Rivian's Stock Price Falls Short After Reduced Production Guidance

Table of Contents

Rivian's Stock Takes a Dive After Bleak Production Forecast

Rivian Automotive, Inc. (RIVN) saw its stock price plummet on [Date of stock drop], following the electric vehicle (EV) maker's announcement of a significantly reduced production guidance for 2023. The company now projects to manufacture only [Number] vehicles this year, a substantial decrease from its previous target of [Previous number] units. This disappointing news sent ripples through the market, underscoring the challenges facing even the most promising players in the burgeoning but fiercely competitive EV sector.

The revised production forecast, revealed in Rivian's [Quarter] earnings report, immediately triggered a sell-off. Shares of Rivian closed down [Percentage]% at [Closing Stock Price] on [Date of stock drop], wiping out [Dollar amount] in market capitalization. This represents a significant setback for the company, which has been struggling to meet initial ambitious production targets since its highly anticipated initial public offering (IPO) in [Year of IPO].

The primary reason cited for the lowered production guidance is [Reason for reduced production]. This issue, coupled with [Additional challenges faced by Rivian, e.g., supply chain disruptions, increased competition], has hampered Rivian's ability to ramp up production at its manufacturing facility in [Location of factory]. The company acknowledged these challenges in its earnings call, emphasizing its commitment to improving efficiency and resolving supply chain bottlenecks. However, investors remained unconvinced, expressing concerns about the company's ability to achieve profitability in the near term.

Rivian's CEO, [CEO's Name], attempted to reassure investors, highlighting the company's strong order book and its ongoing efforts to streamline operations. He emphasized the company’s focus on [Company's future plans and strategies, e.g., improving manufacturing processes, developing new models, expanding its charging infrastructure]. However, analysts remain cautious, pointing to the increasing competition from established automakers and other EV startups.

The reduced production guidance casts a shadow over Rivian's long-term prospects. While the company continues to garner attention for its innovative technology and attractive vehicle designs, its inability to meet production goals raises serious questions about its operational capabilities and financial sustainability. The market’s reaction underscores the growing pressure on EV companies to demonstrate not only technological prowess but also robust manufacturing efficiency and financial discipline. The coming months will be critical for Rivian as it seeks to regain investor confidence and demonstrate its ability to execute its ambitious growth plans. Failure to do so could further exacerbate the downward pressure on its stock price and potentially threaten its long-term viability in the fiercely competitive EV landscape. The company will need to provide concrete evidence of progress in addressing its production challenges to avoid further declines in investor sentiment. Analysts will be closely watching Rivian's progress in the coming quarters, looking for signs of improvement in production output and overall operational efficiency. The coming months will be pivotal in determining whether Rivian can overcome these hurdles and solidify its position in the increasingly crowded electric vehicle market.

[Replace bracketed information with accurate data from Rivian's financial reports and news releases.] For instance, you'll need to find the specific date of the stock drop, the exact percentage decrease, the closing stock price, the revised production number, the previous production target, the quarter of the earnings report, and details on the reasons for the reduced production. You should also include the CEO's name and the location of the factory. Thorough research is needed to replace all bracketed information accurately.

Featured Posts

-

1 5 Billion Bybit Crypto Hack Evidence Points To North Korea

Feb 22, 2025

1 5 Billion Bybit Crypto Hack Evidence Points To North Korea

Feb 22, 2025 -

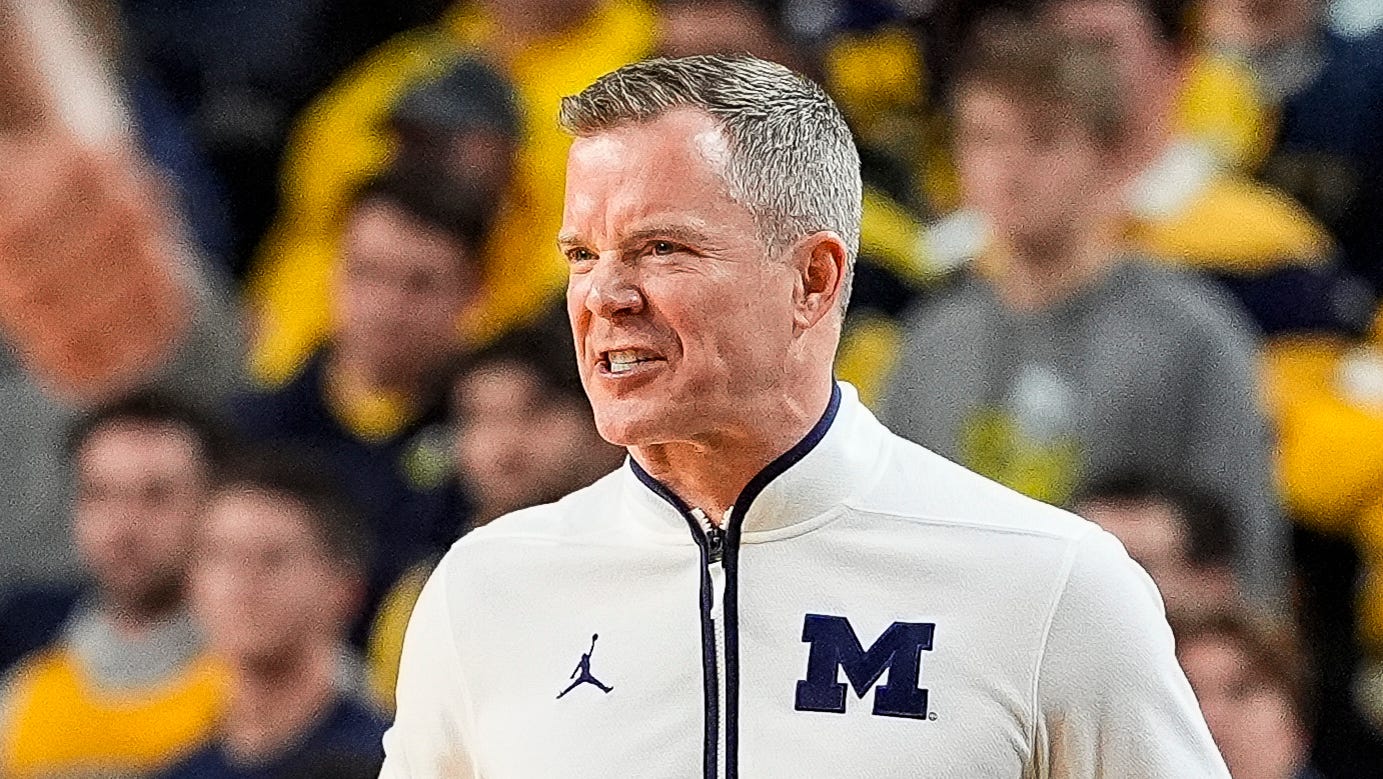

Michigan Wolverines Basketball Dusty May Gets Contract Extension

Feb 22, 2025

Michigan Wolverines Basketball Dusty May Gets Contract Extension

Feb 22, 2025 -

Revealed The Ball Striking Drill That Tormented Tiger Woods

Feb 22, 2025

Revealed The Ball Striking Drill That Tormented Tiger Woods

Feb 22, 2025 -

Todays Stock Market Walmart News And Market Reaction

Feb 22, 2025

Todays Stock Market Walmart News And Market Reaction

Feb 22, 2025 -

Rivian Stock Takes A Hit Impact Of Reduced 2023 Delivery Forecasts

Feb 22, 2025

Rivian Stock Takes A Hit Impact Of Reduced 2023 Delivery Forecasts

Feb 22, 2025

Latest Posts

-

Manchester United Fight Back 2 2 Draw Against Everton

Feb 24, 2025

Manchester United Fight Back 2 2 Draw Against Everton

Feb 24, 2025 -

West Ham Upsets Arsenal 1 0 Key Stats And Match Analysis

Feb 24, 2025

West Ham Upsets Arsenal 1 0 Key Stats And Match Analysis

Feb 24, 2025 -

How To Watch Everton Vs Manchester United Live Tv Listings And Online Streaming

Feb 24, 2025

How To Watch Everton Vs Manchester United Live Tv Listings And Online Streaming

Feb 24, 2025 -

Hamzah Sheeraz Vs Carlos Adames Robbery Fans Outraged Over Fight Ending

Feb 24, 2025

Hamzah Sheeraz Vs Carlos Adames Robbery Fans Outraged Over Fight Ending

Feb 24, 2025 -

Californias Margarita History Where To Find The Best Deals On National Margarita Day

Feb 24, 2025

Californias Margarita History Where To Find The Best Deals On National Margarita Day

Feb 24, 2025