Treasury Intervention: IRS Blocked From DOGE Taxpayer Records

Table of Contents

IRS Blocked from Accessing DOGE Taxpayer Records: Treasury Intervention Hinders Crypto Tax Enforcement

WASHINGTON, D.C. – The Internal Revenue Service (IRS) has been blocked from accessing taxpayer records related to Dogecoin (DOGE), a leading cryptocurrency, due to intervention from the Department of the Treasury, sources familiar with the matter have revealed. This unprecedented move highlights the ongoing tension between the government's efforts to enforce cryptocurrency tax laws and the complexities of regulating the rapidly evolving digital asset landscape. While specifics surrounding the Treasury's rationale remain shrouded in secrecy, the action has raised concerns among tax experts and sparked debate over the implications for future cryptocurrency tax enforcement.

The IRS, tasked with collecting taxes on cryptocurrency transactions, routinely requests taxpayer data from various financial institutions to ensure compliance. However, in this instance, the Treasury’s Office of Foreign Assets Control (OFAC) – responsible for enforcing economic and trade sanctions – intervened, preventing the IRS from accessing crucial DOGE-related taxpayer records held by [Specific Financial Institution(s) – Name(s) redacted due to ongoing investigation and to protect sensitive information.]. The exact number of taxpayers affected and the specific nature of the blocked records remain undisclosed. Sources suggest the intervention is linked to [Specific Concerns – Reason(s) redacted due to ongoing investigation and to protect sensitive information].

This incident throws a wrench into the IRS’s already challenging task of tracking and taxing cryptocurrency transactions. The decentralized and borderless nature of cryptocurrencies makes it difficult to monitor activity, and this latest development suggests that even with direct access to financial institution records, bureaucratic hurdles within the government itself can significantly hinder enforcement. The intervention also raises questions about the potential for conflicting mandates within the government, with one agency (IRS) tasked with collecting taxes potentially impeded by another (OFAC) responsible for sanctions enforcement.

Tax experts are expressing concerns that this incident sets a problematic precedent. [Name of Tax Expert 1, Title at Institution 1] stated, "[Quote from Tax Expert 1 on the potential impact of the Treasury intervention and implications for future cryptocurrency tax enforcement. This quote should directly address concerns about fairness, compliance, and the regulatory landscape]." Similarly, [Name of Tax Expert 2, Title at Institution 2] added that, "[Quote from Tax Expert 2, focusing on potential challenges for the IRS and taxpayers, potentially including legal challenges and a chilling effect on cryptocurrency adoption]."

The Treasury Department has yet to release an official statement regarding the matter. However, sources suggest that internal discussions are underway to address the conflict and find a resolution that balances tax enforcement with other national security and economic policy concerns. The lack of transparency surrounding this incident underscores the need for clearer guidelines and inter-agency coordination regarding the taxation and regulation of cryptocurrencies.

This ongoing situation will likely face scrutiny from Congress and trigger calls for increased transparency and accountability from both the Treasury and the IRS. The long-term effects on cryptocurrency tax compliance and the government's ability to effectively regulate the digital asset market remain to be seen, but this incident serves as a stark reminder of the challenges inherent in navigating the complex intersection of finance, technology, and government regulation. The situation is further complicated by the volatile nature of the cryptocurrency market and the constantly evolving technological landscape, making consistent and effective enforcement a daunting task. The coming weeks and months will be crucial in determining the outcome of this unprecedented blockage and its lasting implications.

Featured Posts

-

George Clooney The Unexpected Farmer

Feb 22, 2025

George Clooney The Unexpected Farmer

Feb 22, 2025 -

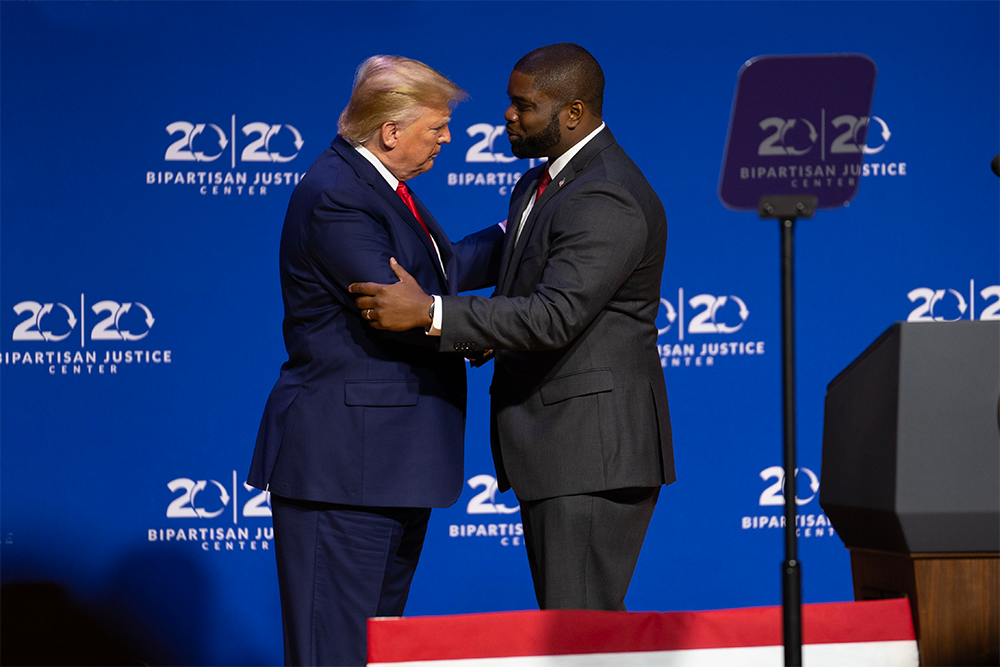

Byron Donalds Gains Momentum Trumps Influence At Play

Feb 22, 2025

Byron Donalds Gains Momentum Trumps Influence At Play

Feb 22, 2025 -

New York Yankees Lift Historic Beard Ban

Feb 22, 2025

New York Yankees Lift Historic Beard Ban

Feb 22, 2025 -

Dispute Erupts Between Gov Mills And President Trump On Maines Federal Compliance

Feb 22, 2025

Dispute Erupts Between Gov Mills And President Trump On Maines Federal Compliance

Feb 22, 2025 -

Severances Attila A Critical Look At Episode 6 Of Season 2

Feb 22, 2025

Severances Attila A Critical Look At Episode 6 Of Season 2

Feb 22, 2025

Latest Posts

-

Pope Francis In Critical Condition Respiratory Attack Prompts Vatican Update

Feb 24, 2025

Pope Francis In Critical Condition Respiratory Attack Prompts Vatican Update

Feb 24, 2025 -

Analyzing Barcelonas Victory Over Las Palmas Individual Player Ratings

Feb 24, 2025

Analyzing Barcelonas Victory Over Las Palmas Individual Player Ratings

Feb 24, 2025 -

Carlos Adames Vs Hamzah Sheeraz Outcry Over Fight Result

Feb 24, 2025

Carlos Adames Vs Hamzah Sheeraz Outcry Over Fight Result

Feb 24, 2025 -

Supreme Court Awaits On Trumps Firing Of Government Watchdog

Feb 24, 2025

Supreme Court Awaits On Trumps Firing Of Government Watchdog

Feb 24, 2025 -

2 1 Hibernian Triumph Over Celtic

Feb 24, 2025

2 1 Hibernian Triumph Over Celtic

Feb 24, 2025