Trump's Dogecoin Dividend: A Risky Gamble For The Economy?

Table of Contents

Trump's Dogecoin Dividend: A Risky Gamble for the Economy?

A proposed, albeit highly unlikely, Dogecoin dividend from a hypothetical Trump presidency has sparked intense debate among economists and cryptocurrency enthusiasts. While no such policy has been officially proposed or is even remotely feasible, the theoretical scenario highlights the potential risks of integrating volatile cryptocurrencies into mainstream economic policy.

WASHINGTON, D.C. – The idea of a Donald Trump presidency distributing Dogecoin as a dividend to American citizens has ignited a firestorm of speculation and criticism. While there's no evidence suggesting Trump, or any political figure for that matter, is seriously considering such a policy, the hypothetical scenario has prompted a serious discussion about the potential economic ramifications of integrating volatile cryptocurrencies into established financial systems.

The initial spark, originating from an obscure online forum, quickly spread across social media, generating feverish debate. Proponents argued such a move could stimulate the economy by distributing wealth directly to the population and boosting Dogecoin's value. Conversely, critics warn of catastrophic consequences, pointing to Dogecoin's highly volatile nature and the potential for widespread market manipulation.

Economic Instability: The primary concern hinges on Dogecoin's price instability. Unlike fiat currencies backed by governments, Dogecoin's value is entirely driven by market forces, subject to significant fluctuations influenced by speculation, social media trends, and even celebrity endorsements. A mass distribution of Dogecoin, potentially involving trillions of coins, would almost certainly trigger extreme volatility, potentially causing a market crash. Economists fear this could trigger a ripple effect, destabilizing global financial markets and eroding investor confidence. [No specific economic models have been produced to quantify the potential impact, but leading economists at institutions like the Brookings Institution and the Peterson Institute for International Economics have publicly expressed grave concerns about the potential for chaos.]

Market Manipulation Concerns: The possibility of widespread market manipulation also looms large. With a significant portion of the population suddenly holding Dogecoin, the potential for coordinated trading activity to artificially inflate or deflate the price is considerable. This could create opportunities for insider trading and other illicit financial activities, undermining the integrity of the financial system. [Several experts in financial crime have raised concerns about the vulnerability of such a system to sophisticated manipulation schemes.]

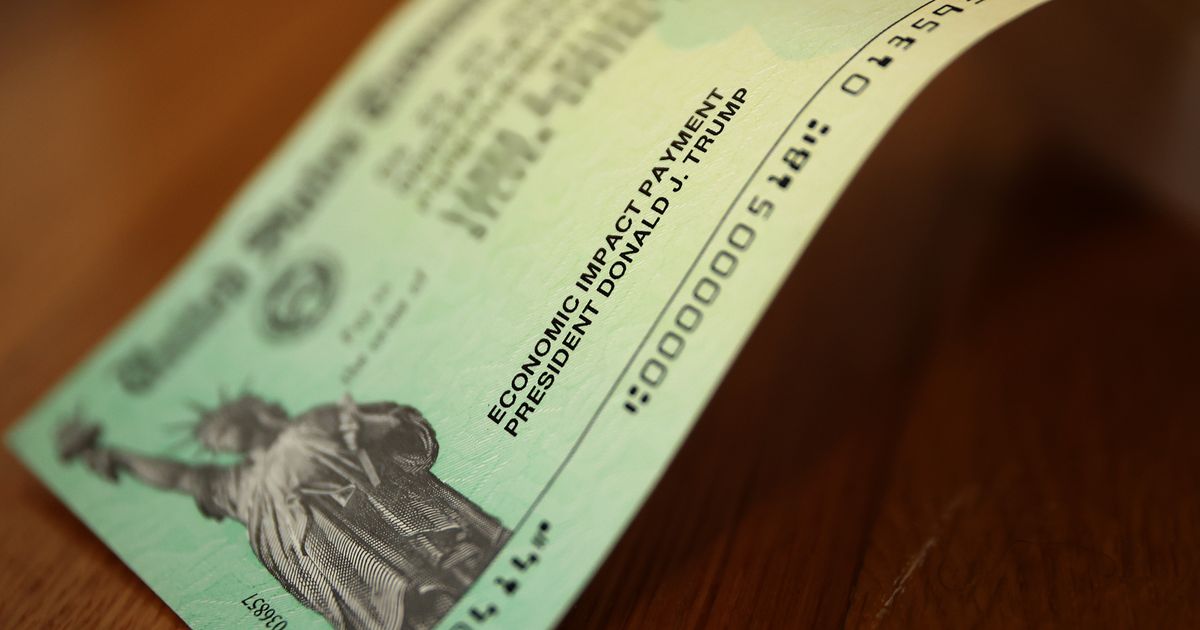

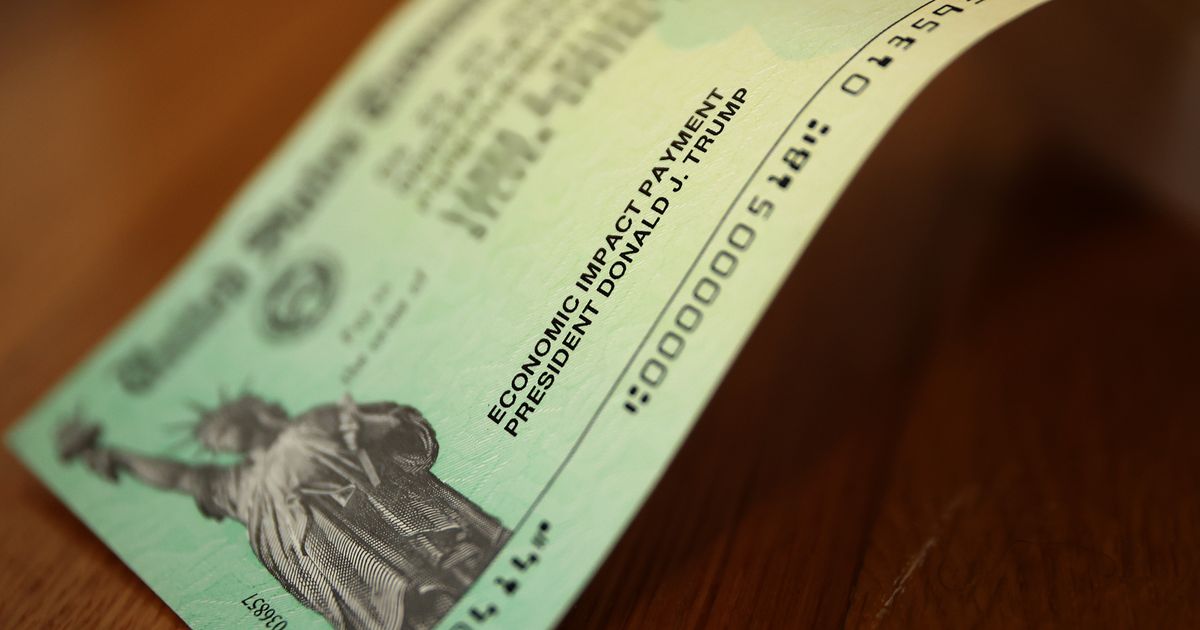

Practical Challenges: Beyond the economic concerns, the practical implementation of such a dividend poses significant logistical hurdles. Distributing trillions of Dogecoin units to millions of citizens would require robust and secure infrastructure, posing technological and administrative challenges. [The logistical complexities alone would require a massive governmental undertaking, surpassing any previous direct payment schemes like stimulus checks, and would likely be prone to significant errors and delays.]

The Political Context: While the Dogecoin dividend remains firmly in the realm of fantasy, its rapid spread highlights the power of misinformation and the potential for unsubstantiated claims to rapidly gain traction online. The discussion also indirectly reflects broader concerns about economic inequality and the search for alternative financial systems. However, the current debate provides a stark illustration of the dangers of relying on speculative assets and the importance of sound economic policies grounded in reality. [While no major political figures beyond fringe groups have endorsed the idea, the virality of the concept emphasizes the need for increased media literacy and critical thinking.]

Conclusion:

The hypothetical Dogecoin dividend proposed in connection with Donald Trump underscores the critical need for careful consideration when integrating cryptocurrencies into established economic systems. The inherent volatility and susceptibility to manipulation of cryptocurrencies like Dogecoin pose significant risks that could have devastating consequences for the global economy. While the scenario is currently highly improbable, the widespread attention it garnered serves as a stark reminder of the importance of sound financial policy and the dangers of speculation.

Featured Posts

-

Derby County Vs Millwall 1 0 Victory For The Lions In Efl Championship

Feb 24, 2025

Derby County Vs Millwall 1 0 Victory For The Lions In Efl Championship

Feb 24, 2025 -

Manchester United Edges Everton In Thrilling Premier League Encounter

Feb 24, 2025

Manchester United Edges Everton In Thrilling Premier League Encounter

Feb 24, 2025 -

Seattle Ufc Event Main Card Results And Recap

Feb 24, 2025

Seattle Ufc Event Main Card Results And Recap

Feb 24, 2025 -

Report Popovich Likely To Retire After Long Spurs Career

Feb 24, 2025

Report Popovich Likely To Retire After Long Spurs Career

Feb 24, 2025 -

Snowmobiler Trapped Then Saved Avalanche Rescue Video

Feb 24, 2025

Snowmobiler Trapped Then Saved Avalanche Rescue Video

Feb 24, 2025

Latest Posts

-

Falling Sales Prompt Artists To Consider Kennedy Center Protest

Feb 24, 2025

Falling Sales Prompt Artists To Consider Kennedy Center Protest

Feb 24, 2025 -

New Legislation Targets Electronic Devices Used In Car Thefts

Feb 24, 2025

New Legislation Targets Electronic Devices Used In Car Thefts

Feb 24, 2025 -

Snl 50th Anniversary Show Covid 19s Impact On The Cast

Feb 24, 2025

Snl 50th Anniversary Show Covid 19s Impact On The Cast

Feb 24, 2025 -

Vatican Provides Update Pope Francis Condition Still Serious But Stable

Feb 24, 2025

Vatican Provides Update Pope Francis Condition Still Serious But Stable

Feb 24, 2025 -

Analysis Trumps Reshaping Of The Pentagon And Its Implications

Feb 24, 2025

Analysis Trumps Reshaping Of The Pentagon And Its Implications

Feb 24, 2025