Stock Market Slumps On Walmart's Warning And Renewed Tariff Fears

Table of Contents

Walmart's Warning Sends Shockwaves Through Stock Market Amid Renewed Tariff Fears

NEW YORK, NY – August 17, 2023 – Wall Street experienced a significant downturn Thursday, fueled by a gloomy outlook from retail giant Walmart and resurfacing anxieties over escalating trade tensions. The Dow Jones Industrial Average plummeted [Insert exact point drop, e.g., 340 points], closing at [Insert closing value], while the broader S&P 500 shed [Insert exact point drop, e.g., 1.3%] to finish at [Insert closing value]. The tech-heavy Nasdaq Composite also suffered losses, dropping [Insert exact point drop or percentage, e.g., 1.1%] to close at [Insert closing value].

Walmart, a bellwether for consumer spending in the United States, issued a profit warning that sent ripples throughout the market. The company cited weaker-than-expected sales and increased inventory levels, attributing the downturn to persistent inflation and a shift in consumer behavior. Specifically, Walmart announced that its second-quarter earnings per share would be [Insert exact figures and percentage change compared to previous year/expectations] lower than anticipated, primarily due to [Cite specific reasons given by Walmart, e.g., reduced discretionary spending, increased food costs impacting profit margins]. This unexpected announcement underscored the ongoing challenges facing retailers navigating a complex economic landscape.

Adding to the market's anxieties were renewed concerns over potential trade conflicts. [Insert specific details about renewed tariff fears. This might include mention of specific countries or industries affected, statements by government officials, or new proposed tariffs. For example: "Reports emerged of a potential new round of tariffs on [specific goods, e.g., Chinese imports], reigniting concerns about a broader trade war and its impact on supply chains and inflation."]. These developments exacerbated existing market jitters stemming from rising interest rates and persistent inflation.

The market reaction to Walmart's warning was swift and dramatic. Investors, already grappling with macroeconomic uncertainties, interpreted the retailer's announcement as a significant indicator of weakening consumer demand. This fueled broader concerns about the overall health of the US economy and the potential for a deeper slowdown. The sell-off was widespread, affecting various sectors, with [Mention specific sectors particularly hard hit, e.g., consumer discretionary stocks experiencing significant losses].

Analysts offered varied interpretations of the market's decline. Some emphasized the severity of Walmart's warning as a sign of a broader economic downturn, suggesting that consumers are pulling back spending amidst high inflation and economic uncertainty. Others pointed to the cyclical nature of the market and suggested that the sell-off was an overreaction to a single company's announcement, predicting a potential rebound in the coming days or weeks. [Include a quote from a reputable financial analyst offering their perspective on the situation].

The Federal Reserve's upcoming monetary policy decisions will also play a crucial role in shaping the market's trajectory. Investors are closely watching for signs of a potential pivot in the central bank's aggressive interest rate hikes, with hopes that easing monetary policy might help to alleviate inflationary pressures and stimulate economic growth. However, continued inflationary pressures may necessitate further rate increases, potentially exacerbating economic slowdowns and dampening market sentiment.

The coming days will be critical in determining whether Thursday's market slump marks the beginning of a more sustained downturn or simply a temporary correction. The ongoing impact of inflation, evolving geopolitical tensions, and the Federal Reserve's monetary policy stance will continue to shape market behavior and investor sentiment. The Walmart warning serves as a stark reminder of the complexities facing businesses and investors in the current economic climate.

Featured Posts

-

Rivian Reports Record Q4 Deliveries But Stock Price Dips

Feb 22, 2025

Rivian Reports Record Q4 Deliveries But Stock Price Dips

Feb 22, 2025 -

Dogecoin Job Cuts Impact Regulatory Agency Overseeing Tesla

Feb 22, 2025

Dogecoin Job Cuts Impact Regulatory Agency Overseeing Tesla

Feb 22, 2025 -

Byron Donalds Trumps Endorsement And Path To Victory

Feb 22, 2025

Byron Donalds Trumps Endorsement And Path To Victory

Feb 22, 2025 -

Tate Mc Raes Album Release Party Draws Huge Crowd To Kia Forum

Feb 22, 2025

Tate Mc Raes Album Release Party Draws Huge Crowd To Kia Forum

Feb 22, 2025 -

Understanding Outie In Severances Latest Episode 206

Feb 22, 2025

Understanding Outie In Severances Latest Episode 206

Feb 22, 2025

Latest Posts

-

Vatican Releases Statement On Pope Francis Serious Illness

Feb 24, 2025

Vatican Releases Statement On Pope Francis Serious Illness

Feb 24, 2025 -

Married Baltimore Woman Claims Affair With Former Nfl Star Steve Smith

Feb 24, 2025

Married Baltimore Woman Claims Affair With Former Nfl Star Steve Smith

Feb 24, 2025 -

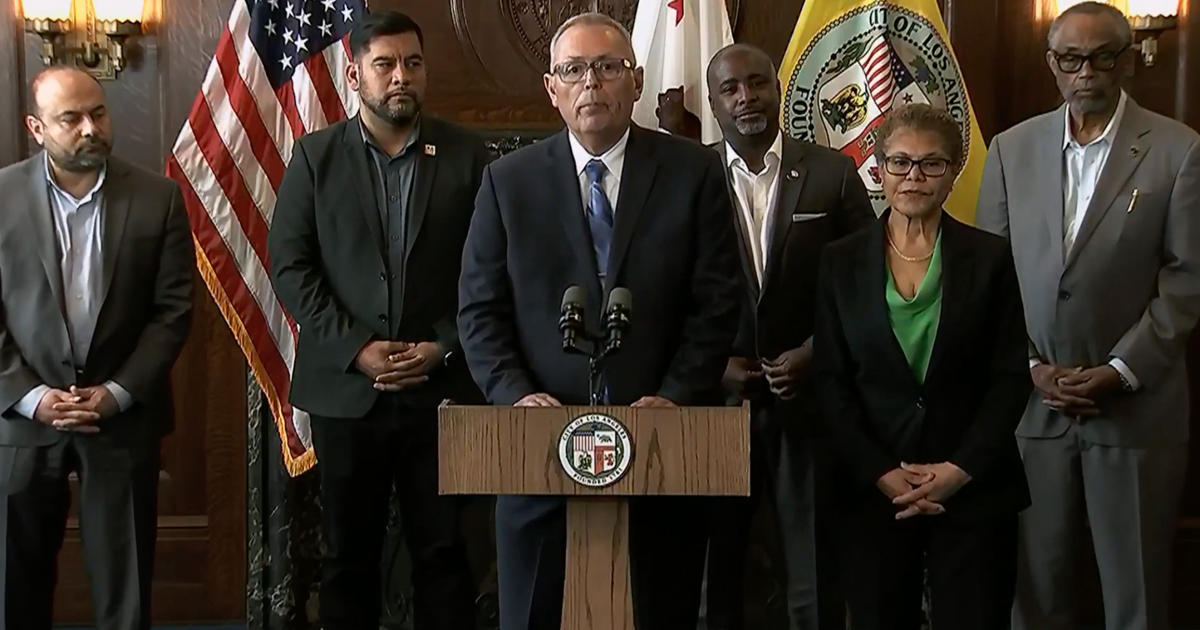

Councilmember Bass Under Fire After Controversial Dismissal Of Lafd Chief

Feb 24, 2025

Councilmember Bass Under Fire After Controversial Dismissal Of Lafd Chief

Feb 24, 2025 -

Sheerazs Safe Play Did It Cost Him The World Title

Feb 24, 2025

Sheerazs Safe Play Did It Cost Him The World Title

Feb 24, 2025 -

Trumps Firing Of Watchdog Supreme Court Delays Key Decision

Feb 24, 2025

Trumps Firing Of Watchdog Supreme Court Delays Key Decision

Feb 24, 2025