Rivian Stock Takes A Hit After Cutting 2023 Production Targets

Table of Contents

Rivian Stock Plunges After Slashing 2023 Production Targets

Rivian Automotive, Inc. (RIVN) saw its stock price plummet on [Date of Stock Drop – e.g., August 9, 2024] after the electric vehicle (EV) maker announced a significant reduction in its 2023 production targets. The company now expects to produce between [Revised Lower Production Target – e.g., 32,000] and [Revised Upper Production Target – e.g., 34,000] vehicles this year, a considerable drop from its previous guidance of [Original Production Target – e.g., 50,000]. This downward revision sent shockwaves through the market, highlighting the ongoing challenges faced by the burgeoning EV industry.

The announcement, made [Time of Announcement – e.g., after the market closed] on [Date of Announcement – e.g., August 8, 2024], cited [Specific Reasons for Production Cut – e.g., supply chain constraints, particularly regarding battery cell availability, and increased production complexities at its Illinois factory] as the primary reasons for the shortfall. The company emphasized its focus on improving production efficiency and quality control, suggesting that prioritizing fewer, higher-quality vehicles was a strategic decision in the long run. However, investors reacted negatively, interpreting the revised targets as a sign of operational difficulties and potentially slower-than-expected growth.

Rivian's stock price fell by [Percentage Drop – e.g., 12%] in after-hours trading following the announcement and continued its decline in the subsequent trading session. This marked [Description of Stock Performance in Relation to Previous Performance – e.g., the largest single-day percentage drop in the stock's price since its initial public offering (IPO) in November 2021]. The company's market capitalization experienced a significant decrease, erasing [Dollar Amount or Percentage Loss in Market Cap – e.g., billions of dollars] in value.

The reduced production targets raise concerns about Rivian's ability to compete effectively with established automakers and other emerging EV players. The company faces stiff competition from industry giants like Tesla, Ford, and General Motors, all of which are ramping up their EV production and expanding their market share. Rivian's relatively small production volume, even at its original target, already positioned it as a niche player in a rapidly growing market. The revised targets further exacerbate these competitive pressures.

Analysts expressed mixed reactions to the news. Some highlighted the long-term strategic benefits of prioritizing quality over quantity, suggesting that a focus on improving production efficiency could pay dividends in the future. Others, however, expressed skepticism, pointing to the potential for further production delays and the ongoing challenges related to supply chain disruptions. The long-term impact of these revised targets on Rivian's financial performance and its ability to achieve its ambitious growth goals remains to be seen.

The company's leadership reaffirmed its commitment to its long-term vision and reiterated its plans for future product development and expansion. However, the significant production cut serves as a stark reminder of the complexities and challenges inherent in establishing a successful EV manufacturing business. The market's negative reaction underscores the importance of meeting production targets and demonstrating consistent, sustainable growth in the fiercely competitive EV landscape. Investors will be closely watching Rivian's performance in the coming quarters to gauge its ability to overcome these hurdles and deliver on its promises. The company's next earnings report will be closely scrutinized for further details on its operational efficiency improvements and future production plans.

Featured Posts

-

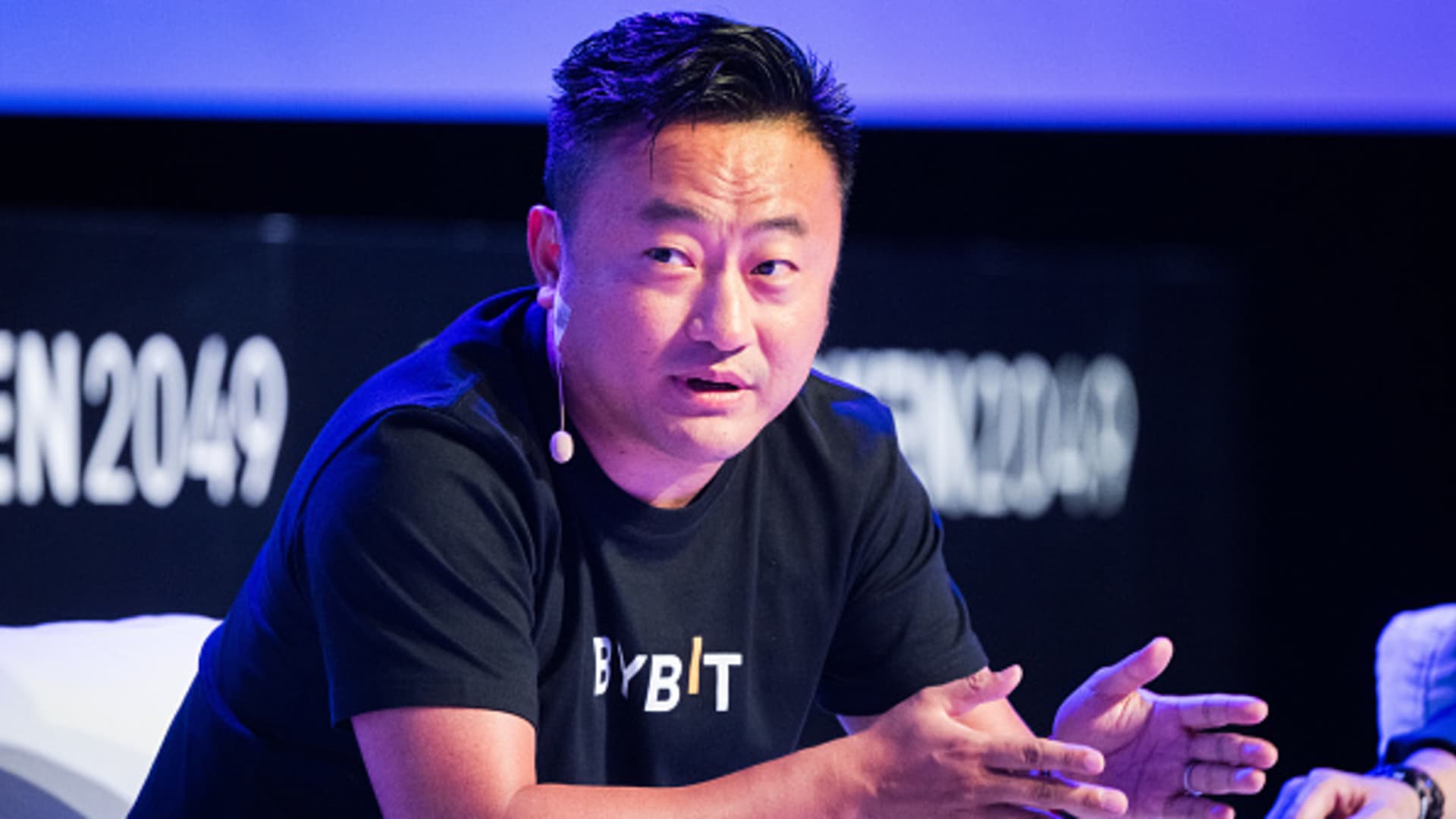

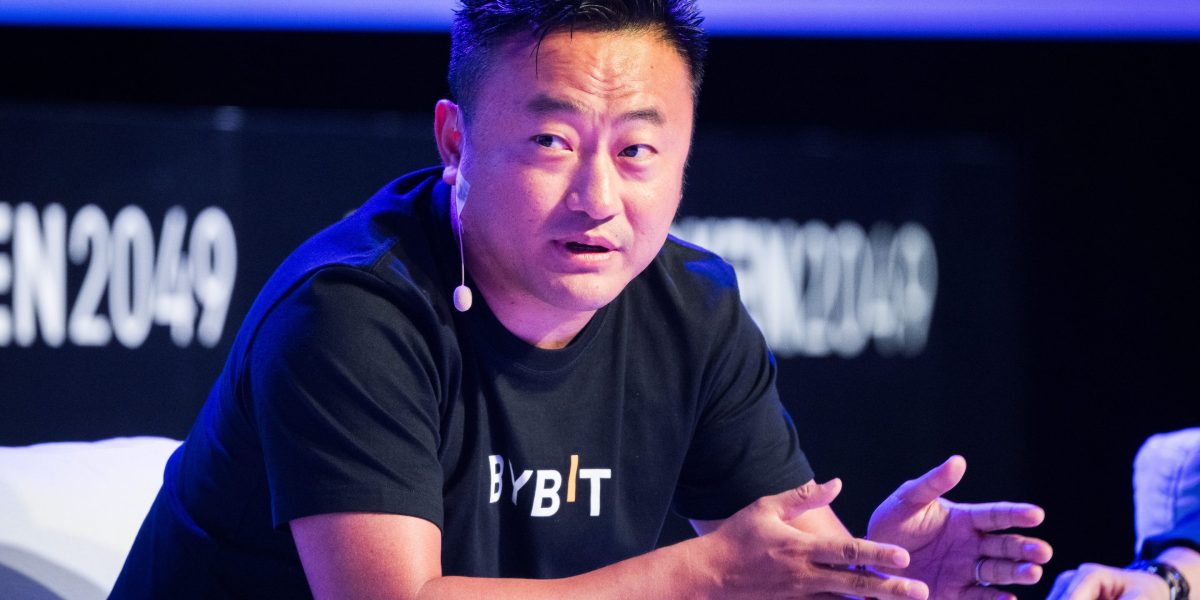

Record Breaking Crypto Theft Hackers Drain 1 5 Billion From Bybit

Feb 22, 2025

Record Breaking Crypto Theft Hackers Drain 1 5 Billion From Bybit

Feb 22, 2025 -

Movie Guru Reviews The Monkey S Gross Out Humor And The Gorge S

Feb 22, 2025

Movie Guru Reviews The Monkey S Gross Out Humor And The Gorge S

Feb 22, 2025 -

Major Crypto Security Breach Bybit Reports 1 4 Billion Loss

Feb 22, 2025

Major Crypto Security Breach Bybit Reports 1 4 Billion Loss

Feb 22, 2025 -

Death Of Voletta Wallace Notorious B I G S Mother Passes Away At 78

Feb 22, 2025

Death Of Voletta Wallace Notorious B I G S Mother Passes Away At 78

Feb 22, 2025 -

Wizards Trail Bucks 84 75 Heading Into The Final Quarter

Feb 22, 2025

Wizards Trail Bucks 84 75 Heading Into The Final Quarter

Feb 22, 2025

Latest Posts

-

Arsenal Thrown Off By West Ham In Premier League Clash

Feb 23, 2025

Arsenal Thrown Off By West Ham In Premier League Clash

Feb 23, 2025 -

Bueckers Leads U Conn To Win Against Butler Game Recap

Feb 23, 2025

Bueckers Leads U Conn To Win Against Butler Game Recap

Feb 23, 2025 -

Could Fleetwood Macs Rumours Reclaim The No 1 Spot

Feb 23, 2025

Could Fleetwood Macs Rumours Reclaim The No 1 Spot

Feb 23, 2025 -

St Mirren Upset Sparks Rangers Outrage

Feb 23, 2025

St Mirren Upset Sparks Rangers Outrage

Feb 23, 2025 -

Poor Rangers Performance Prompts Strong Criticism From Manager Clement

Feb 23, 2025

Poor Rangers Performance Prompts Strong Criticism From Manager Clement

Feb 23, 2025