Tariff Concerns And Walmart Forecast Weigh On Stock Market Performance

Table of Contents

Tariff Concerns and Walmart Forecast Weigh on Stock Market Performance

NEW YORK, NY – October 26, 2023 – Concerns over escalating trade tensions and a disappointing sales forecast from retail giant Walmart sent shockwaves through the stock market today, triggering a broad-based sell-off. The Dow Jones Industrial Average plummeted [Insert exact point drop and percentage here, e.g., 350 points, or 1.2%], while the S&P 500 fell [Insert exact point drop and percentage here, e.g., 40 points, or 1%] and the Nasdaq Composite experienced a [Insert exact point drop and percentage here, e.g., 150-point, or 1.5%] decline. This downturn underscores growing anxieties among investors about the economic outlook, particularly in the face of persistent inflation and the potential for further trade restrictions.

Walmart, a bellwether for consumer spending, issued a weaker-than-expected outlook for the crucial holiday shopping season, citing persistent inflation and a slowdown in consumer demand. The company projected [Insert exact Walmart's projected earnings per share and revenue growth figures here, e.g., earnings per share growth of only 1%, and revenue growth of 2-3%] for the fourth quarter, significantly below analyst expectations of [Insert analyst consensus estimates for earnings per share and revenue growth here, e.g., 3% EPS growth and 4% revenue growth]. This announcement immediately triggered a [Insert exact percentage drop in Walmart's stock price here, e.g., 5%] drop in Walmart's stock price, pulling down other retail stocks and contributing to the broader market decline.

The disappointing forecast from Walmart highlights the ongoing challenges faced by retailers grappling with high inflation and shifting consumer behavior. Consumers are increasingly cautious about their spending, prioritizing essential goods over discretionary purchases, as evidenced by [Insert supporting statistic here, e.g., a recent survey showing a decline in consumer confidence, or data on decreased spending in non-essential categories]. This trend is exacerbating existing pressures on retailers already struggling with rising costs, including increased labor expenses and supply chain disruptions.

Adding fuel to the market's anxieties are renewed concerns over escalating trade tensions. [Insert specific details about the trade tensions, mentioning specific countries, tariffs or trade disputes that are relevant. E.g., "Renewed threats of tariffs on imported goods from China, particularly in the technology sector, have added to the uncertainty." or "The ongoing trade dispute between the US and [Country] regarding [Specific product] is causing significant market volatility."] These developments raise the specter of higher prices for consumers and further disruptions to supply chains, potentially dampening economic growth.

The market's reaction reflects a growing sense of unease among investors about the fragility of the current economic recovery. [Insert quote from a market analyst here, e.g., "The market is clearly reacting to the confluence of factors, including Walmart's disappointing forecast and rising trade tensions," said [Analyst's Name and Title at Financial Institution]. "This highlights the increased uncertainty surrounding the economic outlook and is likely to lead to further volatility in the coming weeks."] The Federal Reserve's continued efforts to combat inflation through interest rate hikes also continue to weigh on market sentiment, as higher borrowing costs increase the cost of doing business and potentially slow down economic growth.

The current market downturn underscores the interconnectedness of global economic factors and the sensitivity of investor sentiment to even minor shifts in economic data and corporate performance. The coming days will be crucial in determining whether this sell-off represents a temporary correction or the start of a more significant market decline. Investors will be closely watching for further developments on the trade front, as well as any additional economic indicators that could shed light on the strength of the consumer and the broader economic outlook. [Insert a closing sentence summarizing the overall outlook, e.g., "The market's future trajectory remains uncertain, contingent on a resolution to trade tensions and the resilience of consumer spending."]

Featured Posts

-

How Much Do Severance Macrodata Refiners Earn Salary Data Revealed

Feb 22, 2025

How Much Do Severance Macrodata Refiners Earn Salary Data Revealed

Feb 22, 2025 -

A Life Cut Short The Death Of Victims Name And Putins Responsibility

Feb 22, 2025

A Life Cut Short The Death Of Victims Name And Putins Responsibility

Feb 22, 2025 -

Giannis Antetokounmpo Injury Report Playing Tonight Vs Washington

Feb 22, 2025

Giannis Antetokounmpo Injury Report Playing Tonight Vs Washington

Feb 22, 2025 -

Spiranac Vows To Save Hooters Can She Turn The Tide

Feb 22, 2025

Spiranac Vows To Save Hooters Can She Turn The Tide

Feb 22, 2025 -

Trump To Take Control Of Usps Firing Postal Board Members Report

Feb 22, 2025

Trump To Take Control Of Usps Firing Postal Board Members Report

Feb 22, 2025

Latest Posts

-

Steve Smith Sr Responds To Viral Social Media Controversy

Feb 24, 2025

Steve Smith Sr Responds To Viral Social Media Controversy

Feb 24, 2025 -

Ud Las Palmas Vs Barcelona Full Match Report Goals And Highlights

Feb 24, 2025

Ud Las Palmas Vs Barcelona Full Match Report Goals And Highlights

Feb 24, 2025 -

Beterbiev Vs Bivol 2 Recap Fight Results Analysis And Highlights

Feb 24, 2025

Beterbiev Vs Bivol 2 Recap Fight Results Analysis And Highlights

Feb 24, 2025 -

Clements Rangers Reign Could End After Disastrous Results

Feb 24, 2025

Clements Rangers Reign Could End After Disastrous Results

Feb 24, 2025 -

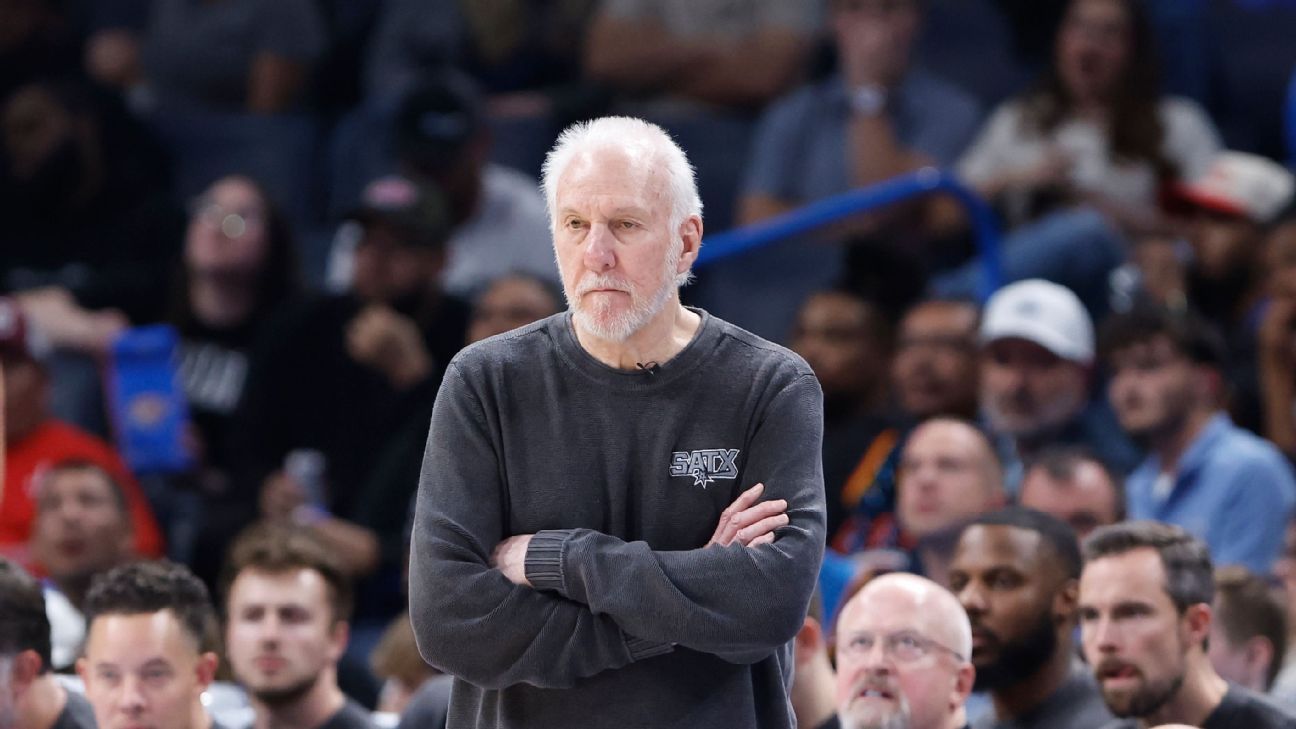

Sources Gregg Popovichs Absence To Extend Into Next Season

Feb 24, 2025

Sources Gregg Popovichs Absence To Extend Into Next Season

Feb 24, 2025