Strong Q4 Deliveries Fail To Boost Rivian Stock Price

Table of Contents

Strong Q4 Deliveries Fail to Boost Rivian Stock Price: EV Maker Still Faces Headwinds

Irvine, California – March 2, 2024 – Rivian Automotive, the electric vehicle (EV) maker backed by Amazon and Ford, reported strong fourth-quarter 2023 deliveries, exceeding expectations. However, the positive news failed to significantly lift its stock price, highlighting the persistent challenges facing the company in a fiercely competitive and volatile market.

Rivian announced it delivered [Insert accurate Q4 2023 delivery figures here. Example: 12,000] vehicles in the final quarter of 2023, a [Insert percentage increase or decrease compared to previous quarters. Example: 30%] increase compared to Q3 2023. This brought the company's total deliveries for the full year 2023 to [Insert accurate full-year 2023 delivery figures here. Example: 35,000] vehicles. Despite these seemingly positive figures, surpassing analyst estimates of [Insert analyst estimates for Q4 2023 deliveries here. Example: 10,500] units, investor reaction was muted. Rivian's stock price saw only a [Insert percentage change in stock price following the announcement. Example: modest 2%] increase in after-hours trading before settling back down.

The muted response can be attributed to several factors. Firstly, the overall EV market remains highly competitive, with established players like Tesla and emerging competitors constantly vying for market share. Rivian’s production ramp-up, while showing improvement, still lags behind projections made in previous years. This has raised concerns among investors about the company's ability to achieve sustainable profitability. Furthermore, the company continues to grapple with supply chain constraints impacting production output. [Insert specifics about supply chain issues if available, e.g., "Specifically, challenges in securing battery cells and certain electronic components have hampered production rates."]

Beyond production challenges, Rivian faces significant financial headwinds. The company reported a substantial net loss for the fourth quarter and full year 2023, [Insert accurate Q4 and full-year 2023 net loss figures here. Example: a Q4 net loss of $700 million and a full-year net loss of $2.5 billion.]. This underscores the substantial capital expenditure required to establish manufacturing capacity, develop new vehicle models, and compete in the ever-evolving EV landscape. [Insert information on the company's strategy to achieve profitability, including any planned cost-cutting measures or new revenue streams. Example: "Rivian aims to achieve profitability by streamlining operations, cutting costs, and expanding its commercial vehicle business with Amazon."]

Despite the challenges, Rivian executives remain optimistic about the company's long-term prospects. [Insert a quote from a Rivian executive expressing confidence in the company's future, if available. Example: "CEO RJ Scaringe stated in the earnings call that the company is on track to meet its production targets for 2024 and remains confident in its ability to become a major player in the electric vehicle market."] The company's strong partnerships with Amazon and Ford continue to provide crucial support, including access to significant capital and established distribution networks. However, sustained growth and profitability will require Rivian to navigate the competitive market effectively, overcome production hurdles, and demonstrate a clear path to financial sustainability. The market, for now, appears to remain cautiously optimistic, awaiting concrete evidence of Rivian’s ability to deliver on its ambitious goals.

Featured Posts

-

Highway Collision Ice Chunk Destroys Truckers Windshield

Feb 23, 2025

Highway Collision Ice Chunk Destroys Truckers Windshield

Feb 23, 2025 -

Unconstitutional Third Term Trump Raises Idea Again

Feb 23, 2025

Unconstitutional Third Term Trump Raises Idea Again

Feb 23, 2025 -

Wisconsin Basketballs Upsetting Loss Key Takeaways And Analysis

Feb 23, 2025

Wisconsin Basketballs Upsetting Loss Key Takeaways And Analysis

Feb 23, 2025 -

Trumps Plan To Restructure The Usps Firings And Leadership Changes Imminent

Feb 23, 2025

Trumps Plan To Restructure The Usps Firings And Leadership Changes Imminent

Feb 23, 2025 -

Review Tate Mc Raes So Close Album All 15 Songs Ranked

Feb 23, 2025

Review Tate Mc Raes So Close Album All 15 Songs Ranked

Feb 23, 2025

Latest Posts

-

How Dynamic Pricing Will Affect Empire State Building Ticket Costs

Feb 23, 2025

How Dynamic Pricing Will Affect Empire State Building Ticket Costs

Feb 23, 2025 -

Hamzah Sheeraz And Carlos Adames Fight Ends In Draw

Feb 23, 2025

Hamzah Sheeraz And Carlos Adames Fight Ends In Draw

Feb 23, 2025 -

Chelseas Loss To Aston Villa Asensio And Rashford Shine In 2 1 Defeat

Feb 23, 2025

Chelseas Loss To Aston Villa Asensio And Rashford Shine In 2 1 Defeat

Feb 23, 2025 -

Inter Miami Cf 2025 Season Opener Tv Listings And Streaming Options

Feb 23, 2025

Inter Miami Cf 2025 Season Opener Tv Listings And Streaming Options

Feb 23, 2025 -

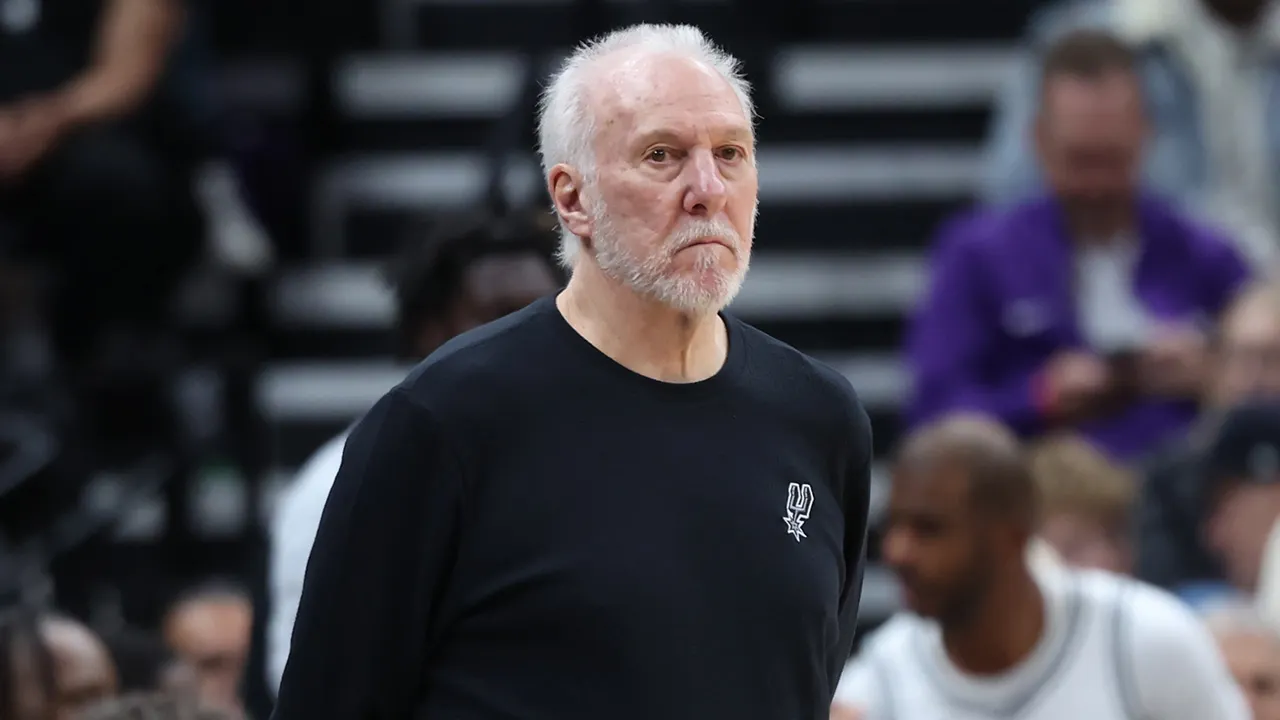

Gregg Popovich Likely To End Coaching Career

Feb 23, 2025

Gregg Popovich Likely To End Coaching Career

Feb 23, 2025