The Potential Fallout: Examining The Implications Of A Trump DOGE Dividend.

Table of Contents

The Potential Fallout: Examining the Implications of a Trump DOGE Dividend

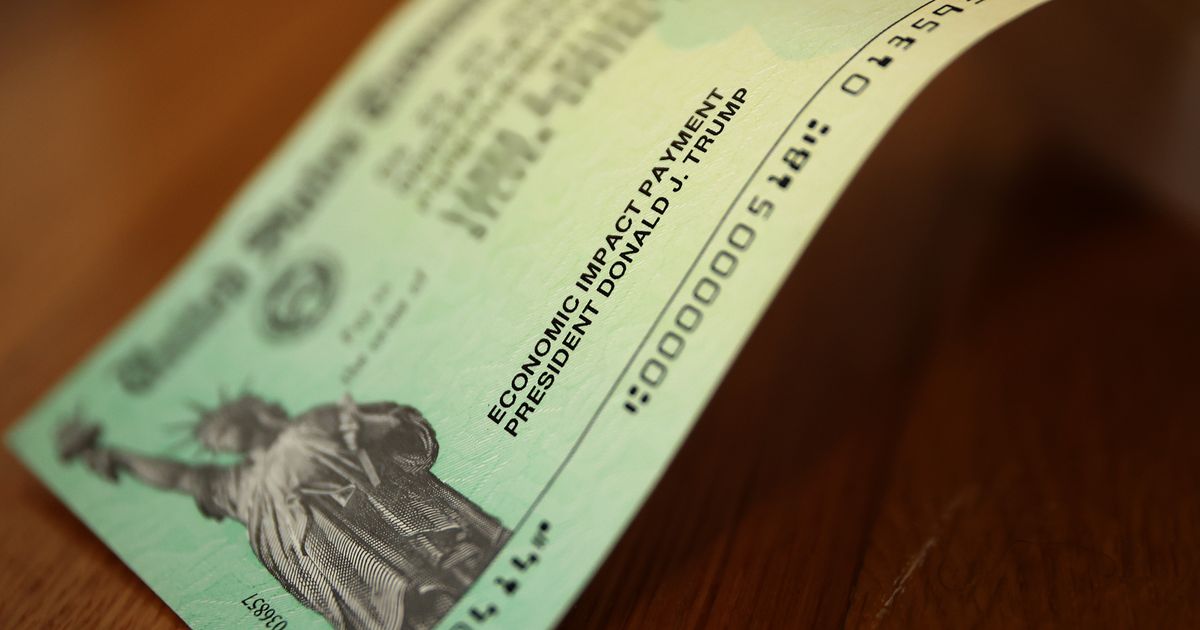

A Trump-endorsed Dogecoin dividend, if it were to materialize, would send shockwaves through the financial world, impacting everything from cryptocurrency markets to the 2024 presidential race. Experts warn of potential legal challenges, market manipulation concerns, and significant ramifications for investors and the broader economy.

Washington, D.C. – The possibility of a Donald Trump-backed Dogecoin dividend, while currently speculative, has ignited a firestorm of debate among economists, legal scholars, and cryptocurrency enthusiasts. While no concrete plan exists, the mere suggestion has exposed vulnerabilities in the regulatory framework surrounding digital assets and highlighted the unpredictable impact of celebrity endorsements on volatile markets.

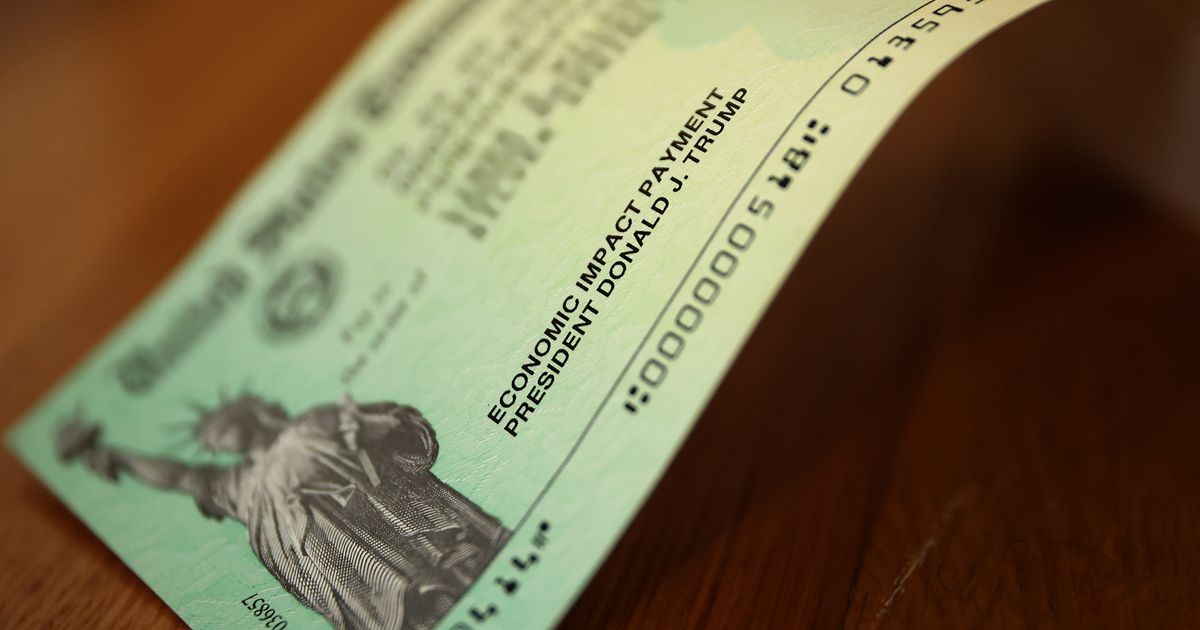

The idea, floated on social media and discussed in certain fringe political circles, proposes a scenario where a future Trump administration, or perhaps even a post-presidency initiative, could distribute Dogecoin (DOGE) as a dividend to American citizens. The specifics—the source of the Dogecoin, the distribution mechanism, and the quantity—remain largely undefined, making any precise analysis challenging. However, the potential consequences are significant and far-reaching.

Market Volatility and Manipulation: The immediate impact on the cryptocurrency market would likely be dramatic. A sudden, massive influx of DOGE into circulation, potentially dwarfing the existing supply, could trigger extreme price volatility. This could lead to significant losses for investors holding DOGE or other cryptocurrencies, potentially triggering a market crash. Furthermore, concerns of market manipulation would be paramount. The distribution mechanism itself could be easily exploited, and accusations of insider trading or pump-and-dump schemes would likely arise.

Legal and Regulatory Hurdles: The legality of such a dividend is highly questionable. The U.S. Treasury Department and the Securities and Exchange Commission (SEC) would face immense pressure to investigate and potentially intervene. Questions surrounding the use of taxpayer funds, if any, to acquire the DOGE would dominate the legal battles. The SEC, already grappling with regulatory uncertainty in the cryptocurrency space, would need to define DOGE’s legal classification – a security, a commodity, or neither – to determine the appropriate legal response. This uncertainty could further destabilize the market.

Political Ramifications: Beyond the economic impact, the proposal has profound political implications. The idea itself highlights the growing influence of social media and cryptocurrency in shaping political discourse. A successful DOGE dividend could be viewed as a populist triumph, boosting Trump's image among certain voter segments. However, it could equally alienate more conservative voters and draw harsh criticism from the establishment. The potential for international repercussions also exists, as a U.S.-backed cryptocurrency initiative could destabilize global financial markets and trigger international responses.

Economic Uncertainty: The broader economic consequences are hard to predict with certainty. While some argue a DOGE dividend could stimulate the economy by distributing wealth, the reality could be far more complicated. The potential for mass devaluation of DOGE, coupled with market instability, could easily lead to a broader economic downturn. The uncertainty surrounding the value and liquidity of DOGE post-distribution could also severely impact consumer confidence.

Conclusion: The prospect of a Trump DOGE dividend, while highly speculative, presents a complex and multifaceted challenge. The potential for market disruption, legal challenges, and political upheaval underscores the need for clear regulatory frameworks within the cryptocurrency space and a careful consideration of the ramifications of such unprecedented initiatives. The lack of concrete details currently surrounding the proposal makes accurate prediction impossible, but the potential for significant upheaval in both the financial and political landscapes is undeniable. Further analysis and dialogue are crucial to fully comprehend the magnitude of the potential fallout.

Featured Posts

-

Dynamic Pricing A New Approach For Empire State Building Tickets

Feb 24, 2025

Dynamic Pricing A New Approach For Empire State Building Tickets

Feb 24, 2025 -

Us Pushes Ukraine To Replace Un Resolution Condemning Russia

Feb 24, 2025

Us Pushes Ukraine To Replace Un Resolution Condemning Russia

Feb 24, 2025 -

Barcelonas 2 0 Win Extends La Liga Dominance

Feb 24, 2025

Barcelonas 2 0 Win Extends La Liga Dominance

Feb 24, 2025 -

Leaked Recording Exposes Controversial Doge Employees Actions

Feb 24, 2025

Leaked Recording Exposes Controversial Doge Employees Actions

Feb 24, 2025 -

Oregon Vs Wisconsin 2025 College Football Matchup Time Odds And Predictions

Feb 24, 2025

Oregon Vs Wisconsin 2025 College Football Matchup Time Odds And Predictions

Feb 24, 2025

Latest Posts

-

Grimes And Elon Musk A Public Dispute Over Childs Healthcare

Feb 24, 2025

Grimes And Elon Musk A Public Dispute Over Childs Healthcare

Feb 24, 2025 -

2025 Insurance Nightmare Doctors Viral Video Highlights Growing Problems

Feb 24, 2025

2025 Insurance Nightmare Doctors Viral Video Highlights Growing Problems

Feb 24, 2025 -

Why Insurance Is Getting Worse In 2025 A Doctors Viral Warning

Feb 24, 2025

Why Insurance Is Getting Worse In 2025 A Doctors Viral Warning

Feb 24, 2025 -

Trumps Dogecoin Dividend Plan A Risky Gamble For The Us Economy

Feb 24, 2025

Trumps Dogecoin Dividend Plan A Risky Gamble For The Us Economy

Feb 24, 2025 -

Concerns Rise Over Potentially Dangerous Dog Breeds

Feb 24, 2025

Concerns Rise Over Potentially Dangerous Dog Breeds

Feb 24, 2025