The Potential Fallout: Examining Trump's Proposed Dogecoin Dividend

Table of Contents

Trump's Dogecoin Dividend: A Political Gamble with Uncertain Economic Fallout

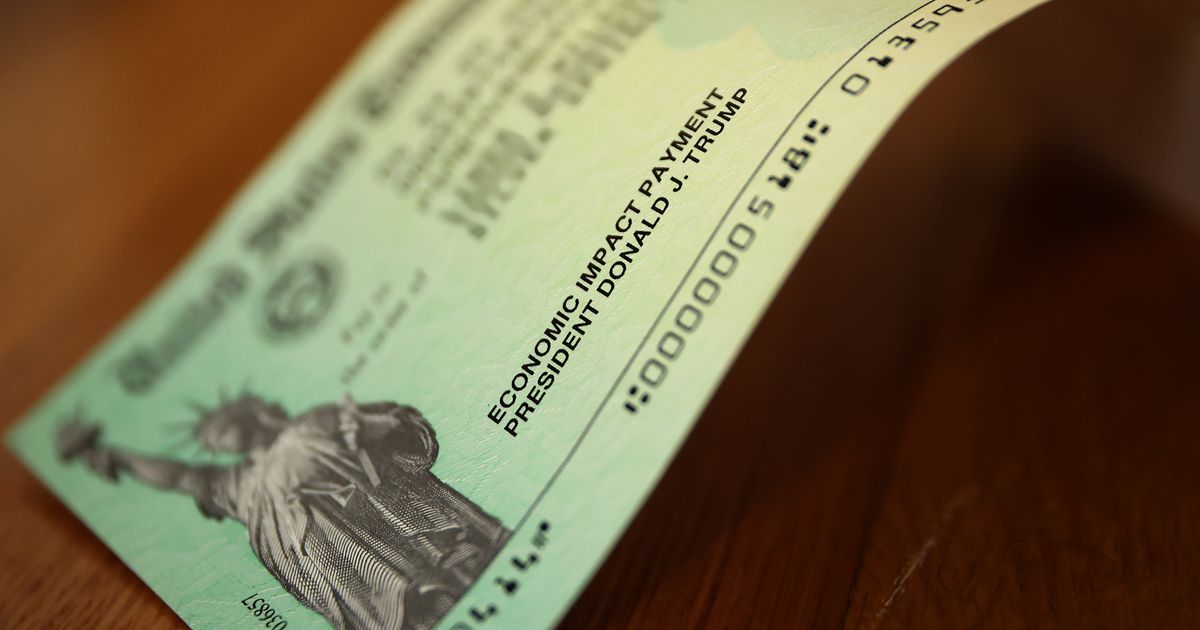

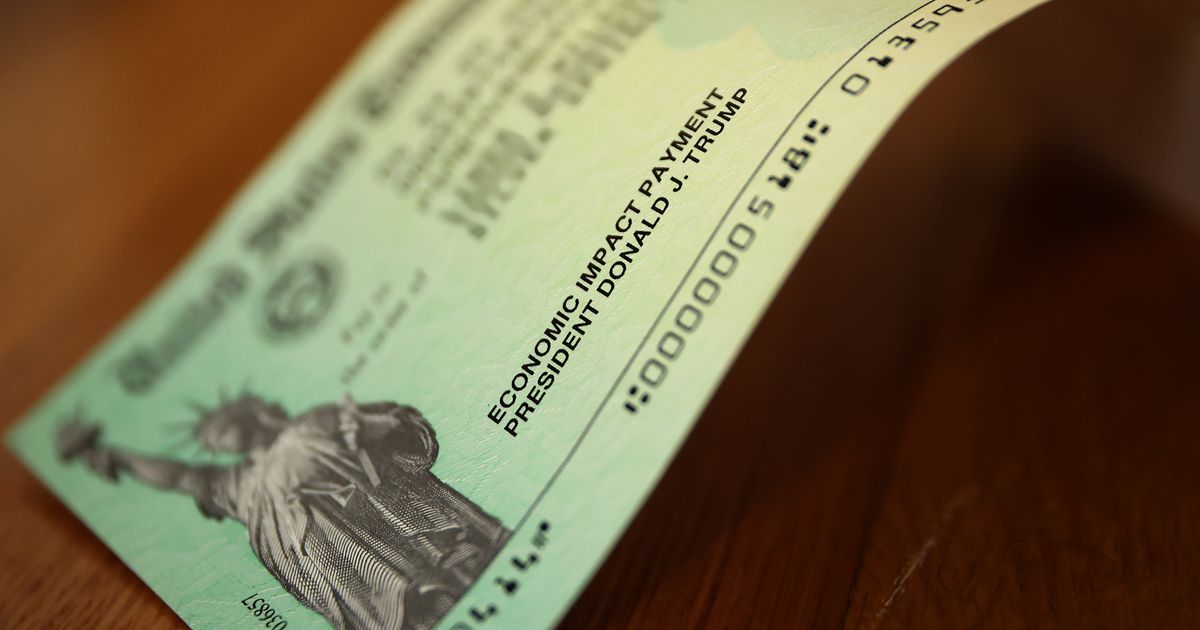

NEW YORK, NY – Donald Trump's recent suggestion of a Dogecoin dividend as part of his economic platform has sent shockwaves through the political and financial worlds. While the former president's proposal lacks concrete details, its potential implications are far-reaching and merit serious consideration. The vagueness surrounding the plan, however, makes a precise economic analysis difficult. [No specific details on the mechanics of the dividend, proposed payout amount, or funding source were provided by Trump. His statements have been largely anecdotal and lacked the specifics usually associated with economic proposals from major political figures.]

The core of Trump's proposal remains shrouded in ambiguity. He has hinted at a potential connection between a strong US dollar and the rise of Dogecoin, suggesting a possible government endorsement or manipulation of the cryptocurrency's value to deliver the dividend. [Trump's exact phrasing varies across different interviews and statements. There is no official white paper or detailed policy document outlining the plan.] This lack of transparency has fueled widespread skepticism among economists and financial analysts.

The potential economic consequences are multifaceted and largely negative, according to numerous experts. Firstly, the massive scale of a Dogecoin dividend, encompassing the entire US population, would likely necessitate the printing of a significant amount of new currency or the direct purchase of Dogecoin by the government, [potentially exceeding $1 trillion depending on the proposed per capita payout and Dogecoin's market capitalization at the time of distribution]. This would drastically increase the money supply, potentially leading to runaway inflation, eroding the value of the dollar, and jeopardizing the stability of the US economy.

Furthermore, the volatile nature of cryptocurrencies like Dogecoin poses considerable risks. Its value is highly susceptible to market fluctuations, potentially rendering the dividend worthless shortly after distribution. [Historical volatility data for Dogecoin shows extreme price swings, often exceeding 100% in a single day. Experts caution that any government investment in such a volatile asset is inherently risky.] The government’s involvement could also artificially inflate Dogecoin’s value in the short term, creating a speculative bubble that would inevitably burst, causing significant financial losses for those who receive the dividend.

Beyond the economic ramifications, the proposal raises serious concerns regarding government integrity and the proper role of the state in the financial markets. Such a drastic intervention could undermine the principles of sound monetary policy and potentially lead to a loss of confidence in the US dollar and its financial institutions. [Multiple economists and financial experts have expressed strong concerns about the proposal’s potential to destabilize the economy and erode public trust in government economic policies.]

The political implications are equally complex. While the proposal might resonate with certain segments of the population, particularly those sympathetic to Trump's populist message, it is widely considered to be economically unsound by mainstream political figures across the spectrum. [The proposal has been widely criticized by both Democratic and Republican economists, with many describing it as irresponsible and lacking in economic feasibility.] The long-term political consequences of such a controversial and economically damaging initiative remain to be seen.

In conclusion, Trump's proposed Dogecoin dividend, while intriguing in its audacity, lacks the necessary detail and economic grounding to be considered a serious policy proposal. The potential for significant economic disruption, coupled with ethical concerns about government manipulation of the cryptocurrency market, renders it a highly risky and potentially disastrous endeavor. Further investigation and clarification from Trump’s campaign are urgently needed to fully understand the implications of this controversial suggestion. Until then, the uncertainty surrounding the proposal continues to dominate the discussion.

Featured Posts

-

Musks Inquiry A Closer Look At Federal Employee Work

Feb 25, 2025

Musks Inquiry A Closer Look At Federal Employee Work

Feb 25, 2025 -

Elon Musk And Steve Bannon Who Is Backing Germanys Af D Party

Feb 25, 2025

Elon Musk And Steve Bannon Who Is Backing Germanys Af D Party

Feb 25, 2025 -

Los Angeles Delta Flight Emergency Landing Passengers Safe After Smoke Incident

Feb 25, 2025

Los Angeles Delta Flight Emergency Landing Passengers Safe After Smoke Incident

Feb 25, 2025 -

Demi Moore Timothee Chalamet And The Conclave Win Big At Sag Awards

Feb 25, 2025

Demi Moore Timothee Chalamet And The Conclave Win Big At Sag Awards

Feb 25, 2025 -

Beyond The Screen Rare Behind The Scenes Images Of Actors

Feb 25, 2025

Beyond The Screen Rare Behind The Scenes Images Of Actors

Feb 25, 2025

Latest Posts

-

Usaid Facing Mass Layoffs Under Trump Administration

Feb 25, 2025

Usaid Facing Mass Layoffs Under Trump Administration

Feb 25, 2025 -

Pope Francis Health Critical But Showing Signs Of Progress

Feb 25, 2025

Pope Francis Health Critical But Showing Signs Of Progress

Feb 25, 2025 -

Timothee Chalamet Millie Bobby Brown And Mikey Madisons Red Carpet Looks At The Sag Awards

Feb 25, 2025

Timothee Chalamet Millie Bobby Brown And Mikey Madisons Red Carpet Looks At The Sag Awards

Feb 25, 2025 -

Sag Awards 2025 Winners Updated List

Feb 25, 2025

Sag Awards 2025 Winners Updated List

Feb 25, 2025 -

Complete List Of Winners 2025 Sag Awards

Feb 25, 2025

Complete List Of Winners 2025 Sag Awards

Feb 25, 2025