The Economic Implications Of A DOGE Dividend Under A Trump Presidency

Table of Contents

The Unlikely Dividend: Exploring the Economic Fallout of a DOGE Payout Under a Trump Presidency

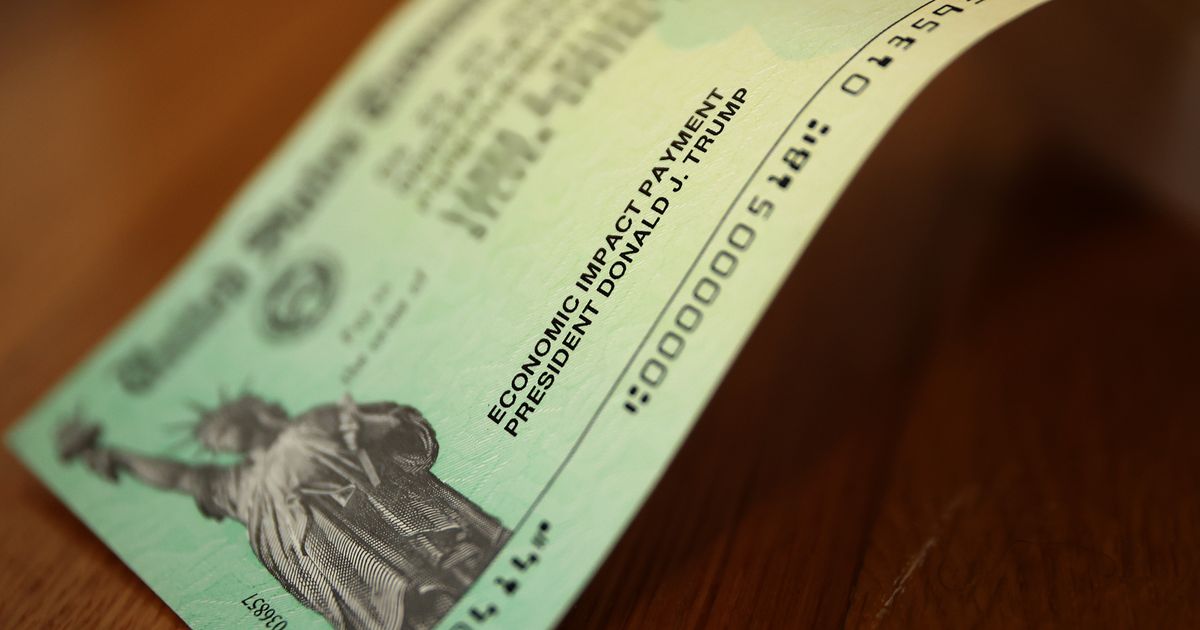

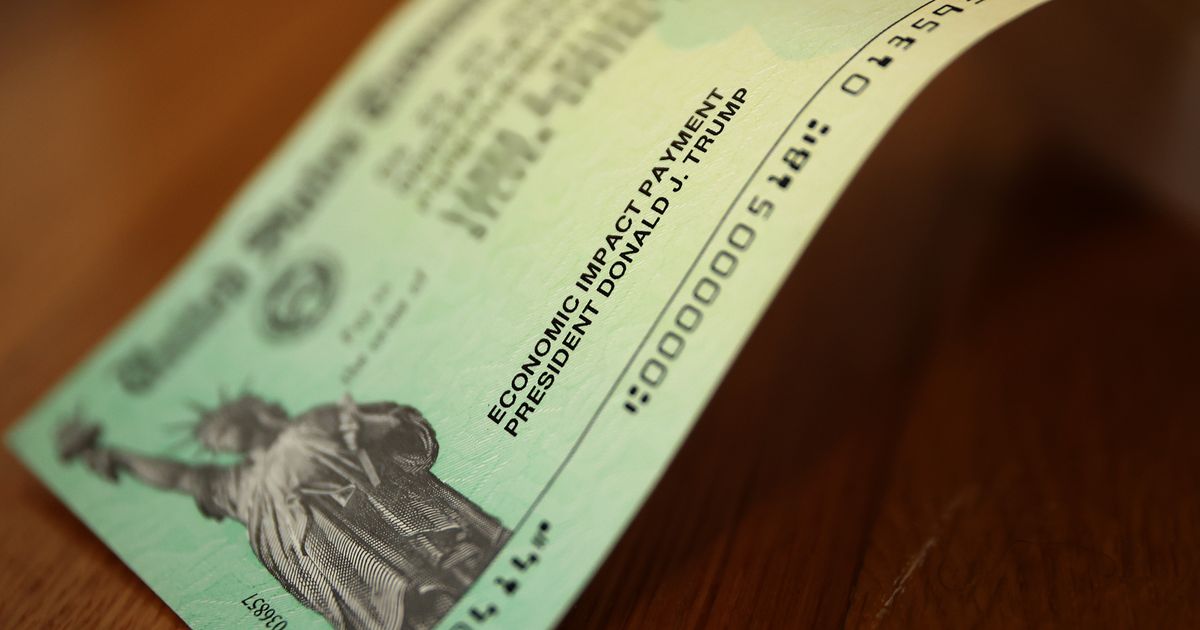

WASHINGTON, D.C. – The prospect of a Dogecoin (DOGE) dividend distributed to American citizens under a hypothetical second Trump presidency has sent shockwaves through financial and political circles. While the idea remains firmly in the realm of speculation, its potential economic consequences are far-reaching and warrant serious consideration. The sheer novelty of such a policy, coupled with the inherent volatility of cryptocurrency, creates a complex scenario with potentially devastating outcomes.

The core issue lies in the unpredictable nature of DOGE itself. Unlike traditional fiat currencies backed by governments, DOGE's value is entirely market-driven, subject to wild swings based on speculation, social media trends, and Elon Musk's tweets. A mass distribution, potentially involving trillions of DOGE, would almost certainly flood the market, causing a dramatic and likely immediate drop in its value. This would render the dividend largely worthless for many recipients, potentially leading to widespread disillusionment and economic anxiety.

Economists are divided on the potential scale of the impact. Some argue that the immediate deflationary effect on DOGE could be absorbed by the market, albeit with significant volatility. They point to the relatively small market capitalization of DOGE compared to the overall US economy. However, others warn of a much more catastrophic scenario. The sudden injection of a massive amount of DOGE into the global cryptocurrency market could trigger a broader cryptocurrency crash, with ripple effects impacting other digital assets and potentially even traditional financial markets.

[Specific economic models predicting the impact of a DOGE dividend are currently lacking. Existing models are insufficient to accurately predict the behavior of a market so significantly influenced by sentiment and speculation. Furthermore, the sheer unpredictability of a Trump administration's economic policies adds another layer of complexity to any forecasting efforts. Any attempt at quantitative analysis would necessitate making numerous highly uncertain assumptions about market reaction, the speed of distribution, and the administration's subsequent economic moves.]

Beyond the immediate market impact, the long-term economic implications are equally uncertain. The potential for increased wealth inequality is a significant concern. Those who already possess significant cryptocurrency holdings would likely benefit disproportionately from the initial price fluctuation, while those receiving the DOGE dividend might lose out due to the subsequent price crash. This could exacerbate existing social and economic divisions within the United States.

The political fallout is also a key element. Such a bold and unconventional policy could face significant legal challenges, questioning the government’s authority to distribute a volatile asset. Moreover, the policy's inherent unpredictability and the potential for economic damage could severely undermine public trust in both the government and the cryptocurrency market itself.

[There is currently no publicly available data on the logistical challenges of distributing a DOGE dividend to the entire US population. The technological infrastructure required to manage such a large-scale transaction would be enormous, requiring significant investment and posing numerous security risks.]

In conclusion, the idea of a DOGE dividend under a Trump administration remains a hypothetical, albeit concerning, possibility. While the immediate impact on the DOGE market is almost certain to be negative, the long-term economic and political consequences are difficult to predict with accuracy. The lack of robust economic models and data regarding such a unique scenario underscores the need for greater research and understanding of the potential risks involved before such a policy is even considered. The potential for widespread economic instability and social unrest highlights the gravity of this unconventional proposition.

Featured Posts

-

The German Election Impacts On Europe And The World

Feb 25, 2025

The German Election Impacts On Europe And The World

Feb 25, 2025 -

Elon Musk Faces Criticism From Grimes Over Sons Medical Care

Feb 25, 2025

Elon Musk Faces Criticism From Grimes Over Sons Medical Care

Feb 25, 2025 -

Economic Concerns Raised Over Trumps Proposed Dogecoin Dividend

Feb 25, 2025

Economic Concerns Raised Over Trumps Proposed Dogecoin Dividend

Feb 25, 2025 -

Lost In Utah A Father And Sons Harrowing Hiking Experience

Feb 25, 2025

Lost In Utah A Father And Sons Harrowing Hiking Experience

Feb 25, 2025 -

Father Son Lost In Utah Abandoned Backpack Provides Life Saving Supplies

Feb 25, 2025

Father Son Lost In Utah Abandoned Backpack Provides Life Saving Supplies

Feb 25, 2025

Latest Posts

-

Fatal Error A Mothers Revenge And The Unforeseen Repercussions

Feb 25, 2025

Fatal Error A Mothers Revenge And The Unforeseen Repercussions

Feb 25, 2025 -

Revised Un Resolution On Russia Us Pressure On Ukraine Intensifies

Feb 25, 2025

Revised Un Resolution On Russia Us Pressure On Ukraine Intensifies

Feb 25, 2025 -

The Lockerbie Tragedy One Mothers Powerful Sculpting Tribute

Feb 25, 2025

The Lockerbie Tragedy One Mothers Powerful Sculpting Tribute

Feb 25, 2025 -

The Silent Toll Massive Russian Casualties In Ukraine Remain Unseen

Feb 25, 2025

The Silent Toll Massive Russian Casualties In Ukraine Remain Unseen

Feb 25, 2025 -

Parking Chaos At Peak District Beauty Spots Avoid These Mistakes

Feb 25, 2025

Parking Chaos At Peak District Beauty Spots Avoid These Mistakes

Feb 25, 2025