The Correlation Between Musk's DOGE And Executive Exits: A Deeper Look

Table of Contents

Musk's Dogecoin Tweets and Executive Exodus: A Troubling Correlation?

Elon Musk's influence on Dogecoin's price is undeniable. But is there a link between his volatile pronouncements on the cryptocurrency and the high turnover rate of executives at Tesla and SpaceX? A closer look reveals a complex picture, hinting at a possible correlation but lacking definitive proof.

PALO ALTO, CA — Elon Musk’s pronouncements on Dogecoin have sent shockwaves through the cryptocurrency market, triggering dramatic price swings. While the flamboyant CEO’s impact on DOGE’s value is well-documented, a less explored question emerges: is there a connection between his Dogecoin-related activity and the notable turnover in executive leadership at his companies, Tesla and SpaceX? While no direct causal link has been definitively established, a closer examination reveals a compelling, albeit circumstantial, case for correlation.

The past few years have witnessed a significant exodus of high-ranking executives from both Tesla and SpaceX. [Insert specific examples here: Include names of executives, their positions, their departure dates, and, if publicly available, brief, neutral summaries of reasons for departure given by the companies]. These departures haven't been attributed solely to one cause, with factors like burnout, differing strategic visions, and personal reasons frequently cited. However, the timing of some exits coincides with periods of significant DOGE price volatility directly attributable to Musk's tweets or public appearances.

[Insert specific example(s) here: For example, if an executive left around a time Musk made a major DOGE announcement that caused a significant price spike or crash, mention this here with precise dates and verifiable information from reputable news sources.] This overlapping timeframe raises questions about the potential indirect impact of Musk’s cryptocurrency pronouncements on the internal dynamics of his companies.

The argument for correlation rests on several factors. First, Musk's actions with Dogecoin—often unpredictable and accompanied by substantial market fluctuations—can create significant financial uncertainty for Tesla and SpaceX. Stock options and other compensation packages for executives are often tied to company performance, and wild swings in DOGE’s value, partially driven by Musk, could indirectly influence the perceived stability and future prospects of these firms. This could lead to some executives seeking more stable employment opportunities.

Secondly, the considerable media scrutiny surrounding Musk's Dogecoin involvement could create an intensely stressful work environment. The constant media cycle, fueled by both his actions and reactions to the price fluctuations of DOGE, could contribute to a sense of instability that impacts morale and retention rates among senior leadership. Furthermore, the perception of risk associated with being linked to a volatile cryptocurrency could also influence executive decisions.

However, it's crucial to acknowledge the limitations of establishing a direct causal relationship. Numerous other factors, unrelated to Dogecoin, likely contribute to executive departures. [Insert specific examples here: Discuss other potential reasons for executive departures, such as internal restructuring, disagreements over strategy, or the demands of managing rapidly growing companies. Cite verifiable sources for this information].

In conclusion, while a definitive link between Musk’s Dogecoin activities and the high executive turnover at Tesla and SpaceX remains unproven, a compelling circumstantial case for correlation exists. Further research, including detailed analysis of executive departure reasons and more precise alignment of timing with specific Dogecoin events, could offer stronger evidence. The current evidence, however, raises significant questions about the potential unintended consequences of Musk’s public actions on his own companies and the well-being of their leadership. The story warrants further investigation and careful consideration of the complex interplay between business decisions, market volatility, and the unpredictable influence of a single, highly influential figure.

Featured Posts

-

From Fire Escape To Ash Covered Landscape L A Residents Struggle

Feb 22, 2025

From Fire Escape To Ash Covered Landscape L A Residents Struggle

Feb 22, 2025 -

Yankees End 49 Year Beard Ban A New Era In Pinstripes

Feb 22, 2025

Yankees End 49 Year Beard Ban A New Era In Pinstripes

Feb 22, 2025 -

Sanctuary Movement Churches Respond To Increased Ice Activity

Feb 22, 2025

Sanctuary Movement Churches Respond To Increased Ice Activity

Feb 22, 2025 -

The Monkey And The Gorge Absurdity And Suspense Compared

Feb 22, 2025

The Monkey And The Gorge Absurdity And Suspense Compared

Feb 22, 2025 -

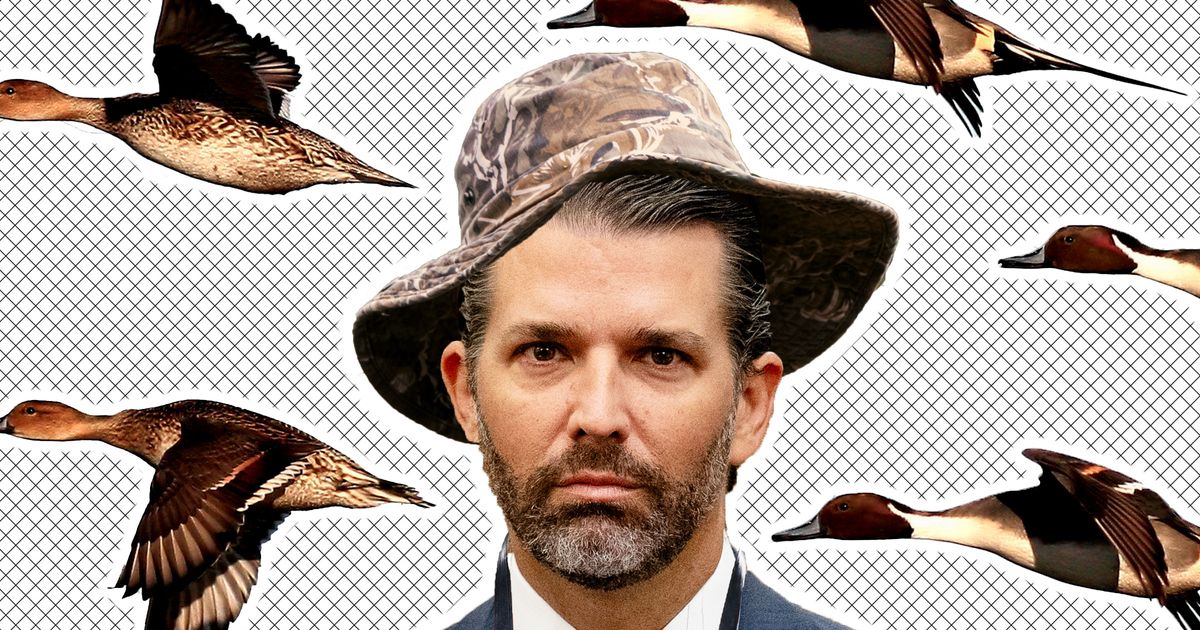

Donald Trump Jr And The Alleged Shooting Of A Rare Italian Duck

Feb 22, 2025

Donald Trump Jr And The Alleged Shooting Of A Rare Italian Duck

Feb 22, 2025

Latest Posts

-

Radio Host Sounds Alarm Trumps Tactics May Hurt His Base

Feb 23, 2025

Radio Host Sounds Alarm Trumps Tactics May Hurt His Base

Feb 23, 2025 -

Beterbiev Vs Bivol Full Results Undercard And Uk Start Time Announced

Feb 23, 2025

Beterbiev Vs Bivol Full Results Undercard And Uk Start Time Announced

Feb 23, 2025 -

Callum Smith Claims Interim Wbo Light Heavyweight Title With Buatsi Victory

Feb 23, 2025

Callum Smith Claims Interim Wbo Light Heavyweight Title With Buatsi Victory

Feb 23, 2025 -

How To Watch Celtic Vs Aberdeen Live Stream Tv Channel And Match Details

Feb 23, 2025

How To Watch Celtic Vs Aberdeen Live Stream Tv Channel And Match Details

Feb 23, 2025 -

Lafd Chief Kristin Crowleys Dismissal Sparks Outrage Controversy Ensues

Feb 23, 2025

Lafd Chief Kristin Crowleys Dismissal Sparks Outrage Controversy Ensues

Feb 23, 2025