Walmart Stock Falls On Weak Outlook, Tariff Concerns Weigh On Spending

Table of Contents

Walmart Stock Falls on Weak Outlook, Tariff Concerns Weigh on Spending

Walmart Inc. (WMT) shares tumbled [X]% on [Date], after the retail giant issued a weaker-than-expected outlook for the current quarter, citing concerns about inflation and the lingering impact of tariffs on consumer spending. The decline underscores growing anxieties among investors about the health of the consumer, a key driver of the U.S. economy. Walmart's disappointing forecast serves as a stark warning for other retailers and a potential harbinger of slower economic growth.

The company reported second-quarter earnings that, while exceeding analysts' estimates, fell short of internal projections. Earnings per share came in at [EPS figure], compared to analysts' consensus estimate of [Analyst estimate EPS figure]. While revenue growth of [Revenue Growth Percentage]% year-over-year appeared positive on the surface, the company's guidance for the crucial back-to-school and holiday shopping seasons proved to be the market's primary concern.

Walmart now expects comparable sales growth in the third quarter to be flat to slightly positive, a significant downgrade from previous forecasts. This subdued outlook is directly attributed to several factors. Firstly, persistent inflation, particularly in food and fuel prices, is squeezing consumer budgets, forcing shoppers to cut back on discretionary spending. Walmart's own data reveals a shift in consumer behavior, with shoppers trading down to cheaper options and prioritizing essential goods over non-essential purchases.

Secondly, the ongoing impact of tariffs, particularly on imported goods, continues to pose a challenge. While Walmart has made efforts to mitigate the impact of tariffs through various strategies, including sourcing goods domestically, the costs associated with these measures, and the overall inflationary pressure, have undoubtedly hampered its profitability and growth projections.

CEO Doug McMillon, in a statement accompanying the earnings release, acknowledged the challenging economic environment. He emphasized the company's commitment to offering value to its customers, highlighting initiatives to streamline operations and control costs. However, he also conceded that the current macroeconomic climate presented significant headwinds for the retail giant.

The stock's decline reflects investor sentiment that the challenges faced by Walmart are not unique to the company but rather indicative of a broader slowdown in consumer spending. This raises concerns about the overall economic health of the country and could trigger a ripple effect throughout the retail sector. Analysts are now revisiting their forecasts for other major retailers, anticipating similar downward revisions in their earnings expectations.

The fall in Walmart's stock price also underscores the ongoing debate surrounding the impact of government policies, specifically tariffs, on consumer spending and business performance. Critics argue that tariffs contribute to higher prices and reduce consumer purchasing power, while proponents maintain that tariffs are necessary to protect domestic industries. Walmart's experience, however, suggests that the impact of tariffs extends beyond the targeted sectors and significantly affects the overall retail landscape.

The coming months will be critical for Walmart and the broader retail industry. The success of the back-to-school and holiday shopping seasons will be crucial in determining the trajectory of consumer spending and, consequently, the performance of retail stocks. For now, Walmart's weaker-than-expected outlook serves as a cautionary tale of the challenges facing businesses in a high-inflationary, tariff-impacted economy. The market's reaction suggests investors remain wary about the resilience of the consumer and the broader economic outlook. Further analysis of consumer spending data and upcoming earnings reports from other major retailers will be needed to gauge the full extent of the impact.

Featured Posts

-

Hunter Schafer Highlights Transgender Rights After Passport Issue

Feb 22, 2025

Hunter Schafer Highlights Transgender Rights After Passport Issue

Feb 22, 2025 -

Clooney On The Farm The Actors Surprising Life Change

Feb 22, 2025

Clooney On The Farm The Actors Surprising Life Change

Feb 22, 2025 -

Hip Hop Legends Mother Voletta Wallace Dies At 78

Feb 22, 2025

Hip Hop Legends Mother Voletta Wallace Dies At 78

Feb 22, 2025 -

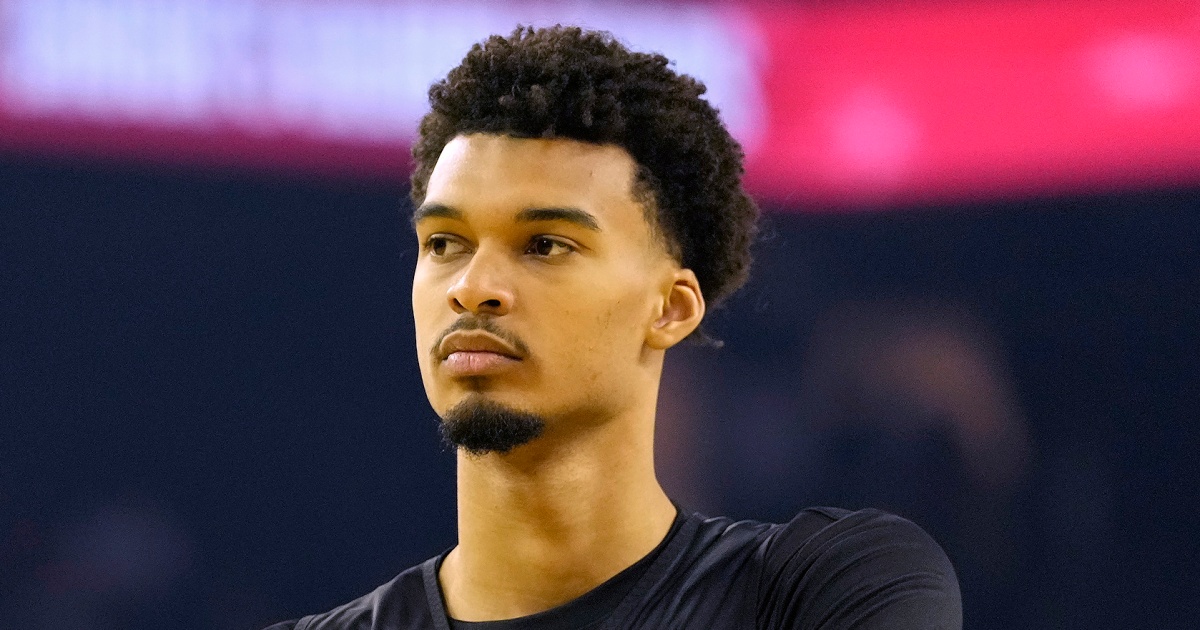

Deep Vein Thrombosis Diagnosis For Victor Wembanyama Recovery And Outlook

Feb 22, 2025

Deep Vein Thrombosis Diagnosis For Victor Wembanyama Recovery And Outlook

Feb 22, 2025 -

Unmasking The Source An Indian Firms Involvement In West Africas Opioid Crisis

Feb 22, 2025

Unmasking The Source An Indian Firms Involvement In West Africas Opioid Crisis

Feb 22, 2025

Latest Posts

-

Complete Ufc Seattle Results Winners Highlights And More

Feb 23, 2025

Complete Ufc Seattle Results Winners Highlights And More

Feb 23, 2025 -

Tel Aviv Receives Remains Claimed To Belong To Shiri Bibas

Feb 23, 2025

Tel Aviv Receives Remains Claimed To Belong To Shiri Bibas

Feb 23, 2025 -

West Hams 1 0 Victory Over Arsenal Key Moments And Analysis

Feb 23, 2025

West Hams 1 0 Victory Over Arsenal Key Moments And Analysis

Feb 23, 2025 -

One Goal Margin Millwall Triumphs Over Derby County

Feb 23, 2025

One Goal Margin Millwall Triumphs Over Derby County

Feb 23, 2025 -

Update Pope Francis Health Worsens Vatican Releases Statement

Feb 23, 2025

Update Pope Francis Health Worsens Vatican Releases Statement

Feb 23, 2025