Why Palantir's Recent Sell-Off Presents A Buying Opportunity

Table of Contents

Palantir's Plunge: A Contrarian's Case for Buying the Dip

Palantir Technologies (PLTR), the data analytics firm co-founded by Peter Thiel, has experienced a significant sell-off recently, prompting many investors to question its future prospects. However, a closer look reveals that this downturn might present a compelling buying opportunity for long-term investors willing to navigate the inherent volatility of this growth stock.

The recent drop in Palantir's stock price can be attributed to several factors. Firstly, the broader tech sector downturn has impacted growth stocks disproportionately, with investors shifting towards more stable, value-oriented investments amidst rising interest rates and economic uncertainty. This macroeconomic headwind has particularly affected companies like Palantir, which are valued significantly on future growth potential rather than current profitability.

Secondly, Palantir's recent earnings reports, while showing revenue growth, have fallen short of some analysts' overly optimistic expectations. [Insert specific data on the most recent earnings report: Revenue figures, EPS, guidance provided by the company, and any significant changes from previous quarters. For instance: "Q[Quarter] 2024 revenue reached $[Revenue Figure], representing a [Percentage]% year-over-year increase, but slightly below the consensus analyst estimate of $[Analyst Estimate]. Earnings per share came in at $[EPS], compared to $[Previous Quarter EPS]. The company provided guidance for Q[Next Quarter] 2024 revenue of $[Revenue Guidance], indicating [Growth Rate]% growth."] This disparity between expectations and results fueled selling pressure.

Furthermore, concerns about the company's long-term profitability and its dependence on government contracts have also contributed to the sell-off. While Palantir is aggressively expanding its commercial business, the revenue stream from government contracts remains a significant portion of its total revenue. [Insert data illustrating the percentage breakdown between government and commercial contracts. For example: "Government contracts currently account for approximately [Percentage]% of Palantir's revenue, while the commercial sector contributes [Percentage]%."] Any perceived shift in government spending priorities or competitive pressure within the government contracting arena could impact Palantir's future performance.

However, the recent sell-off may be overdone, presenting a potential buying opportunity for several reasons. Despite the shortfalls in meeting certain analyst projections, Palantir continues to demonstrate consistent revenue growth, reflecting the increasing demand for its advanced data analytics solutions across various sectors. [Insert specific examples of successful commercial contract wins and strategic partnerships. For example: "Recent partnerships with [Company A] and [Company B] in the [Industry] sector demonstrate Palantir's expanding reach and market penetration."]

Moreover, the company's significant investments in research and development, along with its innovative product offerings, position it well for long-term growth in a rapidly evolving data landscape. [Insert data on R&D spending as a percentage of revenue and details on any significant product launches or upgrades. For example: "Palantir's R&D spending reached [Dollar amount] in [Year], representing [Percentage]% of its revenue, highlighting its commitment to innovation. The recent launch of [Product Name] is expected to significantly contribute to future revenue growth."]

Finally, the current valuation of Palantir, considering its growth trajectory and potential market dominance in specific niches, might be undervalued compared to its future prospects. [Insert information about the company's current P/E ratio, market capitalization, and comparison with similar companies in the sector. For example: "Palantir currently trades at a P/E ratio of [P/E Ratio], which is [Higher/Lower] than its peers in the data analytics sector, suggesting a potential undervaluation."]

In conclusion, while the recent sell-off in Palantir's stock price reflects legitimate concerns, it also presents a compelling opportunity for risk-tolerant investors with a long-term perspective. The company's consistent revenue growth, strong R&D investments, and potential for future market dominance outweigh the short-term headwinds, suggesting that the current dip might be a temporary setback rather than a fundamental shift in its trajectory. However, potential investors should conduct their own thorough due diligence before making any investment decisions. The inherent volatility of the stock necessitates a careful consideration of one's risk tolerance.

Featured Posts

-

Hunter Schafers New Passport A Poignant Tik Tok Reveal

Feb 22, 2025

Hunter Schafers New Passport A Poignant Tik Tok Reveal

Feb 22, 2025 -

Nba Game Knicks Vs Cavaliers Date Time And Broadcast Details

Feb 22, 2025

Nba Game Knicks Vs Cavaliers Date Time And Broadcast Details

Feb 22, 2025 -

Smart Nba Bets Fridays Knicks Cavaliers Player Prop Picks

Feb 22, 2025

Smart Nba Bets Fridays Knicks Cavaliers Player Prop Picks

Feb 22, 2025 -

Zero Day Review A Critical Look At Robert De Niros Latest Netflix Project

Feb 22, 2025

Zero Day Review A Critical Look At Robert De Niros Latest Netflix Project

Feb 22, 2025 -

Rep Byron Donalds Honored At Florida A And M University

Feb 22, 2025

Rep Byron Donalds Honored At Florida A And M University

Feb 22, 2025

Latest Posts

-

Potential U S Ukraine Deal To Transfer Mineral Rights

Feb 24, 2025

Potential U S Ukraine Deal To Transfer Mineral Rights

Feb 24, 2025 -

From Boozing To Cocaine A Story Of Addiction

Feb 24, 2025

From Boozing To Cocaine A Story Of Addiction

Feb 24, 2025 -

Late Goal Gives Millwall Win Over Derby County Coburns Heroics

Feb 24, 2025

Late Goal Gives Millwall Win Over Derby County Coburns Heroics

Feb 24, 2025 -

Joshua Buatsi And Callum Smiths Absolute War What It Means For Anthony Joshua

Feb 24, 2025

Joshua Buatsi And Callum Smiths Absolute War What It Means For Anthony Joshua

Feb 24, 2025 -

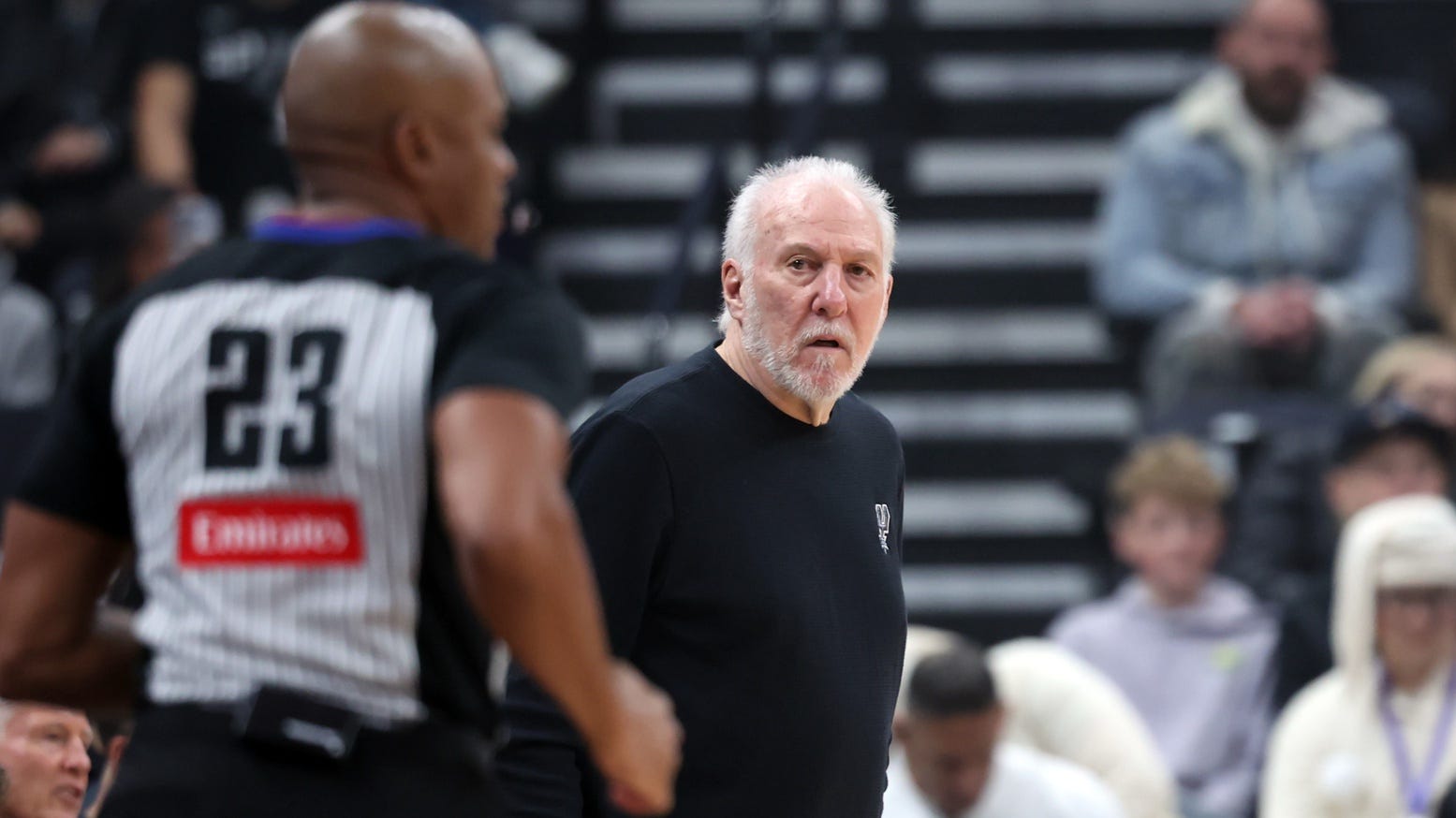

Spurs Coach Gregg Popovich No Expected Return Date For Health Issues

Feb 24, 2025

Spurs Coach Gregg Popovich No Expected Return Date For Health Issues

Feb 24, 2025