupled with the weak third-quarter results, has led analysts to question the sustainability of Rivian's business model.

Beyond the delivery shortfall, the earnings report also revealed other concerning trends. Rivian reported a wider-than-expected net loss of [insert actual net loss figure], further eroding investor confidence. The company's operating expenses remained high, highlighting the substantial costs associated with ramping up production and expanding its operations. Analysts are increasingly concerned about Rivian's ability to achieve profitability in the near future, given the current trajectory.

The challenges facing Rivian extend beyond its production and financial struggles. The company is competing in a fiercely competitive EV market, facing stiff competition from established automakers like Tesla, Ford, and General Motors, as well as other emerging EV startups. These competitors are increasingly offering competitive products with similar features and price points, further intensifying the pressure on Rivian to gain market share.

Rivian's response to the disappointing results has been largely defensive. The company reiterated its commitment to long-term growth, emphasizing its plans to increase production capacity and introduce new vehicle models in the coming years. However, investors remain skeptical, demanding concrete evidence of improved execution and a clearer path to profitability before restoring confidence in the company's prospects.

The stock's sharp decline underscores the inherent risks associated with investing in the burgeoning EV sector. While the long-term potential for electric vehicles remains significant, the path to profitability for many startups is proving far more challenging than initially anticipated. Rivian’s struggles serve as a cautionary tale, highlighting the importance of realistic growth projections, efficient production, and a robust competitive strategy in a rapidly evolving market. The coming months will be critical for Rivian, as the company will need to demonstrate significant improvements in its operational efficiency and delivery numbers to regain investor trust and prevent further erosion of its stock price. The future of Rivian, once a darling of the EV revolution, now hangs in the balance.

Featured Posts

-

Pope Francis In Critical Condition Vatican Issues Statement

Feb 23, 2025

Pope Francis In Critical Condition Vatican Issues Statement

Feb 23, 2025 -

Actor Hunter Schafer Reports Incorrect Gender On Passport

Feb 23, 2025

Actor Hunter Schafer Reports Incorrect Gender On Passport

Feb 23, 2025 -

2025 Mls Season Comprehensive Guide To Games Tv And Dates

Feb 23, 2025

2025 Mls Season Comprehensive Guide To Games Tv And Dates

Feb 23, 2025 -

Pentagon Cuts 5 400 Civilian Employees To Be Fired In First Phase

Feb 23, 2025

Pentagon Cuts 5 400 Civilian Employees To Be Fired In First Phase

Feb 23, 2025 -

Miraculous Escape Trucker Unharmed After Ice Crashes Through Windshield

Feb 23, 2025

Miraculous Escape Trucker Unharmed After Ice Crashes Through Windshield

Feb 23, 2025

Latest Posts

-

Clement Faces Rangers Sack After Poor Performance

Feb 23, 2025

Clement Faces Rangers Sack After Poor Performance

Feb 23, 2025 -

1 0 To West Ham Arsenal Loss Match Report Goals And Stats

Feb 23, 2025

1 0 To West Ham Arsenal Loss Match Report Goals And Stats

Feb 23, 2025 -

Ksis Britains Got Talent Judging Role A Closer Look

Feb 23, 2025

Ksis Britains Got Talent Judging Role A Closer Look

Feb 23, 2025 -

Arsenal Loses To West Ham 0 1 Key Stats And Match Analysis

Feb 23, 2025

Arsenal Loses To West Ham 0 1 Key Stats And Match Analysis

Feb 23, 2025 -

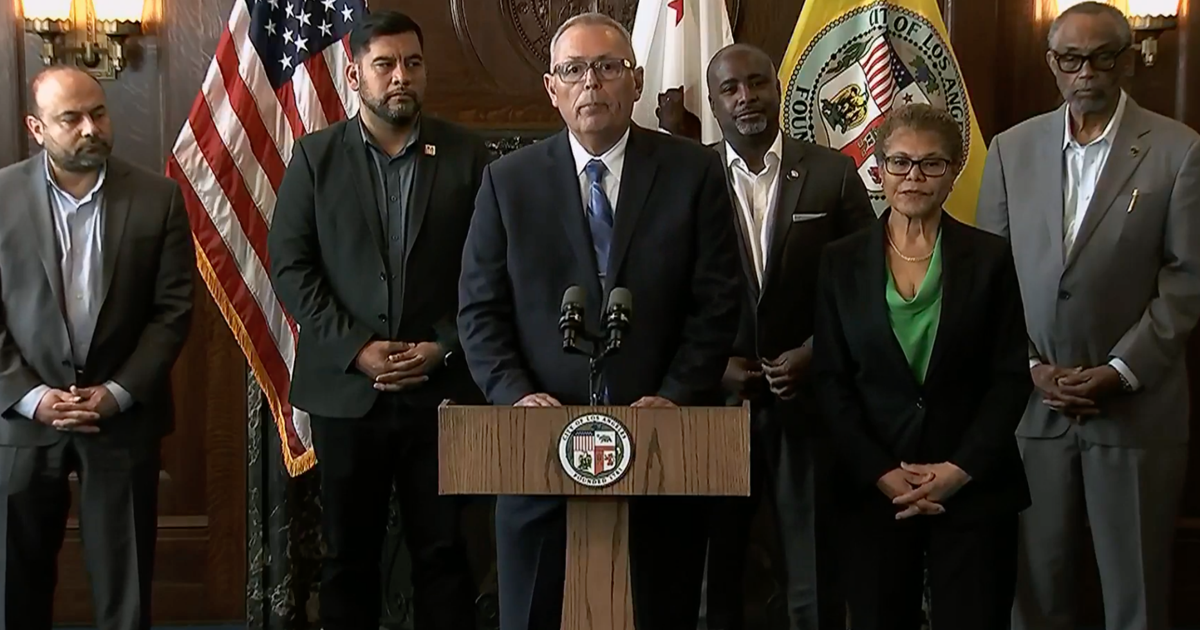

Mayor Bass Defends Decision To Fire Lafd Chief Amid Public Criticism

Feb 23, 2025

Mayor Bass Defends Decision To Fire Lafd Chief Amid Public Criticism

Feb 23, 2025