Why Is Rivian Stock Falling? Investors React To Latest News

Table of Contents

Rivian's Rough Ride: Why the Electric Vehicle Maker's Stock Continues to Plummet

Rivian Automotive (RIVN), a high-profile player in the burgeoning electric vehicle (EV) market, has seen its stock price take a significant beating in recent months. While initial investor enthusiasm propelled the company to a stratospheric valuation, a confluence of factors has contributed to a sustained decline, leaving investors questioning the future of this once-promising EV startup.

Production Shortfalls and Delivery Delays: A primary driver of Rivian's stock woes is its persistent struggle to meet ambitious production targets. The company has consistently fallen short of its projected vehicle deliveries, a shortfall directly impacting revenue and profitability. [Specific numbers on production shortfalls and revised delivery estimates should be inserted here, citing the source – e.g., "Rivian reported producing only X,XXX vehicles in Q[Quarter], falling short of its projected X,XXX by Y% according to their Q[Quarter] earnings report."] This underperformance fuels concerns about the company's ability to scale its operations efficiently and compete effectively with established automakers like Tesla and Ford.

Rising Costs and Shrinking Margins: The EV industry, while experiencing explosive growth, is also characterized by intense competition and escalating costs. Rivian, like many of its competitors, is grappling with inflationary pressures on raw materials, supply chain disruptions, and increased manufacturing expenses. This squeeze on margins has translated into lower-than-expected profitability, prompting investor anxieties about the long-term financial sustainability of the company. [Insert specific data points here on rising costs, e.g., "The company cited a Z% increase in battery material costs in their latest earnings call," or "Supply chain issues resulted in a loss of $X million during Q[Quarter]," with appropriate sourcing].

Increased Competition and Market Saturation: The electric vehicle market is rapidly becoming crowded. Established automakers are aggressively investing in their own EV lines, presenting stiff competition for newer entrants like Rivian. The increased competition puts pressure on pricing, further impacting Rivian's already strained margins. [Include data about market share, competitor actions, and their impact on Rivian's pricing strategy here. For example: "Tesla's recent price cuts have put further pressure on Rivian's pricing strategy, impacting its profitability," referencing specific news articles or reports].

Investor Sentiment and Market Volatility: Beyond specific operational challenges, broader market conditions have also contributed to Rivian's stock decline. The overall market downturn, particularly affecting growth stocks, has negatively impacted investor sentiment towards high-valuation companies like Rivian. [Add specific market indices data here, such as the performance of the Nasdaq or S&P 500 in recent months, and their correlation to Rivian’s stock price. Reference reputable financial news sources].

Looking Ahead: The future of Rivian remains uncertain. The company has ambitious plans for expansion and new product launches. However, its success hinges on its ability to overcome its current challenges, improve its production efficiency, manage costs effectively, and navigate the increasingly competitive EV landscape. [Include details of any future plans or announcements from Rivian, such as new model launches, strategic partnerships, or cost-cutting measures. Reference press releases and official company statements]. Analysts remain divided on Rivian's long-term prospects, with some expressing cautious optimism about the company's potential, while others remain skeptical about its ability to achieve sustainable profitability. [Insert a range of analyst opinions and price targets here, citing reputable financial news sources]. The coming quarters will be critical in determining whether Rivian can regain investor confidence and chart a course towards sustainable growth.

Featured Posts

-

Reachers Season 3 Undercover Adventure A Breakdown Of All 8 Episodes

Feb 22, 2025

Reachers Season 3 Undercover Adventure A Breakdown Of All 8 Episodes

Feb 22, 2025 -

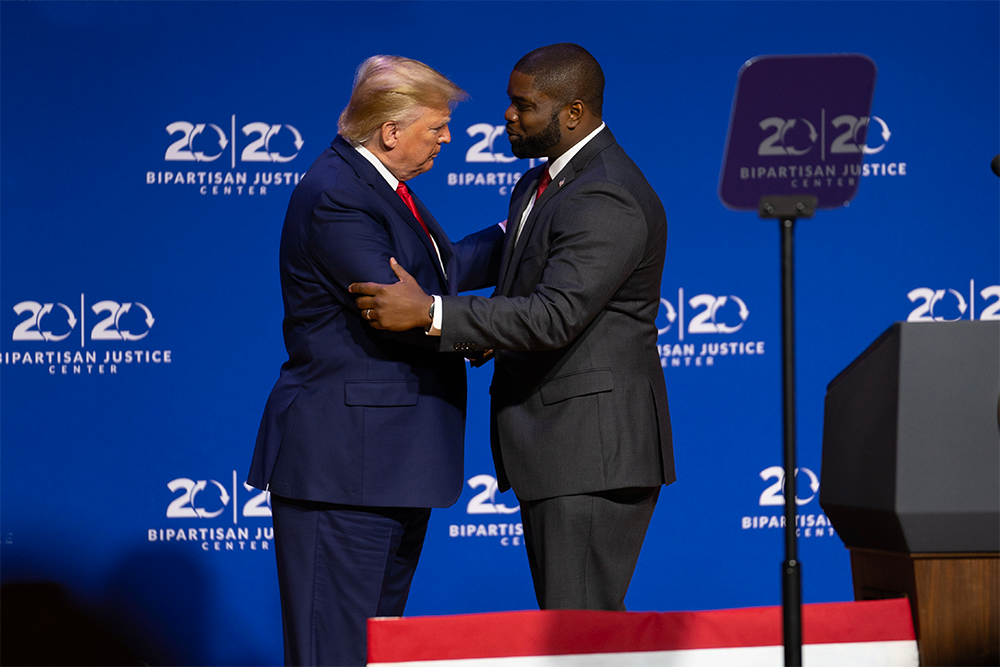

House Speaker Race Trumps Influence On Donalds Candidacy

Feb 22, 2025

House Speaker Race Trumps Influence On Donalds Candidacy

Feb 22, 2025 -

After 2025 Espn And Mlb To Sever Decades Long Partnership

Feb 22, 2025

After 2025 Espn And Mlb To Sever Decades Long Partnership

Feb 22, 2025 -

Live Stream Ncaa Mens Basketball Michigan State Vs Michigan Game Details

Feb 22, 2025

Live Stream Ncaa Mens Basketball Michigan State Vs Michigan Game Details

Feb 22, 2025 -

Report Dusty May Agrees To Contract To Lead Michigan Basketball

Feb 22, 2025

Report Dusty May Agrees To Contract To Lead Michigan Basketball

Feb 22, 2025

Latest Posts

-

Is Southampton Vs Brighton On Tv Today Live Stream Info

Feb 23, 2025

Is Southampton Vs Brighton On Tv Today Live Stream Info

Feb 23, 2025 -

Messis Late Assist Secures Inter Miami 2 2 Draw

Feb 23, 2025

Messis Late Assist Secures Inter Miami 2 2 Draw

Feb 23, 2025 -

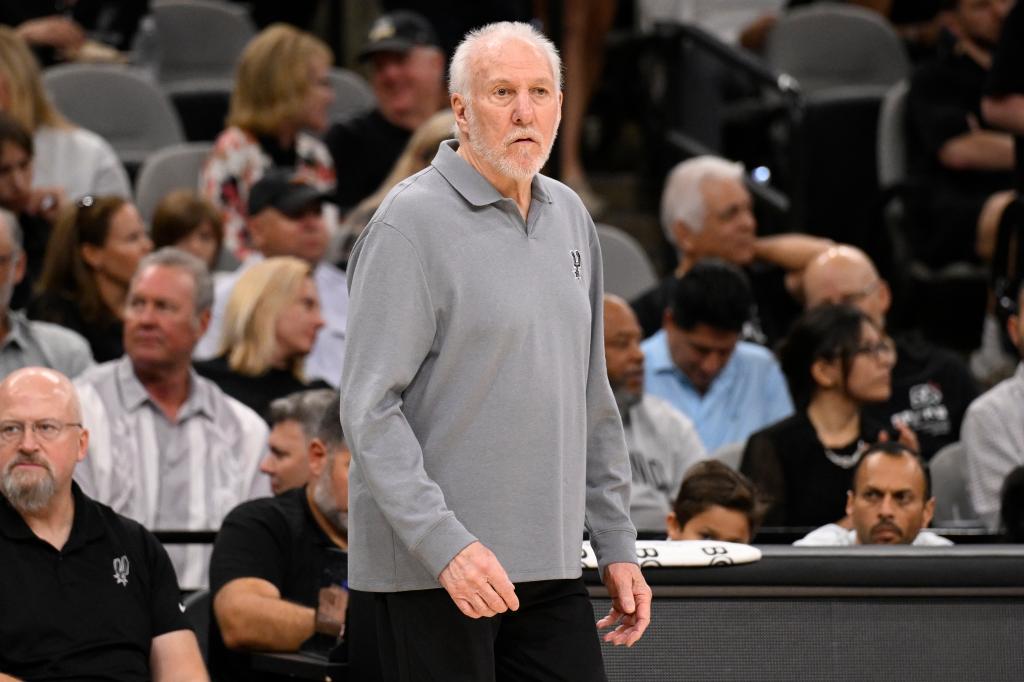

Popovichs Absence Whats Next For The San Antonio Spurs

Feb 23, 2025

Popovichs Absence Whats Next For The San Antonio Spurs

Feb 23, 2025 -

Live Updates Arsenal Vs West Ham Full Match Coverage

Feb 23, 2025

Live Updates Arsenal Vs West Ham Full Match Coverage

Feb 23, 2025 -

German Election 2024 The Economy And Immigration In Focus

Feb 23, 2025

German Election 2024 The Economy And Immigration In Focus

Feb 23, 2025