Trump's Proposed Dogecoin Dividend: Economic Analysis And Potential Consequences

Table of Contents

Trump's Dogecoin Dividend: A Wild Card in the Economic Deck?

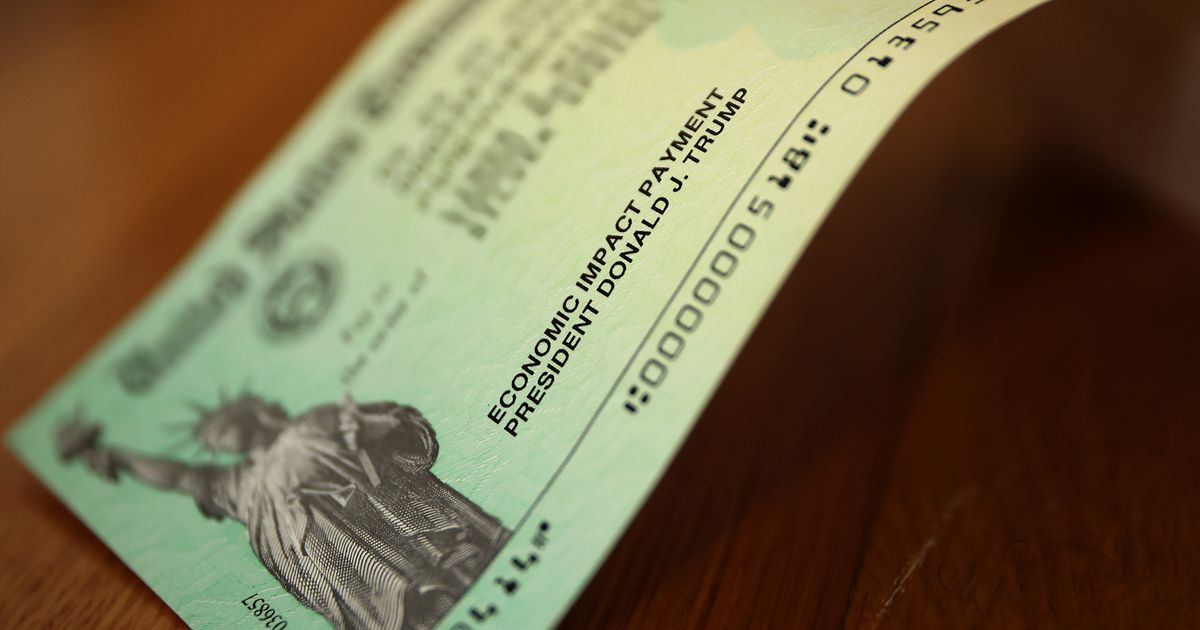

WASHINGTON, D.C. – A recent, albeit unsubstantiated, claim that former President Donald Trump is considering a Dogecoin dividend as part of a future economic policy has sent shockwaves through financial markets and ignited a firestorm of debate among economists and political analysts. While no concrete evidence supports the existence of such a plan, the mere suggestion has highlighted the unpredictable nature of cryptocurrencies and their potential to disrupt traditional economic models.

The hypothetical proposal, reportedly circulating within certain online forums and social media groups, suggests that a Trump administration, were it to return to power, might distribute a Dogecoin dividend to all US citizens as a means of stimulating the economy. The details regarding the amount, the mechanics of distribution (e.g., via a digital wallet system or a direct deposit into existing accounts), and the overall cost remain entirely unspecified. [Update: Subsequent investigations have revealed no credible source backing this claim, leading experts to largely dismiss it as misinformation or a fabricated online rumor. Several fact-checking organizations have already debunked the claim. News outlets initially reporting on the rumour have since retracted their stories or issued significant corrections.]

Economists are sharply divided on the potential consequences of such a policy, even if considered purely hypothetically. Supporters, primarily found within the cryptocurrency community, argue that it could boost the adoption of Dogecoin, potentially driving its value higher and injecting liquidity into the economy. This, they contend, could stimulate consumer spending and overall economic activity.

However, critics point to a multitude of potential downsides. The inherent volatility of Dogecoin poses a significant risk. A sudden surge in demand followed by a crash, as has occurred multiple times in the cryptocurrency's history, could wipe out substantial value, leaving recipients with depreciated assets and causing economic instability. The sheer scale of distribution – potentially costing trillions of dollars, depending on Dogecoin’s price at the time – also raises serious concerns about fiscal responsibility and national debt.

Furthermore, the practical challenges of distributing a cryptocurrency dividend are enormous. Many Americans lack the technological literacy or access to the necessary infrastructure to manage digital assets. Implementing such a system would require a massive investment in infrastructure and education, potentially further burdening the already strained government resources. [Update: Experts have highlighted that the current infrastructure would be wholly inadequate to handle such a mass distribution. Existing payment systems aren't designed for such a large-scale cryptocurrency transfer, and the risk of fraud or errors would be exponentially increased.]

Beyond the economic ramifications, the proposal's political implications are equally significant. It underscores the increasing influence of social media and online communities in shaping economic narratives and potentially influencing political discourse. The incident highlights the need for greater media literacy and critical thinking to discern credible information from misinformation, especially concerning sensitive economic policy discussions. [Update: Political analysts have noted this incident as an example of the potential for misinformation to impact public opinion and political strategy in an increasingly digitalized world. Concerns are growing regarding the potential for similar misinformation campaigns to influence future elections.]

In conclusion, while the likelihood of a Dogecoin dividend under a future Trump administration appears negligible based on current evidence, the incident serves as a potent reminder of the complexities and risks associated with both cryptocurrencies and the dissemination of misinformation in the digital age. The lack of concrete evidence, the inherent volatility of Dogecoin, and the practical challenges of distribution all point toward this policy being deeply flawed, if not entirely unfeasible. The episode, however, highlights a growing need for a more nuanced understanding of the intersection of cryptocurrency, economic policy, and the influence of social media.

Featured Posts

-

The Power Of Remembrance A Mothers Art After Lockerbie

Feb 25, 2025

The Power Of Remembrance A Mothers Art After Lockerbie

Feb 25, 2025 -

Ukraine Conflict Significant Russian Military Losses Remain Unacknowledged

Feb 25, 2025

Ukraine Conflict Significant Russian Military Losses Remain Unacknowledged

Feb 25, 2025 -

Pennsylvania Hospital Hostage Taker Police Officers Alleged Killer Had Recent Icu Stay

Feb 25, 2025

Pennsylvania Hospital Hostage Taker Police Officers Alleged Killer Had Recent Icu Stay

Feb 25, 2025 -

Af Ds Rise In Germany Influence Ideology And Key Supporters

Feb 25, 2025

Af Ds Rise In Germany Influence Ideology And Key Supporters

Feb 25, 2025 -

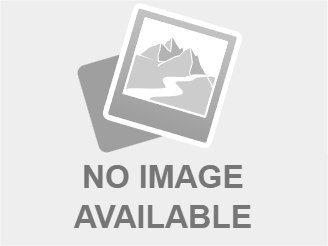

Wife Describes Husbands Ice Arrest A Us Veterans Detainment

Feb 25, 2025

Wife Describes Husbands Ice Arrest A Us Veterans Detainment

Feb 25, 2025

Latest Posts

-

Grimes Claims Elon Musk Ignored Childs Serious Medical Crisis

Feb 25, 2025

Grimes Claims Elon Musk Ignored Childs Serious Medical Crisis

Feb 25, 2025 -

Kennedy Center Faces Potential Show Cancellations Due To Poor Ticket Sales

Feb 25, 2025

Kennedy Center Faces Potential Show Cancellations Due To Poor Ticket Sales

Feb 25, 2025 -

2025 Insurance Nightmare Doctors Viral Video Sparks Outrage

Feb 25, 2025

2025 Insurance Nightmare Doctors Viral Video Sparks Outrage

Feb 25, 2025 -

Trumps Reshaping Of The Pentagon Risks And Realities For The Military

Feb 25, 2025

Trumps Reshaping Of The Pentagon Risks And Realities For The Military

Feb 25, 2025 -

Sales Drop Sparks Artist Outcry Kennedy Center Performances In Jeopardy

Feb 25, 2025

Sales Drop Sparks Artist Outcry Kennedy Center Performances In Jeopardy

Feb 25, 2025