Trump's Dogecoin Dividend Proposal: A Costly And Unlikely Solution

Table of Contents

Trump's Dogecoin Dividend Proposal: A Costly and Unlikely Solution

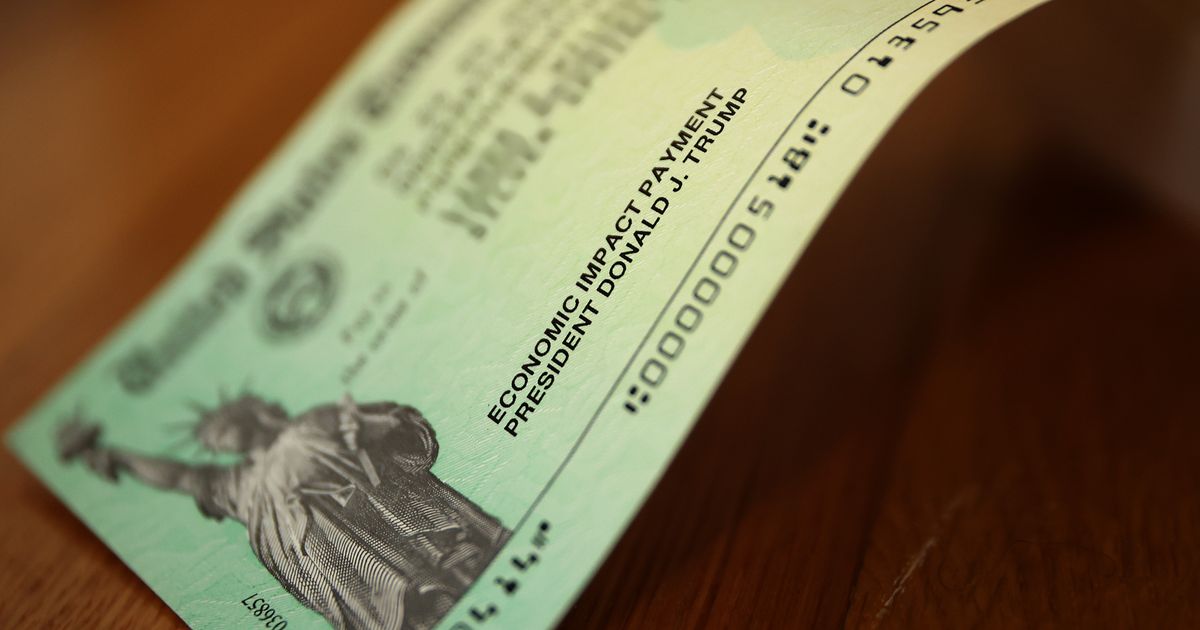

Washington, D.C. – Former President Donald Trump's recent suggestion of paying a national debt dividend in Dogecoin has sparked widespread derision and skepticism from economists and financial experts. The proposal, floated during a recent interview, lacks concrete details but suggests using the cryptocurrency to alleviate the nation's massive debt burden – a move many see as economically unsound and practically infeasible.

The core concept remains vague. Trump didn't specify the mechanism for distributing a Dogecoin dividend, the source of the Dogecoin itself (would the government purchase it? Mine it? A combination?), or how the market impact of such a massive influx of Dogecoin into the economy would be managed. This lack of detail underscores the proposal's inherent impracticality.

Experts point to several insurmountable hurdles. First, the sheer scale of the U.S. national debt (currently exceeding $31 trillion) would require an astronomical amount of Dogecoin. Even assuming a relatively low price for Dogecoin (a highly volatile asset whose value fluctuates dramatically), the purchase or acquisition of sufficient Dogecoin would be a monumental undertaking, likely exceeding the government's fiscal capabilities and possibly crashing the cryptocurrency market itself.

Furthermore, the volatility of Dogecoin presents a significant risk. Unlike stable, government-backed currencies, Dogecoin's value is subject to wild swings driven by speculation and market sentiment. A government-backed dividend in such an asset would expose citizens to unpredictable financial losses, potentially exacerbating existing economic inequality. This would represent a far cry from the purported goal of alleviating financial burdens.

Economists argue that a responsible approach to the national debt requires carefully crafted fiscal policies, including targeted spending cuts, tax reforms, and strategic investments. Simply distributing a cryptocurrency dividend would do nothing to address the underlying causes of the debt or promote long-term economic stability. In fact, it could severely destabilize the economy by introducing massive volatility into the financial system.

The proposal also raises serious concerns about potential conflicts of interest. Trump's past financial dealings, including his endorsement of various cryptocurrencies, raise questions about potential personal gain motivating this proposal. The lack of transparency surrounding the suggestion further fuels this concern.

While Trump's supporters may see the idea as a populist measure, experts are largely united in condemning it as economically irresponsible and politically unrealistic. The plan lacks any credible economic framework and ignores the complex realities of managing a national debt. The proposal serves, primarily, to highlight the significant gap between politically driven pronouncements and sound economic policy. Without a detailed and credible plan addressing the practical limitations and potential economic fallout, the Dogecoin dividend idea remains firmly in the realm of fantasy. The broader consensus within the economic community remains strongly against it.

Featured Posts

-

Criminal Case Diddys Legal Team Faces Shake Up

Feb 24, 2025

Criminal Case Diddys Legal Team Faces Shake Up

Feb 24, 2025 -

Snl 50th Anniversary Analyzing The Impact Of Covid 19 On Key Cast Members

Feb 24, 2025

Snl 50th Anniversary Analyzing The Impact Of Covid 19 On Key Cast Members

Feb 24, 2025 -

Mayor Bass Dismisses L A Fire Chief After Department Conflicts

Feb 24, 2025

Mayor Bass Dismisses L A Fire Chief After Department Conflicts

Feb 24, 2025 -

Elon Musk Demands Federal Employee Work Justifications

Feb 24, 2025

Elon Musk Demands Federal Employee Work Justifications

Feb 24, 2025 -

Bibas Hostages Remains Reportedly Returned To Israel

Feb 24, 2025

Bibas Hostages Remains Reportedly Returned To Israel

Feb 24, 2025

Latest Posts

-

Trumps Usps Overhaul Potential Benefits And Drawbacks For Consumers

Feb 24, 2025

Trumps Usps Overhaul Potential Benefits And Drawbacks For Consumers

Feb 24, 2025 -

Elon Musk Demands Work Justification From All Federal Employees

Feb 24, 2025

Elon Musk Demands Work Justification From All Federal Employees

Feb 24, 2025 -

The 2025 German Federal Election A Look Ahead At Key Contenders And Policies

Feb 24, 2025

The 2025 German Federal Election A Look Ahead At Key Contenders And Policies

Feb 24, 2025 -

Learning From Parking Mistakes In The Peak District

Feb 24, 2025

Learning From Parking Mistakes In The Peak District

Feb 24, 2025 -

Candid On Set Moments Actors Real Lives Revealed

Feb 24, 2025

Candid On Set Moments Actors Real Lives Revealed

Feb 24, 2025