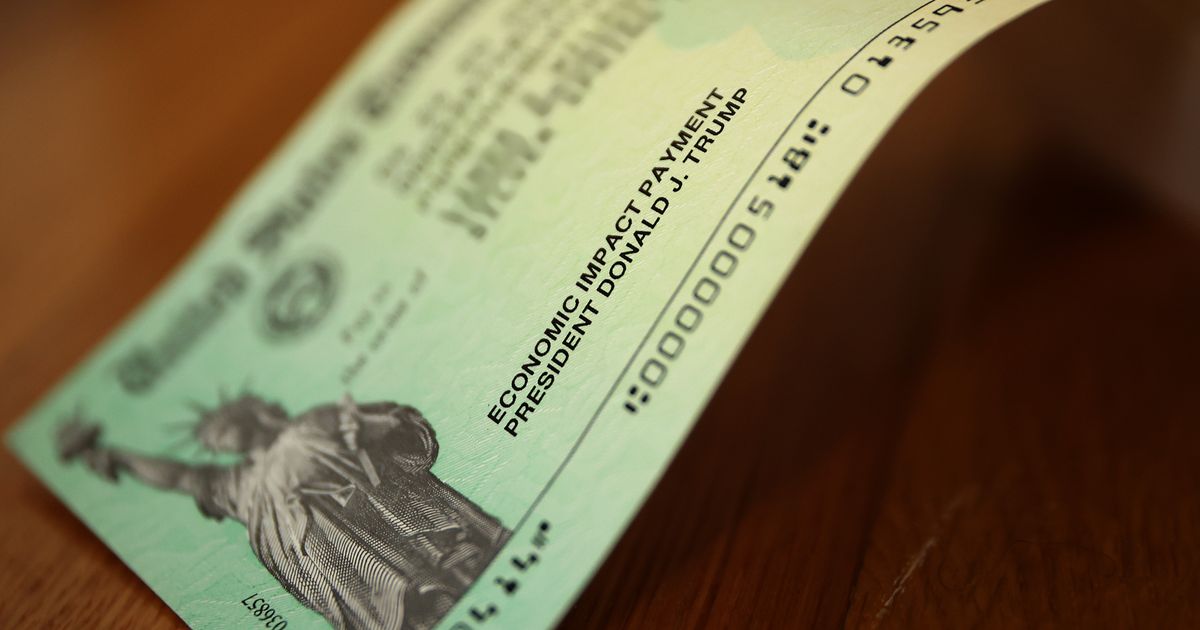

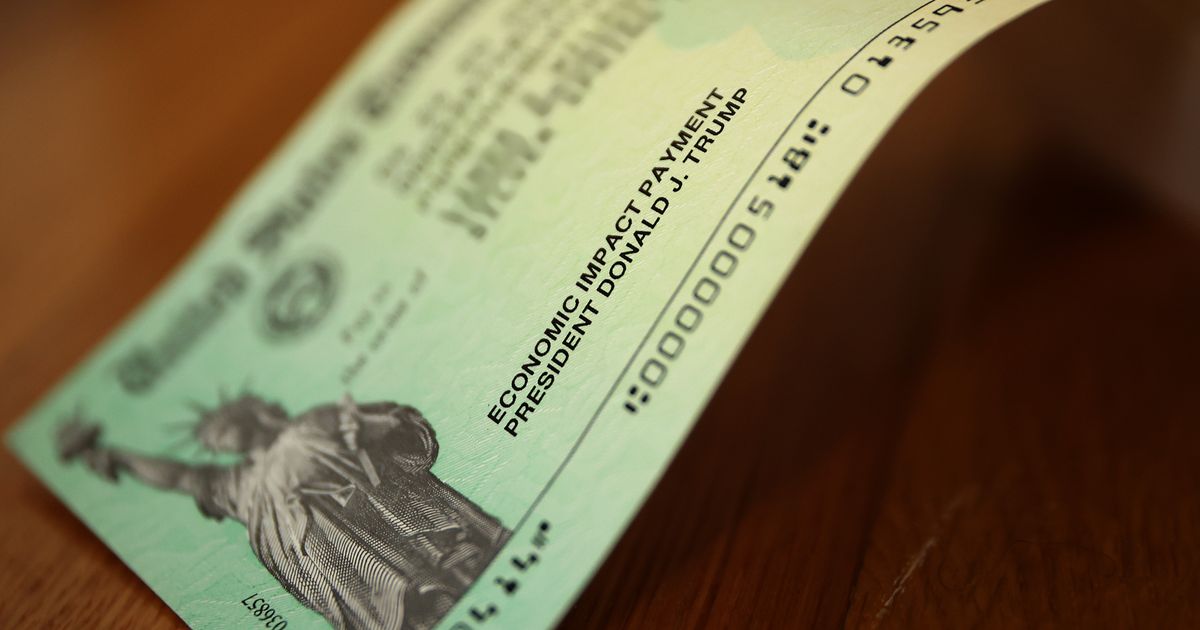

The Economic Implications Of A Trump Dogecoin Dividend: A Detailed Analysis

Table of Contents

The Economic Implications of a Trump Dogecoin Dividend: A Detailed Analysis

A hypothetical Trump Dogecoin dividend, were it to occur, would have unpredictable and potentially significant economic consequences, impacting everything from market volatility to investor confidence. While no such plan exists publicly, exploring the potential ramifications allows for a deeper understanding of the complexities of cryptocurrency and its integration (or lack thereof) into mainstream economics.

Market Volatility and Uncertainty: The most immediate impact of a Trump Dogecoin dividend would be extreme volatility in the cryptocurrency market. Dogecoin, known for its meme-based origins and volatile price swings, would likely experience a dramatic price surge initially, driven by speculation and hype. However, this surge would likely be short-lived. The lack of inherent value in Dogecoin, unlike assets backed by tangible goods or services, makes it highly susceptible to market manipulation and speculative bubbles. A sudden influx of Dogecoin into the market, particularly if distributed unevenly, could lead to a rapid price crash as investors attempt to liquidate their holdings. This could have ripple effects on other cryptocurrencies, potentially triggering a broader market downturn.

Inflationary Pressures: The scale of any hypothetical dividend would be crucial. If a large number of Dogecoins were distributed, it could introduce significant inflationary pressures. A sudden increase in the Dogecoin supply without a corresponding increase in demand could significantly devalue the cryptocurrency. This devaluation could have indirect impacts on the broader economy if Dogecoin were to gain wider adoption as a medium of exchange. The magnitude of this effect is difficult to predict, as it depends heavily on the size of the dividend and the adoption rate of Dogecoin within the economy.

Investor Confidence and Market Sentiment: The announcement of a Trump Dogecoin dividend alone would likely trigger significant uncertainty in financial markets. Such an unconventional policy would raise questions about the fiscal responsibility and economic understanding of the hypothetical administration involved. This could negatively impact investor confidence, leading to a decline in stock prices and increased risk aversion across various asset classes. The long-term effect on investor confidence would depend on several factors, including the overall reaction of the market and the subsequent actions of relevant authorities.

Regulatory Scrutiny and Legal Challenges: A Trump Dogecoin dividend would likely face intense regulatory scrutiny. Government agencies would need to assess the legality of distributing a cryptocurrency as a dividend, considering issues like tax implications, money laundering concerns, and the potential for market manipulation. Legal challenges could arise from various stakeholders, including taxpayers, investors, and regulatory bodies. The outcome of these legal battles could significantly affect the viability and long-term implications of such a plan.

International Implications: The global implications of a Trump Dogecoin dividend are potentially far-reaching. If the US were to adopt such a policy, it could set a precedent for other countries, potentially destabilizing international financial markets and raising concerns about the use of cryptocurrencies in national economic policy. The reaction of other nations and international organizations would play a significant role in shaping the overall consequences of such a move.

Conclusion:

The hypothetical economic implications of a Trump Dogecoin dividend are complex and unpredictable. While the short-term effects might involve dramatic market volatility and potential price surges, the long-term consequences are uncertain and could range from minimal impact to significant economic disruption. The lack of inherent value in Dogecoin, combined with its volatility and the unprecedented nature of such a dividend, creates a high degree of risk and uncertainty. A thorough cost-benefit analysis and a comprehensive understanding of potential risks are crucial before considering any such policy. Further, the entire premise is highly speculative, based on a hypothetical scenario with no current basis in reality.

Featured Posts

-

Smoke In Cabin Forces Delta Flight From Los Angeles To Land Emergency

Feb 24, 2025

Smoke In Cabin Forces Delta Flight From Los Angeles To Land Emergency

Feb 24, 2025 -

10 Viral New Yorker Covers Wry Humor And Public Outcry

Feb 24, 2025

10 Viral New Yorker Covers Wry Humor And Public Outcry

Feb 24, 2025 -

Wisconsin Mens Basketball Team Suffers Narrow Loss To Oregon

Feb 24, 2025

Wisconsin Mens Basketball Team Suffers Narrow Loss To Oregon

Feb 24, 2025 -

Arsenal Vs West Ham Premier League Clash Key Moments And Highlights

Feb 24, 2025

Arsenal Vs West Ham Premier League Clash Key Moments And Highlights

Feb 24, 2025 -

Paris Cyclist Paul Varry A Life Dedicated To Change Ended Tragically

Feb 24, 2025

Paris Cyclist Paul Varry A Life Dedicated To Change Ended Tragically

Feb 24, 2025

Latest Posts

-

Luigi Mangiones Supporters Women Speak Out

Feb 25, 2025

Luigi Mangiones Supporters Women Speak Out

Feb 25, 2025 -

Musk Demands Federal Explanations Or Job Losses Following Last Weeks Actions

Feb 25, 2025

Musk Demands Federal Explanations Or Job Losses Following Last Weeks Actions

Feb 25, 2025 -

The German Election Voters Concerns And Expectations

Feb 25, 2025

The German Election Voters Concerns And Expectations

Feb 25, 2025 -

Parking Woes In The Peak District Visitor Experiences

Feb 25, 2025

Parking Woes In The Peak District Visitor Experiences

Feb 25, 2025 -

Is Insurance Getting Worse Viral Doctors Video Says Yes

Feb 25, 2025

Is Insurance Getting Worse Viral Doctors Video Says Yes

Feb 25, 2025