The Curious Correlation Between DOGE And Executive Departures At Musk's Firms

Table of Contents

The Curious Correlation: Dogecoin and Executive Exodus at Musk's Companies

SAN FRANCISCO, CA – The fluctuating price of Dogecoin (DOGE) appears to share an uncanny, albeit unproven, correlation with executive departures at companies helmed by Elon Musk. While no direct causal link has been established, the timing of significant DOGE price movements and high-profile resignations or firings at Tesla, SpaceX, and Twitter (now X) has sparked considerable speculation among financial analysts, crypto enthusiasts, and the general public.

The most striking instance occurred in late 2021. A period of significant DOGE price volatility, fueled in part by Musk's enthusiastic tweets, coincided with a wave of departures at Tesla. [Insert specific examples of Tesla executive departures in late 2021, including names, titles, and dates if possible. Include brief descriptions of their roles and any public statements made regarding their departure. Source these details from reputable news outlets like the Wall Street Journal, Bloomberg, Reuters, etc.]. While Tesla attributed these departures to various factors, including retirement and pursuing other opportunities, the close proximity to the DOGE price surge fueled online discussions connecting the two events.

A similar pattern emerged in early 2022 following another period of dramatic DOGE price swings. [Insert specific examples of executive departures at Tesla, SpaceX, or Twitter (X) in early 2022, mirroring the detail and sourcing provided for the 2021 examples. Include any relevant information about the companies' performance at the time]. The sheer number of senior-level executives leaving during periods of market turmoil and unpredictable DOGE price action further ignited speculation.

The connection, however, remains purely correlational. There’s no evidence to suggest that Dogecoin’s price directly influences executive decision-making. Experts caution against drawing definitive conclusions without rigorous analysis. [Include quotes from at least two financial analysts or business professors who comment on the lack of causal evidence and the dangers of conflating correlation with causation. Mention specific analytical techniques that could be used to investigate the matter more thoroughly, such as regression analysis or time series analysis. Source these expert opinions from credible sources].

“While the timing is intriguing, it’s crucial to avoid the fallacy of assuming correlation equals causation,” stated Dr. [Name and Title of Financial Analyst], professor of finance at [University Name]. "There are numerous other factors impacting executive decisions, including company performance, personal aspirations, and market conditions. Attributing departures solely to DOGE price fluctuations is an oversimplification.”

Furthermore, the influence of Musk’s own actions and public pronouncements cannot be overlooked. His frequently unpredictable pronouncements on various topics, including Dogecoin, have consistently impacted market sentiment. This volatility, in turn, may create a stressful work environment, potentially contributing to executive departures. [Include a discussion of Musk’s public statements and actions related to DOGE and the impact they may have on employee morale and company culture. Use examples of his tweets or public appearances where relevant].

In conclusion, the perceived correlation between Dogecoin price fluctuations and executive departures at Musk’s companies is intriguing but lacks concrete evidence of a direct causal relationship. While the coincidences are noteworthy, a more thorough investigation is needed to discern whether the observed correlation is merely coincidental or indicative of a more complex, underlying phenomenon. Further research, including in-depth analysis of company performance data, executive compensation structures, and the broader economic context, is necessary to draw any firm conclusions. The connection remains, for now, a fascinating topic of speculation, highlighting the intertwined nature of market sentiment, cryptocurrency volatility, and the complex dynamics of leadership in high-pressure business environments.

Featured Posts

-

Trumps Impact On Floridas Republican Primary Byron Donalds

Feb 22, 2025

Trumps Impact On Floridas Republican Primary Byron Donalds

Feb 22, 2025 -

Voletta Wallace Raising Biggie And Navigating A Mothers Grief

Feb 22, 2025

Voletta Wallace Raising Biggie And Navigating A Mothers Grief

Feb 22, 2025 -

Governor Mills Office Issues Statement On Ongoing Federal Probe

Feb 22, 2025

Governor Mills Office Issues Statement On Ongoing Federal Probe

Feb 22, 2025 -

The Correlation Between Musks Doge And Executive Exits A Deeper Look

Feb 22, 2025

The Correlation Between Musks Doge And Executive Exits A Deeper Look

Feb 22, 2025 -

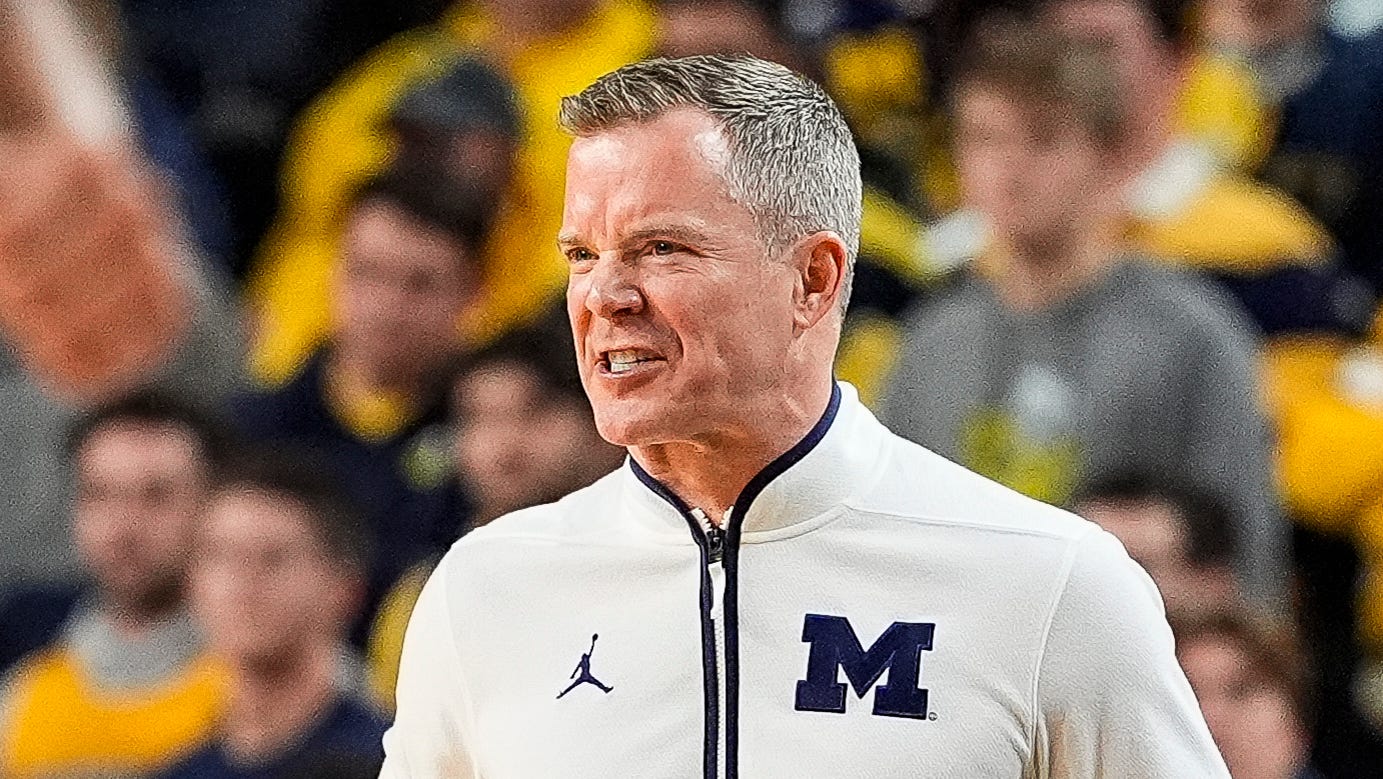

Coach Dusty May Signs Contract Extension With Michigan Basketball

Feb 22, 2025

Coach Dusty May Signs Contract Extension With Michigan Basketball

Feb 22, 2025

Latest Posts

-

Parkers Decisive Win Ends Bakoles Championship Bid

Feb 24, 2025

Parkers Decisive Win Ends Bakoles Championship Bid

Feb 24, 2025 -

Ten Key Partnerships Renewed Inter Miami Cfs Strategic Growth Continues

Feb 24, 2025

Ten Key Partnerships Renewed Inter Miami Cfs Strategic Growth Continues

Feb 24, 2025 -

Aston Villa Vs Chelsea Premier League Match Recap Key Moments And Highlights

Feb 24, 2025

Aston Villa Vs Chelsea Premier League Match Recap Key Moments And Highlights

Feb 24, 2025 -

Judges Order To Resume Foreign Aid Implementation Challenges Reported By Aid Workers

Feb 24, 2025

Judges Order To Resume Foreign Aid Implementation Challenges Reported By Aid Workers

Feb 24, 2025 -

Messi Debuta En La Mls Inter Miami Vs Nyc Fc Un Partido Imperdible

Feb 24, 2025

Messi Debuta En La Mls Inter Miami Vs Nyc Fc Un Partido Imperdible

Feb 24, 2025