The DOGE Factor: Examining The Role Of Cryptocurrency In Recent Firings At Musk's Companies

Table of Contents

The DOGE Factor: Musk's Crypto Craze and the Fallout at Tesla and SpaceX

Elon Musk's penchant for Dogecoin and other cryptocurrencies has been a recurring theme in recent years, sparking both excitement and controversy. While there's no direct, publicly confirmed causal link between Musk's crypto enthusiasm and specific employee firings at Tesla and SpaceX, the indirect connections warrant examination. Numerous reports and anecdotal evidence suggest a complex relationship between Musk's crypto-related decisions and the corporate climate leading to staff reductions. This article explores the potential influence of Dogecoin and other cryptocurrencies on the tumultuous employment landscape at Musk's companies.

The Dogecoin Influence: A Speculative Link

The most prominent example connecting Musk's crypto involvement to personnel changes is the pervasive and often unpredictable nature of his tweets and pronouncements regarding Dogecoin. While not explicitly causing dismissals, these actions have created considerable market volatility. For employees involved in projects directly or indirectly impacted by Dogecoin's price fluctuations (e.g., Tesla's Bitcoin holdings or SpaceX's potential future crypto integrations), the uncertainty could have contributed to a less stable work environment.

For instance, Tesla’s decision to accept Bitcoin as payment, a move heavily influenced by Musk’s personal views on the cryptocurrency, was later reversed amidst concerns about Bitcoin's environmental impact. This volatility created uncertainty among employees involved in payment processing and broader financial operations, potentially contributing to a sense of instability within the company. Similarly, Musk's pronouncements on Dogecoin's potential have led to significant price swings, impacting investors and potentially triggering restructuring or layoffs within related departments.

Beyond Dogecoin: A Broader Crypto Context

Musk's broader interest in cryptocurrency extends beyond Dogecoin. His companies' explorations into Bitcoin and other digital assets have created an atmosphere of both opportunity and risk. The inherent volatility of the crypto market introduces an element of unpredictability that might influence business decisions, including workforce adjustments. Investment strategies related to cryptocurrencies might have affected budgetary allocations, leading to potential resource reallocations and subsequent job cuts. While not directly tied to individual firings, these broader financial maneuvers might have indirectly contributed to the reduction in staff.

Furthermore, Musk's public image, closely intertwined with his crypto pronouncements, could have influenced the overall perception of his companies, attracting or repelling talent. The uncertainty surrounding Musk's crypto-related ventures might have prompted some employees to seek more stable employment opportunities.

Lack of Direct Evidence: The Crucial Caveat

It's crucial to emphasize that no definitive evidence directly links specific firings at Tesla or SpaceX to Musk's crypto activities. Layoffs in these companies are largely attributed to broader economic factors, restructuring initiatives, and Musk's own management style, characterized by high expectations and a demanding work environment.

However, the confluence of Musk's outspoken crypto advocacy, the volatility of the crypto market, and the subsequent workforce reductions at his companies suggests a complex, albeit indirect, relationship. The unpredictable nature of the crypto market, fueled by Musk's public pronouncements, might have contributed to an overall climate of uncertainty that, in turn, may have influenced internal decision-making regarding staffing levels.

Looking Ahead: Transparency and Stability

The connection between Musk's crypto-related actions and employee situations remains a topic requiring further investigation and transparency. While the direct causal link remains unproven, the indirect influence of crypto market volatility on corporate strategy and employee morale cannot be ignored. Greater transparency regarding the financial implications of cryptocurrency investments and their impact on operational decisions could help mitigate future uncertainties and potentially foster a more stable work environment at Tesla and SpaceX. The future success of Musk's ventures may hinge on balancing his innovative spirit with a more predictable and consistent approach to managing the expectations of his workforce.

Featured Posts

-

Michigan State Vs Michigan Basketball Full Game Details And Viewing Guide

Feb 22, 2025

Michigan State Vs Michigan Basketball Full Game Details And Viewing Guide

Feb 22, 2025 -

Friday Nba Top Player Prop Bets For Knicks Cavaliers Matchup

Feb 22, 2025

Friday Nba Top Player Prop Bets For Knicks Cavaliers Matchup

Feb 22, 2025 -

So Close To What A Look At The Production And Musicality Of Tate Mc Raes Hit

Feb 22, 2025

So Close To What A Look At The Production And Musicality Of Tate Mc Raes Hit

Feb 22, 2025 -

Hunter Schafer Highlights Transgender Rights After Passport Issue

Feb 22, 2025

Hunter Schafer Highlights Transgender Rights After Passport Issue

Feb 22, 2025 -

Zero Day Review A Gripping Look At Presidential Power

Feb 22, 2025

Zero Day Review A Gripping Look At Presidential Power

Feb 22, 2025

Latest Posts

-

Merino In Real Sociedad Starting Lineup To Face West Ham

Feb 23, 2025

Merino In Real Sociedad Starting Lineup To Face West Ham

Feb 23, 2025 -

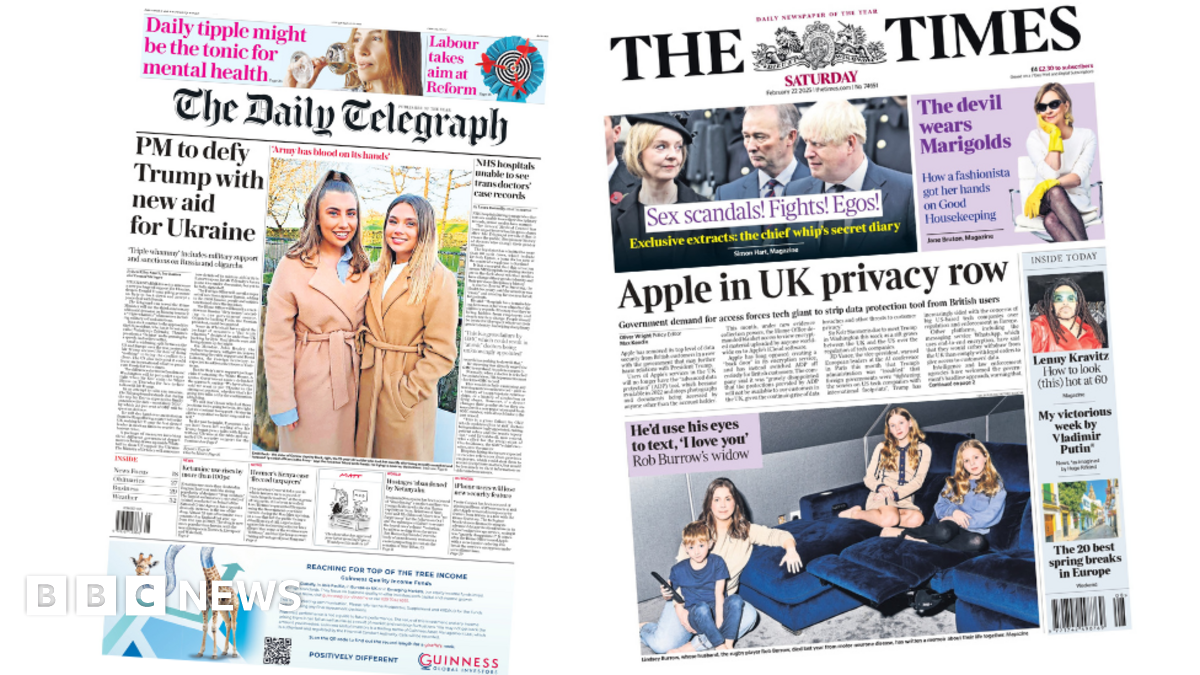

Uk Privacy Row Intensifies Apple Under Pressure

Feb 23, 2025

Uk Privacy Row Intensifies Apple Under Pressure

Feb 23, 2025 -

Bruins Fall To Jimmies In Final Regular Season Matchup

Feb 23, 2025

Bruins Fall To Jimmies In Final Regular Season Matchup

Feb 23, 2025 -

Veteran Bruins Forward Dominates Blue Jackets In Impressive Display

Feb 23, 2025

Veteran Bruins Forward Dominates Blue Jackets In Impressive Display

Feb 23, 2025 -

Ksi Meets Britains Got Talent Judges A First Look

Feb 23, 2025

Ksi Meets Britains Got Talent Judges A First Look

Feb 23, 2025