Treasury Action: IRS Denied Access To Dogecoin Taxpayer Records

Table of Contents

IRS Denied Access to Dogecoin Taxpayer Records: Treasury Spars with Crypto

WASHINGTON, D.C. – The Treasury Department has confirmed that the Internal Revenue Service (IRS) was denied access to certain taxpayer records related to Dogecoin transactions. While the exact nature and scope of the denied access remain unclear, the situation underscores the ongoing challenges faced by tax authorities in regulating the rapidly evolving cryptocurrency market. The denial, sources familiar with the matter indicate, stems from a dispute regarding data privacy protections and the legal interpretation of existing regulations concerning digital asset reporting. The Treasury declined to provide specific details citing ongoing internal review and potential legal ramifications.

The incident follows a recent surge in Dogecoin's popularity and subsequent increase in trading activity. This spike in activity, alongside the relatively decentralized and pseudonymous nature of Dogecoin transactions, has presented a significant hurdle for the IRS in tracking taxable events. Unlike traditional financial transactions which are typically funneled through regulated institutions, Dogecoin transactions often occur on decentralized platforms, making it harder to trace and monitor.

Experts in tax law and blockchain technology suggest that the denial of access may be related to concerns about complying with privacy regulations such as the Bank Secrecy Act (BSA) and the Right to Financial Privacy Act (RFPA). These laws protect taxpayer information and require proper authorization before disclosing sensitive data. The IRS likely needs to navigate complex legal processes to obtain the necessary warrants or permissions to access the requested Dogecoin transaction records, a process complicated by the jurisdictional ambiguities inherent in the decentralized nature of cryptocurrencies.

"The government is playing catch-up," notes Professor [Name of Professor specializing in tax law and cryptocurrency at a reputable University], a leading authority on the intersection of taxation and blockchain technology. "[Professor's quote explaining the complexities of regulating cryptocurrencies and the legal challenges faced by the IRS, potentially including specific legal precedent or pending legislation]." The professor further emphasizes the need for clearer legal frameworks and international cooperation to effectively regulate the cryptocurrency market and ensure fair and efficient tax collection.

Sources within the Treasury Department suggest that discussions are ongoing between the IRS and the relevant data custodians (likely cryptocurrency exchanges) to resolve the issue. These discussions are expected to focus on establishing clear guidelines for data sharing while adhering to privacy protections and complying with all relevant laws. The Treasury is reportedly exploring various options, including potential legislative changes to strengthen its authority in accessing cryptocurrency transaction data.

The outcome of this dispute will likely have significant implications for the broader cryptocurrency landscape and how future tax enforcement efforts are handled. Failure to resolve the issue could hinder the IRS's ability to effectively collect taxes on cryptocurrency transactions and potentially lead to a loss of revenue. Conversely, a successful resolution could establish crucial precedents for future regulatory efforts and provide a blueprint for other governments grappling with similar challenges.

While the precise details of the withheld records remain confidential, this incident highlights the significant technological and legal hurdles involved in regulating digital assets. It underscores the urgent need for policy makers and regulators to create a comprehensive legal framework for cryptocurrencies, one that balances the need for effective tax enforcement with the protection of individual privacy rights. The situation will undoubtedly be closely monitored by both cryptocurrency investors and tax professionals alike.

Featured Posts

-

Neighbours Axed Uk Media Outlets Report Series Cancellation

Feb 22, 2025

Neighbours Axed Uk Media Outlets Report Series Cancellation

Feb 22, 2025 -

House Speaker Vote Will Byron Donalds Finally Win Analysis And Predictions

Feb 22, 2025

House Speaker Vote Will Byron Donalds Finally Win Analysis And Predictions

Feb 22, 2025 -

The Evolution Of Beards In Baseball A Yankees Perspective

Feb 22, 2025

The Evolution Of Beards In Baseball A Yankees Perspective

Feb 22, 2025 -

Bbc News Quiz Kayakers Experience Inside A Whale

Feb 22, 2025

Bbc News Quiz Kayakers Experience Inside A Whale

Feb 22, 2025 -

Doctors Detail Wembanyamas Deep Vein Thrombosis Ending His Season

Feb 22, 2025

Doctors Detail Wembanyamas Deep Vein Thrombosis Ending His Season

Feb 22, 2025

Latest Posts

-

Watch Inglis Stars As Australia Defeats England In Champions Trophy Highlights

Feb 24, 2025

Watch Inglis Stars As Australia Defeats England In Champions Trophy Highlights

Feb 24, 2025 -

Beterbiev Vs Bivol 2 Undercard Predictions And Fight Analysis

Feb 24, 2025

Beterbiev Vs Bivol 2 Undercard Predictions And Fight Analysis

Feb 24, 2025 -

Celtic Suffer Shock Defeat To Hibernian Scottish Footballs Biggest Surprise

Feb 24, 2025

Celtic Suffer Shock Defeat To Hibernian Scottish Footballs Biggest Surprise

Feb 24, 2025 -

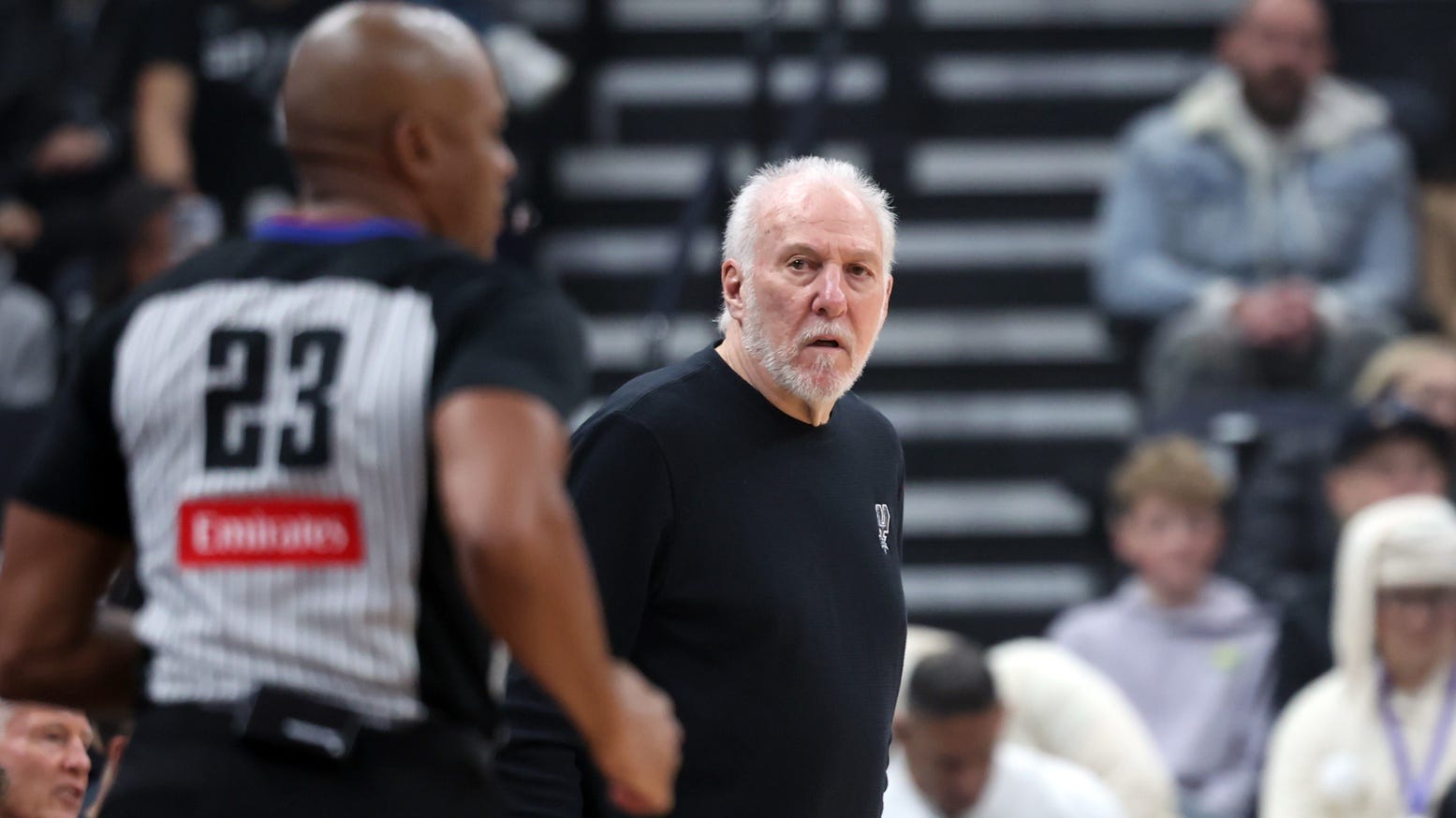

Latest On Gregg Popovichs Health And Absence From The Spurs

Feb 24, 2025

Latest On Gregg Popovichs Health And Absence From The Spurs

Feb 24, 2025 -

Perrie Edwards Long Distance Love Life With Footballer Fiance

Feb 24, 2025

Perrie Edwards Long Distance Love Life With Footballer Fiance

Feb 24, 2025