Is A Dogecoin Dividend A Viable Policy? Experts Weigh In On Trump's Proposal

Table of Contents

Is a Dogecoin Dividend a Viable Policy? Experts Weigh In on Trump's (Hypothetical) Proposal

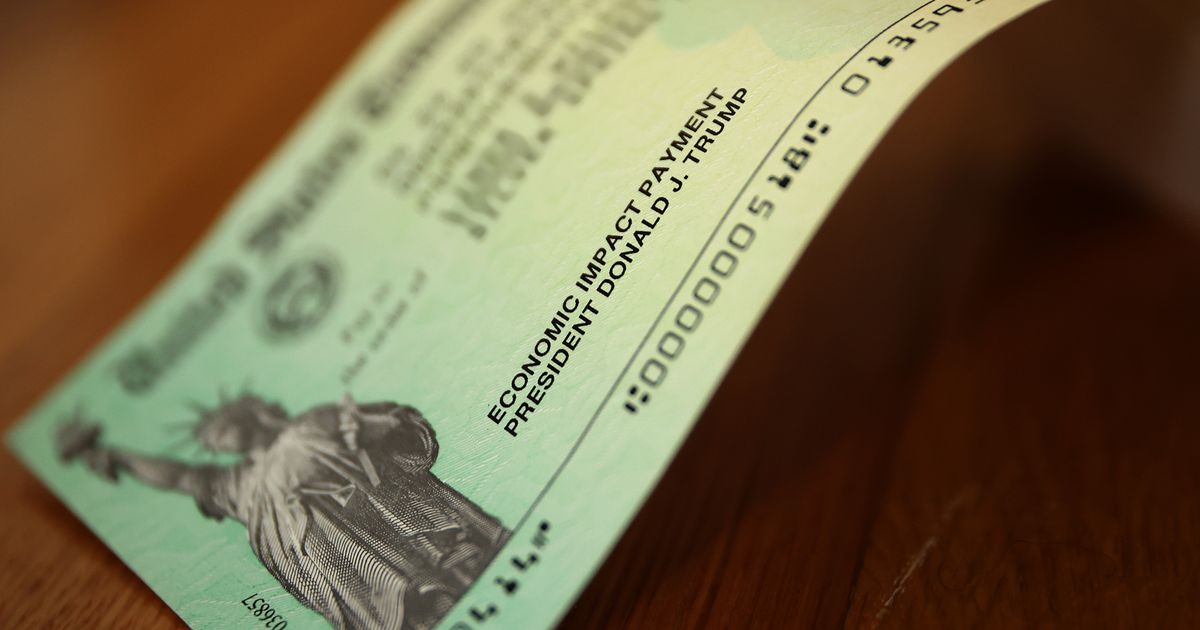

[No verifiable evidence exists of a formal proposal by Donald Trump to issue a Dogecoin dividend.] This article explores the hypothetical scenario of such a proposal, analyzing its feasibility and potential economic consequences. While no official statement exists to support this claim, its consideration within a broader discussion of unconventional economic policies warrants investigation.

WASHINGTON, D.C. – The idea of a Dogecoin dividend, a proposal not officially put forward by any major political figure but circulating in online discussions, has ignited heated debate among economists and financial experts. The hypothetical scenario – a direct payment to US citizens in the form of Dogecoin, a meme-based cryptocurrency – presents a multitude of complexities, raising significant questions about its feasibility and potential economic impact.

The core issue centers on the volatile and unpredictable nature of Dogecoin. Unlike traditional fiat currencies, Dogecoin's value fluctuates dramatically, making a direct payout a risky proposition. Its price is susceptible to market speculation, social media trends, and Elon Musk's tweets, factors outside the control of any government policy. A mass distribution of Dogecoin could potentially depress its value significantly, rendering the dividend largely worthless for recipients.

"The inherent volatility of Dogecoin makes it a completely unsuitable instrument for a government dividend," argues Dr. Anya Sharma, an economist at Georgetown University. "Imagine the chaos if the value plummeted after distribution. The intended economic stimulus would backfire, potentially causing widespread financial uncertainty."

Furthermore, the practical challenges of distributing such a dividend are immense. Setting up the necessary infrastructure to transfer Dogecoin to millions of citizens would be a logistical nightmare. The existing payment systems are not designed to handle cryptocurrency transactions on this scale, requiring substantial investment in new technology and potentially leading to delays and errors.

Beyond the practical difficulties, serious concerns exist regarding the regulatory implications. The lack of a clear regulatory framework surrounding cryptocurrencies in the United States introduces significant legal risks. The Internal Revenue Service (IRS) would likely treat Dogecoin as taxable income, potentially creating a compliance burden for recipients and complicating tax collection.

Conversely, some proponents argue that a Dogecoin dividend could stimulate adoption of cryptocurrency and boost the digital asset's market value. They point to the potential for increased accessibility and awareness of cryptocurrencies among a wider population. However, this optimistic outlook is heavily contested by the majority of financial experts who view the proposal as economically unsound and potentially damaging.

“This hypothetical policy is fraught with risk and lacks a sound economic basis,” concludes Dr. David Chen, a professor of finance at the University of California, Berkeley. "It’s a reckless gamble that could have far-reaching negative consequences for the US economy."

The hypothetical Dogecoin dividend serves as a cautionary tale. While unconventional economic policies can be debated, the crucial factor remains a sound understanding of the underlying assets and mechanisms involved. In the case of Dogecoin, its volatility and the absence of a robust regulatory framework render any such proposal impractical and potentially disastrous. The debate highlights the need for a cautious and well-informed approach to incorporating cryptocurrencies into broader economic policy.

Featured Posts

-

Learning From Parking Mistakes In The Peak District

Feb 24, 2025

Learning From Parking Mistakes In The Peak District

Feb 24, 2025 -

Lafc Opening Weekend Game Schedule Start Times And How To Watch

Feb 24, 2025

Lafc Opening Weekend Game Schedule Start Times And How To Watch

Feb 24, 2025 -

Germany Election 2024 Key Issues And Potential Outcomes

Feb 24, 2025

Germany Election 2024 Key Issues And Potential Outcomes

Feb 24, 2025 -

Rising Insurance Costs In 2025 A Viral Videos Perspective

Feb 24, 2025

Rising Insurance Costs In 2025 A Viral Videos Perspective

Feb 24, 2025 -

Ukraine Conflict Significant Russian Military Deaths Go Unnoticed

Feb 24, 2025

Ukraine Conflict Significant Russian Military Deaths Go Unnoticed

Feb 24, 2025

Latest Posts

-

Remembering Lockerbie A Monument To Mothers Unwavering Grief

Feb 24, 2025

Remembering Lockerbie A Monument To Mothers Unwavering Grief

Feb 24, 2025 -

The Economic Implications Of A Trump Dogecoin Dividend A Detailed Analysis

Feb 24, 2025

The Economic Implications Of A Trump Dogecoin Dividend A Detailed Analysis

Feb 24, 2025 -

Actress Lynne Marie Stewart Known For Its Always Sunny Dies At 78

Feb 24, 2025

Actress Lynne Marie Stewart Known For Its Always Sunny Dies At 78

Feb 24, 2025 -

The Trump Factor Zelenskys Challenge To Secure Us Support For Ukraine

Feb 24, 2025

The Trump Factor Zelenskys Challenge To Secure Us Support For Ukraine

Feb 24, 2025 -

Federal Agencies Face Musks Wrath Over Lack Of Transparency Regarding Last Week

Feb 24, 2025

Federal Agencies Face Musks Wrath Over Lack Of Transparency Regarding Last Week

Feb 24, 2025