The Economic Fallout Of A Potential Trump Dogecoin Dividend

Table of Contents

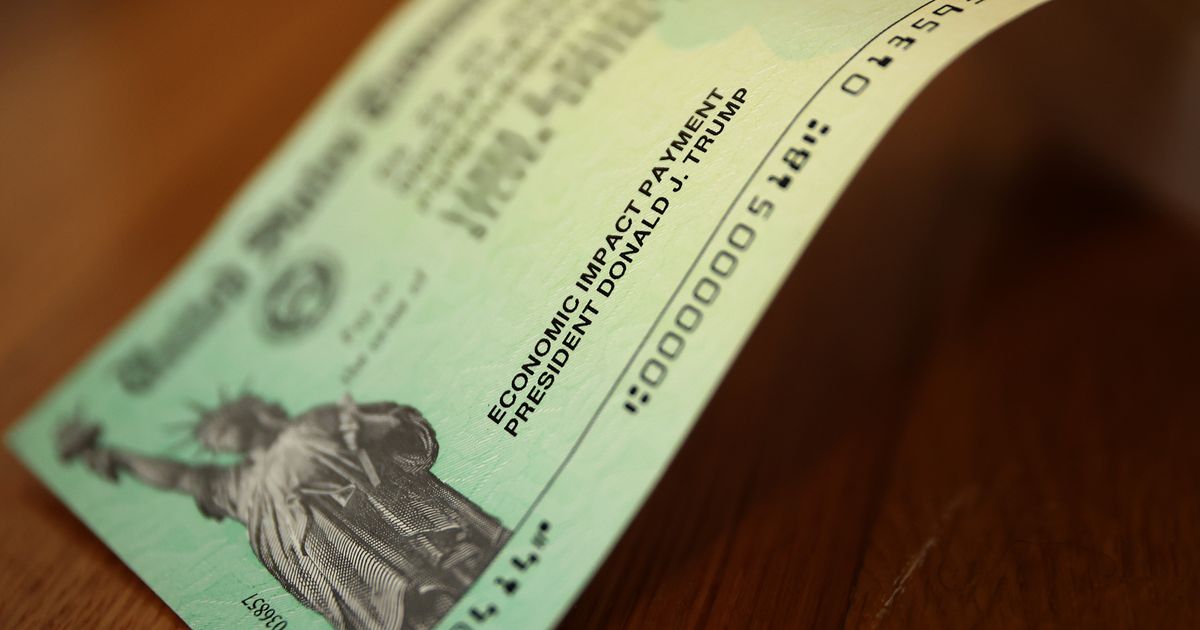

Trump's Dogecoin Dividend: A Speculative Gamble with Real Economic Risks

A potential dividend payout of Dogecoin to Trump supporters, as suggested by some, carries significant economic uncertainty and could trigger market volatility, potentially impacting investor confidence and the broader cryptocurrency market.

The idea of a Donald Trump-backed Dogecoin dividend, while currently lacking concrete evidence of a formal plan, has sparked considerable debate among economists and financial analysts. The sheer speculative nature of such an event makes predicting the exact economic fallout difficult. However, several potential consequences are readily apparent.

Market Volatility and Investor Sentiment: The immediate impact would likely be a surge in Dogecoin's price, driven by speculation and increased demand. This rapid price fluctuation is characteristic of volatile cryptocurrencies and could attract both short-term traders seeking quick profits and long-term investors hoping to capitalize on the perceived endorsement by a major political figure. However, a subsequent crash is equally plausible as the initial hype fades. Such volatility could unsettle the broader cryptocurrency market, impacting other digital assets and potentially triggering a sell-off. The uncertainty surrounding the distribution mechanism, the sheer scale of the potential dividend, and the lack of any established legal framework around such an event contribute to the unpredictable nature of the market response. [Data on historical cryptocurrency market reactions to similar events, such as Elon Musk's tweets, could be included here for further analysis, but requires specific research on comparable situations. Available data suggests high volatility in response to similar high-profile endorsements and pronouncements.]

Economic Uncertainty and Inflationary Concerns: A large-scale distribution of Dogecoin, particularly if it reaches a significant portion of the population, could potentially influence inflation. The value of Dogecoin is highly volatile, and its widespread adoption as a form of currency, even temporarily, carries inflationary risks. [A quantitative analysis of the potential inflationary impact requires modeling various scenarios, including the number of recipients, the total amount of Dogecoin distributed, and the resulting increase in money supply. This requires precise details on the proposed dividend plan – currently unavailable – to provide reliable figures.] This uncertainty could further erode investor confidence, potentially leading to a decrease in investment in other assets.

Regulatory Scrutiny and Legal Challenges: The distribution of a cryptocurrency dividend, especially one tied to a political figure, would likely attract significant regulatory scrutiny. The Securities and Exchange Commission (SEC) and other regulatory bodies would need to determine whether such a distribution constitutes a security offering, triggering various legal requirements and potential penalties. [Specific details on current SEC guidelines regarding cryptocurrency dividends and potential legal precedent are needed here to offer a comprehensive analysis. Research into the legal frameworks governing cryptocurrency distribution and political endorsements is required.] This uncertainty could deter future investment in both Dogecoin and other cryptocurrencies.

Geopolitical Implications: The potential for international repercussions is also significant. The widespread adoption of a meme-based cryptocurrency as a form of payment, even indirectly influenced by a political figure, could affect the stability of traditional financial markets and have implications for international trade and monetary policy. [This section requires further analysis of the potential ripple effects on global economies and international finance, factoring in the global reach of any such scheme. The absence of detailed plans renders this analysis largely speculative at present.]

Conclusion:

The potential economic consequences of a Trump-backed Dogecoin dividend are uncertain but likely significant. The lack of concrete details about the proposed plan makes a precise assessment impossible. However, the potential for market volatility, inflationary pressures, regulatory intervention, and broader economic uncertainty strongly suggests the need for careful consideration of the ramifications of such an unprecedented event. Further research and a more defined proposal are required to provide a more complete and accurate analysis.

Featured Posts

-

Peak District Parking Expert Tips For A Smooth Visit

Feb 25, 2025

Peak District Parking Expert Tips For A Smooth Visit

Feb 25, 2025 -

Everyone Would Have Died Southport Yoga Teachers Harrowing Account

Feb 25, 2025

Everyone Would Have Died Southport Yoga Teachers Harrowing Account

Feb 25, 2025 -

Israeli Hostages Secure Release Palestinian Prisoner Transfer Delayed

Feb 25, 2025

Israeli Hostages Secure Release Palestinian Prisoner Transfer Delayed

Feb 25, 2025 -

Vatican Reports Pope Francis Spent Peaceful Night Despite Critical Condition

Feb 25, 2025

Vatican Reports Pope Francis Spent Peaceful Night Despite Critical Condition

Feb 25, 2025 -

Analysis The Economic Implications Of A Trump Dogecoin Dividend

Feb 25, 2025

Analysis The Economic Implications Of A Trump Dogecoin Dividend

Feb 25, 2025

Latest Posts

-

Post Fire Real Estate In La Risks And Rewards For Buyers

Feb 25, 2025

Post Fire Real Estate In La Risks And Rewards For Buyers

Feb 25, 2025 -

Stars Shine Millie Bobby Brown Timothee Chalamet And Mikey Madisons Sag Awards Red Carpet Looks

Feb 25, 2025

Stars Shine Millie Bobby Brown Timothee Chalamet And Mikey Madisons Sag Awards Red Carpet Looks

Feb 25, 2025 -

Solidarity In Court The Women Rallying Behind Luigi Mangione

Feb 25, 2025

Solidarity In Court The Women Rallying Behind Luigi Mangione

Feb 25, 2025 -

Government Agencies Baffled By Musks Email Lacking Clear Action Plan

Feb 25, 2025

Government Agencies Baffled By Musks Email Lacking Clear Action Plan

Feb 25, 2025 -

Stunning Styles The Best Dressed At The 2025 Sag Awards

Feb 25, 2025

Stunning Styles The Best Dressed At The 2025 Sag Awards

Feb 25, 2025