Strong Deliveries Fail To Boost Rivian Stock Price

Table of Contents

Strong Deliveries Fail to Boost Rivian Stock Price: A Sign of Deeper Market Troubles?

Irvine, California – November 7, 2023 – Electric vehicle (EV) maker Rivian Automotive reported better-than-expected third-quarter deliveries on [Date of release - e.g., November 2nd, 2023], exceeding analysts' forecasts with [Number] vehicles delivered. Despite this positive news, the company's stock price tumbled [Percentage]% in after-hours trading, raising concerns about the broader market's perception of the EV sector and Rivian's long-term prospects.

The unexpected drop highlights the complex interplay of factors influencing investor sentiment beyond just production numbers. While the [Number] deliveries represent a significant increase compared to the same period last year and surpassed expectations of [Analyst forecast number] vehicles, the market reaction suggests investors are prioritizing other metrics, such as profitability and the overall macroeconomic climate.

Rivian delivered [Number] R1T pickup trucks and [Number] R1S SUVs during the quarter. The company attributed the increased production to improvements in its supply chain and manufacturing processes. [CEO's name], Rivian's CEO, stated in a press release that the company is "on track" to meet its full-year production guidance of [Number] vehicles. However, this optimistic outlook failed to resonate with investors, who appear more focused on the company's financial performance.

Rivian's ongoing struggle with profitability continues to weigh heavily on investor confidence. The company reported a substantial net loss in the third quarter of [Dollar amount/Loss percentage], reflecting the high costs associated with EV production, research and development, and building out its manufacturing capabilities. Analysts have expressed concerns that Rivian's aggressive expansion plans, including its ambitious foray into commercial vehicles with its EDV van, might further strain its already precarious financial position.

The broader economic uncertainty also plays a significant role. Rising interest rates, persistent inflation, and fears of a potential recession have created a challenging environment for growth stocks, particularly in the volatile EV sector. Investors are increasingly favoring companies demonstrating clear paths to profitability and strong cash flow, placing pressure on EV startups like Rivian to demonstrate financial sustainability beyond strong production numbers.

The market's negative reaction to Rivian's delivery figures underscores a shift in investor priorities. While robust production is essential for long-term success, it's no longer sufficient to drive stock prices upward. Investors are demanding demonstrable progress toward profitability and a compelling narrative around sustainable growth. Rivian's challenge now is to convince the market that it can navigate the current economic headwinds and deliver on its long-term promises, not just meet short-term production targets.

Several analysts have already downgraded their outlook for Rivian stock following the third-quarter results. [Analyst's Name from reputable firm], an analyst at [Investment firm name], commented that while the delivery numbers were "impressive," the ongoing losses and macroeconomic uncertainty overshadow the positive production developments. Other analysts echoed similar sentiments, emphasizing the need for Rivian to demonstrate clear steps toward profitability in the coming quarters to regain investor confidence.

Looking ahead, Rivian will need to strategically balance its growth ambitions with a focus on operational efficiency and cost control. The company’s success hinges on effectively managing its supply chain, optimizing production costs, and clearly communicating a pathway to profitability to investors. Failure to do so could further erode investor confidence and exacerbate the challenges facing the company in a competitive and increasingly demanding market. The market's reaction to the recent delivery update serves as a stark reminder that in the long-term, sustainable financial performance is as crucial as production volume for EV companies striving for long-term success.

Featured Posts

-

007 And Amazon Examining The Potential Implications Of The Deal

Feb 22, 2025

007 And Amazon Examining The Potential Implications Of The Deal

Feb 22, 2025 -

Severance Season 2 Episode 6 Recap Cards On The Table Explained

Feb 22, 2025

Severance Season 2 Episode 6 Recap Cards On The Table Explained

Feb 22, 2025 -

Actor Hunter Schafers Passport Amended To List Assigned Sex At Birth

Feb 22, 2025

Actor Hunter Schafers Passport Amended To List Assigned Sex At Birth

Feb 22, 2025 -

Aykroyds Candid Admission Why He Missed The Snl 50 Anniversary

Feb 22, 2025

Aykroyds Candid Admission Why He Missed The Snl 50 Anniversary

Feb 22, 2025 -

Gaza Return Body Identified Not Bibas Mother Says Idf

Feb 22, 2025

Gaza Return Body Identified Not Bibas Mother Says Idf

Feb 22, 2025

Latest Posts

-

2025 German Federal Election Current Polling Data And Analysis

Feb 24, 2025

2025 German Federal Election Current Polling Data And Analysis

Feb 24, 2025 -

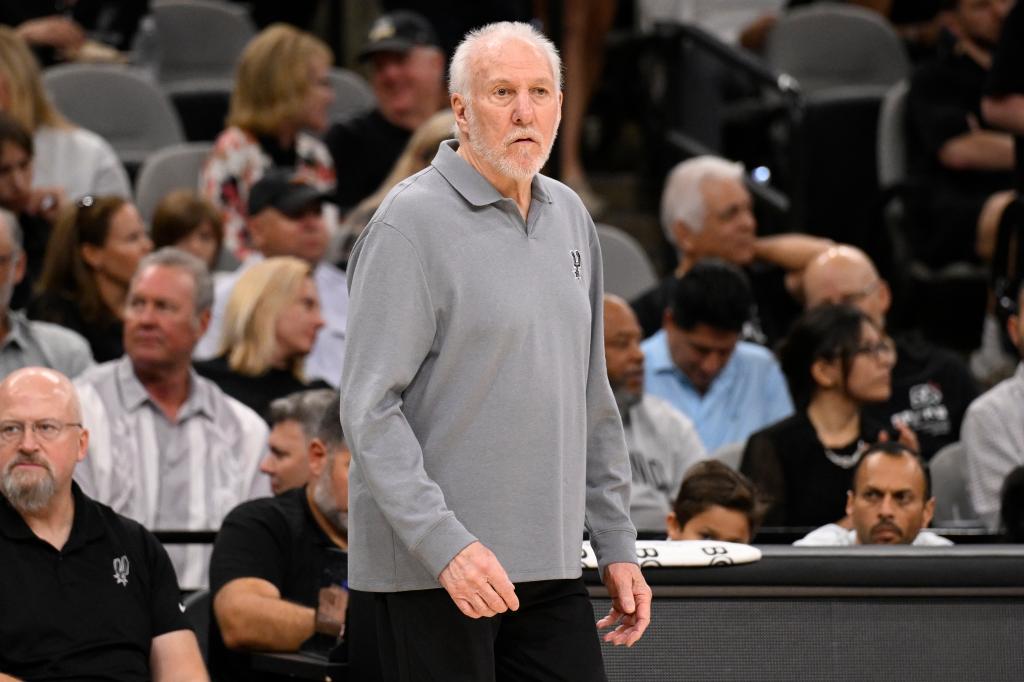

Gregg Popovichs Spurs Future Uncertain Coachs Absence This Season Explained

Feb 24, 2025

Gregg Popovichs Spurs Future Uncertain Coachs Absence This Season Explained

Feb 24, 2025 -

Mls Live Stream Where To Watch La Galaxy Lafc And Inter Miami Matches

Feb 24, 2025

Mls Live Stream Where To Watch La Galaxy Lafc And Inter Miami Matches

Feb 24, 2025 -

Authorities Search For Suspect After Virginia Officers Shot Killed

Feb 24, 2025

Authorities Search For Suspect After Virginia Officers Shot Killed

Feb 24, 2025 -

Dope Girls Bbc Complete Cast Guide For The 1920s Drama

Feb 24, 2025

Dope Girls Bbc Complete Cast Guide For The 1920s Drama

Feb 24, 2025