Is A Dogecoin Dividend Feasible? Analyzing Trump's Controversial Proposal

Table of Contents

Is a Dogecoin Dividend Feasible? Analyzing Trump's Controversial Proposal

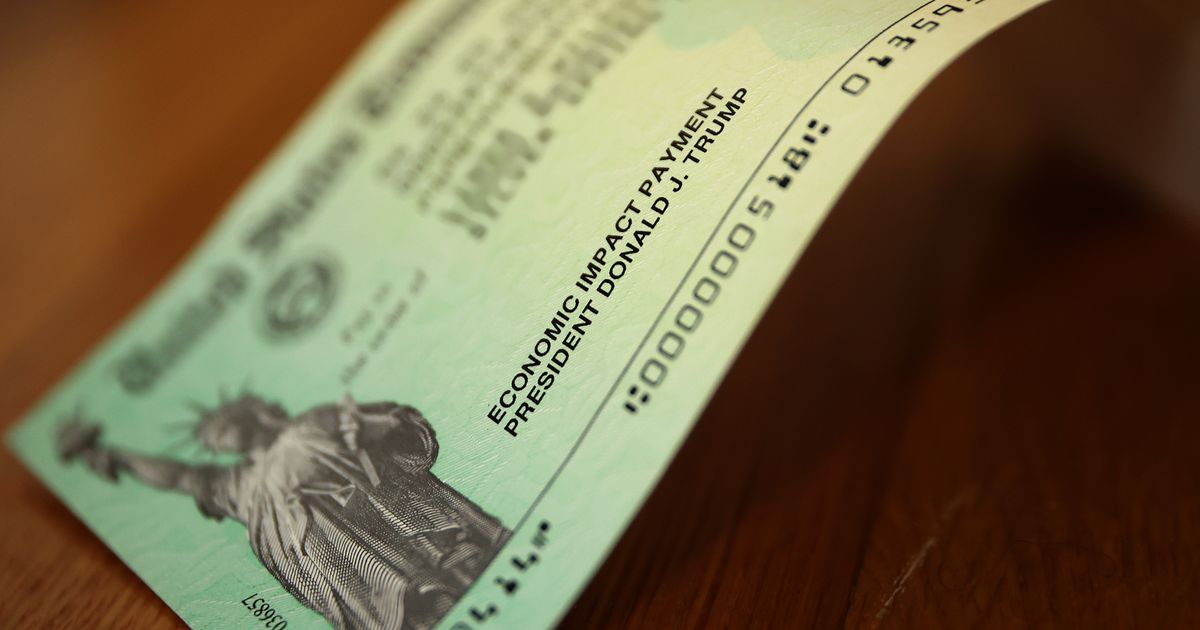

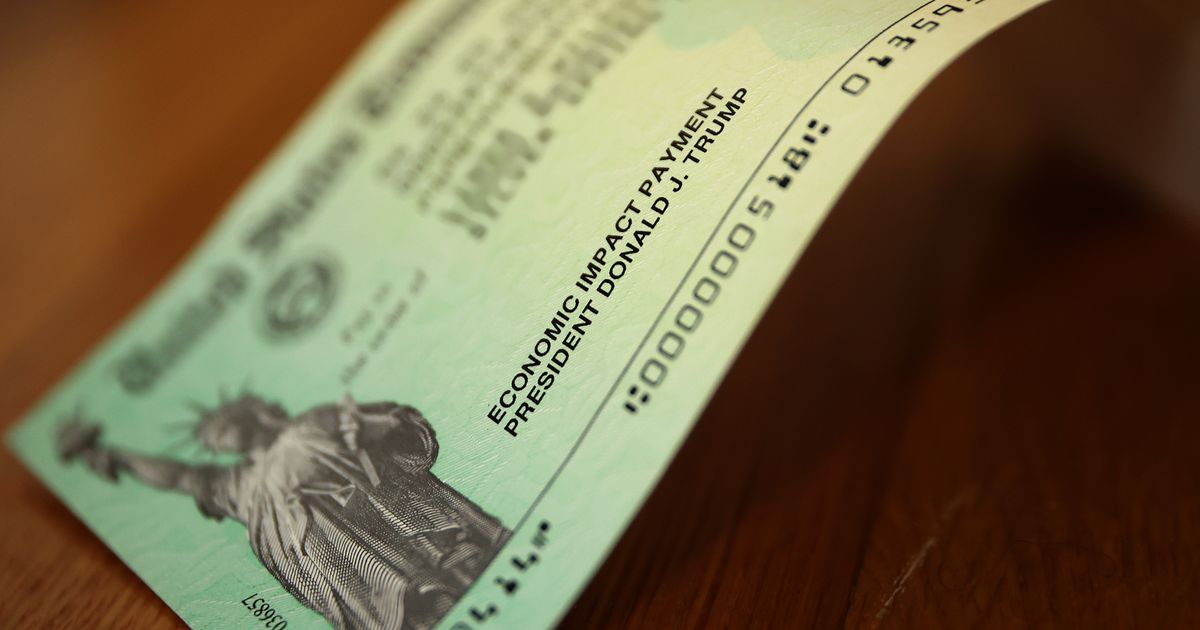

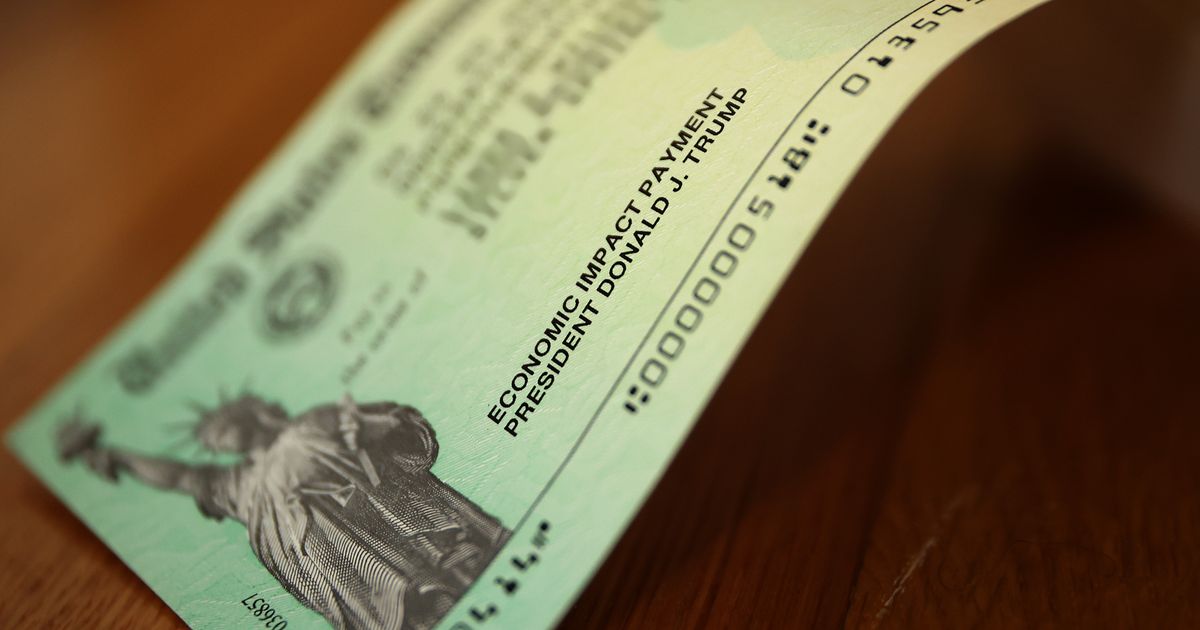

WASHINGTON, D.C. – A recent proposal by former President Donald Trump to distribute a Dogecoin dividend to every American citizen has ignited a firestorm of debate. The plan, unveiled [on the date of the proposal's unveiling – insert date here] during a [location of unveiling – insert location, e.g., campaign rally, press conference] speech, immediately sparked controversy among economists, financial analysts, and the general public. While the precise details of Trump's proposal remain somewhat vague [insert details about vagueness, e.g., lack of specifics on funding mechanism, distribution method, etc.], the core concept raises significant questions about its feasibility and potential consequences.

The central challenge lies in the inherent volatility of Dogecoin. Unlike traditional fiat currencies or established assets, Dogecoin's value is highly susceptible to market fluctuations and speculative trading. Its price has historically demonstrated dramatic swings, making it an incredibly risky asset for a large-scale government distribution. [Insert data on Dogecoin's price volatility, perhaps including a chart or graph showing historical price fluctuations. Cite the source of the data]. Distributing Dogecoin as a dividend would therefore expose millions of Americans to potentially significant financial losses if the cryptocurrency's value were to plummet after the distribution.

Beyond the volatility issue, the mechanics of such a widespread distribution present enormous logistical hurdles. The process would necessitate the creation of a robust and secure system capable of delivering Dogecoin to potentially hundreds of millions of individual digital wallets. This would require significant technological infrastructure, substantial investment, and careful coordination to prevent fraud and ensure equitable distribution. [Insert details about existing mechanisms for crypto distribution and whether they scale to this level, citing sources]. The cost associated with establishing and managing such a system could dwarf the potential benefit.

Furthermore, the funding mechanism for this dividend remains unclear. Trump's proposal lacks specifics on how the government would acquire the necessary amount of Dogecoin. Buying such a massive quantity on the open market could drastically inflate the cryptocurrency's price, potentially triggering a speculative bubble and ultimately harming the very people the dividend is intended to benefit. [Insert analysis of the potential market impact of a large-scale Dogecoin purchase by the government. Cite economic models or expert opinions]. Alternatively, mining the cryptocurrency would require significant energy expenditure, raising environmental concerns.

The legal and regulatory implications are equally significant. The legality of a government distributing a cryptocurrency as a dividend is untested territory. [Insert legal analysis or expert quotes on the legal ramifications of such a move. Cite relevant laws or regulations]. It would almost certainly require significant changes to existing financial regulations and could potentially face legal challenges.

Finally, the economic impact is uncertain. While proponents argue a Dogecoin dividend could stimulate the economy by boosting consumer spending, critics counter that the inherent volatility of Dogecoin could lead to unpredictable and potentially negative consequences. [Include analysis from economists on the potential economic impacts, both positive and negative, citing their affiliations and expertise]. The risk of widespread financial losses outweighs any potential economic benefits.

In conclusion, while the idea of a Dogecoin dividend is undeniably attention-grabbing, a thorough analysis reveals significant obstacles. The cryptocurrency's volatility, the logistical challenges of distribution, the uncertain funding mechanisms, and the potential legal and regulatory hurdles raise serious concerns about its feasibility and potential negative consequences. The proposal lacks a clear and robust plan to address these fundamental issues, rendering it a highly impractical and potentially harmful policy initiative.

Featured Posts

-

West Ham Vs Arsenal Live Score Commentary And Post Match Report

Feb 24, 2025

West Ham Vs Arsenal Live Score Commentary And Post Match Report

Feb 24, 2025 -

Key Dates And Candidates For Germanys 2025 Election

Feb 24, 2025

Key Dates And Candidates For Germanys 2025 Election

Feb 24, 2025 -

Governors Statement Virginia Beach Police Show Exceptional Bravery

Feb 24, 2025

Governors Statement Virginia Beach Police Show Exceptional Bravery

Feb 24, 2025 -

Full Mls Opening Weekend Schedule Find Lafcs Game And How To Watch

Feb 24, 2025

Full Mls Opening Weekend Schedule Find Lafcs Game And How To Watch

Feb 24, 2025 -

Southampton 0 0 Brighton Live Score And Match Report

Feb 24, 2025

Southampton 0 0 Brighton Live Score And Match Report

Feb 24, 2025

Latest Posts

-

Lawyer Requests Dismissal From Sean Combs Legal Proceedings

Feb 24, 2025

Lawyer Requests Dismissal From Sean Combs Legal Proceedings

Feb 24, 2025 -

Is A Dogecoin Dividend A Viable Policy Examining Trumps Proposal

Feb 24, 2025

Is A Dogecoin Dividend A Viable Policy Examining Trumps Proposal

Feb 24, 2025 -

Markles Netflix Project Insights From Her Vision Board

Feb 24, 2025

Markles Netflix Project Insights From Her Vision Board

Feb 24, 2025 -

Policy Gridlock How Democratic States Are Thwarting Trump

Feb 24, 2025

Policy Gridlock How Democratic States Are Thwarting Trump

Feb 24, 2025 -

Delta Los Angeles Flight Makes Emergency Landing Due To Smoke

Feb 24, 2025

Delta Los Angeles Flight Makes Emergency Landing Due To Smoke

Feb 24, 2025