The Potential Economic Impact Of A Trump Dogecoin Dividend

Table of Contents

Trump Dogecoin Dividend: A Speculative Economic Earthquake?

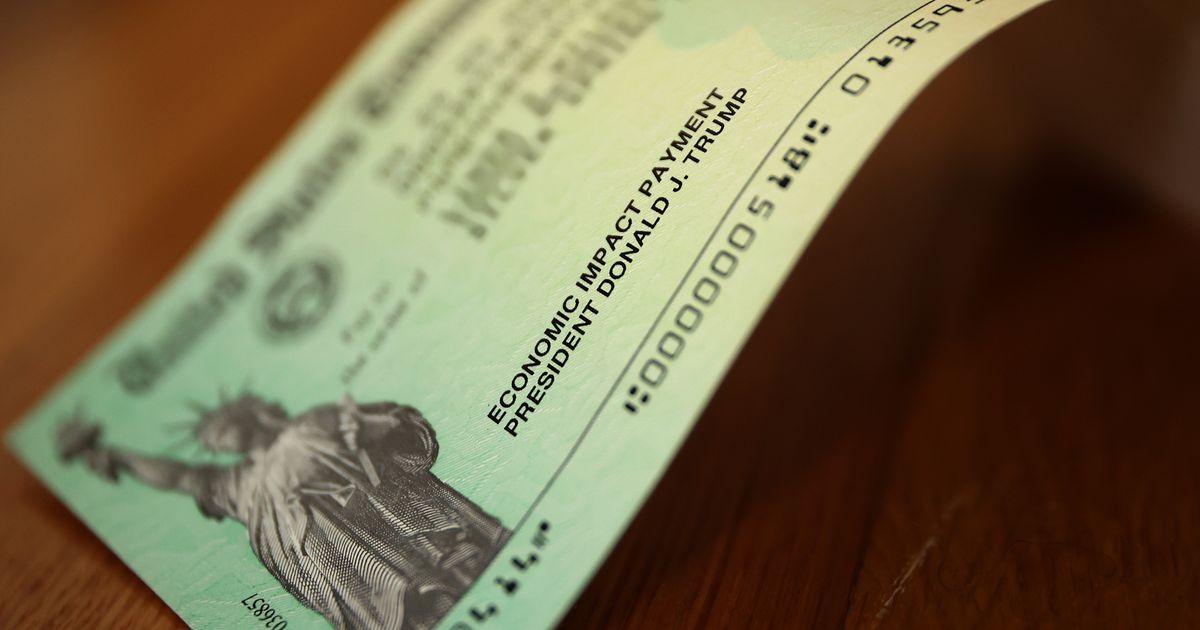

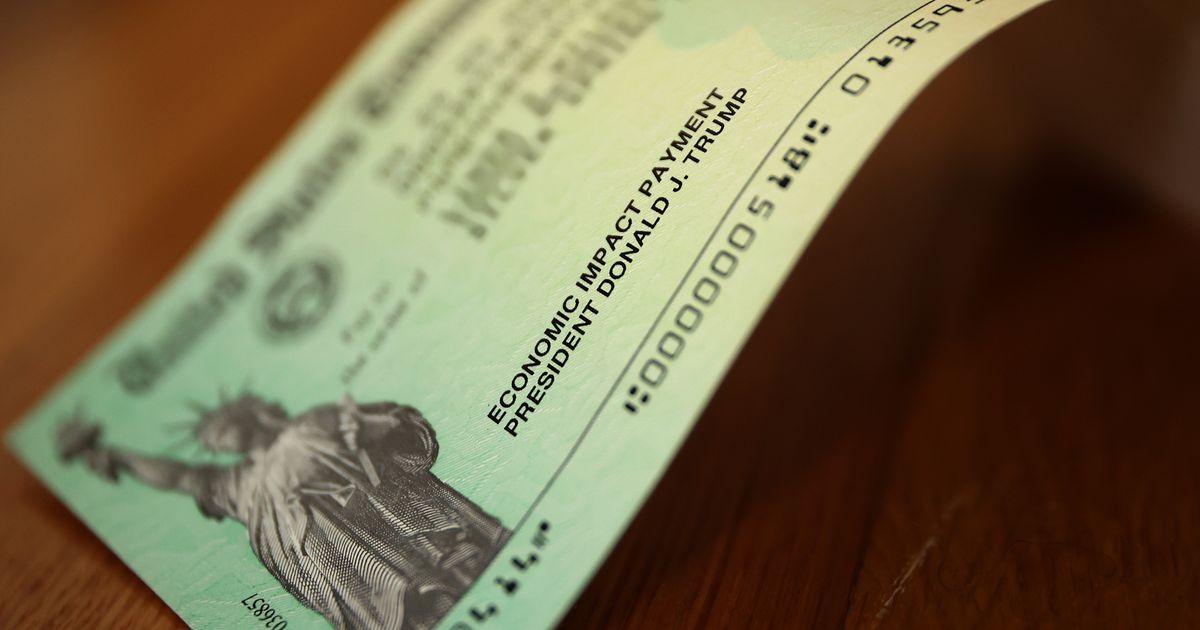

WASHINGTON, D.C. – The audacious proposal of a nationwide Dogecoin dividend, championed by former President Donald Trump during his recent presidential campaign, has sent shockwaves through the financial and political landscapes. While the specifics remain shrouded in ambiguity, the potential economic consequences of such a move are vast and largely unpredictable, sparking intense debate among economists and market analysts. [The exact proposal, including the amount of Dogecoin per recipient and the funding mechanism, remains unclear. Trump's campaign website offers little detail beyond general pronouncements about economic revitalization through cryptocurrency.] Trump's team has suggested funding this plan through a combination of private investment and a restructuring of the national debt, but concrete plans are yet to be revealed.

The core uncertainty lies in the very nature of Dogecoin. Unlike traditional fiat currencies, Dogecoin's value is highly volatile, subject to intense speculation and market manipulation. [According to CoinMarketCap, as of October 26, 2023, Dogecoin's price is approximately $0.07, though this fluctuates constantly.] This inherent instability presents a significant risk. A mass distribution of Dogecoin, potentially impacting millions of Americans, could lead to a dramatic surge in demand, temporarily inflating its price. However, such a surge is unlikely to be sustainable, potentially triggering a sharp crash and leaving recipients with substantial losses.

Economists warn of several potential negative economic consequences. A sudden influx of Dogecoin into the economy could further destabilize already fragile markets, potentially contributing to inflation. [Experts at the Peterson Institute for International Economics, for instance, have expressed concerns about the inflationary potential of such a policy, citing its unpredictable nature and potential for market disruption.] The value of the dividend would also likely be highly unequal, benefiting those already possessing significant digital assets or technological literacy more than those lacking access or understanding.

Furthermore, the mechanics of distribution pose a significant challenge. [The logistical details of distributing a cryptocurrency dividend to every eligible American citizen remain entirely unaddressed. Questions around secure wallet creation, preventing fraud, and ensuring equitable access remain unanswered.] The cost of implementing such a system, considering the necessary technological infrastructure and potential bureaucratic hurdles, could be enormous.

Beyond the economic risks, the proposal raises serious questions about financial governance and the role of cryptocurrency in a national economy. Such a policy could undermine faith in the US dollar and established financial institutions, while simultaneously introducing unprecedented levels of financial risk to millions of ordinary citizens. [Legal scholars at Georgetown University Law Center are currently studying the legal implications of such a dividend, particularly regarding the federal government's authority to distribute a volatile asset like Dogecoin.] The lack of transparency and detailed policy proposals adds to the skepticism surrounding the plan's feasibility and long-term impacts.

The Trump campaign's emphasis on the potential for economic growth through this policy remains largely unsupported by empirical evidence or rigorous economic modeling. The inherent volatility and speculative nature of Dogecoin make it an unsuitable instrument for a large-scale economic stimulus program. While proponents argue it could democratize access to financial markets and boost economic activity, the overwhelming consensus among economic experts is that the potential risks far outweigh any perceived benefits. The long-term impact, should such a policy ever be implemented, would likely be far more complex and potentially devastating than initially envisioned. The debate, however, will undoubtedly continue as the 2024 presidential election draws nearer.

Featured Posts

-

Update Israeli Hostages Freed Prisoner Exchange Postponed

Feb 25, 2025

Update Israeli Hostages Freed Prisoner Exchange Postponed

Feb 25, 2025 -

Understanding The Rise Of Potentially Dangerous Dog Breeds

Feb 25, 2025

Understanding The Rise Of Potentially Dangerous Dog Breeds

Feb 25, 2025 -

Suspect In Police Officer Killing Took Pennsylvania Hospital Hostages Week Prior Icu Visit Confirmed

Feb 25, 2025

Suspect In Police Officer Killing Took Pennsylvania Hospital Hostages Week Prior Icu Visit Confirmed

Feb 25, 2025 -

Snls 50th Celebrates Despite Covid Rudolph And Shorts Stories

Feb 25, 2025

Snls 50th Celebrates Despite Covid Rudolph And Shorts Stories

Feb 25, 2025 -

Artists Weigh Protest Kennedy Center Shows At Risk Amid Sales Slump

Feb 25, 2025

Artists Weigh Protest Kennedy Center Shows At Risk Amid Sales Slump

Feb 25, 2025

Latest Posts

-

Delta Los Angeles Flight Experiences Smoke Makes Emergency Landing

Feb 25, 2025

Delta Los Angeles Flight Experiences Smoke Makes Emergency Landing

Feb 25, 2025 -

Parking Fines In The Peak District My Expensive Experience

Feb 25, 2025

Parking Fines In The Peak District My Expensive Experience

Feb 25, 2025 -

Car Theft Prevention Ban On Key Fob Cloning Devices Imminent

Feb 25, 2025

Car Theft Prevention Ban On Key Fob Cloning Devices Imminent

Feb 25, 2025 -

Musks Call For Federal Employee Transparency Sparks Debate

Feb 25, 2025

Musks Call For Federal Employee Transparency Sparks Debate

Feb 25, 2025 -

After Her Sons Murder A Mothers Quest For Revenge

Feb 25, 2025

After Her Sons Murder A Mothers Quest For Revenge

Feb 25, 2025