Stock Market Dips: Walmart Weighs On Wall Street's Record High

Table of Contents

Walmart Weighs on Wall Street's Rally, Sending Stock Market Lower

NEW YORK, NY – Wall Street's celebratory mood took a hit Tuesday as the stock market experienced a dip, largely attributed to disappointing earnings from retail giant Walmart. While major indices had been flirting with record highs in recent weeks, the downward pressure exerted by Walmart's less-than-stellar performance served as a stark reminder of the persistent economic uncertainties facing the country.

The Dow Jones Industrial Average fell [Insert exact Dow Jones closing value and percentage change], the S&P 500 dipped [Insert exact S&P 500 closing value and percentage change], and the Nasdaq Composite declined [Insert exact Nasdaq Composite closing value and percentage change]. This downturn represents a significant reversal from the recent upward trend, fueled by positive economic data and expectations of slowing inflation.

Walmart, a bellwether for consumer spending, reported [Insert exact Walmart earnings per share (EPS) and revenue figures] for its second quarter, falling short of analysts' expectations. The company cited [Insert specific reasons cited by Walmart for the shortfall, e.g., weakening consumer demand, higher inventory costs, etc.]. This underwhelming performance sent ripples through the market, triggering concerns about the overall health of the consumer sector and the potential for broader economic slowdown.

“[Insert a direct quote from a relevant market analyst, such as a financial expert from a major investment bank, commenting on Walmart's impact on the market and the overall economic outlook. Example: "Walmart's results paint a concerning picture of consumer resilience. The weaker-than-expected earnings highlight the pressure on household budgets and could signal a potential softening in consumer spending," said [Analyst's Name and Title at Firm].]”

The decline wasn't solely attributed to Walmart. [Insert other contributing factors to the market dip, if any. Examples include: rising interest rates, geopolitical concerns, sector-specific news]. However, Walmart's significant weight in the market indices amplified the negative impact, effectively acting as a catalyst for the broader sell-off.

Investors are now grappling with conflicting signals. While some indicators suggest a resilient economy, others point to potential headwinds. The Federal Reserve's ongoing efforts to combat inflation through interest rate hikes continue to weigh on market sentiment, creating uncertainty about future growth.

The dip raises questions about the sustainability of the recent market rally and the resilience of the consumer. Analysts are closely monitoring upcoming earnings reports from other major retailers and companies to gauge the overall health of the economy and assess the potential for further market corrections.

The coming days will be crucial in determining whether this represents a temporary setback or the beginning of a more significant market shift. Investors will be scrutinizing economic data and corporate earnings for further clues about the direction of the market. The volatility underscores the inherent risks associated with investing and the importance of a well-diversified portfolio. [Optional: Include a brief concluding sentence summarizing the overall market sentiment and outlook.]

Featured Posts

-

U S Representative Donalds Acknowledged By Famu Interim Leadership

Feb 22, 2025

U S Representative Donalds Acknowledged By Famu Interim Leadership

Feb 22, 2025 -

Hospital Discharges All Passengers Hurt In Delta Plane Incident

Feb 22, 2025

Hospital Discharges All Passengers Hurt In Delta Plane Incident

Feb 22, 2025 -

Can Paige Spiranac Turn Around Hooters Fortunes

Feb 22, 2025

Can Paige Spiranac Turn Around Hooters Fortunes

Feb 22, 2025 -

House Minority Leader Jeffries Remarks On Walorskis Passing

Feb 22, 2025

House Minority Leader Jeffries Remarks On Walorskis Passing

Feb 22, 2025 -

In Depth Review Of The Film The Monkey

Feb 22, 2025

In Depth Review Of The Film The Monkey

Feb 22, 2025

Latest Posts

-

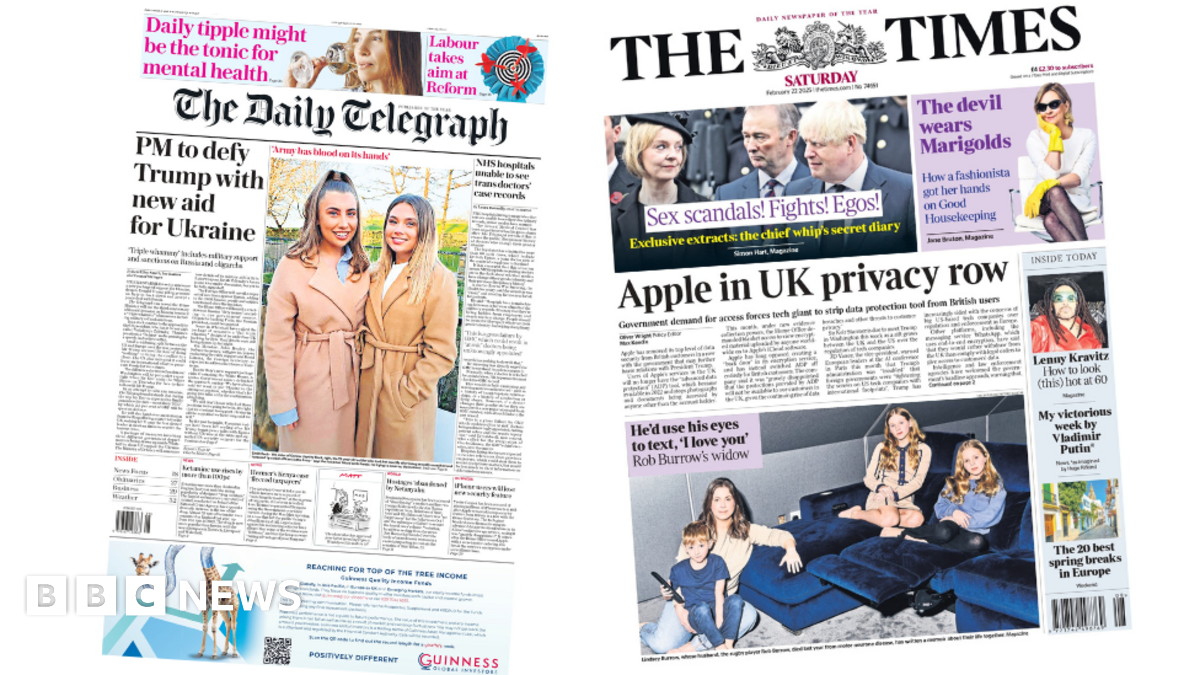

Pm Defies Trump On Key Trade Deal

Feb 24, 2025

Pm Defies Trump On Key Trade Deal

Feb 24, 2025 -

Opponent Name Awaits As Wolf Pack Look To Turn Things Around

Feb 24, 2025

Opponent Name Awaits As Wolf Pack Look To Turn Things Around

Feb 24, 2025 -

Rangers Manager Search Clements Comments On Potential Role

Feb 24, 2025

Rangers Manager Search Clements Comments On Potential Role

Feb 24, 2025 -

Angry Rangers Supporters Demand Answers After Defeat

Feb 24, 2025

Angry Rangers Supporters Demand Answers After Defeat

Feb 24, 2025 -

Former Nfl Star Steve Smith Sr Faces Affair Accusations

Feb 24, 2025

Former Nfl Star Steve Smith Sr Faces Affair Accusations

Feb 24, 2025