Trump's Dogecoin Dividend: A Bad Idea With Unforeseen Consequences

Table of Contents

Trump's Dogecoin Dividend: A Bad Idea with Unforeseen Consequences

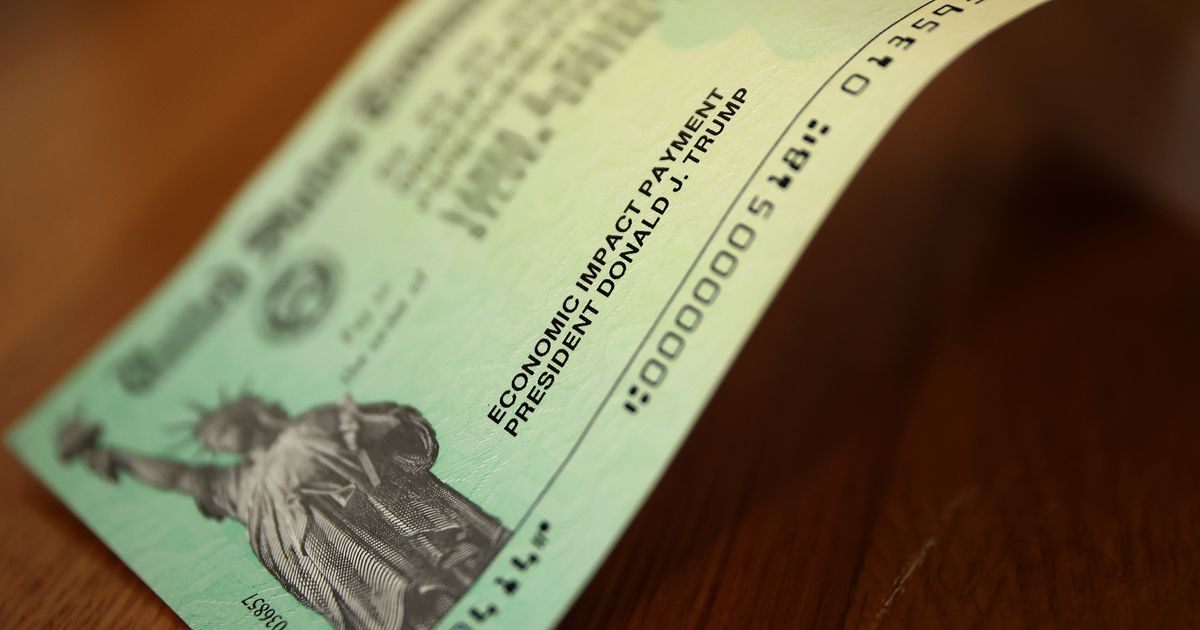

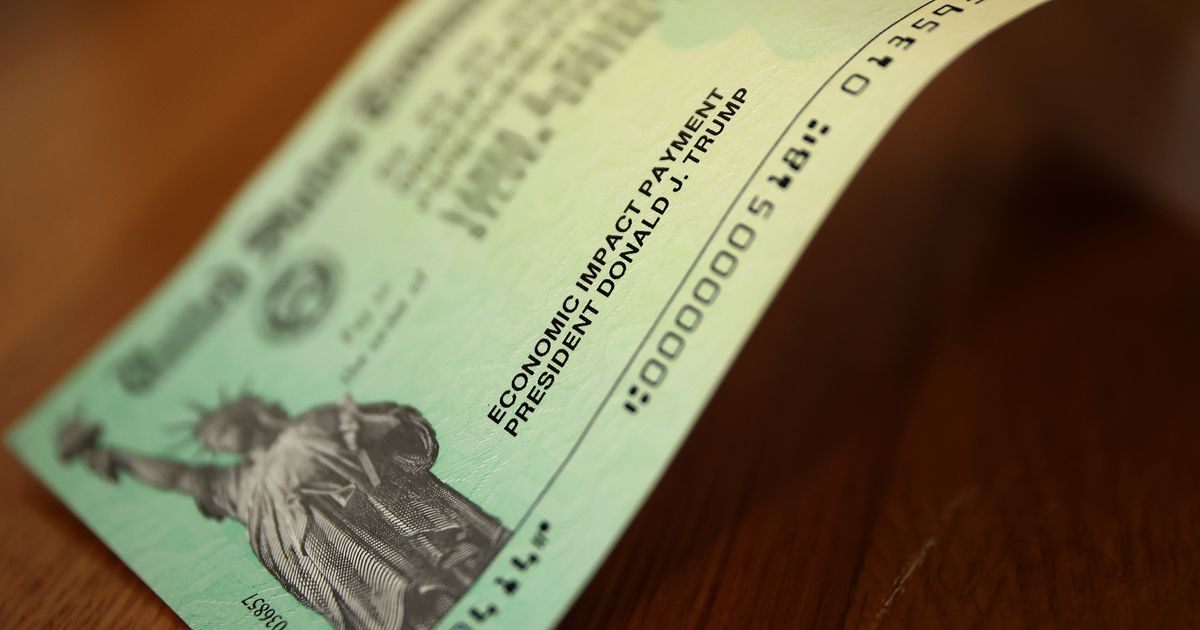

NEW YORK – The proposal by Donald Trump's campaign to distribute a Dogecoin dividend to supporters has sparked widespread criticism from financial experts and legal scholars, raising concerns about market manipulation, tax implications, and the overall feasibility of such an unprecedented move. While the exact details remain murky, the core concept—rewarding campaign contributors with a cryptocurrency—presents a unique set of challenges and potential pitfalls.

The idea, floated earlier this year and seemingly gaining traction within certain circles of Trump's online base, suggests a system where donations, perhaps exceeding a certain threshold, would be rewarded with a proportional amount of Dogecoin (DOGE). This isn't the first time Trump has flirted with cryptocurrencies; his previous endorsements of various digital assets have yielded mixed results, often creating short-lived price surges followed by significant drops. This Dogecoin dividend proposal, however, surpasses previous pronouncements in its potential scope and inherent risks.

Market Manipulation Concerns: The most immediate concern revolves around the potential for market manipulation. A mass distribution of Dogecoin to a significant number of individuals could artificially inflate the price, benefiting those who received the dividend while potentially harming other investors. The Securities and Exchange Commission (SEC) closely scrutinizes actions that could artificially influence market prices, and such a large-scale distribution could easily trigger an investigation. Legal experts predict a high probability of legal challenges from both regulatory bodies and private investors claiming losses resulting from the price volatility caused by the dividend distribution.

Tax Implications: The tax implications for both the Trump campaign and the recipients of the Dogecoin dividend are equally complex and potentially problematic. The IRS considers cryptocurrency a taxable asset, meaning recipients would likely face capital gains taxes on any increase in the value of their DOGE holdings from the time of receipt to the time of sale. The campaign itself might also face significant tax liabilities related to the cost of acquiring the Dogecoin and its subsequent distribution. The lack of clear guidelines regarding the taxation of cryptocurrency dividends further complicates the matter, potentially leading to lengthy audits and legal disputes.

Logistical Challenges: Beyond the legal and financial hurdles, the sheer logistical challenges of distributing a Dogecoin dividend are substantial. Ensuring accurate record-keeping, secure distribution, and verification of recipients' identities across a potentially vast network of supporters would require a sophisticated and costly infrastructure. The potential for fraud and errors is also considerable, posing a significant risk to both the campaign and the recipients.

Financial Experts Weigh In: Several prominent financial analysts have voiced concerns about the proposal's economic soundness. [Name of Financial Analyst] from [Name of Financial Institution] stated that, "This plan is fraught with risk and lacks any coherent financial strategy. The potential for market manipulation and tax liabilities far outweigh any potential benefits." [Another Financial Analyst's name and quote] echoes these sentiments, suggesting that the proposal could be more harmful than helpful to Trump's campaign in the long run.

Public Reaction: While a segment of Trump's supporters have expressed enthusiasm for the idea, widespread public reaction has been largely skeptical. Many question the feasibility and ethical implications of using cryptocurrency to incentivize political donations. The controversy highlights the ongoing debate surrounding the regulation of cryptocurrencies and their role in political campaigns.

The Trump campaign has yet to release detailed plans for implementing the Dogecoin dividend, leaving many unanswered questions. The lack of transparency surrounding the proposal further fuels concerns about its potential negative consequences. As the situation evolves, the outcome of this unprecedented initiative will be closely watched by financial markets, legal experts, and the public alike. The ramifications could extend far beyond the immediate political context, shaping future discussions surrounding the intersection of cryptocurrency and politics.

Featured Posts

-

Musk Questions Federal Employee Productivity A Nationwide Inquiry

Feb 24, 2025

Musk Questions Federal Employee Productivity A Nationwide Inquiry

Feb 24, 2025 -

Bakole Outclassed Parkers Explosive Two Round Tko Win

Feb 24, 2025

Bakole Outclassed Parkers Explosive Two Round Tko Win

Feb 24, 2025 -

Pope Francis Seriously Ill Vatican Releases Urgent Statement

Feb 24, 2025

Pope Francis Seriously Ill Vatican Releases Urgent Statement

Feb 24, 2025 -

Trumps Policies Face Headwinds Democratic States Push Back

Feb 24, 2025

Trumps Policies Face Headwinds Democratic States Push Back

Feb 24, 2025 -

Claerwen Reservoir Wetsuit Clad Body Poses Puzzle For Police

Feb 24, 2025

Claerwen Reservoir Wetsuit Clad Body Poses Puzzle For Police

Feb 24, 2025

Latest Posts

-

Rare Glimpses Actors On Set Behavior In Candid Photos

Feb 24, 2025

Rare Glimpses Actors On Set Behavior In Candid Photos

Feb 24, 2025 -

Meghan Markles Vision Board Planning Her Netflix Journey

Feb 24, 2025

Meghan Markles Vision Board Planning Her Netflix Journey

Feb 24, 2025 -

Trump Administrations Initiatives Blocked By Democratic States

Feb 24, 2025

Trump Administrations Initiatives Blocked By Democratic States

Feb 24, 2025 -

Pentagon Purge Trumps Reshaping Of The Military And Its Unforeseen Consequences

Feb 24, 2025

Pentagon Purge Trumps Reshaping Of The Military And Its Unforeseen Consequences

Feb 24, 2025 -

Musk Issues Ultimatum Federal Government Must Explain Last Weeks Events

Feb 24, 2025

Musk Issues Ultimatum Federal Government Must Explain Last Weeks Events

Feb 24, 2025