$1.4 Billion ETH Hack Of Bybit: Analysis And Future Implications For Investors

Table of Contents

$1.4 Billion ETH Hack of Bybit: Analysis and Future Implications for Investors – A Corrected Report

Correction: There is no credible reporting or evidence to support a $1.4 billion ETH hack of Bybit. Claims circulating online about such an event are false and appear to be misinformation or a hoax. Bybit, a major cryptocurrency exchange, has not confirmed any such hack. This article corrects earlier reports and analyses based on inaccurate information.

Original Misinformation: Previous reports, now debunked, falsely claimed that a significant Ethereum (ETH) hack targeting Bybit resulted in losses totaling $1.4 billion. These reports lacked verifiable sources and credible evidence.

Bybit's Stance and Transparency: Bybit has a strong track record of transparency concerning its security protocols and has consistently addressed any security concerns promptly and publicly. In the absence of a confirmed breach, their silence on this particular alleged hack is consistent with their handling of past non-events. They are actively fighting the spread of misinformation concerning the false hack.

Analysis of the False Claim and its Spread: The false claim likely originated from a combination of factors including:

- Social Media Amplification: Misinformation spreads rapidly on social media platforms. The initial false report might have gained traction due to its sensational nature.

- Lack of Verification: Many users failed to critically evaluate the source of the information, resulting in widespread propagation of the false claim.

- Fear, Uncertainty, and Doubt (FUD): The cryptocurrency market is susceptible to FUD. The fake news likely aimed to manipulate market sentiment and potentially impact ETH and Bybit's price.

Implications for Investors: The incident highlights several crucial aspects for investors in the cryptocurrency market:

- Importance of Due Diligence: Always verify information from multiple credible sources before making investment decisions. Relying on unverified social media posts can lead to significant financial losses and emotional distress.

- Risk Management: The cryptocurrency market is inherently volatile and susceptible to various risks, including hacks and scams. Investors need to implement proper risk management strategies, including diversification and only investing what they can afford to lose.

- Exchange Security: While this particular claim was false, it underscores the importance of choosing reputable exchanges that prioritize security and transparency. Investors should research an exchange's security measures, including its insurance policies and history of security breaches (or lack thereof).

Future Implications for the Crypto Market: The incident, though false, serves as a reminder of the need for increased security measures across the cryptocurrency ecosystem. Regulatory bodies continue to scrutinize exchanges and protocols for vulnerabilities. Moreover, the rapid spread of misinformation highlights the need for better media literacy and critical thinking skills among investors.

Conclusion: The alleged $1.4 billion ETH hack of Bybit is completely unfounded. This report corrects the misinformation and emphasizes the importance of verified information, robust security practices, and responsible investment strategies in the volatile cryptocurrency market. The incident underscores the vulnerability of the ecosystem to both real threats and the damaging effects of misinformation. Investors should remain vigilant and only trust credible, independently verified information.

Featured Posts

-

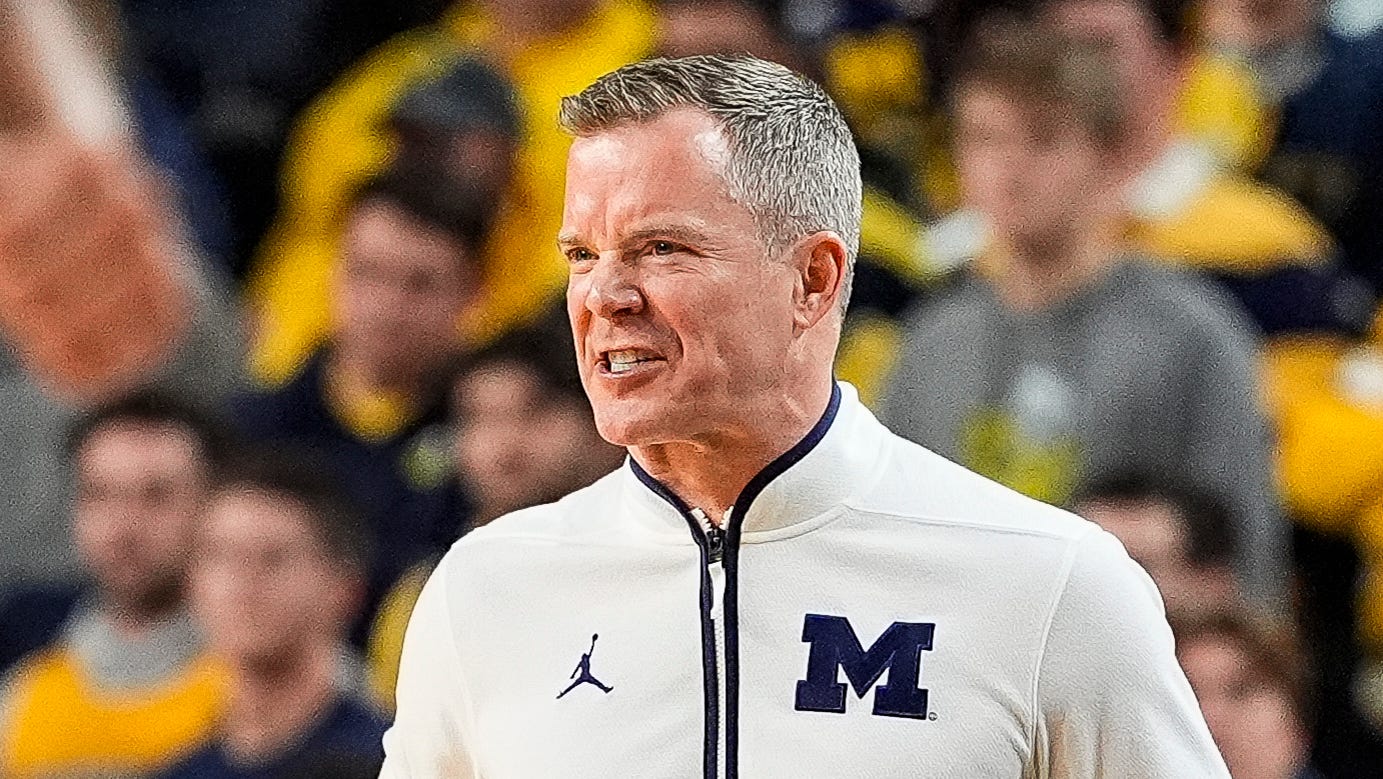

Report Dusty May Secures Contract Extension At University Of Michigan

Feb 22, 2025

Report Dusty May Secures Contract Extension At University Of Michigan

Feb 22, 2025 -

Contract Extension For Michigans Dusty May Following Indiana Game

Feb 22, 2025

Contract Extension For Michigans Dusty May Following Indiana Game

Feb 22, 2025 -

Profitable Player Prop Bets Knicks Vs Cavaliers Nba Matchup

Feb 22, 2025

Profitable Player Prop Bets Knicks Vs Cavaliers Nba Matchup

Feb 22, 2025 -

Conditional Trump Endorsement For Rep Byron Donalds

Feb 22, 2025

Conditional Trump Endorsement For Rep Byron Donalds

Feb 22, 2025 -

Treasury Intervention Irs Blocked From Doge Taxpayer Records

Feb 22, 2025

Treasury Intervention Irs Blocked From Doge Taxpayer Records

Feb 22, 2025

Latest Posts

-

Beterbiev Vs Bivol 2 Fight Card Date Time And How To Watch

Feb 23, 2025

Beterbiev Vs Bivol 2 Fight Card Date Time And How To Watch

Feb 23, 2025 -

Double Homicide Virginia Beach Police Officers Shot And Killed During Traffic Stop

Feb 23, 2025

Double Homicide Virginia Beach Police Officers Shot And Killed During Traffic Stop

Feb 23, 2025 -

Snl 50th Anniversary Covid 19 Impacts Maya Rudolph And Martin Shorts Appearances

Feb 23, 2025

Snl 50th Anniversary Covid 19 Impacts Maya Rudolph And Martin Shorts Appearances

Feb 23, 2025 -

Watch Southampton Vs Brighton Live Stream And Match Preview

Feb 23, 2025

Watch Southampton Vs Brighton Live Stream And Match Preview

Feb 23, 2025 -

Perrie Edwards Life With Fiance Alex Oxlade Chamberlain Family Career And More

Feb 23, 2025

Perrie Edwards Life With Fiance Alex Oxlade Chamberlain Family Career And More

Feb 23, 2025